Pharmaceutical Packaging Equipment Market Size (2024 – 2030)

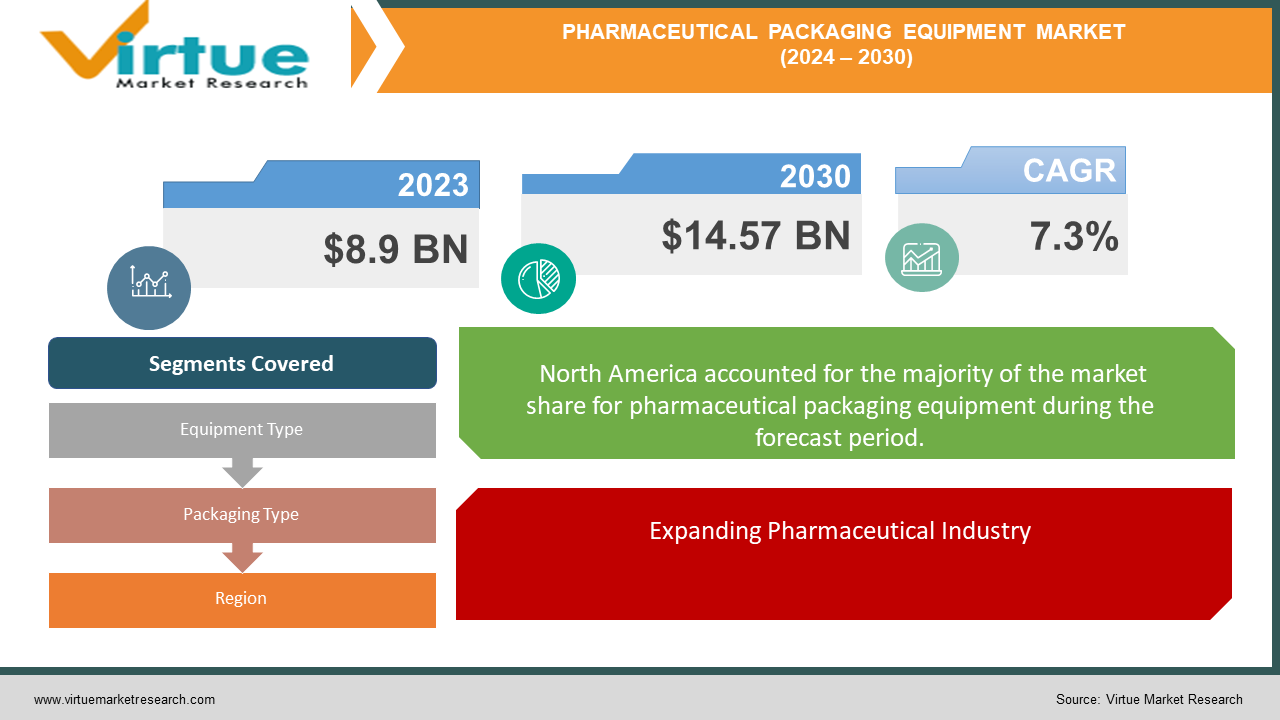

The Global Pharmaceutical Packaging Equipment Market was valued at USD 8.9 billion in 2023 and is projected to reach a market size of USD 14.57 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.3% between 2024 and 2030.

The global pharmaceutical packaging equipment market plays a crucial role in ensuring the safety, efficacy, and integrity of pharmaceutical products. This market encompasses a wide range of machinery designed for various packaging processes, including filling, sealing, labeling, and inspecting pharmaceutical goods. The demand for advanced packaging equipment is driven by the growing pharmaceutical industry, which is fueled by increasing healthcare needs, rising prevalence of chronic diseases, and an aging population. Technological advancements such as automation, robotics, and smart packaging solutions are revolutionizing the industry, enhancing operational efficiency and compliance with stringent regulatory standards. The integration of IoT and AI technologies in packaging equipment allows for real-time monitoring, predictive maintenance, and enhanced traceability, further bolstering market growth. Additionally, there is a significant emphasis on sustainable packaging solutions to reduce environmental impact, prompting manufacturers to develop eco-friendly and energy-efficient equipment. The COVID-19 pandemic has also accelerated the demand for reliable packaging systems to support the rapid production and distribution of vaccines and therapeutics. As the pharmaceutical industry continues to expand and innovate, the packaging equipment market is poised for robust growth, driven by the need for advanced, efficient, and sustainable solutions.

Key Market Insights:

Adoption of technologies like RFID tags and QR codes has increased by over 30%, enhancing product traceability and anti-counterfeiting measures.

Stringent regulatory requirements drive over 25% of the demand for equipment ensuring adherence to global standards.

Approximately 20% of manufacturers are investing in eco-friendly packaging solutions to minimize environmental impact.

There is a 15% increase in demand for flexible and customizable packaging equipment to meet diverse product specifications.

The pharmaceutical industry's expansion in emerging markets contributes to more than 35% of the growth in equipment sales.

COVID-19 highlighted the necessity for robust packaging systems, especially for vaccines and medications, driving up demand by 40% during the peak period.

Global Pharmaceutical Packaging Equipment Market Drivers:

Technological Advancements in Packaging Solutions.

Technological advancements in packaging solutions are a significant driver of the global pharmaceutical packaging equipment market. The integration of automation, robotics, and advanced tracking systems has revolutionized the packaging process, making it more efficient, accurate, and reliable. Automated systems reduce the risk of human error, enhance production speeds, and ensure consistent quality, meeting the stringent regulatory standards of the pharmaceutical industry. Innovations such as smart packaging, which includes RFID tags and QR codes, improve product traceability and combat counterfeiting, ensuring patient safety and regulatory compliance. These technological developments not only optimize operational efficiency but also support the industry's move towards more sustainable and eco-friendly packaging solutions.

Expanding Pharmaceutical Industry

The expanding pharmaceutical industry is another major driver of the pharmaceutical packaging equipment market. With the increasing global demand for medications driven by the rise in chronic diseases, an aging population, and growing healthcare awareness, the pharmaceutical sector is experiencing substantial growth. This surge in pharmaceutical production necessitates advanced packaging equipment capable of handling a wide variety of products, including solid and liquid dosages, injectables, and complex biologics. Additionally, the growing emphasis on personalized medicine and biologics requires specialized packaging solutions to maintain product integrity and efficacy. The expansion of the pharmaceutical industry, coupled with the need for innovative packaging technologies, propels the demand for sophisticated pharmaceutical packaging equipment.

Global Pharmaceutical Packaging Equipment Market Restraints and Challenges:

The global pharmaceutical packaging equipment market faces several significant restraints and challenges that could impede its growth. One of the primary challenges is the high cost of advanced packaging equipment, which can be a substantial financial burden for small and medium-sized pharmaceutical companies. The initial investment, along with ongoing maintenance and operational costs, can be prohibitive, limiting the adoption of state-of-the-art technologies. Additionally, stringent regulatory requirements and compliance standards across different countries present a complex landscape for manufacturers. Navigating these regulations requires substantial resources and expertise, which can slow down innovation and market entry for new players. The market also faces challenges related to the sustainability and environmental impact of packaging materials. There is increasing pressure to develop eco-friendly and biodegradable packaging solutions, which necessitates significant research and development efforts. Moreover, the rapid pace of technological advancements means that equipment can quickly become obsolete, leading to frequent upgrades and replacements, adding to the overall cost. Economic fluctuations and market volatility can further impact the purchasing power of pharmaceutical companies, affecting their investment in new packaging equipment. These factors collectively pose significant challenges to the growth and development of the pharmaceutical packaging equipment market.

Global Pharmaceutical Packaging Equipment Market Opportunities:

The global pharmaceutical packaging equipment market is poised for significant opportunities driven by advancements in technology and evolving industry demands. One of the key opportunities lies in the increasing adoption of smart packaging solutions, which offer enhanced product tracking, anti-counterfeiting features, and improved patient safety. Smart packaging, incorporating technologies like RFID tags and QR codes, provides real-time data and ensures compliance with stringent regulatory standards. Another promising opportunity is the growing demand for sustainable and eco-friendly packaging solutions. As environmental concerns rise, pharmaceutical companies are seeking innovative materials and processes that reduce their ecological footprint. This shift towards green packaging opens up new avenues for manufacturers to develop biodegradable, recyclable, and energy-efficient packaging equipment. Additionally, the expanding pharmaceutical industry, particularly in emerging markets, presents a vast growth potential. These regions are experiencing increased healthcare access, rising prevalence of chronic diseases, and an aging population, driving the need for advanced packaging solutions. The trend towards personalized medicine and biologics also offers significant opportunities for specialized packaging equipment that ensures the integrity and efficacy of these complex products. By leveraging these opportunities, companies in the pharmaceutical packaging equipment market can drive innovation, expand their market presence, and meet the evolving needs of the global pharmaceutical industry.

PHARMACEUTICAL PACKAGING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Equipment Type, Packaging Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Packaging Technology, IMA Group, Marchesini Group S.p.A., Uhlmann Group, Korber AG, Multivac Group, Romaco Holding GmbH, Optima Packaging Group GmbH, Syntegon Technology GmbH, Robert Bosch GmbH |

Global Pharmaceutical Packaging Equipment Market Segmentation: By Equipment Type

-

Primary Packaging Equipment

-

Secondary Packaging Equipment

-

Labelling and Serialization Equipment

The Global Pharmaceutical Packaging Equipment Market by Equipment Type, Primary Packaging Equipment market share last year and is poised to maintain its dominance throughout the forecast period. Primary packaging equipment holds a pivotal position within the pharmaceutical industry due to its direct contact with medications, ensuring sterility and maintaining product integrity. This critical role makes it a top priority for pharmaceutical companies striving to uphold stringent safety standards and regulatory requirements. The demand for advanced primary packaging solutions is further underscored by the industry's growth in biologics and personalized medicine, which require specialized packaging to preserve the efficacy of complex formulations. Market research indicates that primary packaging equipment dominated the market in 2023, with estimates suggesting a significant 60.25% market share. Reports from various sources, including The Brainy Insights and MarketsandMarkets, corroborate this leadership position, highlighting the segment's crucial role in drug safety and its alignment with evolving pharmaceutical trends. As pharmaceutical innovations continue to advance and regulatory pressures intensify, primary packaging equipment is poised to maintain its dominance, driven by the necessity for reliable, sterile, and tamper-proof packaging solutions that safeguard the efficacy and safety of medications worldwide.

Global Pharmaceutical Packaging Equipment Market Segmentation: By Packaging Type

-

Liquids Packaging Equipment

-

Solid Packaging Equipment

-

Semi-Solid Packaging Equipment

The Global Pharmaceutical Packaging Equipment Market by Packaging Type, Liquids Packaging Equipment market share last year and is poised to maintain its dominance throughout the forecast period. Liquid packaging equipment shows a promising potential to lead within the pharmaceutical industry, supported by substantial market research indicating its significant presence. Reports, such as those from The Brainy Insights citing a 49.65% market share in 2023, underscore its strong foothold. This dominance is driven by several key factors. Firstly, the high production volume of liquid pharmaceuticals, including syrups and injections, generates substantial demand for specialized packaging equipment tailored to handle these formulations efficiently and safely. Moreover, the increasing prevalence of specific liquid medications like eye drops and ear drops further boosts the market, necessitating precise and sterile packaging solutions to maintain product efficacy and patient safety. Despite its strong position, the leadership of liquids packaging equipment is not guaranteed, as the industry faces ongoing challenges such as regulatory complexities and technological advancements. However, with the continuous expansion of pharmaceutical manufacturing and the evolving healthcare landscape, liquids packaging equipment is poised to maintain its prominence, provided it adapts to emerging trends and innovations in the sector.

Global Pharmaceutical Packaging Equipment Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Pharmaceutical Packaging Equipment Market by Region, North America market share last year and is poised to maintain its dominance throughout the forecast period. North America maintains a formidable position in the global pharmaceutical packaging equipment market, driven by several compelling factors. The region benefits significantly from its large and established pharmaceutical industry, particularly in the United States, which commands a substantial portion of the global market and consistently invests in research and development. This robust industry demand necessitates advanced packaging solutions to ensure product safety and compliance with stringent regulatory standards, further reinforcing North America's leadership. Strict regulations governing drug safety and packaging standards in the region also contribute to the demand for high-quality equipment that meets these rigorous requirements. However, the market landscape is evolving, presenting nuances that could influence North America's dominance. Emerging markets in regions like Asia Pacific, particularly China and India, are experiencing rapid growth in their pharmaceutical sectors. This growth trajectory suggests a potential shift in market share over time as these regions expand their manufacturing capabilities and regulatory frameworks. Moreover, manufacturers may increasingly prioritize cost-effectiveness, considering equipment options from emerging markets that offer competitive pricing. This focus on cost-efficiency could challenge North America's stronghold in the long term. In conclusion, while North America currently holds a strong position driven by its established industry and stringent regulations, the dynamic nature of global markets and the rise of emerging economies pose potential challenges to its dominance in the pharmaceutical packaging equipment market. Adaptation to evolving trends and competitive pressures will be crucial for sustaining leadership in the future.

COVID-19 Impact Analysis on the Global Pharmaceutical Packaging Equipment Market.

The COVID-19 pandemic has had a profound impact on the global pharmaceutical packaging equipment market, acting as both a catalyst for growth and a source of significant challenges. On one hand, the pandemic led to an unprecedented surge in the demand for pharmaceuticals, including vaccines, diagnostic kits, and therapeutic drugs, necessitating rapid scaling up of production capacities. This surge drove the need for advanced packaging equipment to ensure the safe, efficient, and compliant packaging of these critical products. The urgency to distribute vaccines globally also spurred innovations in packaging solutions that ensure temperature control and product stability, highlighting the importance of reliable packaging in maintaining the integrity of pharmaceutical products. On the other hand, the pandemic disrupted global supply chains, causing delays in the procurement of raw materials and components essential for manufacturing packaging equipment. Travel restrictions and lockdowns further hampered on-site installations and maintenance services, posing operational challenges for manufacturers. Additionally, economic uncertainties affected capital investments, especially for small and medium-sized enterprises. Despite these hurdles, the pandemic underscored the critical role of resilient and adaptable pharmaceutical packaging systems, driving long-term investments in automation, digitalization, and sustainable practices to better prepare for future healthcare emergencies.

Latest trends / Developments:

The global pharmaceutical packaging equipment market is witnessing several notable trends and developments driven by technological advancements and evolving industry needs. One significant trend is the increasing adoption of automation and robotics in packaging processes. Automated systems enhance efficiency, reduce human error, and ensure consistent quality, meeting stringent regulatory requirements. The integration of Industry 4.0 technologies, such as IoT and AI, enables real-time monitoring, predictive maintenance, and data analytics, optimizing operational performance and reducing downtime. Another major development is the rise of smart packaging solutions that incorporate features like RFID tags and QR codes for better traceability, anti-counterfeiting, and patient engagement. These technologies provide real-time information on product status and history, enhancing supply chain transparency and security. Sustainability is also a key focus, with a growing emphasis on eco-friendly packaging materials and energy-efficient equipment. Manufacturers are investing in research and development to create biodegradable and recyclable packaging solutions that minimize environmental impact. Additionally, the demand for customized and flexible packaging equipment is increasing, driven by the growth of personalized medicine and complex biologics. These trends underscore the industry's move towards more advanced, secure, and sustainable packaging solutions, reflecting the changing landscape of the pharmaceutical sector.

Key Players:

-

Bosch Packaging Technology

-

IMA Group

-

Marchesini Group S.p.A.

-

Uhlmann Group

-

Korber AG

-

Multivac Group

-

Romaco Holding GmbH

-

Optima Packaging Group GmbH

-

Syntegon Technology GmbH

-

Robert Bosch GmbH

Chapter 1. Pharmaceutical Packaging Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pharmaceutical Packaging Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pharmaceutical Packaging Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pharmaceutical Packaging Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pharmaceutical Packaging Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pharmaceutical Packaging Equipment Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Primary Packaging Equipment

6.3 Secondary Packaging Equipment

6.4 Labelling and Serialization Equipment

6.5 Y-O-Y Growth trend Analysis By Equipment Type

6.6 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 7. Pharmaceutical Packaging Equipment Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Liquids Packaging Equipment

7.3 Solid Packaging Equipment

7.4 Semi-Solid Packaging Equipment

7.5 Y-O-Y Growth trend Analysis By Packaging Type

7.6 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Pharmaceutical Packaging Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Equipment Type

8.1.3 By Packaging Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Equipment Type

8.2.3 By Packaging Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Equipment Type

8.3.3 By Packaging Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Equipment Type

8.4.3 By Packaging Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Equipment Type

8.5.3 By Packaging Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pharmaceutical Packaging Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bosch Packaging Technology

9.2 IMA Group

9.3 Marchesini Group S.p.A.

9.4 Uhlmann Group

9.5 Korber AG

9.6 Multivac Group

9.7 Romaco Holding GmbH

9.8 Optima Packaging Group GmbH

9.9 Syntegon Technology GmbH

9.10 Robert Bosch GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Pharmaceutical Packaging Equipment market is expected to be valued at US$ 8.9 billion.

Through 2030, the Global Pharmaceutical Packaging Equipment market is expected to grow at a CAGR of 7.3%.

By 2030, Global Market is expected to grow to a value of US$ 14.57 billion.

North America is predicted to lead the Global Pharmaceutical Packaging Equipment market.

The Global Pharmaceutical Packaging Equipment Market has segments By Category, Distribution Channel, and Region