Electrolyte Drinks Market Size (2025 – 2030)

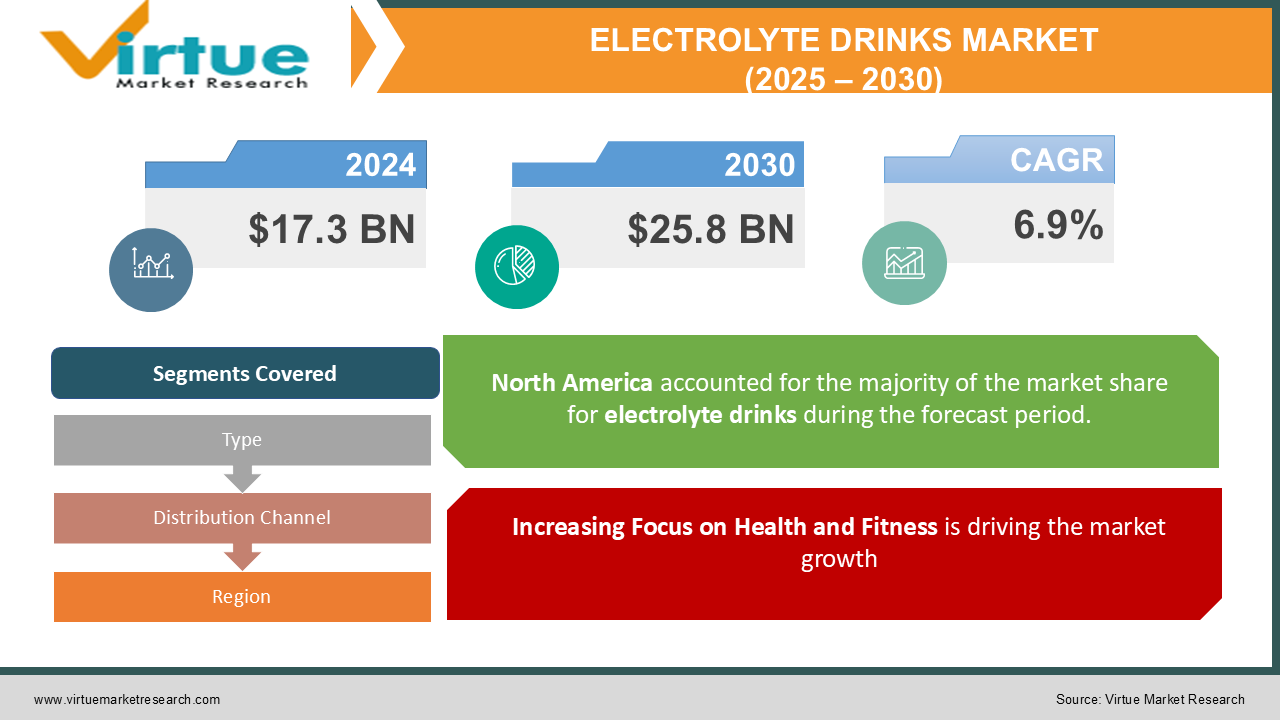

The Global Electrolyte Drinks Market was valued at USD 17.3 billion in 2024 and is projected to reach USD 25.8 billion by 2030, growing at a CAGR of 6.9% during the forecast period.

Electrolyte drinks, also known as sports drinks, help replenish lost electrolytes and fluids, making them essential for hydration, especially during physical activities and illness.

The rising global focus on fitness, increasing consumer awareness about hydration and nutrition, and a growing preference for healthier alternatives to carbonated beverages are key factors driving market growth. Additionally, innovations in flavors and formulations tailored to consumer demands, such as sugar-free and plant-based options, are further propelling the market.

Key Market Insights

-

The isotonic segment leads the market, accounting for over 50% of global revenue in 2024, due to its balanced electrolyte content.

-

Offline distribution channels, including supermarkets and convenience stores, dominate the market, with a share of over 60%, driven by widespread availability and consumer preference for physical purchases.

-

The online distribution channel is the fastest-growing segment, with a CAGR of 9.3%, as e-commerce platforms expand their reach and offer convenience.

-

North America holds the largest market share, contributing to over 35% of global revenue, due to a well-established fitness culture and high consumer awareness.

-

The Asia-Pacific region is witnessing rapid growth, supported by increasing fitness trends, urbanization, and rising disposable incomes. Key players are focusing on sustainable packaging and organic formulations to align with consumer preferences for eco-friendly and health-conscious products.

Global Electrolyte Drinks Market Drivers

1. Increasing Focus on Health and Fitness is driving the market growth

The global rise in health consciousness and fitness awareness has significantly boosted the demand for electrolyte drinks. These beverages are widely consumed by athletes, fitness enthusiasts, and individuals engaging in physical activities to maintain hydration and replenish lost electrolytes.

Moreover, the increasing prevalence of fitness centers, gyms, and sports events has amplified the need for electrolyte drinks. Brands are capitalizing on this trend by launching targeted marketing campaigns and introducing new products designed for fitness-focused consumers.

2. Growing Demand for Functional Beverages is driving the market growth

Consumers are increasingly seeking beverages that offer functional benefits beyond basic hydration. Electrolyte drinks, which help improve endurance, prevent dehydration, and aid recovery, are gaining popularity as a healthier alternative to sugary carbonated drinks.

Innovations such as low-calorie, organic, and sugar-free options are attracting health-conscious consumers, while the addition of vitamins and minerals is expanding the functional appeal of these drinks. This trend is further supported by the rising demand for personalized nutrition and wellness solutions.

3. Expanding Online Distribution Channels is driving the market growth

The growth of e-commerce platforms has revolutionized the way consumers purchase electrolyte drinks. Online channels offer convenience, competitive pricing, and a wide variety of products, making them increasingly popular among tech-savvy and urban consumers.

Subscription models and direct-to-consumer sales strategies are further driving the online segment, allowing brands to build loyalty and engage directly with their customers.

Global Electrolyte Drinks Market Challenges and Restraints

1. Competition from Natural Alternatives is restricting the market growth

Electrolyte drinks face competition from natural alternatives such as coconut water, which is often perceived as a healthier and more natural option. Coconut water offers similar benefits, including hydration and electrolyte replenishment, and appeals to health-conscious consumers seeking clean-label products.

To counter this competition, manufacturers need to emphasize the unique benefits of their products, such as enhanced formulations for athletic performance and innovative flavors.

2. Concerns Over Sugar Content and Artificial Ingredients is restricting the market growth

The high sugar content and artificial additives in many traditional electrolyte drinks have raised health concerns, particularly among consumers looking to reduce their sugar intake. Regulatory scrutiny and changing consumer preferences for natural and low-sugar options have prompted the need for reformulation and innovation.

Brands that fail to address these concerns risk losing market share to competitors offering healthier alternatives.

Market Opportunities

The Global Electrolyte Drinks Market presents significant growth opportunities driven by evolving consumer preferences and technological advancements. The rising demand for plant-based and organic beverages presents a prime opportunity for manufacturers to develop natural electrolyte drinks free from artificial additives and preservatives, appealing to health-conscious consumers. Innovative packaging solutions, such as recyclable bottles and convenient portable sachets, can attract environmentally conscious consumers and expand market reach by offering greater convenience and sustainability. Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing increased adoption of fitness and wellness trends, creating significant opportunities for market penetration as these regions embrace healthier lifestyles. The growing interest in personalized nutrition opens avenues for developing customized electrolyte drinks tailored to individual needs, such as products targeting specific age groups or fitness goals, further enhancing consumer engagement and satisfaction. Expanding the use of electrolyte drinks beyond the realm of athletic performance, such as for general hydration, recovery from illness, and travel-related dehydration, can broaden the consumer base and drive sales by positioning electrolyte drinks as essential for overall well-being and everyday hydration needs.

ELECTROLYTE DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo, Inc., The Coca-Cola Company, Danone S.A., Abbott Laboratories, Nestlé S.A., GlaxoSmithKline plc, Otsuka Pharmaceutical Co., Ltd., Ultima Replenisher, BioSteel Sports Nutrition Inc., LyteLine LLC |

Electrolyte Drinks Market Segmentation - By Type

-

Isotonic

-

Hypertonic

-

Hypotonic

The isotonic segment currently dominates the electrolyte drinks market due to its balanced electrolyte concentration, making it ideal for rapid hydration during physical activities. Isotonic drinks closely mimic the electrolyte composition of human blood and sweat, facilitating efficient fluid and electrolyte absorption into the bloodstream. This balanced composition ensures optimal hydration and replenishment of essential minerals like sodium, potassium, and magnesium lost through perspiration during exercise. By providing a quick and effective source of hydration, isotonic drinks help athletes and active individuals maintain performance, reduce fatigue, and improve recovery. The ability to rapidly rehydrate and replenish electrolytes makes isotonic drinks the preferred choice for athletes, fitness enthusiasts, and individuals engaged in strenuous physical activities.

Electrolyte Drinks Market Segmentation - By Distribution Channel

-

Offline (Supermarkets, Convenience Stores, Specialty Stores)

-

Online

The offline segment currently dominates the electrolyte drinks market, driven by the widespread availability of these beverages in various retail outlets such as supermarkets, convenience stores, and pharmacies. Consumers can readily purchase electrolyte drinks from their preferred local stores, ensuring easy access and immediate availability. However, the online segment is experiencing rapid growth, fueled by the expansion of e-commerce platforms and the emergence of direct-to-consumer models. Online platforms offer a convenient and accessible channel for consumers to purchase a wide variety of electrolyte drinks from different brands, often at competitive prices and with the added benefit of home delivery. Direct-to-consumer models allow brands to connect directly with consumers, bypassing traditional retail channels and offering exclusive products, personalized recommendations, and potentially lower prices. The growth of online sales is further facilitated by the increasing penetration of smartphones and internet connectivity, enabling consumers to easily browse, compare, and purchase electrolyte drinks online. While the offline segment still maintains a significant market share, the online segment is poised for continued growth, driven by the increasing convenience, accessibility, and innovative distribution models offered by e-commerce platforms and direct-to-consumer brands.

Electrolyte Drinks Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the global electrolyte drinks market. This dominance is attributed to a strong fitness culture, high consumer awareness, and significant disposable income, driving demand for premium electrolyte drinks. The U.S. leads the market with substantial investments in sports and fitness infrastructure. Europe holds a significant market share, with countries like Germany, the UK, and France at the forefront of consumption. The region's focus on health and wellness, coupled with increasing demand for natural and organic beverages, supports market growth. Asia-Pacific is the fastest-growing market, projected to achieve a CAGR of 8.1% during the forecast period. Rapid urbanization, rising disposable incomes, and the increasing popularity of fitness activities are key growth drivers. China, Japan, and India are major contributors in this region. Latin America is an emerging market with significant potential, driven by increasing health awareness and a growing middle-class population. Brazil and Mexico are key markets, fueled by a rising demand for hydration solutions. The Middle East & Africa region is witnessing steady growth, driven by an increasing focus on health and wellness. Urban centers are experiencing a surge in demand for functional beverages, including electrolyte drinks.

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the electrolyte drinks market. During the initial stages, supply chain disruptions affected the availability of raw materials and finished products. However, the pandemic also heightened consumer awareness about health and hydration, leading to increased demand for electrolyte drinks. Post-pandemic, the market has continued to grow as consumers prioritize immune health, fitness, and wellness. Online sales have surged, with e-commerce platforms becoming a preferred channel for purchasing electrolyte drinks.

Latest Trends/Developments

The electrolyte drinks market is witnessing a significant shift towards healthier options, driven by evolving consumer preferences. Manufacturers are increasingly focusing on launching sugar-free and low-calorie versions to cater to the growing demand for healthier beverages. This trend is further emphasized by a strong focus on natural ingredients, with a preference for plant-based sweeteners, natural colors and flavors, and clean-label formulations. To appeal to diverse consumer tastes, companies are continuously introducing innovative flavors, such as tropical fruit blends and herbal infusions, adding a refreshing twist to the traditional electrolyte drink experience. Recognizing the importance of sustainability, many brands are adopting eco-friendly packaging solutions, including recyclable and biodegradable materials, to minimize their environmental impact. Furthermore, the perception of electrolyte drinks is expanding beyond the realm of sports and fitness. Brands are actively promoting these beverages as a convenient hydration solution for everyday use, positioning them as essential for maintaining overall health and well-being, especially during periods of physical exertion, heat exposure, or illness.

Key Players

-

PepsiCo, Inc.

-

The Coca-Cola Company

-

Danone S.A.

-

Abbott Laboratories

-

Nestlé S.A.

-

GlaxoSmithKline plc

-

Otsuka Pharmaceutical Co., Ltd.

-

Ultima Replenisher

-

BioSteel Sports Nutrition Inc.

-

LyteLine LLC

Chapter 1. Electrolyte Drinks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electrolyte Drinks Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electrolyte Drinks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electrolyte Drinks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electrolyte Drinks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electrolyte Drinks Market – By Type

6.1 Introduction/Key Findings

6.2 Isotonic

6.3 Hypertonic

6.4 Hypotonic

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Electrolyte Drinks Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Offline (Supermarkets, Convenience Stores, Specialty Stores)

7.3 Online

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Electrolyte Drinks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Electrolyte Drinks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo, Inc.

9.2 The Coca-Cola Company

9.3 Danone S.A.

9.4 Abbott Laboratories

9.5 Nestlé S.A.

9.6 GlaxoSmithKline plc

9.7 Otsuka Pharmaceutical Co., Ltd.

9.8 Ultima Replenisher

9.9 BioSteel Sports Nutrition Inc.

9.10 LyteLine LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 17.3 billion in 2024 and is projected to reach USD 25.8 billion by 2030, growing at a CAGR of 6.9%.

Key drivers include rising health and fitness awareness, growing demand for functional beverages, and the expansion of online distribution channels.

Segments include Type (Isotonic, Hypertonic, Hypotonic) and Distribution Channel (Offline, Online).

North America dominates the market, contributing to over 35% of global revenue, driven by a strong fitness culture and high consumer awareness.

Key players include PepsiCo, Inc., The Coca-Cola Company, Danone S.A., and Nestlé S.A.