Injection Molding Market Size (2025 – 2030)

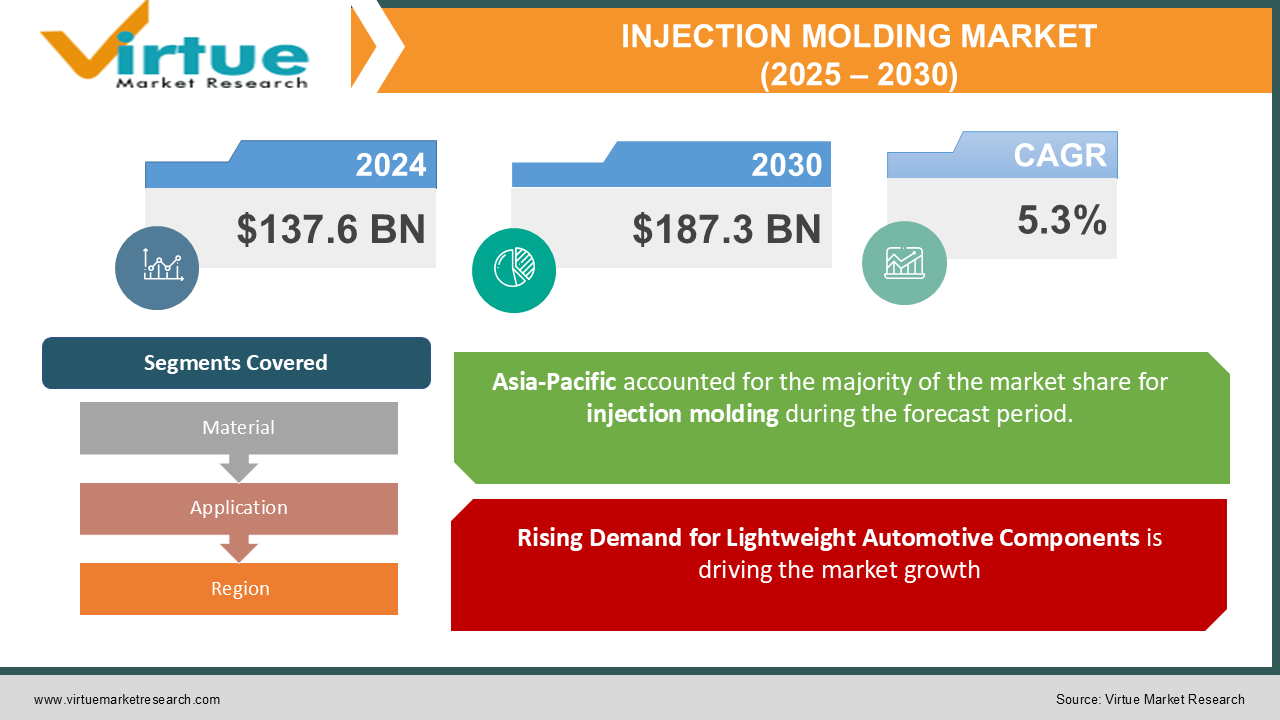

The Global Injection Molding Market was valued at USD 137.6 billion in 2024 and is projected to reach USD 187.3 billion by 2030, expanding at a CAGR of 5.3% from 2025 to 2030.

Injection molding is a manufacturing process used for producing complex and precision components from a wide variety of materials, including plastics, metals, and ceramics. The market's growth is primarily driven by increasing demand from industries such as automotive, packaging, healthcare, and consumer goods.

The development of advanced materials and the adoption of automation in injection molding processes are further enhancing production efficiency, reducing costs, and expanding application possibilities. Increasing emphasis on lightweight materials, particularly in the automotive and aerospace industries, is also propelling the market forward.

Key Market Insights

Thermoplastics dominated the market in 2024, holding more than 60% of the revenue share, owing to their versatility and recyclability.

The automotive industry is the largest application segment, accounting for over 35% of the global market share, driven by the need for lightweight, durable, and cost-effective components.

Asia-Pacific emerged as the leading region, capturing 40% of the market share in 2024, thanks to rapid industrialization and the presence of major manufacturing hubs.

Global Injection Molding Market Drivers

Rising Demand for Lightweight Automotive Components is driving the market growth

The automotive industry's shift towards lightweight materials to improve fuel efficiency and reduce carbon emissions is a key driver of the injection molding market. Injection molding enables the mass production of complex and lightweight components with high precision, meeting the stringent requirements of modern vehicle designs.

Governments worldwide are implementing regulations to reduce vehicle emissions, further driving the adoption of lightweight plastics and composites. For example, the European Union's 2024 carbon emission targets for passenger cars have accelerated the use of injection-molded parts in automotive manufacturing.

Growth in Packaging Industry is driving the market growth

The packaging industry, particularly flexible and rigid packaging, heavily relies on injection molding for the production of containers, caps, closures, and other packaging components. The rise of e-commerce, increased consumer demand for convenience products, and innovations in sustainable packaging are driving the growth of this segment.

The development of bioplastics for eco-friendly packaging solutions is further propelling the market, as businesses and consumers alike prioritize sustainability. For instance, companies such as Coca-Cola and Unilever are increasingly adopting biodegradable and recyclable injection-molded packaging solutions.

Advancements in Medical Device Manufacturing is driving the market growth

Injection molding is a cornerstone of medical device manufacturing due to its ability to produce sterile, high-precision components at scale. The growing demand for medical devices, such as syringes, inhalers, and diagnostic equipment, is significantly contributing to the market's growth.

The COVID-19 pandemic highlighted the critical role of injection molding in the production of essential medical supplies, reinforcing its importance in the healthcare sector. Post-pandemic, the adoption of advanced materials and miniaturized components in medical technologies continues to drive demand.

Global Injection Molding Market Challenges and Restraints

Environmental Concerns and Regulatory Compliance is restricting the market growth

The injection molding industry faces challenges related to the environmental impact of plastic waste. Despite efforts to improve recyclability and sustainability, the improper disposal of plastic products remains a significant concern.

Stringent environmental regulations, particularly in developed regions such as North America and Europe, require manufacturers to invest in eco-friendly materials and processes. This increases production costs and creates barriers for smaller market players.

High Initial Investment and Maintenance Costs is restricting the market growth

The injection molding process requires sophisticated machinery and molds, which involve substantial initial investments. Additionally, the maintenance of injection molding machines and molds can be costly, especially for small and medium-sized enterprises (SMEs).

The adoption of automation and robotics in injection molding processes, while enhancing efficiency, also adds to the overall cost, potentially limiting adoption among cost-sensitive industries.

Market Opportunities

The Global Injection Molding Market presents significant opportunities driven by technological advancements, material innovations, and expanding applications across diverse industries. 3D printing-enabled injection molding is emerging as a transformative technology, allowing manufacturers to produce molds faster and at lower costs. This development is particularly beneficial for prototyping and low-volume production, enabling businesses to bring products to market more quickly. The increasing focus on sustainability is creating opportunities for biodegradable and bio-based plastics in injection molding. Industries such as packaging, healthcare, and consumer goods are exploring these materials to align with regulatory standards and consumer preferences for environmentally friendly products. Emerging economies in regions like Asia-Pacific, Latin America, and Africa are witnessing rapid industrialization and urbanization, driving demand for injection-molded products. Infrastructure development, rising disposable incomes, and expanding manufacturing bases in these regions further bolster market opportunities.

INJECTION MOLDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Engel Austria GmbH, Arburg GmbH & Co. KG, Sumitomo (SHI) Demag Plastics Machinery GmbH, Milacron LLC, Husky Injection Molding Systems Ltd., Nissei Plastic Industrial Co., Ltd., Toshiba Machine Co., Ltd., KraussMaffei Group GmbH, Haitian International Holdings Ltd., Wittmann Battenfeld GmbH |

Injection Molding Market Segmentation - By Material

-

Thermoplastics

-

Thermosetting Plastics

-

Elastomers

-

Others

Thermoplastics have solidified their position as the dominant material segment in the injection molding industry due to their exceptional properties and versatility. These materials, which soften when heated and harden upon cooling, offer a wide range of advantages that make them ideal for numerous applications. Their ease of molding enables the creation of intricate and complex shapes, while their recyclability contributes to sustainable manufacturing practices. 2 Thermoplastics are renowned for their durability, strength, and resistance to various environmental factors, making them suitable for demanding applications in sectors such as automotive and packaging. The automotive industry extensively utilizes thermoplastics to produce lightweight and fuel-efficient components, including interior and exterior parts, as well as under-the-hood components. In the packaging industry, thermoplastics are employed to create a diverse array of packaging solutions, from rigid containers to flexible films, offering excellent barrier properties, impact resistance, and recyclability. The versatility of thermoplastics, coupled with their cost-effectiveness and environmental benefits, has solidified their position as the preferred choice for a wide range of injection molding applications.

Injection Molding Market Segmentation - By Application

-

Automotive

-

Packaging

-

Consumer Goods

-

Electronics

-

Healthcare

-

Others

The automotive sector stands as the dominant application segment for injection molding, fueled by the extensive utilization of injection-molded components across various vehicle areas. From the interior cabin to the exterior body panels and the intricate under-the-hood components, injection molding offers a versatile and efficient solution for manufacturing a wide range of automotive parts. The interior of a modern vehicle is replete with injection-molded components, including dashboards, door panels, instrument clusters, and seat components. These parts are often crafted from a variety of materials, such as ABS, PP, and PC/ABS blends, enabling the creation of intricate designs, textures, and colors that enhance the vehicle's aesthetic appeal and comfort. Exterior components, such as bumpers, grilles, and side mirrors, are also frequently produced through injection molding. These parts must withstand harsh environmental conditions, including extreme temperatures, UV radiation, and impact, necessitating the use of durable and weather-resistant materials like PP, TPO, and PC. Under the hood, injection molding plays a crucial role in manufacturing components such as engine covers, intake manifolds, and fuel rails. These parts require high levels of precision and dimensional accuracy to ensure optimal engine performance and reliability. Moreover, the growing trend towards lightweighting in the automotive industry is driving the development of advanced injection molding techniques, such as thin-wall injection molding and multi-component injection molding, to produce lighter and more fuel-efficient components

Injection Molding Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific dominated the global injection molding market in 2024, accounting for 40% of the total revenue. The region's dominance is attributed to the presence of major automotive and electronics manufacturers in countries like China, Japan, and India. The growing adoption of EVs and advancements in consumer electronics are driving demand for injection-molded components in the region. Additionally, government initiatives supporting local manufacturing and investments in infrastructure development further strengthen the market's growth in Asia-Pacific. North America and Europe are key markets, driven by technological advancements, high demand for medical devices, and stringent environmental regulations promoting sustainable materials.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the injection molding market in 2020, with disruptions in supply chains and temporary shutdowns of manufacturing facilities. However, the market rebounded strongly in 2021 due to increased demand for medical devices, packaging, and consumer goods. The pandemic highlighted the importance of injection molding in producing essential healthcare supplies, such as syringes, face shields, and ventilator components. The post-pandemic recovery is characterized by increased investments in automation, digitalization, and sustainability in injection molding processes.

Latest Trends/Developments

The injection molding industry is undergoing a transformative phase, driven by technological advancements and evolving consumer preferences. Automation and robotics are revolutionizing production processes, enhancing efficiency, and reducing labor costs. By integrating robotic arms and automated systems, manufacturers can achieve greater precision, consistency, and speed in mold operations. Furthermore, the adoption of sustainable materials, such as biodegradable and bio-based plastics, is gaining momentum as industries strive to minimize their environmental impact and comply with stricter regulations. The integration of Industry 4.0 technologies, including IoT and AI, is enabling real-time monitoring of production processes, predictive maintenance, and optimized operations. This data-driven approach empowers manufacturers to make informed decisions, improve efficiency, and reduce downtime. 3D printing is also making significant inroads into the injection molding industry, accelerating product development cycles and reducing costs. By utilizing 3D printing for rapid prototyping and mold production, manufacturers can quickly iterate on designs and bring innovative products to market faster. Additionally, the growing demand for smaller and more precise medical components is driving advancements in micro-injection molding techniques. By mastering the intricacies of micro-molding, manufacturers can produce intricate medical devices with exceptional accuracy and reliability. As the injection molding industry continues to evolve, these technological innovations will shape the future of manufacturing, enabling the production of high-quality, sustainable, and innovative products

Key Players

-

Engel Austria GmbH

-

Arburg GmbH & Co. KG

-

Sumitomo (SHI) Demag Plastics Machinery GmbH

-

Milacron LLC

-

Husky Injection Molding Systems Ltd.

-

Nissei Plastic Industrial Co., Ltd.

-

Toshiba Machine Co., Ltd.

-

KraussMaffei Group GmbH

-

Haitian International Holdings Ltd.

-

Wittmann Battenfeld GmbH

Chapter 1. Injection Molding Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Injection Molding Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Injection Molding Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Injection Molding Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Injection Molding Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Injection Molding Market – By Material

6.1 Introduction/Key Findings

6.2 Thermoplastics

6.3 Thermosetting Plastics

6.4 Elastomers

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2025-2030

Chapter 7. Injection Molding Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Packaging

7.4 Consumer Goods

7.5 Electronics

7.6 Healthcare

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Injection Molding Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Injection Molding Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Engel Austria GmbH

9.2 Arburg GmbH & Co. KG

9.3 Sumitomo (SHI) Demag Plastics Machinery GmbH

9.4 Milacron LLC

9.5 Husky Injection Molding Systems Ltd.

9.6 Nissei Plastic Industrial Co., Ltd.

9.7 Toshiba Machine Co., Ltd.

9.8 KraussMaffei Group GmbH

9.9 Haitian International Holdings Ltd.

9.10 Wittmann Battenfeld GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 137.6 billion in 2024 and is projected to reach USD 187.3 billion by 2030, growing at a CAGR of 5.3%.

Key drivers include rising demand for lightweight automotive components, growth in the packaging industry, and advancements in medical device manufacturing

Segments include Material (Thermoplastics, Thermosetting Plastics) and Application (Automotive, Packaging, Consumer Goods, Electronics, Healthcare).

Asia-Pacific dominates the market, accounting for over 40% share, driven by rapid industrialization and the presence of major manufacturing hubs.

Leading players include Engel Austria GmbH, Arburg GmbH & Co. KG, Sumitomo (SHI) Demag Plastics Machinery GmbH, and Milacron LLC.