Syringes Market Size (2025 – 2030)

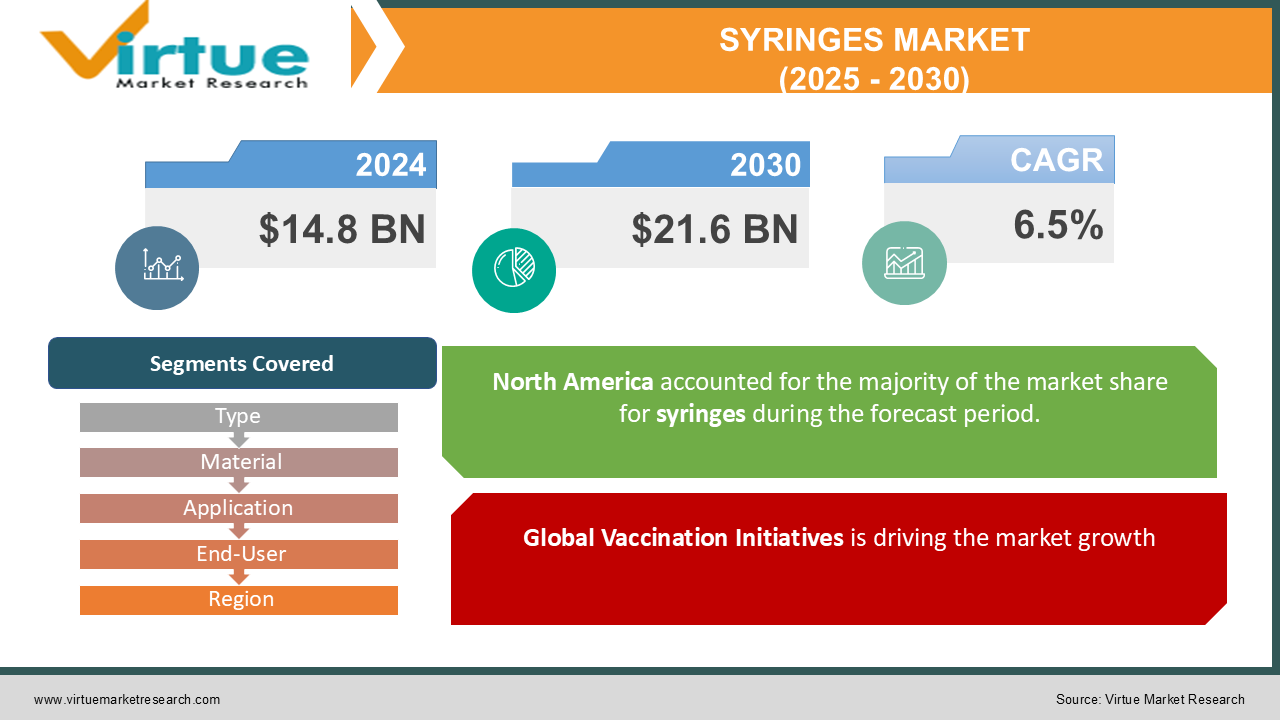

The Global Syringes Market was valued at USD 14.8 billion in 2024 and is projected to reach USD 21.6 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030.

Syringes are critical medical devices used for the administration of medications and collection of fluids in healthcare settings. The growing prevalence of chronic diseases, advancements in syringe technology, and increasing adoption of safe syringes are fueling the market growth. Moreover, rising healthcare expenditures and expanded vaccination programs globally are driving the demand for syringes, particularly in emerging markets.

The global syringes market is poised for significant growth in the coming years, driven by factors such as the increasing prevalence of chronic diseases, rising geriatric populations, and the growing demand for vaccines. The market is primarily segmented into disposable and reusable syringes, with disposable syringes dominating the market due to concerns about infection control and the convenience they offer. Key players in the market are focusing on technological advancements to develop safer and more efficient syringes, such as self-administration devices and safety syringes with needle-shielding mechanisms. Additionally, the increasing emphasis on healthcare infrastructure development in emerging economies is expected to further fuel market growth.

Key Market Insights

-

The increase in conditions like diabetes and cancer is driving demand for syringes in treatment regimens. Regulatory mandates promoting the use of safety syringes to prevent needle-stick injuries are influencing the market positively.

-

Developing regions with limited resources prefer reusable syringes, creating a robust market segment.

-

Plastic syringes are the most widely used due to their affordability and lightweight nature.

-

Smart syringes with dose-monitoring capabilities are emerging as a trend in advanced healthcare systems.

-

Countries like India and China are leading exporters of syringes due to cost-effective manufacturing.

-

The growing trend of self-administration of medications, especially for diabetes, is expanding the home care segment.

Global Syringes Market Drivers

Global Vaccination Initiatives is driving the market growth

The rising focus on immunization programs worldwide is one of the primary drivers of the syringes market. Large-scale vaccination drives for diseases such as influenza, measles, and COVID-19 have significantly boosted syringe demand. Organizations like WHO and UNICEF are heavily investing in vaccine delivery infrastructure in low- and middle-income countries, further propelling the market. For example, during the COVID-19 pandemic, billions of syringes were procured to administer vaccines globally. As vaccination campaigns for emerging infectious diseases continue, the demand for syringes is expected to remain robust.

Rising Prevalence of Chronic Diseases is driving the market growth

The increasing burden of chronic diseases such as diabetes and cancer is another significant growth driver. Diabetic patients require frequent insulin injections, creating a consistent demand for syringes. Similarly, cancer treatments often involve chemotherapy, which relies on intravenous drug delivery. Advances in syringe technology, such as prefilled syringes that reduce preparation time and risk of contamination, are further boosting their adoption in chronic disease management.

Technological Advancements in Syringes is driving the market growth

Innovations in syringe design and functionality are transforming the market. Safety syringes, equipped with features to prevent accidental needle-stick injuries, are witnessing growing adoption due to stringent regulations and healthcare worker safety initiatives. Additionally, smart syringes, which offer precise dosing and tracking capabilities, are gaining traction in advanced healthcare systems. These advancements not only enhance patient safety but also improve overall healthcare outcomes, driving market growth.

Global Syringes Market Challenges and Restraints

Concerns over Syringe Disposal is restricting the market growth

Improper disposal of syringes poses significant environmental and health risks, particularly in developing regions with inadequate waste management systems. Syringe-related waste can lead to the spread of infectious diseases and environmental pollution, creating challenges for manufacturers and healthcare providers. Governments and regulatory bodies are emphasizing the need for proper disposal methods, which adds to operational costs and complexity. The lack of awareness and infrastructure for effective waste management in emerging economies remains a critical restraint.

High Cost of Advanced Syringe is restricting the market growth

Advanced syringes, such as safety and smart syringes, are relatively expensive compared to conventional options, limiting their adoption in cost-sensitive markets. Healthcare facilities in low-income regions often prioritize affordability over advanced features, creating a gap in market penetration for high-end syringes. Additionally, the initial investment required for transitioning to advanced syringes can be a barrier for smaller healthcare providers.

Market Opportunities

The Global Syringes Market presents significant opportunities, particularly in emerging economies where healthcare infrastructure is expanding rapidly. Increasing government investments in public health and vaccination programs are expected to drive syringe demand in these regions. The increasing prevalence of chronic diseases, such as diabetes and arthritis, coupled with the aging population, drives the demand for disposable syringes. Additionally, the rising focus on vaccination programs, particularly in emerging markets, is fueling the need for safety syringes. Technological advancements, including the development of pre-filled syringes and auto-injectors, are revolutionizing drug delivery and enhancing patient convenience. Moreover, the growing emphasis on infection control and the rising awareness of the risks associated with reusable syringes are propelling the growth of the disposable syringe segment. Additionally, the rising trend of home healthcare, particularly for chronic disease management, offers opportunities for syringe manufacturers to cater to the growing consumer base. Innovations in sustainable syringe designs, such as biodegradable or reusable syringes, can address environmental concerns and create new revenue streams for companies. Furthermore, the development of prefilled syringes with precise dosing mechanisms offers convenience and reduces the risk of contamination, making them highly desirable in advanced healthcare settings. Collaborative efforts between manufacturers, governments, and international organizations to improve access to syringes in underprivileged areas can significantly expand market reach.

SYRINGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Material, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton, Dickinson and Company, Terumo Corporation, Nipro Corporation, Medtronic plc, Smiths Medical, Hindustan Syringes & Medical Devices Ltd., Gerresheimer AG, Braun Melsungen AG, Hamilton Company, Weigao Group |

Syringes Market Segmentation - By Type

-

Disposable Syringes

-

Reusable Syringes

Disposable syringes have become the dominant choice in the market due to their numerous advantages. Their widespread use in vaccination programs worldwide has solidified their position, as they offer a reliable and safe method for administering vaccines to large populations. Additionally, disposable syringes significantly reduce the risk of cross-contamination, a major concern in healthcare settings. By eliminating the need for sterilization and reuse, they prevent the transmission of blood-borne diseases, such as HIV and hepatitis. Furthermore, advancements in syringe technology, including the development of safety syringes with built-in needle-shielding mechanisms, have enhanced their safety profile. These factors, combined with increasing healthcare awareness and stringent regulatory standards, have propelled disposable syringes to the forefront of the market..

Syringes Market Segmentation - By Material

-

Glass Syringes

-

Plastic Syringes

Plastic syringes are preferred for their lightweight, cost-effectiveness, and ease of mass production.

Syringes Market Segmentation - By Application

-

Immunization

-

Drug Delivery

-

Blood Collection

-

Others

Drug delivery applications account for the largest market share, driven by the growing prevalence of chronic diseases requiring regular injections.

Syringes Market Segmentation - By End-User

-

Hospitals & Clinics

-

Home Care Settings

-

Diagnostic Centers

-

Others

Hospitals and clinics remain the largest end-users of syringes due to the high volume of medical procedures performed.

Syringes Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the market with advanced healthcare infrastructure, high vaccination rates, and significant investment in medical technology. The presence of key manufacturers and growing adoption of safety syringes further bolster the region’s dominance.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly accelerated the demand for syringes globally, driven by the rollout of massive vaccination campaigns. Manufacturers ramped up production to meet unprecedented demand, with governments and international organizations securing bulk supplies. The pandemic also highlighted the importance of safety syringes to minimize needle-stick injuries during mass immunization programs. However, supply chain disruptions and raw material shortages posed challenges for the industry. Post-pandemic, the increased awareness of immunization and disease prevention is expected to sustain demand for syringes, while innovations in design and safety features will shape future market trends. The unprecedented demand for vaccines led to a surge in syringe production and consumption. Manufacturers ramped up production to meet the increased demand, particularly for auto-disable (AD) syringes, which are crucial for preventing needle-stick injuries. However, the pandemic also highlighted supply chain vulnerabilities and logistical challenges in ensuring timely distribution of syringes, especially to low- and middle-income countries. Additionally, the pandemic accelerated the adoption of advanced syringe technologies, such as pre-filled syringes and auto-injectors, to streamline vaccination processes and reduce healthcare worker exposure. While the pandemic presented both challenges and opportunities for the syringes market, it underscored the critical role of syringes in public health and emphasized the need for robust supply chains and innovative technologies to address future health crises.

Latest Trends/Developments

The syringes market is witnessing notable trends, including the rising popularity of prefilled syringes, which offer convenience and reduce the risk of contamination. Manufacturers are increasingly focusing on eco-friendly syringes to address environmental concerns. Innovations in smart syringe technology, integrating dose-tracking and monitoring features, are gaining traction in advanced healthcare systems. Additionally, the expansion of online distribution channels is enhancing accessibility and driving sales of syringes directly to consumers. The growing emphasis on healthcare worker safety has led to the adoption of safety syringes equipped with needle protection mechanisms. The increasing prevalence of chronic diseases, such as diabetes and arthritis, coupled with the rising geriatric population, is fueling the demand for disposable syringes. Furthermore, the growing focus on vaccination programs, particularly in developing countries, is driving the adoption of safety syringes to prevent needle-stick injuries. Technological advancements, such as the development of pre-filled syringes and auto-injectors, are enhancing patient convenience and reducing medication errors. Additionally, the increasing emphasis on infection control and the rising awareness of the risks associated with reusable syringes are propelling the growth of the disposable syringe segment.

Key Players

-

Becton, Dickinson and Company

-

Terumo Corporation

-

Nipro Corporation

-

Medtronic plc

-

Smiths Medical

-

Hindustan Syringes & Medical Devices Ltd.

-

Gerresheimer AG

-

Braun Melsungen AG

-

Hamilton Company

-

Weigao Group

Chapter 1. Syringes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Syringes Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Syringes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Syringes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Syringes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Syringes Market – By Type

6.1 Introduction/Key Findings

6.2 Disposable Syringes

6.3 Reusable Syringes

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Syringes Market – By Material

7.1 Introduction/Key Findings

7.2 Glass Syringes

7.3 Plastic Syringes

7.4 Y-O-Y Growth trend Analysis By Material

7.5 Absolute $ Opportunity Analysis By Material, 2025-2030

Chapter 8. Syringes Market – By Application

8.1 Introduction/Key Findings

8.2 Immunization

8.3 Drug Delivery

8.4 Blood Collection

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Syringes Market – By End-User

9.1 Introduction/Key Findings

9.2 Hospitals & Clinics

9.3 Home Care Settings

9.4 Diagnostic Centers

9.5 Others

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2025-2030

Chapter 10. Syringes Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Material

10.1.3 By By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Material

10.2.4 By By Application

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Material

10.3.4 By By Application

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Material

10.4.4 By By Application

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Material

10.5.4 By By Application

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Syringes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Becton, Dickinson and Company

11.2 Terumo Corporation

11.3 Nipro Corporation

11.4 Medtronic plc

11.5 Smiths Medical

11.6 Hindustan Syringes & Medical Devices Ltd.

11.7 Gerresheimer AG

11.8 Braun Melsungen AG

11.9 Hamilton Company

11.10 Weigao Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 14.8 billion in 2024 and is projected to reach USD 21.6 billion by 2030, growing at a CAGR of 6.5%.

Key drivers include global vaccination campaigns, rising prevalence of chronic diseases, and technological advancements in syringe design

The market is segmented by type (disposable, reusable), material (glass, plastic), application (immunization, drug delivery), and end-user (hospitals, home care).

North America leads the market, accounting for a significant share due to its advanced healthcare infrastructure and high adoption of safety syringes.

Leading players include Becton, Dickinson and Company, Terumo Corporation, Nipro Corporation, Medtronic plc, and Smiths Medical.