Low-Density Polyethylene Market Size (2025 – 2030)

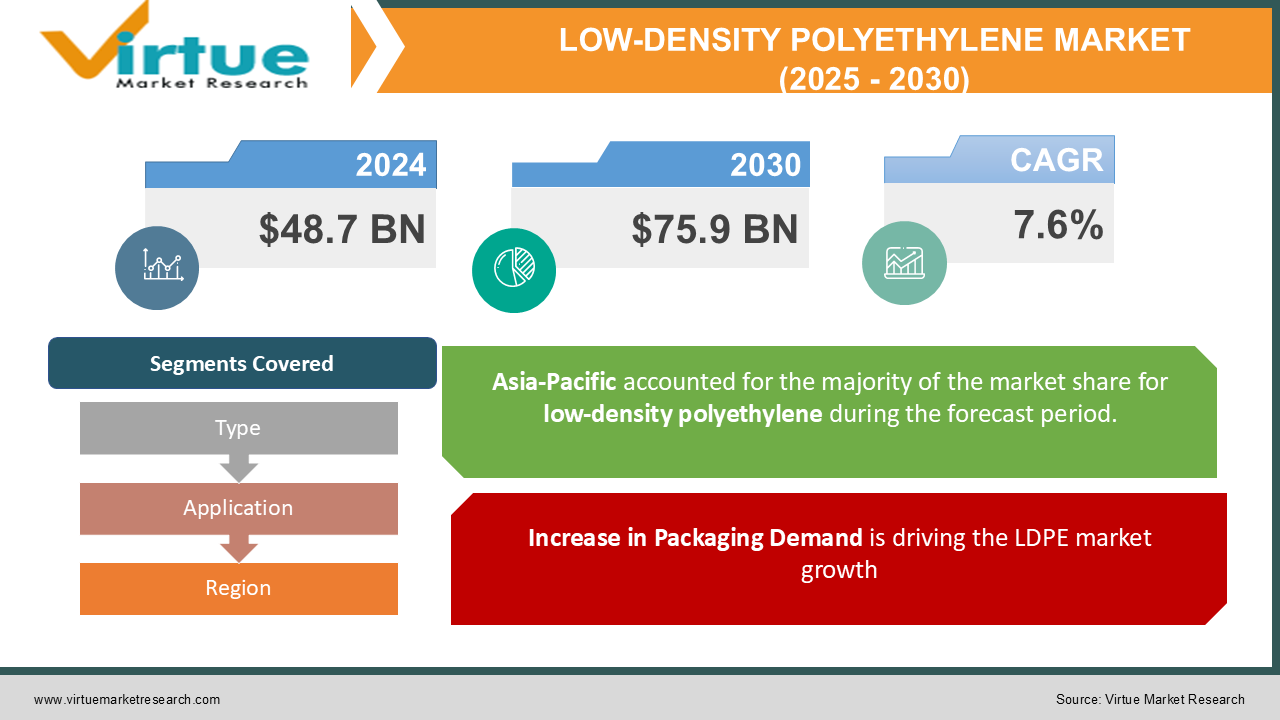

The Global Low-Density Polyethylene (LDPE) Market was valued at USD 48.7 billion in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2030, reaching USD 75.9 billion by 2030.

LDPE is one of the most commonly used forms of polyethylene, recognized for its flexibility, low-density structure, and ease of processing. It is widely utilized in packaging materials, agricultural applications, consumer goods, and more, due to its excellent chemical resistance, moisture barrier properties, and versatility.

LDPE is primarily produced via a high-pressure polymerization process and finds application in manufacturing films, packaging materials, plastic bags, containers, and many other products. Despite facing competition from other materials, such as high-density polyethylene (HDPE) and biodegradable plastics, LDPE remains highly popular due to its low cost and excellent material properties. The increasing demand for eco-friendly alternatives, advancements in the recycling process, and the growing trend of sustainable packaging are expected to positively impact the growth of the LDPE market. Furthermore, significant growth in end-use industries such as packaging, agriculture, and automotive, particularly in emerging markets, is set to drive the demand for LDPE in the forecasted period.

Key Market Insights:

-

Packaging applications dominate the LDPE market, contributing significantly to overall market share.

-

The Asia-Pacific region leads the global LDPE market, driven by rising industrialization, demand for packaging, and growing agricultural sectors.

-

Growing focus on sustainable packaging solutions is expected to increase demand for recyclable and eco-friendly LDPE products.

-

Film applications hold the largest share in the LDPE market, with demand driven by packaging needs in industries like food and beverage, e-commerce, and consumer goods.

-

Agriculture is another rapidly expanding application sector, where LDPE is used for mulch films, greenhouse films, and other agricultural products.

-

The growing popularity of automotive applications such as fuel tank liners and protective coatings for vehicles will drive LDPE demand in the automotive sector.

-

Extrusion processes dominate the manufacturing of LDPE products, owing to their efficiency and versatility in production.

Global LDPE Market Drivers:

Increase in Packaging Demand is driving the LDPE market growth

Packaging remains the largest application sector for LDPE. The demand for packaging materials has been surging, particularly due to the growth of e-commerce and retail sectors. LDPE is a preferred material in the production of plastic bags, shrink wraps, and films for packaging purposes. The food and beverage industry, in particular, contributes significantly to packaging demand, where LDPE’s barrier properties make it an ideal choice for preserving freshness and extending shelf life. Moreover, the growing trend toward lightweight and cost-effective packaging further accelerates the demand for LDPE, as it is both inexpensive and durable. The increase in consumer awareness regarding the environmental impact of packaging materials is pushing companies toward adopting recyclable LDPE solutions. Innovations in recycling processes and the promotion of circular economies are anticipated to bolster the demand for LDPE as part of sustainable packaging practices.

Growth in the Agricultural Sector is driving the LDPE market growth

The agricultural sector is a key driver of the LDPE market. The increasing adoption of plastic films in farming practices, such as mulch films and greenhouse films, is fostering significant market growth. LDPE films offer various advantages, including protection from weeds, retention of soil moisture, and improved crop yields. Additionally, greenhouse covers made from LDPE allow optimal light transmission while providing a durable barrier against environmental stressors. With global food demand increasing, particularly in developing countries, the agricultural sector's reliance on LDPE products is expected to grow steadily. The trend toward modern farming techniques, including controlled environment agriculture (CEA), further fuels the demand for LDPE-based agricultural films and other products.

Automotive Industry Expansion is driving the LDPE market growth

The automotive sector is another important driver for the LDPE market, particularly for applications such as fuel tank liners, protective coatings, and insulation materials. The use of LDPE in automotive parts provides benefits such as lightweight construction and improved durability. As the automotive industry increasingly shifts towards producing more fuel-efficient and environmentally friendly vehicles, LDPE’s role in reducing weight and improving vehicle performance becomes more crucial. Additionally, the increasing adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is expected to create new opportunities for LDPE in vehicle production. The need for high-quality insulation and protection for sensitive components in these vehicles will lead to an uptick in demand for LDPE-based products.

Global LDPE Market Challenges and Restraints:

Environmental Concerns is restricting the market growth

One of the primary challenges faced by the LDPE market is the growing environmental concern surrounding plastic waste. While LDPE is technically recyclable, its recycling rate remains relatively low compared to other materials, mainly due to issues with sorting and processing. As governments and consumers alike increasingly demand more sustainable and biodegradable alternatives to plastic, this could lead to a decline in LDPE’s use in certain applications. Environmental regulations aimed at reducing plastic waste, such as plastic bag bans and single-use plastic restrictions, are pressuring manufacturers to find more sustainable solutions. The rising shift toward biodegradable and bio-based plastics is also posing a potential threat to the LDPE market, especially in applications like packaging, where consumers are more environmentally conscious.

Price Volatility of Raw Materials is restricting the market growth

The price of LDPE is heavily influenced by the cost of raw materials, such as ethane and natural gas, which are used in the polymerization process. Fluctuations in the prices of these raw materials can affect the overall cost structure of LDPE production. Since LDPE is often produced using high-pressure polymerization techniques, its production can be more sensitive to feedstock price variations compared to other plastics. This volatility could impact manufacturers' profitability and, by extension, the pricing of LDPE products.

Market Opportunities:

The global shift toward sustainability offers a significant opportunity for LDPE manufacturers to innovate. Advancements in recycling technologies, such as the development of chemical recycling, which allows LDPE to be broken down and reused without degradation in quality, are opening new avenues for growth. Additionally, the promotion of circular economy practices, where products are reused and recycled, is expected to drive demand for LDPE in the coming years. Furthermore, LDPE manufacturers can benefit from expanding their product offerings to cater to growing industries such as automotive, agriculture, and e-commerce packaging. The potential to develop biodegradable LDPE alternatives or lightweight LDPE solutions that are compatible with sustainable initiatives presents long-term growth opportunities for the market.

LOW-DENSITY POLYETHYLENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil Chemical Company, LyondellBasell Industries, SABIC, Reliance Industries, Chevron Phillips Chemical, Formosa Plastics, LG Chem, Dow Inc., INEOS, BASF |

Low-Density Polyethylene Market Segmentation: By Type

-

Film

-

Injection Molding

-

Extrusion

-

Others (Blown Molding, Rotational Molding)

The film segment is the largest and most prominent segment of the LDPE market, as it accounts for the majority of LDPE production. This segment includes products like plastic bags, stretch films, and shrink films, widely used in the packaging industry. The extrusion and injection molding segments also play a significant role, with LDPE used in manufacturing durable and lightweight products in applications like automotive parts and containers.

Low-Density Polyethylene Market Segmentation: By Application

-

Packaging

-

Agriculture

-

Automotive

-

Consumer Goods

-

Others (Construction, Electrical)

Packaging remains the leading application for LDPE, particularly in food and beverage packaging, where flexibility, moisture resistance, and ease of production are key benefits. The agriculture segment is experiencing substantial growth as LDPE is increasingly used for mulch films and greenhouse covers. Other emerging sectors such as automotive and consumer goods are also expected to grow, with demand for LDPE-driven products like protective films and insulation materials.

Low-Density Polyethylene Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The Asia-Pacific region holds the largest share of the LDPE market, driven by substantial demand in countries like China, India, and Japan, where LDPE is extensively used in packaging, agriculture, and automotive applications. North America and Europe follow as significant markets, with strong demand for sustainable and recyclable packaging solutions. The growth of the agricultural sector in Latin America and Africa also presents considerable opportunities for LDPE suppliers.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the LDPE market. On one hand, the demand for packaging materials, particularly for food, e-commerce, and healthcare products, surged significantly due to the shift in consumer behavior and increased online shopping. On the other hand, supply chain disruptions and temporary shutdowns of manufacturing facilities affected the production and distribution of LDPE products. However, the post-pandemic recovery has been strong, with increased demand for LDPE in industries like e-commerce packaging, food packaging, and healthcare. The pandemic also accelerated the adoption of sustainable packaging solutions, which is expected to benefit the LDPE market in the long term.

Latest Trends/Developments:

The rise of smart packaging solutions in the food and beverage industry is driving the development of LDPE films with enhanced barrier properties and active packaging features. Increasing investments in recycling technologies to improve LDPE’s sustainability profile are expected to reduce environmental concerns and boost recycling rates. Biodegradable LDPE alternatives are being developed to meet growing consumer demand for eco-friendly products. Advances in automotive applications, including the use of LDPE in lightweight vehicle components, will further push market growth.

Key Players:

-

ExxonMobil Chemical Company

-

LyondellBasell Industries

-

SABIC

-

Reliance Industries

-

Chevron Phillips Chemical

-

Formosa Plastics

-

LG Chem

-

Dow Inc.

-

INEOS

-

BASF

Chapter 1. Low-Density Polyethylene (LDPE) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Low-Density Polyethylene (LDPE) Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Low-Density Polyethylene (LDPE) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Low-Density Polyethylene (LDPE) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Low-Density Polyethylene (LDPE) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Low-Density Polyethylene (LDPE) Market – By Type

6.1 Introduction/Key Findings

6.2 Film

6.3 Injection Molding

6.4 Extrusion

6.5 Others (Blown Molding, Rotational Molding)

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Low-Density Polyethylene (LDPE) Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Agriculture

7.4 Automotive

7.5 Consumer Goods

7.6 Others (Construction, Electrical)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Low-Density Polyethylene (LDPE) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Low-Density Polyethylene (LDPE) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil Chemical Company

9.2 LyondellBasell Industries

9.3 SABIC

9.4 Reliance Industries

9.5 Chevron Phillips Chemical

9.6 Formosa Plastics

9.7 LG Chem

9.8 Dow Inc.

9.9 INEOS

9.10 BASF

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global LDPE market was valued at USD 48.7 billion in 2024 and is expected to reach USD 75.9 billion by 2030, growing at a CAGR of 7.6%.

The key drivers include the increase in packaging demand, the growth of agriculture, and expanding automotive applications.

The market is segmented by type (film, injection molding, extrusion, others) and by application (packaging, agriculture, automotive, consumer goods, others).

The Asia-Pacific region dominates the global LDPE market with a significant share due to the high demand for LDPE in packaging, agriculture, and automotive applications.

Leading players include ExxonMobil Chemical Company, LyondellBasell Industries, SABIC, Reliance Industries, and Chevron Phillips Chemical.