Battery Separators Market Size (2025 – 2030)

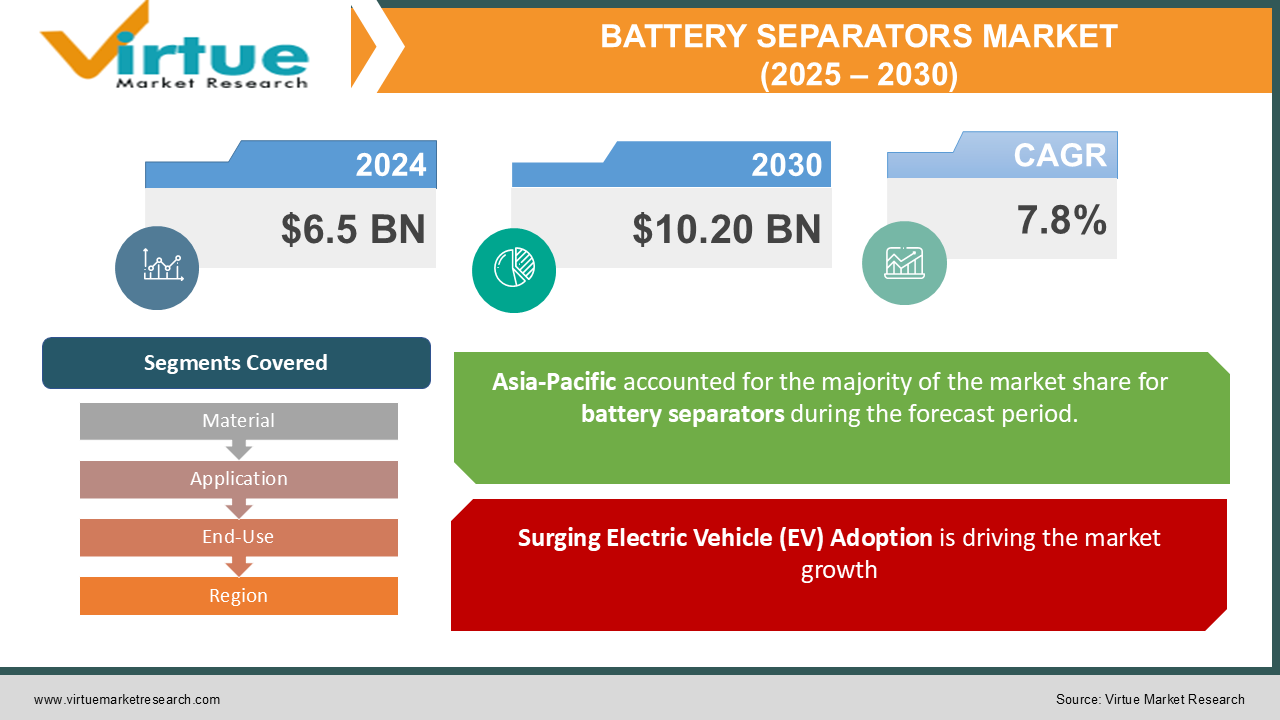

The Global Battery Separators Market was valued at USD 6.5 billion in 2024 and is projected to reach USD 10.20 billion by 2030, growing at a CAGR of 7.8% during the forecast period (2025–2030).

Battery separators are critical components of electrochemical cells that prevent physical contact between anode and cathode while facilitating ion transport. Their demand is growing significantly due to the rising adoption of electric vehicles (EVs), renewable energy storage systems, and advancements in consumer electronics.

Increasing investments in lithium-ion battery technologies and robust government initiatives promoting electric mobility are key drivers of market growth. The market is witnessing significant innovation, with manufacturers focusing on improving separator properties such as thermal stability, electrolyte wettability, and mechanical strength.

Key Market Insights

Polypropylene separators dominated the market in 2024, holding over 40% of the revenue share, due to their low cost and excellent chemical resistance.

Lithium-ion batteries accounted for the largest application segment, contributing over 55% of the global market share, fueled by growing EV adoption.

The automotive sector emerged as the largest end-use industry in 2024, with a market share of approximately 50%, driven by the surge in electric vehicle production.

Asia-Pacific led the market in 2024, capturing more than 60% of the global share, owing to the presence of major battery manufacturers in China, Japan, and South Korea.

Global Battery Separators Market Drivers

Surging Electric Vehicle (EV) Adoption is driving the market growth

The rapid growth of the EV industry is a significant driver for the battery separators market. EV batteries require separators to ensure efficient ion flow and prevent short circuits, making them integral to the performance and safety of electric vehicles.

Governments worldwide are promoting EV adoption through incentives and subsidies to achieve carbon neutrality goals, directly boosting the demand for high-quality battery separators. For example, in 2024, global EV sales surpassed 11 million units, creating a surge in demand for lithium-ion batteries and their components, including separators.

Rising Renewable Energy Deployments is driving the market growth

The increasing deployment of renewable energy storage systems, such as solar and wind power storage, has accelerated the demand for advanced batteries. Battery separators play a crucial role in these systems, ensuring durability and performance over extended periods.

Countries are investing heavily in grid-scale energy storage systems to stabilize power grids and integrate renewable energy sources effectively. For instance, the global energy storage capacity exceeded 25 GW in 2024, further driving the adoption of separators tailored for energy storage applications.

Growing Consumer Electronics Market is driving the market growth

The proliferation of smart devices, wearables, and portable consumer electronics is fueling the demand for compact, efficient, and long-lasting batteries. Separators enhance the safety and efficiency of these batteries, making them indispensable for consumer electronics manufacturers.

With the global consumer electronics market expected to grow at a CAGR of 6% from 2024 to 2030, the demand for separators, particularly for lithium-ion batteries, is projected to increase significantly.

Global Battery Separators Market Challenges and Restraints

Environmental and Safety Concerns is restricting the market growth

The production and disposal of battery separators, particularly those made from synthetic polymers, pose environmental challenges. Non-biodegradable materials used in separators contribute to plastic waste, and improper disposal can lead to soil and water contamination.

Additionally, safety concerns such as thermal runaway and separator degradation under high temperatures remain critical challenges, especially in applications like EVs and energy storage systems. Manufacturers must invest in R&D to develop eco-friendly and high-performance separators, which may increase production costs.

Volatile Raw Material Prices is restricting the market growth

Battery separators are primarily made from materials such as polyethylene, polypropylene, and ceramic coatings. Fluctuations in the prices of these raw materials, driven by supply chain disruptions and geopolitical uncertainties, impact the profitability of separator manufacturers.

For instance, the rising costs of polypropylene in 2023, due to supply shortages, led to increased production costs for separators, creating pricing pressures across the value chain.

Market Opportunities

The Global Battery Separators Market offers significant opportunities driven by advancements in material science, emerging battery technologies, and regional expansions.

Solid-state batteries, considered the next generation of energy storage, present a transformative opportunity for battery separator manufacturers. These batteries require separators with enhanced thermal stability, chemical resistance, and high ionic conductivity, paving the way for ceramic-based and hybrid separators. As major players like Toyota and Solid Power accelerate solid-state battery commercialization, the demand for advanced separators is expected to soar.

The recycling and repurposing of lithium-ion batteries is another area of growth. Governments and organizations are focusing on creating circular economies for batteries, which will require durable separators that can withstand multiple charge-discharge cycles without degradation.

Moreover, developing markets in Africa, the Middle East, and Latin America present untapped growth potential. Rising investments in infrastructure and electrification projects in these regions are driving demand for energy storage systems, creating new opportunities for separator manufacturers.

BATTERY SEPARATORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Material, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Asahi Kasei Corporation, SK Innovation Co., Ltd., Toray Industries, Inc., Sumitomo Chemical Co., Ltd., Entek International LLC, W-Scope Corporation, Celgard LLC, Freudenberg Performance Materials, UBE Industries Ltd., Dreamweaver International |

Battery Separators Market Segmentation - By Material

-

Polyethylene

-

Polypropylene

-

Ceramic-Coated

-

Others

Polypropylene separators have emerged as the dominant player in the separator market, primarily due to their cost-effectiveness, mechanical strength, and chemical resistance. These properties make them highly suitable for a wide range of applications, particularly in the automotive and industrial sectors. In the automotive industry, polypropylene separators are extensively used in lithium-ion batteries powering electric vehicles (EVs) and hybrid electric vehicles (HEVs). Their excellent thermal stability and dimensional stability enable them to withstand the rigorous operating conditions encountered in automotive applications. Additionally, polypropylene separators offer superior electrolyte wettability, which contributes to enhanced battery performance. In the industrial sector, polypropylene separators find applications in energy storage systems, such as stationary batteries for grid-scale energy storage and backup power systems. Their robust performance and long cycle life make them a reliable choice for these demanding applications. While polypropylene separators continue to dominate the market, ongoing research and development efforts are focused on improving their performance and addressing emerging challenges, such as thermal runaway and electrolyte leakage. By optimizing the microstructure and surface properties of polypropylene separators, researchers aim to enhance their safety, energy density, and cycle life, further solidifying their position as the leading separator material.

Battery Separators Market Segmentation - By Application

-

Lithium-Ion Batteries

-

Lead-Acid Batteries

-

Others

Lithium-ion batteries have emerged as the dominant application segment, driven by their exceptional energy density, long cycle life, and high power output. These attributes make them ideal for powering a wide range of devices, from portable electronics like smartphones and laptops to large-scale applications such as electric vehicles and renewable energy storage systems. The automotive industry, in particular, has witnessed a significant surge in demand for lithium-ion batteries as automakers accelerate their transition towards electric and hybrid vehicles. The ability of these batteries to deliver extended driving range, rapid charging capabilities, and consistent performance under diverse conditions has been instrumental in driving the adoption of EVs. Furthermore, lithium-ion batteries play a crucial role in the integration of renewable energy sources into the grid. By storing excess energy generated from solar and wind power, these batteries help ensure a reliable and sustainable energy supply. As research and development continue to advance lithium-ion battery technology, we can expect to see even greater innovation and broader applications in the years to come.

Battery Separators Market Segmentation - By End-Use

-

Automotive

-

Consumer Electronics

-

Industrial

-

Energy Storage Systems

The automotive sector stands as the dominant end-use segment for batteries, propelled by the surging production of electric vehicles (EVs) and hybrid vehicles. As the world transitions towards sustainable transportation, the demand for high-performance, reliable batteries is escalating. EVs, in particular, necessitate advanced battery technologies to deliver extended range, rapid charging capabilities, and optimal performance under diverse conditions. The increasing adoption of hybrid vehicles, which combine internal combustion engines with electric motors, further fuels the need for efficient battery solutions. The automotive industry's focus on electrification and hybridization is driving significant investments in battery research and development, leading to innovations in battery chemistry, cell design, and thermal management systems. These advancements are not only enhancing the driving experience but also contributing to reduced emissions and improved energy efficiency, making the automotive sector a key driver of the global battery market.

Battery Separators Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific dominated the market in 2024, accounting for more than 60% of the global market share. The region's dominance is attributed to the presence of leading battery manufacturers such as Panasonic, LG Chem, and Samsung SDI in countries like China, Japan, and South Korea. China, the world's largest EV producer, drives significant demand for lithium-ion batteries and separators. Government initiatives, such as subsidies for EV production and renewable energy projects, further bolster the region's market growth. North America and Europe are witnessing steady growth due to advancements in solid-state battery technologies and stringent regulations promoting clean energy. Meanwhile, Latin America and the Middle East & Africa are emerging as lucrative markets, driven by investments in renewable energy infrastructure.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly disrupted the global battery separators market in 2020, with production halts and supply chain disruptions impacting sales. However, the market rebounded strongly in 2021 due to rising demand for EVs and renewable energy systems as governments prioritized green recovery plans.

Battery separators gained prominence in medical applications during the pandemic, with an increased focus on backup power systems in healthcare facilities. The post-pandemic era has accelerated investments in battery technologies, driving innovations in separator materials and production techniques.

Latest Trends/Developments

Advancements in separator technology are driving the evolution of battery performance and safety. Ceramic-coated separators, with their superior thermal stability and safety features, are emerging as a promising solution for EV applications. Simultaneously, the industry is focusing on sustainable materials like biodegradable and bio-based separators to address environmental concerns associated with plastic waste. The development of solid-state batteries is revolutionizing the separator landscape, demanding high-performance materials for next-generation energy storage. To meet the rising demand for separators in EVs and energy storage systems, key players are expanding their manufacturing footprint, particularly in the Asia-Pacific region. Moreover, the integration of artificial intelligence (AI) is optimizing separator designs and enhancing battery performance, leading to reduced production costs and improved efficiency. These advancements collectively contribute to the development of safer, more efficient, and environmentally friendly battery solutions, propelling the growth of electric vehicles and renewable energy storage systems.

Key Players

-

Asahi Kasei Corporation

-

SK Innovation Co., Ltd.

-

Toray Industries, Inc.

-

Sumitomo Chemical Co., Ltd.

-

Entek International LLC

-

W-Scope Corporation

-

Celgard LLC

-

Freudenberg Performance Materials

-

UBE Industries Ltd.

-

Dreamweaver International

Chapter 1. Battery Separators Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Battery Separators Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Battery Separators Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Battery Separators Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Battery Separators Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Battery Separators Market – By Material

6.1 Introduction/Key Findings

6.2 Polyethylene

6.3 Polypropylene

6.4 Ceramic-Coated

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2025-2030

Chapter 7. Battery Separators Market – By Application

7.1 Introduction/Key Findings

7.2 Lithium-Ion Batteries

7.3 Lead-Acid Batteries

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Battery Separators Market – By End User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Consumer Electronics

8.4 Industrial

8.5 Energy Storage Systems

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 9. Battery Separators Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Battery Separators Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Asahi Kasei Corporation

10.2 SK Innovation Co., Ltd.

10.3 Toray Industries, Inc.

10.4 Sumitomo Chemical Co., Ltd.

10.5 Entek International LLC

10.6 W-Scope Corporation

10.7 Celgard LLC

10.8 Freudenberg Performance Materials

10.9 UBE Industries Ltd.

10.10 Dreamweaver International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 6.5 billion in 2024 and is projected to reach USD 10.20 billion by 2030, growing at a CAGR of 7.8%.

Key drivers include surging EV adoption, rising renewable energy deployments, and growing demand in consumer electronics.

Segments include Material (Polyethylene, Polypropylene, Ceramic-Coated), Application (Lithium-Ion, Lead-Acid), and End-Use (Automotive, Consumer Electronics, Industrial).

Asia-Pacific leads the market with over 60% share, driven by its strong battery manufacturing base and growing EV industry.

Major players include Asahi Kasei Corporation, SK Innovation Co., Ltd., Toray Industries, Inc., and Sumitomo Chemical Co., Ltd.