Polyolefins Market Size (2024 – 2030)

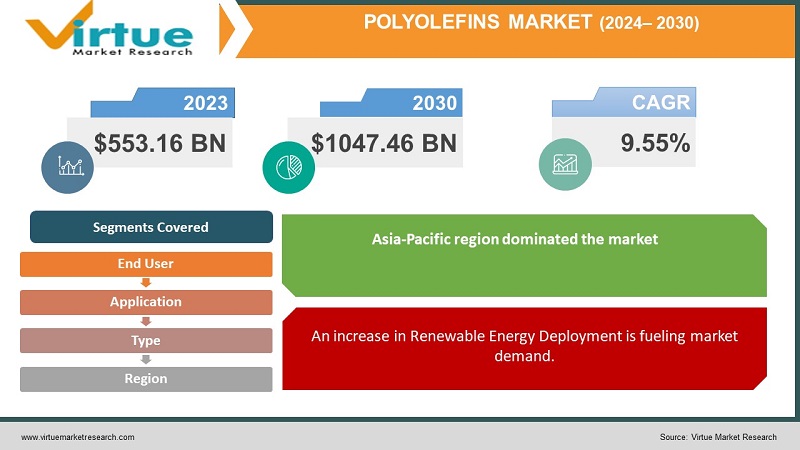

The Global Polyolefins Market was valued at USD 553.16 billion and is projected to reach a market size of USD 1047.46 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.55%.

Polyolefin refers to a group of thermoplastics known as polypropylene and polyethylene. These materials are primarily produced by polymerizing ethylene and propylene which are derived from gas and oil respectively. The production process involves converting olefins, hydrocarbons, or monomers into this polymer. Polyolefin is highly valued for its processability, chemical stability, and lasting durability. It finds applications, in sectors such, as packaging, consumer goods, fibers, and textiles. The United States is projected to experience an increase, in the demand for polyolefins like polyethylene, polypropylene, ethylene vinyl acetate, and thermoplastics between 2023 and 2030. This growth can be attributed to the rising utilization of masks, gloves, shoe and head covers, and gowns. The public's growing awareness of health issues and their emphasis on hygiene and infection prevention are the driving factors, behind this trend.

Key Market Insights:

During the year 2022, India had a production capacity of, more than 12 thousand kilotons, for polyolefins. The majority of polyolefins were manufactured by Reliance Industries Limited accounting for 47% of India’s overall polyolefins production capacity.

In the region, there was a 9% decrease, in the export volumes of polyethylene from the US to China in 2018 amounting to 584,157 metric tons. This decline goes against the trend.

The polyethylene industry, in Brazil is experiencing growth due to the increasing need for materials, in the automotive sector. This demand stems from the desire to enhance efficiency and offer design options.

Colombia stands as a player, in the industry within South America trailing only behind Brazil and Argentina. The sales of auto parts reached USD 4.21 billion in 2018 displaying an annual growth rate of 9.5 percent compared to the previous year. As a result, this expansion, in the sector continues to fuel market growth.

The fluctuating prices of oil, the unstable economy, and the strict environmental regulations are obstructing the expansion of the Polyolefins market share throughout the projected time frame.

Polyolefins Market Drivers:

Demand from the healthcare sector is increasing Polyolefins market size.

Modern healthcare heavily relies on the use of polyolefins, a type of material. These versatile materials are widely used in healthcare applications making up around 90% of those applications. Polyolefins are becoming increasingly popular, as a replacement for glass and metal due to their properties and adherence to medical and environmental regulations. They find applications in equipment like syringes, drug delivery systems, nasal sprays, and surgical instruments.

Additionally, polyolefins play a role in packaging solutions such as container and closure systems. However, with growing concerns about plastic usage in the healthcare sector economic uncertainties, and consumer sensitivities, the adoption of polyolefin in healthcare applications continues to rise.

Moreover, there is an increased demand for syringes due to the pandemic. Furthermore (HMD) is investing significantly in expanding its production capacity to meet this rising consumer demand. This surge in syringe demand is expected to drive the need for polypropylene in the future. Furthermore, governments are allocating funds, towards needle production which significantly contributes to the market growth.

An increase in Renewable Energy Deployment is fueling market demand.

Many nations are currently prioritizing development. Working towards increasing the proportion of renewable energy in their overall energy consumption and production. European countries, such, as Germany, Sweden, Spain, and Italy are at the forefront of the energy sector due to investments made to achieve climate change targets. Brazil, Japan, Turkey, China, the United States, and Australia also play roles in driving growth within this sector. Moreover, as more investments flow into energy projects there is a decline in reliance on coal for power generation.

As the focus continues to shift towards the development of energy sources there is a growing demand for polyolefins. Materials widely used in appliances that contribute to producing renewable energy infrastructure and equipment. Notably, the United States stands out as one of the world's leading producers of hydropower. In regions like the Pacific Northwest hydropower accounts for up to 70% of electricity supply. The operation of power stations necessitates components such as turbines and bearings made from high-density polyolefins (HDPE).

Furthermore within solar energy production domains materials like polystyrene and polyethylene terephthalate (PET) are now being utilized as substitutes, for metal junction boxes. Furthermore, the usage of high-density polyethylene (HDPE) is prevalent, in the production of diameter conduits. These conduits play a role in wind farms as they are responsible for safeguarding cables and preserving the surrounding environment. As a result, these combined factors contribute to the expansion of energy implementation. Consequently drives up the need, for polyolefins.

Global Polyolefins Market Restraints and Challenges:

The price of the product depends directly on the cost of the materials used. Changes, in these costs have an impact on the polyolefin market and commodity prices. The fluctuating cost of substances poses a challenge in producing polyolefins because when the cost of raw materials increases the cost of polyolefins.

Polyolefins are primarily produced using olefins derived from oil and natural gas cracking. The price of polyolefins follows the price trends of oil. The continuous rise in oil and natural gas prices is causing concern as they are crucial for producing olefin and its derivatives.

In March 2020 crude oil was priced at $32.20 per barrel; however, with reduced demand and oversupply due to lockdowns imposed in countries, its price surged to $64.61 per barrel in April 2021. These fluctuations, in crude oil costs have compelled companies to reduce their crude oil purchases, impacting polyolefin production.

Global Polyolefins Market Opportunities:

Polyolefins are commonly utilized in the food industry as packaging materials due, to their nature lack of odor and nonporous properties. High-density polyethylene (HDPE) density polyethylene (LDPE) polypropylene (PP) linear low-density polyethylene (LLDPE) and certain copolymers based on polyethylene find use in food packaging applications. These polyolefin films are cost-effective. Offer resistance, against moisture and gas permeation.

Additionally, these containers have the advantage of being able to withstand temperatures and prevent any leakage of food. Moreover, they are lightweight and perfectly conform to the shape of the food, which means they take up space, for storage and transportation. In countries such as India and China where the population is rapidly growing the food industry is experiencing expansion. This rapid growth in the food industry will inevitably lead to a demand for packaging materials. As a result, it is expected that emerging economies will provide opportunities, for the expansion of the global polyolefins market.

POLYOLEFINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.55% |

|

Segments Covered |

By Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sinopec Corp, LyondellBasell Industries Holdings, Exxon Mobil Corp, TotalEnergies, Stavian Quang Yen Petrochemical, Chevron Corp, Repsol, PetroChina Company Ltd, Dow, SABIC SK Nexdene |

Polyolefins Market Segmentation: By Type

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polystyrene

In 2022, based on the type, the Polyethylene (PE) segment accounted for the largest revenue share by almost 55% and has led the market. Polyethylene (PE) is widely popular, as a plastic due to its affordability, performance, and versatility. It finds applications in fields such as packaging, automotive, construction, and consumer goods.

Among polyolefins, Polystyrene (PS) is experiencing growth with an annual growth rate (CAGR) of 5.2% over the projected period. PS is a durable plastic used in areas including packaging, insulation, and food service. The expansion of the PS market can be attributed to the increasing demand, for eco-packaging solutions and the rising needs of developing economies.

Polyolefins Market Segmentation: By Application

-

Films & Sheets

-

Injection Moulding

-

Blow Moulding

-

Extrusion Coatings

-

Pipe & Extrusion

-

Wire & Cables

-

Others

In 2022, based on the application, the Films & Sheets segment accounted for the largest revenue share by almost 35% and has led the market. Polyolefins are materials, for producing films and sheets because they possess characteristics such as lightness, strength, flexibility, and moisture resistance. These films and sheets made from polyolefins find applications in industries, like packaging, agriculture, construction, and consumer goods.

The Pipe & Extrusion sector is experiencing growth in the use of polyolefins with a projected compound growth rate (CAGR) of 5.5%. This can be attributed to the increasing adoption of polyolefins, in pipe and extrusion applications driven by their benefits such as resistance to corrosion lasting durability, and cost effectiveness. The expansion of the Pipe and extrusion market is fueled by the growing need for infrastructure development in emerging economies and the rising demand for robust pipes, within the oil and gas industry.

Polyolefins Market Segmentation: By End User

-

Packaging

-

Automotive

-

Construction

-

Electrical

-

Agriculture

-

Others

In 2022, based on the end user, the Packing segment accounted for the largest revenue share by almost 40% and has led the market. Polyolefins are widely preferred for packaging purposes due, to their nature, durability, flexibility, and resistance to moisture. They find use in packaging applications including food packaging, beverage packaging, and industrial packaging.

Among the end users of polyolefins the construction industry is experiencing growth with a compound annual growth rate (CAGR) of 5.2% during the projected period. This is primarily attributed to the increasing utilization of polyolefins in construction applications like pipes, fittings, roofing materials, and insulation. The expansion of the construction sector can be attributed to the escalating demand for infrastructure development in emerging economies as the growing need for lightweight and long-lasting materials, in construction projects.

Polyolefins Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the Asia-Pacific region dominated the global medical tourism market with a revenue of 45%. This is because there is a growing need, for developing economies in the areas of China and India. The expansion of the polyolefins industry, in Asia Pacific is also fueled by the increasing urbanization and disposable incomes.

The Middle East and Africa (MEA) is experiencing growth, in the global polyolefins market with an annual growth rate (CAGR) of 5.5% throughout the projected period. This growth can be attributed to investments made in the petrochemical sector within the MEA region. Countries like Saudi Arabia, the United Arab Emirates, and Qatar are expanding their production capacities due to their oil and gas reserves, which serve as materials, for polyolefin production.

COVID-19 Impact Analysis on the Global Polyolefins Market:

The polyolefins industry is currently experiencing a period of reduced demand, for its products. The abundance of polyethylene capacity expansions has caused oversupply. Squeezed profit margins, which has put pressure on producers. Manufacturers were already grappling with disruptions in the supply chain due to the trade war between the U.S. And China. Now COVID-19 has added delays to cargo deliveries. The emergence of COVID-19 as a declared pandemic by the World Health Organization is noticeably impacting growth. According to the International Monetary Fund, it is expected that global GDP will decline by 0.3% in 2020. The World Trade Organization (WTO) projects that global trade volumes could decrease between 13% and 32% in 2020 due to the repercussions of COVID-19. This pandemic is affecting industries such as automotive, oil and gas construction, and aerospace among others since most countries have issued "stay at home" guidelines or lockdown measures. It is anticipated that the impact of COVID-19 will be felt throughout 2020 and possibly for months into 2021. Given that Polyolefins products are used in these industries the downturn, in their operations directly affects the growth of the Polyolefins market.

Latest Trends/ Developments:

The market, for polyolefins is constantly changing, with new trends and advancements emerging. Some of the trends include a rising demand for sustainable solutions in the form of bio-based and recycled polyolefins. Additionally, there is a shift towards adopting a circular economy model, where polyolefins are recycled and reused times. Furthermore, ongoing technological developments aim to enhance the performance properties of polyolefins. Lastly, polyolefins are being utilized in applications such, as printing, medical devices, and automotive components. These trends are propelling the growth of the polyolefins market offering manufacturers and end users opportunities.

Key Players:

-

Sinopec Corp

-

LyondellBasell Industries Holdings

-

Exxon Mobil Corp

-

TotalEnergies

-

Stavian Quang Yen Petrochemical

-

Chevron Corp

-

Repsol

-

PetroChina Company Ltd

-

Dow

-

SABIC SK Nexdene

- In November 2022 Stavian Quang Yen Petrochemical, Ltd. decided to choose LyondellBasells polypropylene (PP) technology for their large-scale production facility. The planned facility will house a 600 kiloton, per annum PP plant equipped with LyondellBasell renowned Spherical technology. This collaboration marks a milestone as LyondellBasell becomes the licensor of polypropylene, for the group's inaugural polyolefin facility.

- In August 2022 SABIC SK Nexlene, a partnership, between SABIC and SK Geo Centric revealed plans to enlarge their production facility located in Ulsan, South Korea. The upgraded plant is scheduled to begin operations in the quarter of 2024 and cater to the increasing need for NEXLENE-based polyolefin solutions, across industries.

Chapter 1. Polyolefins Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polyolefins Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polyolefins Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polyolefins Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polyolefins Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polyolefins Market – By Type

6.1 Introduction/Key Findings

6.2 Polyethylene (PE)

6.3 Polypropylene (PP)

6.4 Polystyrene

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Polyolefins Market – By Application

7.1 Introduction/Key Findings

7.2 Films & Sheets

7.3 Injection Moulding

7.4 Blow Moulding

7.5 Extrusion Coatings

7.6 Pipe & Extrusion

7.7 Wire & Cables

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Polyolefins Market – By End User

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Automotive

8.4 Construction

8.5 Electrical

8.6 Agriculture

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End User

8.9 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Polyolefins Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Polyolefins Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sinopec Corp

10.2 LyondellBasell Industries Holdings

10.3 Exxon Mobil Corp

10.4 TotalEnergies

10.5 Stavian Quang Yen Petrochemical

10.6 Chevron Corp

10.7 Repsol

10.8 PetroChina Company Ltd

10.9 Dow

10.10 SABIC SK Nexdene

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyolefins Market was valued at USD 553.16 billion and is projected to reach a market size of USD 1047.46 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.55%.

Demand from the healthcare sector is increasing, Increasing Renewable Energy Deployment.

Based on Type, the Global Polyolefins Market is segmented into Polyethylene (PE), Polypropylene (PP), and Polystyrene.

Asia Pacific is the most dominant region for the Global Polyolefins Market.

Sinopec Corp, LyondellBasell Industries Holdings, PetroChina Company Ltd, TotalEnergies, Chevron Corp, and Repsol are the key players operating in the Global Polyolefins Market.