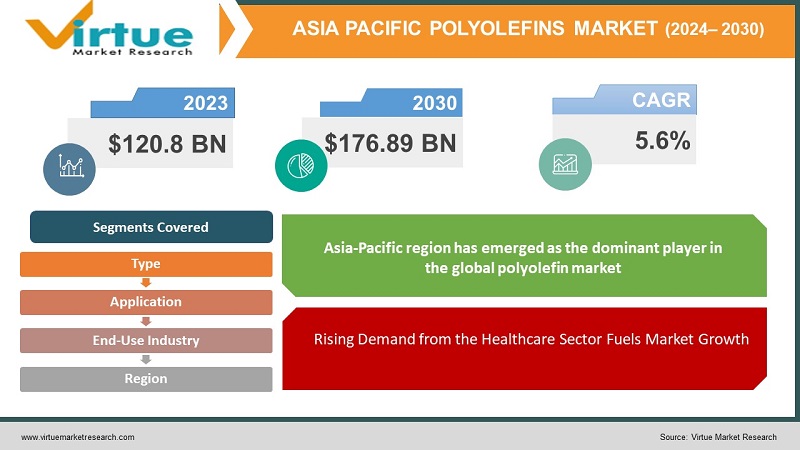

Asia Pacific Polyolefins Market Size (2024-2030)

The Asia Pacific Polyolefins Market was valued at USD 120.8 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 176.89 billion by 2030, growing at a CAGR of 5.6%.

Polyolefin refers to a type of polymer derived from olefin monomers, which consist of carbon and hydrogen atoms. The most prevalent varieties include polyethylene (PE) and polypropylene (PP). These materials are extensively utilized across various sectors due to their outstanding characteristics, such as high tensile strength, flexibility, resistance to chemicals, and cost-effectiveness. PE and PP are instrumental in the manufacturing of an array of products, including packaging materials, automotive components, toys, and piping. Furthermore, they play a significant role in the construction industry, being employed for insulation and roofing solutions. The adaptability of these materials has also facilitated the creation of specialized grades, including high-performance variants, designed for more rigorous applications.

Key Market Insights:

- The Asia Pacific (APAC) region represents a significant player in the global polyolefin market, characterized by a dynamic economy, varied industrial environments, and a rapidly increasing population. Polyolefins, which include versatile plastics such as polyethylene (PE) and polypropylene (PP), are intricately woven into the economic framework of APAC.

- Their lightweight nature, durability, and cost-effectiveness make them a favored option in multiple sectors, including packaging, construction, automotive, and consumer products. This extensive utilization, along with the ongoing economic growth in numerous APAC nations, establishes the region as a leading force in the global polyolefin market.

Asia Pacific Polyolefins Market Drivers:

Rising Demand from the Healthcare Sector Fuels Market Growth

The effective functioning of modern healthcare systems is largely dependent on the use of polyolefins. A diverse array of thermoplastic materials is utilized in healthcare applications, with approximately 90% of these applications involving polyolefins. These materials are increasingly favored as alternatives to glass and metal due to their superior physical characteristics and adherence to medical and environmental standards. Polyolefins find applications in medical devices, including syringes, drug delivery systems, nasal sprays, and surgical instruments.

Additionally, they are integral to a variety of pharmaceutical packaging solutions, such as container and closure systems. Despite the regulatory scrutiny surrounding plastic usage in healthcare, coupled with economic uncertainties and consumer concerns, the application of polyolefins in the sector continues to expand.

The demand for syringes has surged as a result of the ongoing pandemic. Companies like Hindustan Syringes & Medical Devices Ltd. (HMD) are making significant investments to enhance their production capacities to address this rising consumer demand. This sudden increase in syringe usage is expected to lead to a higher requirement for polypropylene. Moreover, government initiatives to boost needle production are also playing a significant role in driving overall market growth.

Asia Pacific Polyolefins Market Restraints and Challenges:

Fluctuating Raw Material Prices hinders market growth.

The price of polyolefin products is directly linked to the cost of the raw materials involved in their production. Fluctuations in raw material and commodity prices significantly affect the polyolefin market. Instability in the costs of essential substances presents challenges for polyolefin manufacturing; when raw material prices rise, the production costs of polyolefins also increase.

Olefins, which are derived from the cracking of oil and natural gas, are the primary raw materials for polyolefin production. Consequently, the pricing of polyolefins is closely aligned with oil prices. The ongoing increases in oil and natural gas prices are raising concerns, as these resources are crucial for producing olefins and their derivatives.

Asia Pacific Polyolefins Market Opportunities:

Growth of the Food Sector in Emerging Economies Creates Opportunities.

Polyolefins serve as an ideal packaging material in the food sector due to their nonpolar, odorless, and nonporous characteristics. Common types of polyolefins used in food packaging include high-density polyethylene (HDPE), low-density polyethylene (LDPE), isotactic polypropylene (PP), linear low-density polyethylene (LLDPE), and various polyethylene-based copolymers. These materials are not only cost-effective but also demonstrate superior moisture and gas barrier properties.

Additionally, polyolefin films are heat resistant and effectively prevent food leakage. Their lightweight nature allows for more efficient packaging that conforms well to the food's shape, thereby minimizing storage and transportation space. In rapidly developing countries like India and China, the food industry is experiencing significant growth driven by population increases. This expansion in the food sector is expected to lead to heightened demand for packaging materials, creating lucrative opportunities for the polyolefins market in emerging economies.

ASIA PACIFIC POLYOLEFINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6 % |

|

Segments Covered |

By Type, appliccation, end user industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Reliance Industries, ExxonMobil Corporation, LyondellBasell Industries N.V., Ducor Petrochemical, Tosoh Corporation, Formosa Plastics Corporation, Ineos Group AG, Sinopec Group, Borealis AG and Abu Dhabi Polymers Company Ltd. |

Asia Pacific Polyolefins Market Segmentation

Asia Pacific Polyolefins Market Segmentation: By Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Others

The polyethylene segment held the largest share of the polyolefin market. This material is extensively utilized across various industries due to its outstanding properties, including high chemical resistance, low moisture absorption, and effective electrical insulation. Polyethylene, a thermoplastic polymer produced through the polymerization of ethylene, is categorized into different types based on molecular weight and density, such as low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), and ultra-high molecular weight polyethylene (UHMWPE).

The growing demand for polyethylene is largely driven by the rapid expansion of the food sector in developing countries like China and India, as well as advancements in the renewable energy sector. Its widespread application in food packaging contributes significantly to its market traction. Additionally, high-density polyethylene conduits are employed in wind farms to safeguard electrical wiring. Polyethylene also serves as battery separators and junction boxes in renewable energy projects, including solar power installations.

Asia Pacific Polyolefins Market Segmentation: By Application:

- Injection Molding

- Film & Sheets

- Blow Molding

- Profile Extrusion

- Others

The injection molding segment has established itself as the dominant force in the market. This manufacturing process involves injecting molten material into a mold to produce finished products. During injection molding, the material is heated until it melts, then injected into a mold where it cools and solidifies into the desired shape. This method can be automated, enabling high-volume production with consistent quality. Overall, injection molding is a cost-effective and efficient technique for producing high-quality products, and ongoing advancements in this application are expected to further drive growth in the segment.

The blow molding segment has also shown substantial growth during the study period. This manufacturing process is widely used to create a variety of plastic products. Blow molding involves melting the material and extruding it into a hollow tube, which is then inflated to achieve the desired shape. The extrusion process employs a machine called an extruder, equipped with a screw that melts polymer pellets and forces them through a die. Once the polymer is formed into a tube, it is clamped between two mold halves, and air is blown through the center, causing the tube to expand and conform to the shape of the mold.

Blow molding is a versatile and cost-effective method that efficiently produces complex shapes with minimal waste, making it an ideal choice for high-volume plastic product manufacturing.

Asia Pacific Polyolefins Market Segmentation By End-Use Industry:

- Packaging

- Construction

- Automotive

- Electronics & Electricals

- Pharmaceuticals

- Others

The demand for polyolefins in the packaging industry has experienced the most significant growth in recent years. These thermoplastic polymers are extensively utilized to manufacture both flexible and rigid packaging materials. They provide numerous advantages, including exceptional chemical resistance, high strength, and low moisture absorption. Additionally, their lightweight and cost-effective nature makes them an appealing choice for manufacturers aiming to lower production costs. The increasing emphasis on sustainable and eco-friendly packaging solutions is anticipated to further enhance the demand for polyolefins in the packaging sector in the coming years.

Polyolefins are also versatile polymers employed in various applications within the construction industry, including pipes, cables, roofing, insulation, and flooring. Their properties, such as resistance to chemicals, UV light, and moisture, make them ideal for construction use. Furthermore, their lightweight and durable characteristics add to their attractiveness. As the construction industry continues to grow, the demand for polyolefins is expected to rise correspondingly in the years ahead.

Asia Pacific Polyolefins Market Segmentation- By Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

The Asia-Pacific region has emerged as the dominant player in the global polyolefin market, driven by established consumer bases in countries such as China, India, and Japan, particularly in the electronics manufacturing and construction sectors. However, the outbreak of COVID-19 in China significantly disrupted the polyolefins market, as it is one of the largest consumers of these materials, affecting industries such as packaging, toy manufacturing, construction, and automotive.

China holds the largest market share in the region, bolstered by its position as a manufacturing hub. This trend is expected to further enhance market growth in the area. In addition, the expansion of the Indian market is fueled by increasing demand for packaged foods and beverages, a trend linked to population growth and rising disposable income levels.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly affected the polyolefin market, leading to a decline in demand across various industries, including automotive, packaging, and construction. The economic slowdown resulted in reduced activity, while disrupted supply chains and fluctuating raw material prices further impacted market dynamics. However, as economies gradually reopen and the demand for sustainable and recyclable materials increases, the market is anticipated to recover in the coming years.

The outbreak also notably altered the working environment for many businesses. With imposed restrictions, numerous financial institutions and banks were compelled to allow their employees to work from home. Consequently, the financial sector is grappling with delayed lease payments and rapid interest rate fluctuations, prompting a substantial reconfiguration of the financial landscape.

Latest Trends/ Developments:

- January 2024 – PetroChina Lanhai Advanced Material Plans New Polyolefin Plant. PetroChina Lanhai Advanced Material has announced its intention to build a polyolefin plant in Nantong, Jiangsu province, to enhance its production capabilities and address increasing product demands. The new facility will have an annual production capacity of 200,000 tons of polyethylene (PE), 100,000 tons of alpha-olefins, 100,000 tons of polyolefin elastomer (POE), and 50,000 tons of ethylene-propylene-diene monomer (EPDM). The project involves an investment of approximately USD 1.6 billion, underscoring its scale and strategic significance.

- November 2022 – Tavian Quang Yen Petrochemical Selects LyondellBasell Technology. Tavian Quang Yen Petrochemical, Ltd. has announced its decision to utilize LyondellBasell's polypropylene technology for its upcoming large-scale production facility. The plant, designed with a production capacity of 600 kilotons per annum, will incorporate LyondellBasell's Spheripol technology. This collaboration establishes LyondellBasell as the polypropylene licensor for Tavian Quang Yen Petrochemical's inaugural polyolefin facility.

- August 2022 – SABIC SK Nexlene Expands Manufacturing Plant in South Korea. SABIC SK Nexlene, a joint venture between SABIC and SK Geo Centric, revealed plans to expand its manufacturing plant in Ulsan, South Korea. This expansion aims to fulfill the growing demand for NEXLENE-based polyolefin solutions across various industries. The expanded facility is expected to be operational by the second quarter of 2024.

Key Players:

These are top 10 players in the Asia Pacific Polyolefins Market :-

- Reliance Industries

- ExxonMobil Corporation

- LyondellBasell Industries N.V.

- Ducor Petrochemical

- Tosoh Corporation

- Formosa Plastics Corporation

- Ineos Group AG

- Sinopec Group

- Borealis AG

- Abu Dhabi Polymers Company Ltd. (Borouge)

Chapter 1. Asia Pacific Polyolefins Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Polyolefins Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Polyolefins Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Polyolefins Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Polyolefins Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Polyolefins Market– By Type

6.1. Introduction/Key Findings

6.2. Polyethylene (PE)

6.3. Polypropylene (PP)

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Asia Pacific Polyolefins Market– By Application

7.1. Introduction/Key Findings

7.2. Injection Molding

7.3. Film & Sheets

7.4. Blow Molding

7.5. Profile Extrusion

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Asia Pacific Polyolefins Market– By End-Use Industry

8.1. Introduction/Key Findings

8.2. Packaging

8.3. Construction

8.4. Automotive

8.5. Electronics & Electricals

8.6. Pharmaceuticals

8.7. Others

8.8. Y-O-Y Growth trend Analysis End-Use Industry

8.9. Absolute $ Opportunity Analysis End-Use Industry , 2023-2030

Chapter 9. Asia Pacific Polyolefins Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By End-Use Industry

9.1.3. By Type

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Polyolefins Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1 Reliance Industries

10.2. ExxonMobil Corporation

10.3. LyondellBasell Industries N.V.

10.4. Ducor Petrochemical

10.5. Tosoh Corporation

10.6. Formosa Plastics Corporation

10.7. Ineos Group AG

10.8.Sinopec Group

10.9. Borealis AG

10.10. Abu Dhabi Polymers Company Ltd. (Borouge)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific (APAC) region represents a significant player in the global polyolefin market, characterized by a dynamic economy, varied industrial environments, and a rapidly increasing population.

The top players operating in the Asia Pacific Polyolefins Market are - Reliance Industries, ExxonMobil Corporation, LyondellBasell Industries N.V., Ducor Petrochemical, Tosoh Corporation, Formosa Plastics Corporation, Ineos Group AG, Sinopec Group, Borealis AG and Abu Dhabi Polymers Company Ltd.

The COVID-19 pandemic significantly affected the polyolefin market, leading to a decline in demand across various industries, including automotive, packaging, and construction.

January 2024 – PetroChina Lanhai Advanced Material Plans New Polyolefin Plant. PetroChina Lanhai Advanced Material has announced its intention to build a polyolefin plant in Nantong, Jiangsu province, to enhance its production capabilities and address increasing product demands.

India is the fastest-growing region in the Asia Pacific Polyolefins Market