Polyethylene Market Size (2025 – 2030)

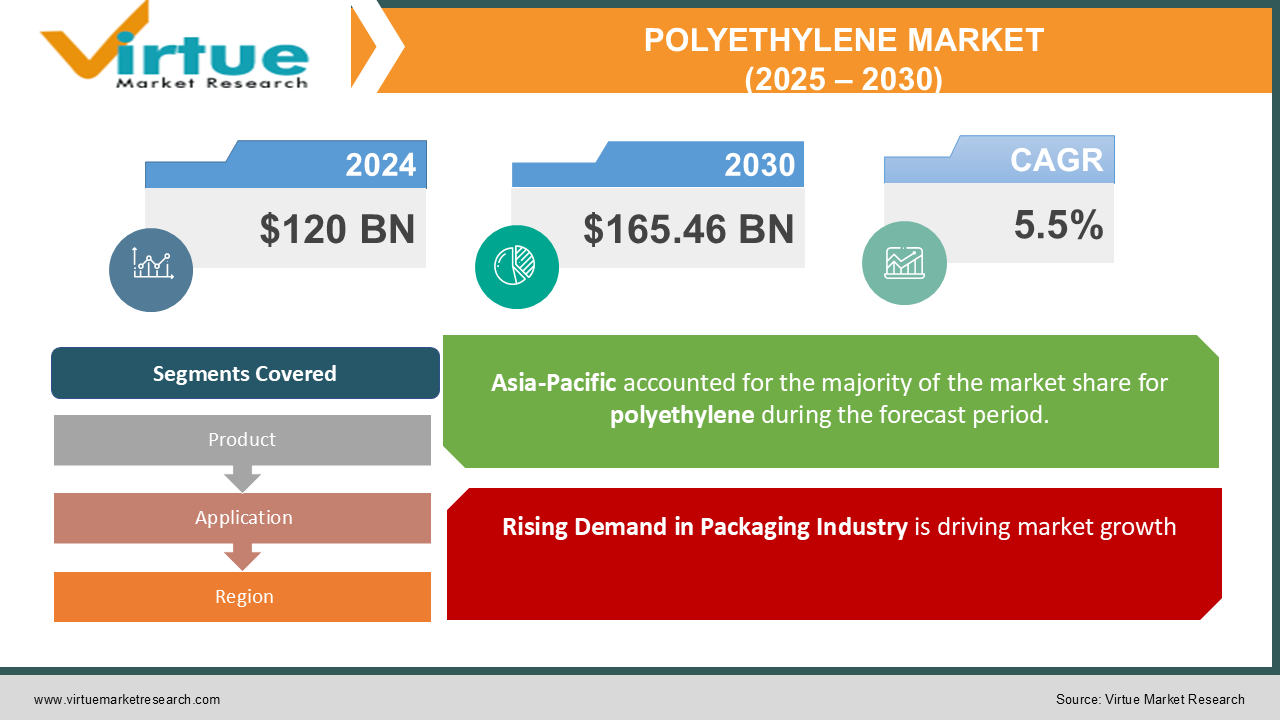

The Global Polyethylene Market was valued at USD 120 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The market is expected to reach USD 165.46 billion by 2030.

The Polyethylene Market focuses on the production and application of polyethylene, one of the most widely used plastics worldwide. Polyethylene is known for its versatility, durability, and cost-effectiveness, making it a critical component in industries like packaging, construction, automotive, and healthcare. The market growth is fueled by rising demand for lightweight materials, increasing packaging needs, and innovations in recycling and sustainable solutions.

Key Market Insights

-

The global polyethylene production exceeded 100 million metric tons in 2024, accounting for over one-third of global plastic demand.

-

High-density polyethylene (HDPE) dominates the market, contributing to more than 45% of total polyethylene consumption due to its strength and versatility in applications such as piping and containers.

-

Low-density polyethylene (LDPE) finds significant usage in packaging films, contributing approximately 25% to the market share.

-

Asia-Pacific is the largest consumer of polyethylene, holding over 45% of the global market share in 2024, driven by rapid industrialization and urbanization in countries like China and India.

-

Increasing focus on sustainability has led to the development of bio-based polyethylene, which is expected to grow at a CAGR of 8% during the forecast period.

Global Polyethylene Market Drivers

Rising Demand in Packaging Industry is driving market growth:

The packaging industry is the largest consumer of polyethylene, driven by its properties like durability, flexibility, and moisture resistance. The rise in e-commerce has further amplified the demand for polyethylene films, bags, and wraps. Additionally, food and beverage industries extensively utilize polyethylene for packaging to ensure product freshness and safety. Emerging economies, particularly in Asia-Pacific, are witnessing a surge in packaged food consumption due to urbanization and changing consumer lifestyles. Moreover, polyethylene's ability to cater to diverse packaging needs—ranging from stretch films to rigid containers—bolsters its demand. The growing trend of single-use plastics, though a challenge environmentally, remains a driver for short-term market expansion in emerging regions. Innovations like multi-layered polyethylene films are also enhancing its appeal in high-barrier packaging applications.

Growth in Infrastructure and Construction Activities is driving market growth:

Polyethylene's usage in construction materials such as pipes, geomembranes, and insulation products is increasing due to its strength, chemical resistance, and longevity. Rapid urbanization and infrastructure development in developing regions have spurred demand for polyethylene-based materials. High-density polyethylene (HDPE) pipes, for instance, are extensively used in water distribution systems and sewage management due to their leak-proof and corrosion-resistant properties. Governments across the globe are investing heavily in infrastructure modernization, driving the demand for durable and cost-effective materials. The ongoing shift toward green buildings and energy-efficient construction materials further supports the use of polyethylene in insulation and vapor barriers, enhancing its application scope in the sector.

Advancements in Recycling Technologies is driving market growth:

The polyethylene market is undergoing a transformation with the rise of recycling technologies aimed at addressing environmental concerns. Mechanical recycling methods are already prevalent, but innovations in chemical recycling have paved the way for converting polyethylene waste into high-quality raw materials. Governments and private players are investing in advanced recycling facilities, especially in regions like Europe and North America, where strict regulations on plastic waste management are enforced. The emergence of bio-based polyethylene, produced from renewable resources such as sugarcane, also aligns with the sustainability goals of industries and consumers alike. As consumer awareness around sustainability grows, companies are adopting circular economy practices, leading to increased demand for recyclable polyethylene and driving market growth.

Global Polyethylene Market Challenges and Restraints

Environmental Concerns and Regulatory Pressures is restricting market growth:

Despite its extensive use, polyethylene is at the forefront of environmental debates due to its contribution to plastic pollution. Single-use polyethylene products are often discarded improperly, leading to long-term environmental damage. Governments and environmental organizations worldwide are introducing strict regulations to curb plastic waste, including bans on single-use plastics and taxes on virgin polymer production. Such regulatory pressures are pushing manufacturers to innovate and invest in sustainable solutions, which can increase production costs. The lack of widespread infrastructure for recycling polyethylene waste, especially in developing regions, further complicates the market's sustainability efforts.

Fluctuating Raw Material Prices is restricting market growth:

Polyethylene production heavily depends on petrochemical derivatives like ethylene, which are subject to price volatility due to fluctuations in crude oil prices. Political instability in oil-producing regions, supply-demand imbalances, and global economic shifts directly impact the pricing of raw materials, creating uncertainties for polyethylene manufacturers. Additionally, the increasing demand for bio-based alternatives and stricter environmental norms are pushing raw material costs higher, affecting the profit margins of producers. These challenges necessitate strategic planning and investment in alternative raw materials and sustainable practices to ensure market stability and growth.

Market Opportunities

The growing emphasis on sustainability presents a significant opportunity for the polyethylene market to innovate and cater to environmentally conscious consumers. The development of bio-based polyethylene from renewable resources such as sugarcane, corn, and other biomass aligns with global sustainability goals. Companies investing in research and development to produce cost-effective, biodegradable polyethylene stand to gain a competitive edge. Additionally, emerging economies in Asia-Pacific, Africa, and South America present untapped markets for polyethylene applications in packaging, construction, and automotive industries. The expanding e-commerce industry in these regions is fueling demand for durable and lightweight polyethylene packaging solutions. Technological advancements in recycling are opening avenues for circular economies, where waste polyethylene is reused to create high-quality products. Companies collaborating with governments and environmental organizations to establish efficient waste management and recycling systems can leverage these opportunities to strengthen their market presence.

POLYETHYLENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil, Dow Chemical, LyondellBasell Industries, SABIC, INEOS, Chevron Phillips Chemical, BASF, Borealis, Reliance Industries, Braskem |

Polyethylene Market Segmentation - By Product

-

High-Density Polyethylene (HDPE)

-

Low-Density Polyethylene (LDPE)

-

Linear Low-Density Polyethylene (LLDPE)

-

Others

High-Density Polyethylene (HDPE) leads the market due to its versatility, strength, and resistance to environmental stress. It is extensively used in piping systems, packaging, and containers, making it the most significant contributor to market revenue.

Polyethylene Market Segmentation - By Application

-

Packaging

-

Construction

-

Automotive

-

Electrical and Electronics

-

Healthcare

-

Others

The packaging segment dominates the application landscape, accounting for the largest market share. Its extensive use in food and beverage, e-commerce, and consumer goods industries underscores its critical role in global polyethylene demand.

Polyethylene Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific holds the largest market share in the polyethylene industry, driven by rapid industrialization, urbanization, and population growth in countries like China and India. The region's thriving packaging and construction industries contribute significantly to polyethylene consumption. With rising investments in infrastructure development and a growing consumer base, Asia-Pacific is expected to maintain its dominance during the forecast period.

COVID-19 Impact Analysis on the Polyethylene Market

The COVID-19 pandemic had a mixed impact on the polyethylene market. On one hand, the demand for polyethylene surged in key sectors like healthcare and packaging. With the heightened need for medical supplies such as face shields, syringes, and protective equipment, polyethylene played a crucial role in supporting the healthcare response. Additionally, the increased consumption of packaged food and the surge in e-commerce during lockdowns further drove polyethylene demand, as it is widely used in packaging materials. On the other hand, the pandemic caused significant disruptions to global supply chains, leading to delays in raw material procurement and production activities. The automotive and construction industries, which are major end-users of polyethylene, saw a slowdown during the crisis, which adversely affected the overall market. These sectors' reduced demand for polyethylene products resulted in a temporary market downturn. Despite these challenges, the polyethylene market showed a strong recovery. As industries deemed essential—such as healthcare, packaging, and food production—continued to thrive, the demand for polyethylene rebounded quickly. Additionally, post-pandemic, governments around the world have focused on economic recovery and infrastructure development, which has further boosted the demand for polyethylene in construction and other industrial applications. This rebound highlights polyethylene's critical role in global supply chains and its resilience in times of crisis, positioning the market for sustained growth in the coming years.

Latest Trends/Developments

The polyethylene market is experiencing several transformative trends, with sustainability taking center stage. Companies are increasingly focusing on sustainable and bio-based polyethylene solutions to align with global environmental standards. As part of this shift, there is a growing adoption of circular economy practices, with investments in advanced recycling technologies aimed at reducing waste and enhancing resource efficiency. Additionally, polyethylene is finding advanced applications in sectors like automotive lightweighting and green building materials. These innovations contribute to reducing carbon footprints and improving energy efficiency. In the automotive industry, polyethylene is being used to produce lighter components that improve fuel efficiency and reduce emissions, while in construction, polyethylene-based materials are being integrated into eco-friendly building designs.Another notable trend is the rise of smart packaging solutions. Polyethylene films are increasingly being integrated with sensors and indicators that provide real-time data on product conditions, enhancing convenience and safety for consumers. This innovation is particularly valuable in food packaging, where it help extend shelf life and maintain product quality. Emerging markets are also adopting advanced polyethylene solutions to meet their growing needs for infrastructure and packaging. As these economies expand, polyethylene plays a crucial role in meeting the demand for efficient, cost-effective materials. Furthermore, strategic collaborations between major industry players and governments to address plastic waste are underscoring the sector's commitment to sustainability and responsible production. These initiatives not only help tackle environmental concerns but also foster innovation, ensuring that polyethylene remains a vital part of the global economy while aligning with a more sustainable future.

Key Players

-

ExxonMobil

-

Dow Chemical

-

LyondellBasell Industries

-

SABIC

-

INEOS

-

Chevron Phillips Chemical

-

BASF

-

Borealis

-

Reliance Industries

-

Braskem

Chapter 1. Polyethylene Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polyethylene Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polyethylene Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polyethylene Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polyethylene Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polyethylene Market – By Product

6.1 Introduction/Key Findings

6.2 High-Density Polyethylene (HDPE)

6.3 Low-Density Polyethylene (LDPE)

6.4 Linear Low-Density Polyethylene (LLDPE)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Polyethylene Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Construction

7.4 Automotive

7.5 Electrical and Electronics

7.6 Healthcare

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Polyethylene Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Polyethylene Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil

9.2 Dow Chemical

9.3 LyondellBasell Industries

9.4 SABIC

9.5 INEOS

9.6 Chevron Phillips Chemical

9.7 BASF

9.8 Borealis

9.9 Reliance Industries

9.10 Braskem

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyethylene Market was valued at USD 120 billion in 2024 and is expected to reach USD 174 billion by 2030, growing at a CAGR of 5.5%.

Key drivers include the rising demand in the packaging industry, growth in infrastructure and construction activities, and advancements in recycling technologies.

The market is segmented by product (HDPE, LDPE, LLDPE, Others) and by application (Packaging, Construction, Automotive, Electrical and Electronics, Healthcare, Others).

Asia-Pacific is the most dominant region, driven by rapid industrialization, urbanization, and high polyethylene demand in packaging and construction industries.

Leading players include ExxonMobil, Dow Chemical, LyondellBasell Industries, SABIC, INEOS, and Chevron Phillips Chemical, among others.