Food Packaging Market Size (2024-2030)

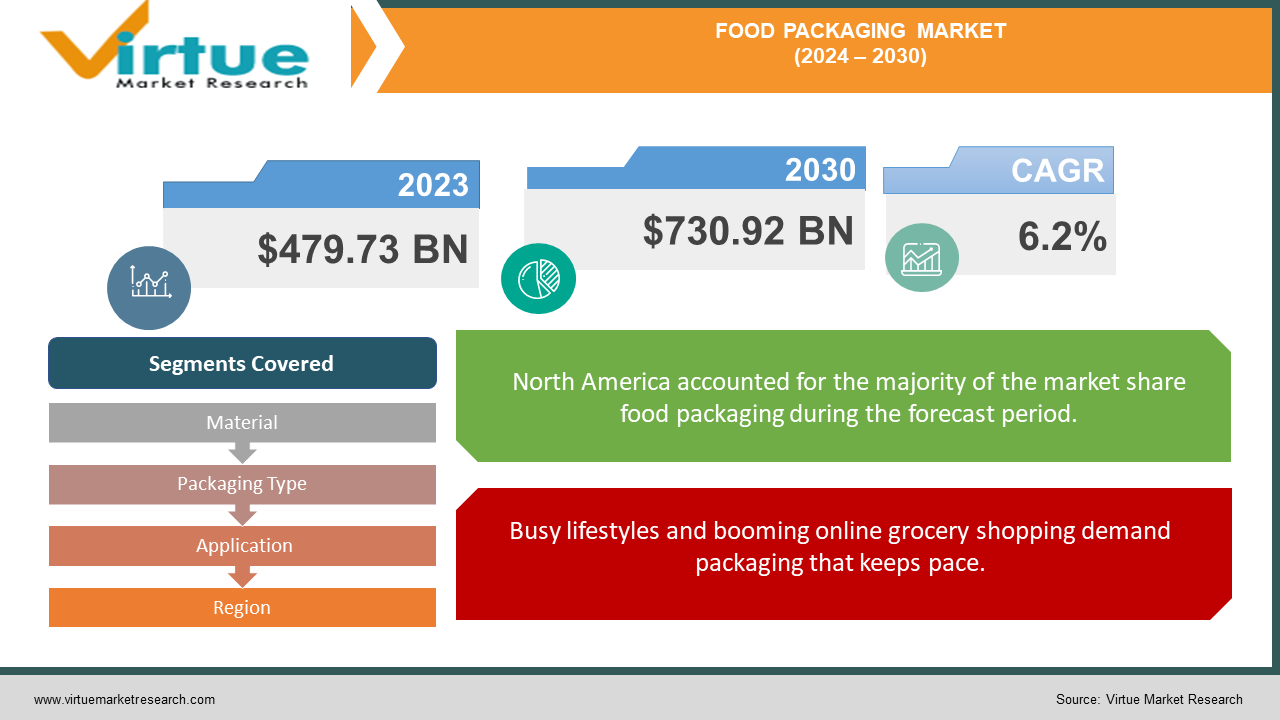

The Food Packaging Market was valued at USD 479.73 billion in 2023 and is projected to reach a market size of USD 730.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

The food packaging industry plays a vital role in protecting and preserving the food we consume. It encompasses a wide range of materials and designs, from plastic wrap to glass jars, all ensuring food safety and extended shelf life.

The food packaging industry is undergoing a transformation driven by sustainability and innovation. Consumers are increasingly environmentally conscious, and this is reflected in the demand for eco-friendly packaging solutions.

Innovation is another key theme shaping the future of food packaging. Manufacturers are constantly developing new materials and technologies to create more functional and appealing packaging.

For instance, active packaging is a promising development that can extend the shelf life of food products by up to 50% or control the atmosphere within the package to prevent spoilage. This technology holds immense potential for reducing food waste and ensuring product freshness.

Key Market Insights:

-

Flexible packaging is the most widely used type of food packaging due to its cost-effectiveness and versatility. The demand for sustainable and eco-friendly packaging solutions is driving innovation in the market.

-

Asia-Pacific is the leading region in the food packaging market, followed by North America and Europe.

-

The rising demand for convenience foods, increasing urbanization, and growing consumer awareness about food safety are driving the market growth.

Food Packaging Market Drivers:

Busy lifestyles and booming online grocery shopping demand packaging that keeps pace.

Our fast-paced lives are characterized by a desire for convenience, and this extends to the food we consume. The online grocery market is experiencing explosive growth, with projections estimating a global market size of a staggering $1.4 trillion by 2025. This necessitates the development of innovative packaging solutions that can withstand the rigors of shipping and ensure food arrives fresh and undamaged. Similarly, the ever-increasing popularity of pre-packaged meals relies heavily on packaging to maintain freshness and portability throughout the supply chain.

Eco-conscious consumers drive the market towards recyclable and biodegradable materials.

A Greener Future for Food Packaging: Environmental concerns are at the forefront of consumer consciousness, driving a major market shift towards sustainable packaging materials. Consumers are increasingly demanding recyclable, biodegradable, and compostable options to minimize their environmental footprint. This is evident in the growing popularity of alternative materials like paperboard, glass, and bioplastics, offering an eco-friendly alternative to traditional plastics. Additionally, a study by Innova Market Insights reveals a 5% increase in global food and beverage product launches utilizing fabric packaging, highlighting the exploration of innovative and sustainable solutions for the future of food packaging.

New technologies like active packaging extend shelf life and enhance food quality.

Technological advancements are constantly pushing the boundaries of what's possible in food packaging. New materials and technologies are emerging to create packaging solutions that are not only functional but also visually appealing to consumers. Active packaging is a prime example of this innovation. It utilizes cutting-edge technology to extend shelf life by up to 50% or control the atmosphere within the package, minimizing food waste and ensuring product quality.

Durable yet lightweight packaging ensures safe delivery of food products online.

The e-commerce boom has significantly impacted the food industry, and food packaging is no exception. The rise of online grocery shopping necessitates packaging that can withstand the rigors of shipping, ensuring food products arrive safely at consumers' doorsteps. This translates to a demand for durable yet lightweight solutions that can effectively protect food during transport without adding unnecessary weight or bulk. By creating innovative packaging solutions that cater to the e-commerce landscape, the food packaging market is ensuring the continued success of online grocery shopping and fresh food delivery.

Food Packaging Market Restraints and Challenges:

The food packaging industry navigates challenges alongside its growth. One key hurdle is the complex dance between cost and sustainability. While eco-friendly materials like bioplastics are gaining traction, they often come with a higher price tag compared to traditional plastics. This creates a pressure point for manufacturers who must balance environmental responsibility with affordability for cost-conscious consumers.

Furthermore, the focus on recyclable packaging is not without its roadblocks. While the materials themselves might be recyclable, the infrastructure and technology for efficient large-scale recycling aren't always readily available in all regions. This gap between intention and capability can lead to challenges in managing the ever-growing stream of post-consumer packaging waste.

Consumer behavior also presents a hurdle. The success of sustainable packaging solutions hinges on active participation from consumers. Encouraging proper sorting and recycling of used packaging requires ongoing educational efforts. Consumers need to understand their role in the process to ensure a truly circular economy for food packaging.

Food Packaging Market Opportunities:

The food packaging industry isn't just about overcoming challenges, it's a field brimming with exciting opportunities that can revolutionize how we interact with and protect our food. Bio-based and biodegradable materials offer a path towards a more sustainable future. Imagine packaging made from plant-based materials or even food waste itself! This wouldn't just address environmental concerns but also potentially reduce reliance on traditional plastics while maintaining the functionality and performance we expect. This focus on eco-friendly solutions can extend to cold chain logistics, where innovative packaging can integrate seamlessly with refrigerated transportation systems. By creating packaging that helps maintain optimal temperatures during transport, food spoilage can be significantly reduced, minimizing waste and ensuring food arrives fresh at its destination. Additionally, the rise of online grocery shopping presents an opportunity for packaging that goes beyond simple protection. Imagine packaging that incorporates robust anti-counterfeiting and brand protection measures. By utilizing track-and-trace technologies or embedding security features directly into the packaging, the industry can ensure product authenticity and consumer safety in the ever-growing e-commerce landscape. These exciting possibilities hold the potential to revolutionize food safety, reduce waste across the supply chain, and create a more efficient food system for the future.

FOOD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Material, Packaging Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Plc, Berry Global Group Inc, Ball Corporation, Sealed Air Corporation, Mondi Group, Stora Enso, Constantia Flexibles, Smurfit Kappa Group plc, Huhtamaki, Tetra Pak |

Food Packaging Market Segmentation: By Material

-

Plastics

-

Glass

-

Metal

-

Paper & Paperboard

-

Bioplastics

When it comes to materials, plastics reign supreme in the food packaging market due to their affordability, versatility, and ability to act as barriers. However, Bioplastics are experiencing the most significant growth. Made from renewable resources, these eco-friendly alternatives offer a promising solution to address sustainability concerns in the industry.

Food Packaging Market Segmentation: By Packaging Type

-

Rigid Packaging

-

Flexible Packaging

-

Active Packaging

-

Sustainable Packaging

The food packaging market is segmented by packaging type, with two key players: rigid and flexible packaging. Rigid packaging, like bottles and boxes, currently dominates the market due to its sturdiness and ability to protect products. However, flexible packaging, encompassing pouches and wraps, is experiencing the fastest growth. This surge is driven by its lightweight design, convenience, and lower overall cost, making it ideal for the growing popularity of pre-packaged meals and online grocery shopping.

Food Packaging Market Segmentation: By Application

-

Bakery & Confectionery

-

Dairy Products

-

Fruits & Vegetables

-

Meat, Poultry & Seafood

-

Convenience Foods

The food packaging market is segmented by various factors, with application being a key one. Traditionally, the meat, poultry, and seafood segment has dominated due to the need for specialized packaging to ensure freshness, safety, and extended shelf life. This often involves vacuum-sealed bags, modified atmosphere packaging, or trays with protective films. However, the market is experiencing a shift, with the bakery & confectionery segment projected as the fastest-growing application sector. This is driven by the increasing demand for convenient and visually appealing packaging for these products.

Food Packaging Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has a well-established food processing infrastructure and a high disposable income, making it the current leader in the food packaging market. The demand for convenient, single-serve packaging options is strong, driven by busy lifestyles. However, there's also a growing focus on sustainability, with consumers demanding eco-friendly solutions. This is pushing innovation in bioplastics and recyclable materials.

The European food packaging market is characterized by stringent regulations and a focus on food safety. There's a strong emphasis on reusable and recyclable packaging, with well-developed recycling infrastructure in many countries. The market is also receptive to innovative solutions like active packaging that extends shelf life and reduces waste.

Asia-Pacific is expected to witness the most significant growth in the food packaging market due to its expanding population, rising middle class, and increasing urbanization. The demand for convenient and affordable packaging solutions is high. However, concerns about plastic pollution are driving a shift towards sustainable alternatives. Biodegradable and compostable packaging options are gaining traction here.

COVID-19 Impact Analysis on the Food Packaging Market:

The COVID-19 pandemic sent shockwaves through the food packaging industry, creating a period of both disruption and unexpected opportunity. In the initial stages, panic buying and the dramatic rise of online grocery shopping led to a temporary spike in demand for specific types of packaging. Single-serve options, portion control packaging, and solutions designed specifically for the rigors of e-commerce deliveries were in high demand as consumers stocked up on essentials and embraced the convenience of online grocery shopping. However, consumer priorities began to shift as the pandemic progressed. While hygiene remained a top concern, with some focus on potentially germ-resistant packaging materials, there was a growing awareness of the environmental impact of increased packaging waste. This led to a renewed interest in sustainable packaging options, with bioplastics and compostable materials regaining traction as consumers sought to minimize their environmental footprint even amidst a global health crisis. The most lasting impact of COVID-19 on the food packaging market is likely to be its role in accelerating the e-commerce boom for groceries. As online grocery shopping becomes the norm for many consumers, the need for innovative packaging solutions that can withstand the rigors of online deliveries remains paramount. By creating durable yet lightweight packaging that ensures the safe arrival of food products, the food packaging industry can effectively adapt to this new normal and continue to meet the evolving needs of a convenience-driven and environmentally conscious consumer base.

Latest Trends/ Developments:

The food packaging industry is constantly pushing boundaries with innovative solutions that prioritize sustainability, functionality, and consumer experience. Bioplastics and other sustainable materials are leading the charge, with exploration of materials like seaweed-based packaging and mushroom composites offering a glimpse into an eco-friendly future. Technology is also playing a growing role, with the potential for smart and interactive packaging that monitors freshness, interacts with consumers, and even combats food spoilage through color-changing indicators. As online food sales surge, the industry is also focusing on robust anti-counterfeiting measures. This could involve invisible inks, trackable tags, or blockchain technology to ensure product authenticity and brand protection throughout the supply chain. Another exciting development is the use of cold plasma technology for food preservation. This non-thermal process eliminates bacteria and pathogens on food surfaces without compromising quality, offering a promising new tool for extending shelf life and enhancing food safety. Finally, the industry is placing a strong emphasis on minimizing waste and incorporating recycled materials. Upcycling food waste into packaging or utilizing post-consumer recycled content are innovative approaches that promote a more circular economy for food packaging. These trends showcase the dynamic and future-oriented nature of the food packaging industry, paving the way for a more sustainable and efficient food system.

Key Players:

-

Amcor Plc

-

Berry Global Group Inc

-

Ball Corporation

-

Sealed Air Corporation

-

Mondi Group

-

Stora Enso

-

Constantia Flexibles

-

Smurfit Kappa Group plc

-

Huhtamaki

-

Tetra Pak

Chapter 1. Food Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Packaging Market – By Material

6.1 Introduction/Key Findings

6.2 Plastics

6.3 Glass

6.4 Metal

6.5 Paper & Paperboard

6.6 Bioplastics

6.7 Y-O-Y Growth trend Analysis By Material

6.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Food Packaging Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Rigid Packaging

7.3 Flexible Packaging

7.4 Active Packaging

7.5 Sustainable Packaging

7.6 Y-O-Y Growth trend Analysis By Packaging Type

7.7 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Food Packaging Market – By Application

8.1 Introduction/Key Findings

8.2 Bakery & Confectionery

8.3 Dairy Products

8.4 Fruits & Vegetables

8.5 Meat, Poultry & Seafood

8.6 Convenience Foods

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Food Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material

9.1.3 By Packaging Type

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material

9.2.3 By Packaging Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material

9.3.3 By Packaging Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material

9.4.3 By Packaging Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material

9.5.3 By Packaging Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Food Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amcor Plc

10.2 Berry Global Group Inc

10.3 Ball Corporation

10.4 Sealed Air Corporation

10.5 Mondi Group

10.6 Stora Enso

10.7 Constantia Flexibles

10.8 Smurfit Kappa Group plc

10.9 Huhtamaki

10.10 Tetra Pak

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Food Packaging Market was valued at USD 479.73 billion in 2023 and is projected to reach a market size of USD 730.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

Soaring Demand for Convenience, Sustainability Shift, Innovation for Enhanced Functionality and Appeal, E-commerce Influence.

Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat, Poultry & Seafood, Convenience Foods.

North America holds the title of the most dominant region for the Food Packaging Market, driven by factors like established infrastructure and high consumer demand for convenience.

Amcor Plc, Berry Global Group Inc, Ball Corporation, Sealed Air Corporation, Mondi Group, Stora Enso, Constantia Flexibles, Smurfit Kappa Group plc, Huhtamaki, Tetra Pak.