Vitamin Water Market Size (2024 – 2030)

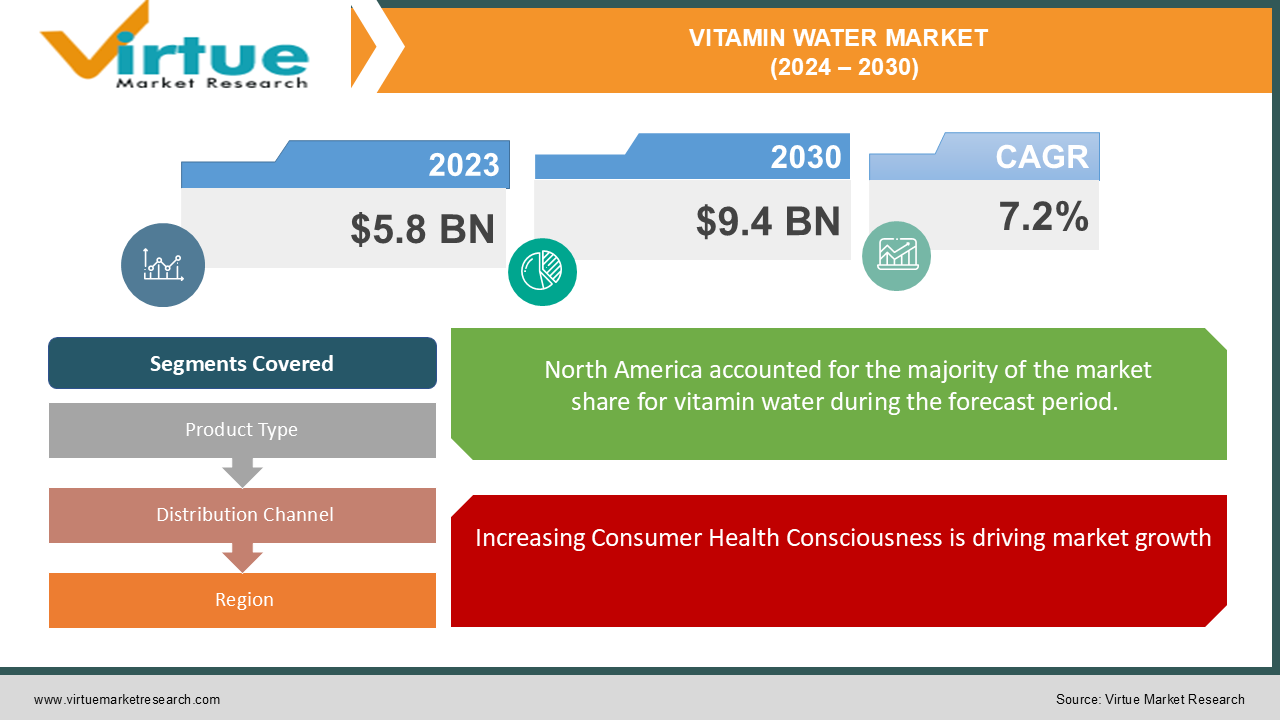

The Global Vitamin Water Market was valued at USD 5.8 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The market is expected to reach USD 9.4 billion by 2030.

DOWNLOAD FREE SAMPLE REPORT NOW

The Vitamin Water Market focuses on the production and distribution of enhanced water products infused with vitamins and minerals. These beverages are marketed as healthier alternatives to traditional soft drinks and energy drinks, appealing to consumers who seek functional beverages that provide additional nutritional benefits. The market is driven by increasing consumer health consciousness, the rise of fitness culture, and the demand for convenient, on-the-go hydration solutions that offer more than just refreshment. The growing interest in wellness and preventive healthcare is also propelling the market forward, as consumers seek products that can contribute to their overall health and well-being.

Key Market Insights

- Manufacturers in the Vitamin Water Market are continuously innovating to introduce new flavors, formulations, and packaging options. This innovation is attracting a broader consumer base and catering to diverse tastes and preferences.

- Vitamin water offers a convenient and portable hydration solution for consumers on the go. Its packaging is often designed for ease of use, making it a popular choice among busy individuals who seek quick and easy access to health-enhancing beverages.

- While the Vitamin Water Market is growing, it faces competition from other functional beverages, such as electrolyte drinks, plant-based waters, and energy drinks. Companies in this space must differentiate their products to maintain market share.

- The demand for vitamin water varies significantly across different regions, with North America and Europe being the largest markets. However, emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to increasing urbanization and health awareness.

Global Vitamin Water Market Drivers

Increasing Consumer Health Consciousness is driving market growth:

The rising awareness of health and wellness among consumers is a major driver for the Vitamin Water Market. As more people become aware of the importance of a balanced diet and adequate nutrient intake, there is a growing demand for beverages that offer additional health benefits.

Vitamin water, infused with essential vitamins and minerals, is perceived as a healthier alternative to sugary soft drinks and energy drinks. This shift in consumer preference is particularly evident among millennials and Gen Z, who are more likely to seek out functional beverages that contribute to their overall well-being. The growing interest in preventive healthcare and the desire to maintain a healthy lifestyle are further fueling the demand for vitamin water.

Expansion of the Fitness and Active Lifestyle Movement is driving market growth:

The global trend towards fitness and active lifestyles is another key driver of the Vitamin Water Market. As more people engage in physical activities such as gym workouts, yoga, running, and sports, the need for beverages that provide hydration along with essential nutrients has increased.

Vitamin water is often marketed as a functional beverage that can support physical performance and recovery, making it a popular choice among fitness enthusiasts. The rise of social media influencers and fitness trends has also contributed to the growth of this market, as consumers are increasingly influenced by online content that promotes healthy living and the benefits of functional beverages.

Innovation and Product Diversification is driving market growth:

Innovation and product diversification are crucial factors driving the growth of the Vitamin Water Market. Manufacturers are continuously developing new flavors, formulations, and packaging options to cater to a diverse consumer base. For instance, some brands offer vitamin water with added electrolytes for enhanced hydration, while others focus on providing specific vitamins such as vitamin C, B vitamins, or antioxidants.

The introduction of low-calorie and sugar-free options has also expanded the appeal of vitamin water to health-conscious consumers who are mindful of their sugar intake. Additionally, the use of natural ingredients and clean label formulations has resonated with consumers who prioritize transparency and authenticity in their food and beverage choices.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Vitamin Water Market Challenges and Restraints

High Sugar Content and Health Concerns is restricting market growth:

Despite being marketed as a healthier alternative to traditional soft drinks, many vitamin water products contain significant amounts of added sugars, which can pose a challenge to market growth. As consumers become more health-conscious and seek to reduce their sugar intake, they may opt for beverages that offer the perceived health benefits of vitamin water without the associated sugar content.

This has led to criticism and scrutiny from health advocates and regulatory bodies, who argue that the high sugar content in some vitamin water products can contribute to obesity, diabetes, and other health issues. In response, some brands have reformulated their products to offer lower-sugar or sugar-free alternatives, but overcoming this challenge requires ongoing efforts to educate consumers and improve product formulations.

Competition from Other Functional Beverages is restricting market growth:

The Vitamin Water Market faces significant competition from a wide range of other functional beverages, including electrolyte drinks, plant-based waters, energy drinks, and fortified teas. These beverages often target similar consumer demographics and offer comparable benefits, such as enhanced hydration, energy boosts, and nutrient supplementation.

The growing variety of functional beverage options available in the market means that consumers have more choices, which can dilute the demand for vitamin water. To maintain market share, vitamin water brands must differentiate their products by highlighting unique benefits, such as specific vitamin formulations or natural ingredient profiles. Additionally, they must stay attuned to emerging trends in the functional beverage space and adapt their offerings accordingly.

Global Vitamin Water Market Opportunities

The Vitamin Water Market presents several significant opportunities, particularly in the areas of product innovation, expanding consumer bases, and global market expansion. One of the most promising opportunities lies in the development of personalized vitamin water products that cater to specific consumer needs.

As the trend towards personalization continues to grow, consumers are increasingly seeking products that address their individual health concerns and preferences. Vitamin water brands can capitalize on this trend by offering customized formulations that provide targeted benefits, such as immune support, energy enhancement, or cognitive function. Additionally, the use of advanced technology, such as digital health platforms, can enable consumers to track their nutrient intake and choose vitamin water products that align with their health goals.

Another key opportunity is the expansion of the Vitamin Water Market in emerging regions, particularly in Asia-Pacific and Latin America. These regions are experiencing rapid urbanization, rising disposable incomes, and increasing health awareness, which are driving the demand for functional beverages. The growing middle-class population in these regions is also more likely to spend on premium and health-enhancing products, creating a favorable environment for the growth of vitamin water. To tap into these markets, companies must tailor their products to local tastes and preferences, as well as invest in marketing and distribution strategies that resonate with consumers in these regions.

The rise of e-commerce and digital marketing also presents opportunities for vitamin water brands to reach a wider audience and increase sales. With more consumers shopping online for food and beverages, companies can leverage digital platforms to promote their products, engage with consumers, and offer convenient purchasing options. The use of social media, influencer marketing, and targeted online advertising can help brands build awareness and drive demand for vitamin water. Additionally, the growing popularity of subscription services and direct-to-consumer models provides an opportunity for vitamin water brands to build customer loyalty and generate recurring revenue.

GLOBAL VITAMIN WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company (Glaceau Vitaminwater), PepsiCo, Inc. (Propel Water), Danone S.A. (Volvic Touch of Fruit), Nestlé S.A. (Nestlé Pure Life +), Vitamin Well AB, Talking Rain Beverage Company, Inc. (Sparkling ICE), Hint, Inc., Keurig Dr Pepper Inc. (Bai Antioxidant Water), New York Spring Water, Inc. (VBlast), Smartwater (part of The Coca-Cola Company) |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

GLOBAL VITAMIN WATER MARKET SEGMENTATION ANALYSIS

Vitamin Water Market Segmentation - By Product Type

-

Non-Flavored Vitamin Water

-

Sugar-Free Vitamin Water

-

Low-Calorie Vitamin Water

-

Electrolyte-Infused Vitamin

Flavored Vitamin Water dominates the market due to its broad appeal and variety of options that cater to diverse consumer tastes. The availability of multiple flavor options makes it a popular choice among consumers who seek a balance of taste and health benefits.

Vitamin Water Market Segmentation - By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Stores

-

Fitness and Health Clubs

Supermarkets/Hypermarkets are the most dominant distribution channels for vitamin water, as they provide widespread availability and easy access to consumers. These retail outlets offer a wide range of product options, making it convenient for consumers to purchase vitamin water as part of their regular grocery shopping.

Vitamin Water Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

What's Next for Your Market? Get a Snapshot with FREE Sample Report

North America is the most dominant region in the Vitamin Water Market, driven by high consumer awareness, a strong focus on health and wellness, and the presence of major brands. The region's advanced retail infrastructure, coupled with the popularity of fitness and active lifestyles, supports the widespread adoption of vitamin water. Additionally, the U.S. and Canada have well-established markets for functional beverages, contributing to the region's leadership position.

COVID-19 Impact Analysis on the Vitamin Water Market

The COVID-19 pandemic had a mixed impact on the Vitamin Water Market. On one hand, the pandemic led to an increased focus on health and immunity, driving demand for products that offer additional health benefits. Vitamin water, with its added vitamins and minerals, was perceived as a way to boost immunity and support overall health, leading to increased sales in certain segments of the market. Consumers sought out products that could help them maintain their health and well-being during the pandemic, and vitamin water was seen as a convenient and accessible option.

On the other hand, the pandemic also disrupted supply chains, leading to challenges in the production and distribution of vitamin water. Lockdowns, travel restrictions, and labor shortages affected the availability of raw materials and the ability to manufacture and distribute products. Additionally, the closure of gyms, fitness centers, and other recreational facilities led to a decline in demand for on-the-go beverages like vitamin water, particularly in the early stages of the pandemic. As a result, some companies experienced a temporary decline in sales. Despite these challenges, the Vitamin Water Market showed resilience, with many brands adapting to the changing environment by increasing their online presence and offering home delivery options.

The shift towards e-commerce and the growing importance of digital marketing played a crucial role in maintaining consumer engagement and driving sales during the pandemic. As the world continues to recover from the pandemic, the Vitamin Water Market is expected to rebound and grow, driven by the ongoing focus on health and wellness and the increasing demand for functional beverages.

Latest Trends/Developments

The Vitamin Water Market is witnessing several key trends and developments that are shaping its growth and evolution. One of the most notable trends is the increasing demand for clean label and natural products. Consumers are becoming more discerning about the ingredients in their food and beverages, and they are seeking products that are free from artificial colors, flavors, and preservatives. In response, many vitamin water brands are reformulating their products to include natural ingredients and transparent labeling, which is helping to build trust and loyalty among health-conscious consumers.

Another significant trend is the growing popularity of plant-based and organic vitamin water options. As the demand for plant-based products continues to rise, some brands are introducing vitamin water made with plant-based vitamins and minerals, catering to consumers who prefer natural and sustainable options. Organic vitamin water is also gaining traction, particularly among consumers who prioritize organic products as part of their health and wellness routines.

The use of sustainable packaging is also becoming increasingly important in the Vitamin Water Market. With the growing concern over plastic waste and environmental impact, many brands are exploring eco-friendly packaging solutions, such as recyclable or biodegradable bottles. Some companies are also adopting reusable packaging models, where consumers can refill their bottles at designated stations, reducing the need for single-use plastics.

Personalization is another emerging trend in the Vitamin Water Market. In response, some brands are offering customizable vitamin water options, where consumers can choose the vitamins and minerals they want to add to their beverages. This trend is aligned with the broader shift towards personalized nutrition, where consumers take a more proactive approach to their health by selecting products that meet their individual needs.

Key Players

-

The Coca-Cola Company (Glaceau Vitaminwater)

-

PepsiCo, Inc. (Propel Water)

-

Danone S.A. (Volvic Touch of Fruit)

-

Nestlé S.A. (Nestlé Pure Life +)

-

Vitamin Well AB

-

Talking Rain Beverage Company, Inc. (Sparkling ICE)

-

Hint, Inc.

-

Keurig Dr Pepper Inc. (Bai Antioxidant Water)

-

New York Spring Water, Inc. (VBlast)

-

Smartwater (part of The Coca-Cola Company)

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Vitamin Water Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Vitamin Water Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Vitamin Water Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Vitamin Water Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Vitamin Water Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Vitamin Water Market – By Product Type

6.1 Introduction/Key Findings

6.2 Flavored Vitamin Water

6.3 Non-Flavored Vitamin Water

6.4 Sugar-Free Vitamin Water

6.5 Low-Calorie Vitamin Water

6.6 Electrolyte-Infused Vitamin

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Vitamin Water Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Specialty Stores

7.6 Fitness and Health Clubs

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Vitamin Water Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Vitamin Water Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Coca-Cola Company (Glaceau Vitaminwater)

9.2 PepsiCo, Inc. (Propel Water)

9.3 Danone S.A. (Volvic Touch of Fruit)

9.4 Nestlé S.A. (Nestlé Pure Life +)

9.5 Vitamin Well AB

9.6 Talking Rain Beverage Company, Inc. (Sparkling ICE)

9.7 Hint, Inc.

9.8 Keurig Dr Pepper Inc. (Bai Antioxidant Water)

9.9 New York Spring Water, Inc. (VBlast)

9.10 Smartwater (part of The Coca-Cola Company)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Vitamin Water Market was valued at USD 5.8 billion in 2023 and is projected to reach USD 9.4 billion by 2030, growing at a CAGR of 7.2% during the forecast period.

Key drivers include increasing consumer health consciousness, the expansion of fitness and active lifestyle trends, and continuous product innovation and diversification.

The market is segmented by product type (e.g., flavored vitamin water, non-flavored vitamin water) and distribution channel (e.g., supermarkets/hypermarkets, online retail).

North America is the most dominant region, driven by high consumer awareness, a strong focus on health and wellness, and the presence of major brands.

Leading players include The Coca-Cola Company, PepsiCo, Inc., Danone S.A., and Nestlé S.A., among others.