High-Density Polyethylene (HDPE) Market Size (2024 – 2030)

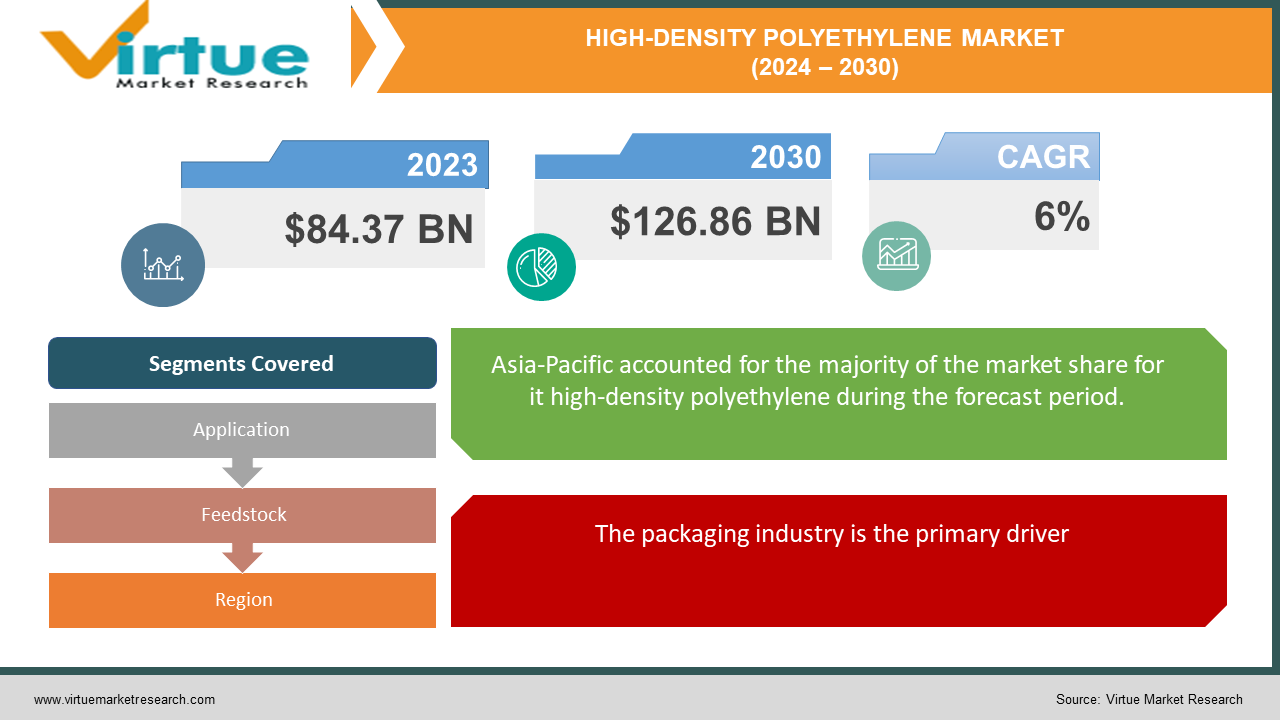

The Global High-Density Polyethylene (HDPE) Market was valued at USD 84.37 billion in 2023 and will row at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 126.86 billion by 2030.

The HDPE market caters to a vast array of applications, with packaging being its biggest user. This versatile plastic thrives due to its durability, lightweight nature, and cost-effectiveness. However, the market is evolving as environmental concerns rise. Manufacturers are developing sustainable solutions like bio-based HDPE and improved recycling methods, while also innovating with high-performance grades for industrial uses. As the world builds and packages more, the HDPE market is expected to keep growing in the coming years.

Key Market Insights:

Growing environmental concerns are pushing the demand for sustainable HDPE solutions.

Manufacturers are focusing on developing high-performance HDPE grades with enhanced properties like flame retardancy, improved chemical resistance, and higher heat tolerance.

Packaging is the leading application segment within the HDPE market, accounting for roughly 45% of the market share.

The Asia Pacific region is forecast to witness the highest CAGR of 9%.

Global High-Density Polyethylene (HDPE) Market Drivers:

Versatility and Performance are driving the market growth

High-density polyethylene (HDPE) is a champion of versatility in the plastics world. Its winning combination of strength and lightweight design makes it a go-to material for countless applications. Imagine a plastic that's tough enough to handle heavy-duty tasks yet light enough for efficient transportation – that's HDPE. But it doesn't stop there. HDPE is a master of shapeshifting, easily molded into various forms, from rigid pipes to flexible films. This adaptability extends to its chemical resistance, creating a barrier against unwanted elements that could compromise the product inside. Think of it as a bodyguard for whatever it contains. These combined strengths make HDPE the ideal candidate for a wide range of uses, from packaging and construction to medical devices and industrial components. It's a plastic with the muscle to perform and the adaptability to excel in a diverse range of roles.

Growing E-commerce is driving the market growth

The e-commerce boom is fueling a surge in HDPE packaging. As online shopping explodes, companies are constantly seeking ways to optimize their packaging for efficiency and cost-effectiveness. HDPE steps up to the plate as a champion in this arena. Its light weight translates to significant savings on shipping costs – every gram counts when dealing with millions of packages. But don't be fooled by its lightness; HDPE is a heavyweight in terms of protection. Its robust nature ensures products survive the rigors of transport, withstanding bumps, jostles, and potential stacking during long journeys. This translates to fewer damaged goods and happier customers. Furthermore, HDPE's versatility allows for customization, creating secure packaging solutions for a wide variety of products, from delicate electronics to bulky furniture. In the fast-paced world of e-commerce, HDPE's perfect balance of affordability, protection, and adaptability makes it a preferred choice for businesses looking to navigate the online shopping landscape.

The packaging industry is the primary driver

Reigning supreme in the HDPE market is the packaging industry. From the ubiquitous plastic bottles lining grocery store shelves to the heavy-duty shipping containers and the crinkly wraps securing your favorite snacks, HDPE is everywhere you look. The secret to its dominance lies in its robust nature. Unlike its flimsier plastic cousins, HDPE boasts remarkable durability, ensuring the packaged goods inside can withstand everyday wear and tear. This translates to longer shelf life for products and peace of mind for consumers. But HDPE goes beyond just basic protection. It acts as a formidable barrier against unwanted elements, shielding contents from moisture, contamination, and even pesky critters. Imagine a plastic bodyguard for your food, beverages, and household goods. This combination of strength and protective properties makes HDPE the go-to choice for a vast array of packaging needs, from keeping your shampoo fresh to ensuring your furniture arrives safely during a move. No wonder the packaging industry continues to be the driving force behind the ever-expanding HDPE market.

Global High-Density Polyethylene (HDPE)Market challenges and restraints:

Price Volatility of Raw Materials is restricting the market growth

The Achilles' heel of the HDPE market is its dependence on crude oil. This creates a volatile situation, with unpredictable swings in global oil prices directly impacting the cost of HDPE production. Imagine manufacturers constantly on edge, unsure of their bottom line due to fluctuating oil prices. This translates to difficulties in planning and budgeting, making it challenging for them to maintain stable prices for consumers. The ripple effect goes further, potentially leading to price hikes for HDPE products, impacting affordability for consumers. This uncertainty creates a roadblock for both manufacturers and consumers in the HDPE market. Finding alternative, more stable feedstocks or implementing effective price hedging strategies will be crucial to overcome this challenge and ensure a more sustainable future for the HDPE market.

Environmental Concerns are restricting the market growth

A shadow of environmental concern looms over the HDPE market. Growing public awareness of plastic pollution, particularly the alarming issue of ocean plastic waste and microplastics, is putting pressure on the entire HDPE lifecycle. Consumers are questioning the environmental impact of everything from HDPE production to disposal. Images of plastic-choked oceans and microplastics infiltrating the food chain are fueling a movement towards more sustainable practices. This translates to a challenge for the HDPE market. Manufacturers are under scrutiny to improve their environmental footprint, reduce reliance on virgin plastic, and prioritize innovations in recycling technologies. Finding ways to make HDPE production cleaner and designing products for recyclability are crucial steps. The future of HDPE hinges on its ability to adapt to a more environmentally conscious world.

Market Opportunities:

The HDPE market teems with exciting opportunities. Surging demand for lightweight, durable packaging solutions across various industries, including food & beverage, pharmaceuticals, and personal care, presents a significant growth prospect for HDPE. Furthermore, the growing emphasis on sustainable practices is driving innovation in HDPE recycling technologies, making it a more eco-friendly material choice. This resonates well with environmentally conscious consumers and businesses. HDPE's potential for applications beyond traditional packaging, such as pipes, medical devices, and automotive components, opens doors to new market segments. Additionally, rising infrastructure development projects in emerging economies create a demand for HDPE pipes due to their strength, corrosion resistance, and extended lifespan. By focusing on lightweight and sustainable product development, coupled with advancements in recycling technologies, HDPE manufacturers can capitalize on these opportunities and solidify their position in the ever-evolving market landscape.

HIGH-DENSITY POLYETHYLENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Application, Feedstock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil, Dow, SABIC, Sinopec, LyondellBasell Formosa Plastics, Braskem, Chevron Phillips Chemical, Reliance Industries, Borealis |

High-Density Polyethylene (HDPE) Market Segmentation - by Application

-

Packaging

-

Construction

-

Transportation

-

Consumer Goods

High-Density Polyethylene (HDPE) wears many hats, with packaging being its most prominent role. Imagine the plastic bottles lining store shelves, the sturdy containers holding your favorite household products, and the crinkly wraps keeping your food fresh – that's all HDPE in action. But its reach extends far beyond the kitchen. In construction, HDPE transforms into heavy-duty pipes silently carrying water underground or transforming into conduits protecting electrical cables. Large geomembranes made of HDPE act as environmental guardians in landfills, preventing contamination. The transportation industry gets a lightweight boost from HDPE used in car parts and interior components. Even everyday items like appliances, toys, and furniture often incorporate HDPE for its durability and versatility. This vast array of applications makes HDPE a truly indispensable material in our daily lives.

High-Density Polyethylene (HDPE) Market Segmentation - By Feedstock

-

Naphtha

-

Natural Gas

-

Renewable Resource

Naphtha, derived from crude oil, currently reigns supreme as the dominant feedstock for HDPE production. It's a well-established source with a long history in the industry. However, rumblings of change are in the air. Natural gas is gaining traction as a more sustainable alternative, offering a slightly cleaner burning profile. The real game-changer though, is the emergence of renewable resources. Bio-based HDPE, derived from sugarcane or other plant sources, is a revolutionary trend. While still in its early stages, it promises a future less reliant on fossil fuels and with a smaller environmental footprint. The battle for HDPE feedstock dominance is on, with traditional methods facing challenges from cleaner options and the exciting possibilities of bio-based alternatives.

High-Density Polyethylene (HDPE) Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The crown jewel of the HDPE market rests in the Asia-Pacific region. This dominance is fueled by a booming manufacturing sector and a rapidly growing population, both demanding a surge in packaging solutions. Countries like China and India are experiencing explosive economic development, leading to a rise in disposable incomes and increased consumer spending. This translates to a greater demand for packaged goods, which is where HDPE shines. Its affordability, durability, and versatility make it the go-to choice for manufacturers in this region. While other regions like North America and Europe have established HDPE markets, the sheer scale of growth in Asia-Pacific makes it the undisputed leader

COVID-19 Impact Analysis on the Global High-Density Polyethylene (HDPE)Market

The COVID-19 pandemic delivered a mixed bag of impacts on the Global High-Density Polyethylene (HDPE) market. In the initial stages (2020), lockdowns and disruptions in supply chains led to a decline in demand for HDPE. Many manufacturing sectors, especially automotive and construction, faced shutdowns, reducing their need for HDPE products like pipes and car parts. Additionally, with a shift towards online shopping, the demand for rigid HDPE packaging for non-essential goods softened. However, the picture started to improve in 2021 as restrictions eased and economic activity rebounded. The surge in e-commerce remained a strong driver, requiring a significant amount of HDPE for flexible packaging solutions to deliver the explosion of online orders. Furthermore, the growing focus on hygiene during the pandemic increased the demand for HDPE in hygiene products like sanitizer bottles and medical equipment. Looking ahead, the long-term impact of COVID-19 on the HDPE market remains to be seen. Fluctuations in oil prices, a key factor in HDPE production costs, continue to pose a challenge. However, the market is expected to experience moderate growth in the coming years, driven by factors like rising demand in Asia's developing economies, the ongoing e-commerce boom, and the potential for increased use of HDPE in hygiene and medical applications.

Latest trends/Developments

The High-Density Polyethylene (HDPE) market is navigating a wave of innovation and adaptation. Sustainability is a major theme, with a growing focus on bio-based HDPE derived from renewable resources like sugarcane. This reduces reliance on fossil fuels and lessens the environmental footprint. Additionally, advancements in recycling technologies are creating a more circular economy for HDPE. Chemical recycling processes are breaking down used HDPE into its basic building blocks, allowing it to be reborn into new products. This reduces virgin plastic usage and waste generation. On the performance side, manufacturers are developing high-performance HDPE grades with enhanced properties. These include fire retardant qualities for improved safety in construction applications and innovations in barrier technology to extend the shelf life of packaged food and beverages. The lightweight nature of HDPE remains a key advantage, and research is ongoing to develop even lighter yet robust grades for applications like fuel-efficient vehicles. However, challenges remain. Fluctuations in oil prices continue to create uncertainty for manufacturers, and stricter regulations on plastic use are impacting some traditional HDPE applications. The industry is responding by exploring alternative feedstocks and designing products with recyclability in mind. Overall, the HDPE market is embracing change, with a focus on sustainability, performance enhancement, and navigating a more regulated environment. This multi-pronged approach will be crucial for HDPE to retain its position as a versatile and valuable material in the years to come.

Key Players:

-

ExxonMobil

-

Dow

-

SABIC

-

Sinopec

-

LyondellBasell

-

Formosa Plastics

-

Braskem

-

Chevron Phillips Chemical

-

Reliance Industries

-

Borealis

Chapter 1. High-Density Polyethylene (HDPE)Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High-Density Polyethylene (HDPE)Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High-Density Polyethylene (HDPE)Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High-Density Polyethylene (HDPE)Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High-Density Polyethylene (HDPE)Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High-Density Polyethylene (HDPE)Market – By Application

6.1 Introduction/Key Findings

6.2 Packaging

6.3 Construction

6.4 Transportation

6.5 Consumer Goods

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. High-Density Polyethylene (HDPE)Market – By Feedstock

7.1 Introduction/Key Findings

7.2 Naphtha

7.3 Natural Gas

7.4 Renewable Resource

7.5 Y-O-Y Growth trend Analysis By Feedstock

7.6 Absolute $ Opportunity Analysis By Feedstock, 2024-2030

Chapter 8. High-Density Polyethylene (HDPE)Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Feedstock

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Feedstock

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Feedstock

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Feedstock

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Feedstock

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. High-Density Polyethylene (HDPE)Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil

9.2 Dow

9.3 SABIC

9.4 Sinopec

9.5 LyondellBasell

9.6 Formosa Plastics

9.7 Braskem

9.8 Chevron Phillips Chemical

9.9 Reliance Industries

9.10 Borealis

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global High-Density Polyethylene (HDPE) Market was valued at USD 84.37 billion in 2023 and will row at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 126.86 billion by 2030.

Growing E-commerce, Versatility, and Performance are the reasons that are driving the market.

Based on application it is divided into four segments – Packaging, Construction, Transportation, Consumer Goods

Asia-Pacific is the most dominant region for the High-Density Polyethylene (HDPE)Market.

Braskem, Chevron Phillips Chemical, Reliance Industries, Borealis