Asia Pacific Electrolyte Drinks Market Size (2024-2030)

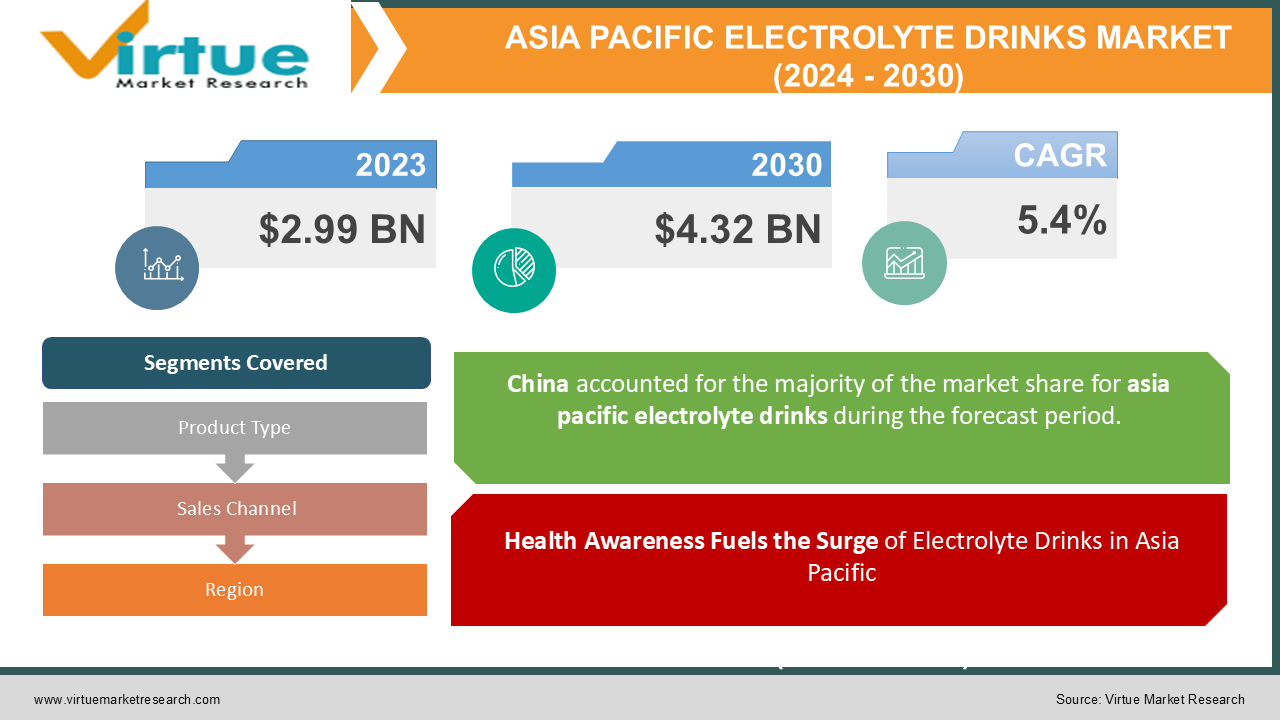

The Asia Pacific Electrolyte Drinks Market was valued at USD 2.99 billion in 2023 and is projected to reach a market size of USD 4.32 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.4% between 2024 and 2030.

The Asia Pacific electrolyte drinks market stands at the forefront of a burgeoning industry, driven by a confluence of factors ranging from increasing health consciousness to changing lifestyle preferences. As the region witnesses rapid urbanization and a rising middle class, there's a palpable shift towards healthier beverage options, of which electrolyte drinks have emerged as a frontrunner. These beverages, enriched with essential minerals like potassium, sodium, and magnesium, offer hydration and replenishment benefits that cater to the active lifestyles prevalent in the region. Moreover, the Asia Pacific region's diverse climate conditions, ranging from tropical to subtropical, further accentuate the need for effective hydration solutions, making electrolyte drinks a compelling choice for consumers across various demographics. With an expanding fitness-conscious population, coupled with a growing awareness of the importance of electrolyte balance for overall well-being, the market for these beverages is witnessing robust growth. Against this backdrop, understanding the dynamics of the Asia Pacific electrolyte drinks market becomes imperative for businesses aiming to capitalize on the burgeoning demand. This introduction sets the stage for a comprehensive exploration of market trends, consumer preferences, key players, and growth opportunities within this dynamic and evolving industry landscape.

Key Market Insights:

- 72% of consumers in China actively seek functional beverages, driving demand for electrolyte drinks.

- Natural electrolyte drinks are expected to claim a 65% market share by 2027, with ingredients like coconut water and plant-based sweeteners gaining popularity.

- Over 55% of electrolyte drinks in the Asia Pacific region are sold through independent retailers, such as convenience stores, due to their widespread presence and convenience for impulse purchases.

- China leads the electrolyte drinks market in the Asia Pacific region, accounting for nearly 40% of total sales, propelled by its large population and rising disposable income.

- The region's fitness culture is driving a projected 25% increase in demand for electrolyte drinks among fitness enthusiasts, with gym memberships expected to surpass 300 million by 2025.

- The hypertonic electrolyte drink segment, formulated for intense exercise, is anticipated to witness the fastest growth due to rising participation in high-performance sports.

Asia Pacific Electrolyte Drinks Market Drivers:

Health Awareness Fuels the Surge of Electrolyte Drinks in Asia Pacific

Rising health consciousness among consumers in the Asia Pacific region is driving a notable shift towards functional beverages, with electrolyte drinks emerging as a popular choice. As individuals increasingly prioritize their overall well-being, there's a heightened awareness of the importance of maintaining electrolyte balance, especially among those leading active lifestyles or residing in hot climates. Electrolyte drinks are positioned as more than just a source of hydration; they are marketed to replenish essential minerals lost through sweat, offering a holistic solution to support physical activity and combat dehydration. This appeal is particularly resonant in the Asia Pacific, where diverse climate conditions and a burgeoning fitness culture contribute to the growing demand for such beverages. Moreover, the perception that electrolyte drinks provide health benefits beyond simple hydration aligns with the broader trend towards functional and wellness-oriented products, further fueling their popularity among health-conscious consumers in the region.

Electrolyte Drinks Surge in Demand Amidst Asia Pacific's Fitness Boom.

The Asia Pacific region is witnessing a notable surge in the popularity of fitness programs and a heightened emphasis on leading a healthy lifestyle, propelled by factors such as rising disposable incomes, rapid urbanization, and a growing awareness of the benefits of exercise. This burgeoning fitness culture is reshaping consumer preferences, particularly in the beverage sector, where electrolyte drinks are emerging as a favored choice. As individuals seek products that can enhance their performance during exercise and aid in quicker post-workout recovery, the demand for electrolyte drinks is on the rise. These beverages, formulated to replenish essential minerals lost through sweat, align perfectly with the needs of an active population keen on optimizing their fitness routines. Moreover, the increasing proliferation of fitness centers and gyms across the region further amplifies the demand for electrolyte drinks, as health-conscious consumers gravitate towards convenient and effective hydration solutions to support their workout regimes. The confluence of these factors underscores the growing significance of electrolyte drinks within the evolving landscape of Asia Pacific's health and fitness industry, positioning them as a key player in catering to the needs of an increasingly active and wellness-oriented demographic.

Asia Pacific Electrolyte Drinks Market Restraints and Challenges:

In navigating the Asia Pacific electrolyte drinks market, several notable restraints and challenges present themselves, shaping the industry's trajectory. Regulatory hurdles and compliance requirements pose significant obstacles for market players, particularly concerning labeling, health claims, and ingredient sourcing standards, which vary across different countries within the region. Additionally, heightened competition from alternative hydration solutions, including sports drinks, coconut water, and DIY electrolyte mixes, adds complexity to market dynamics, compelling companies to differentiate their offerings through innovation and marketing strategies. Economic uncertainties and fluctuations in disposable incomes in certain countries within the region may also impact consumer purchasing behavior, influencing demand patterns for electrolyte drinks. Furthermore, concerns regarding the environmental impact of single-use packaging and the sustainability of production processes present challenges for companies seeking to align with increasingly eco-conscious consumer preferences. Addressing these restraints and challenges requires a multifaceted approach, encompassing regulatory compliance, product differentiation, economic resilience, and sustainable practices, to sustain growth and foster resilience within the Asia Pacific electrolyte drinks market.

Asia Pacific Electrolyte Drinks Market Opportunities:

Within the Asia Pacific electrolyte drinks market, a plethora of opportunities await savvy businesses poised to capitalize on emerging trends and consumer preferences. The region's rapidly expanding middle class and urban population present a vast consumer base increasingly inclined towards health and wellness products, providing a fertile ground for electrolyte drink manufacturers to tap into. Moreover, with rising awareness of the importance of hydration and electrolyte balance, fueled by a growing fitness culture and changing lifestyle patterns, there's a heightened demand for innovative electrolyte formulations tailored to diverse consumer needs. Expanding distribution channels, including e-commerce platforms and convenience stores, offer convenient avenues for market penetration and accessibility, particularly in remote or underserved areas. Additionally, partnerships with fitness centers, sports events, and health-focused initiatives can enhance brand visibility and foster consumer engagement. Furthermore, leveraging technological advancements such as smart packaging and personalized nutrition solutions can enable companies to offer enhanced product experiences and cater to evolving consumer preferences. By strategically positioning themselves to capitalize on these opportunities, businesses can unlock untapped potential and drive sustained growth within the dynamic Asia Pacific electrolyte drinks market.

ASIA PACIFIC ELECTROLYTE DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

5.4% |

||

|

Segments Covered |

By Product Type, Sales Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

PepsiCo, Inc. (Gatorade), The Coca-Cola Company (Powerade), Red Bull GmbH, Lucozade Ribena Suntory (Lucozade Sport), Abbott Laboratories (Pedialyte), Glanbia plc (Optimum Nutrition), Otsuka Pharmaceutical Co., Ltd. (Pocari Sweat), Danone S.A. (Evian), Monster Beverage Corporation (Monster Hydro), BodyArmor SuperDrink (Dr Pepper Snapple Group) |

Asia Pacific Electrolyte Drinks Market Segmentation:

Asia Pacific Electrolyte Drinks Market Segmentation By Sales Channel:

- Independent Retailers

- Convenience Stores

- Specialist Retailers

- Supermarkets & Hypermarkets

- Online Retailers

In the Asia Pacific Electrolyte Drinks Market Segmented by Sales Channel, Independent Retailers had the largest market share last year and are poised to maintain their dominance throughout the forecast period. Independent retailers, comprising convenience stores, corner shops, and mom-and-pop stores, form a ubiquitous presence across the Asia Pacific region, serving as vital hubs for everyday essentials, including electrolyte drinks. Their extensive reach, particularly in rural areas and densely populated cities, ensures easy access to these beverages for a diverse consumer base. Catering to the daily needs of individuals, especially athletes, outdoor workers, and those in hot climates, independent retailers offer a convenient solution for immediate hydration requirements, often resulting in impulse purchases. Moreover, their adaptability to local preferences enables them to stock a wide array of electrolyte drink brands, including regional favorites that might not be available in larger chain stores, thereby catering to diverse taste preferences. However, these retailers face challenges such as competition from larger chains, which leverage bulk buying power to offer lower prices, and limited marketing reach compared to big brands. Despite these hurdles, the inherent strengths of independent retailers—flexibility, convenience, and localization—are poised to maintain their dominance as the primary sales channel for electrolyte drinks in the Asia Pacific region in the foreseeable future.

Asia Pacific Electrolyte Drinks Market Segmentation By Product Type:

- Natural

- Artificial

The Asia Pacific Electrolyte Drinks Market Segmented by Product Type, Artificial had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Asia Pacific region is witnessing a significant shift towards health-conscious consumption patterns, particularly in the realm of electrolyte drinks, where consumers are increasingly gravitating towards products perceived as natural and beneficial. This preference for natural ingredients such as coconut water, plant-based sweeteners, and Himalayan pink salt reflects a broader trend towards clean labeling and clean eating. Manufacturers are capitalizing on this trend by heavily marketing electrolyte drinks featuring natural sources of electrolytes, emphasizing health benefits and clean ingredients. Despite potential challenges related to affordability and taste preferences, driven by the higher cost of natural ingredients and lingering preferences for artificial flavors, respectively, the growing disposable income in many parts of the region is enabling consumers to prioritize premium products, including natural electrolyte drinks. As awareness of the health benefits associated with natural ingredients continues to grow, it is expected to drive a sustained demand for natural electrolyte drinks, solidifying their dominance in the market landscape throughout the forecast period.

Asia Pacific Electrolyte Drinks Market Segmentation By Region:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

The Asia Pacific Electrolyte Drinks Market Segmented by Region, China had the largest market share last year and is poised to maintain its dominance throughout the forecast period. China stands as a colossal force in the Asia Pacific Electrolyte Drinks Market, boasting the world's largest population, a significant portion of which aligns with the target demographic for such beverages. With rising disposable incomes and a surging wave of health consciousness sweeping the nation, there exists a massive potential consumer pool eager to embrace functional beverages like electrolyte drinks. Government initiatives promoting fitness further bolster this favorable environment, while the presence of established domestic and international brands offers consumers a diverse array of choices. However, as other Asian countries like India and Southeast Asian nations experience rapid economic growth and increasing disposable incomes, the landscape may witness a redistribution of market share in the future. Additionally, competition and market saturation pose ongoing challenges, necessitating continual innovation in product offerings and marketing strategies to sustain dominance. Despite these factors, China's advantageous position, driven by its sheer population size, economic growth, and health-conscious trends, solidifies its status as a powerhouse in the Asia Pacific electrolyte drinks market, albeit with an eye on evolving dynamics within the region.

COVID-19 Impact Analysis on the Asia Pacific Electrolyte Drinks Market.

The COVID-19 pandemic has significantly impacted the Asia Pacific electrolyte drinks market, leading to both short-term disruptions and long-term shifts in consumer behavior and market dynamics. Initially, the widespread lockdowns and social distancing measures implemented across the region resulted in a decline in overall consumption as people stayed indoors and outdoor activities, including sports events and fitness activities, were suspended. This led to a temporary slump in demand for electrolyte drinks, particularly in the on-the-go segment. Moreover, supply chain disruptions and logistical challenges further exacerbated the situation, impacting production and distribution capabilities. However, as the pandemic progressed, there was a notable shift towards health and wellness products, including electrolyte drinks, as consumers became more health-conscious and sought ways to boost their immunity and overall well-being. This trend, coupled with the gradual easing of restrictions and resumption of outdoor activities, contributed to a recovery in demand for electrolyte drinks, albeit with changes in consumption patterns and preferences. Additionally, the growing popularity of e-commerce channels for purchasing beverages further accelerated during the pandemic, presenting both challenges and opportunities for market players. Overall, while COVID-19 posed initial challenges to the Asia Pacific electrolyte drinks market, it also catalyzed shifts towards health-oriented consumption patterns and digitalization, shaping the future trajectory of the industry.

Latest trends / Developments:

The Asia Pacific Electrolyte Drinks Market is experiencing a robust boom, fueled by a burgeoning health consciousness and a thriving fitness culture. Consumers are increasingly turning away from artificial ingredients, instead embracing natural sources of electrolytes like coconut water and Himalayan pink salt. This shift towards natural alternatives is driving a trend towards premiumization, with consumers showing a willingness to pay more for products perceived to offer enhanced health benefits. While China currently dominates the market, propelled by its vast population and increasing disposable income, competition is intensifying in emerging markets like India and Southeast Asia. As brands vie for a share of this growing and health-focused consumer base, continued innovation is expected in both natural flavors and functionality. Expect to see a proliferation of new products catering to diverse tastes and preferences, as companies seek to differentiate themselves and capitalize on the lucrative opportunities presented by the region's booming electrolyte drinks market.

Key Players:

- PepsiCo, Inc. (Gatorade)

- The Coca-Cola Company (Powerade)

- Red Bull GmbH

- Lucozade Ribena Suntory (Lucozade Sport)

- Abbott Laboratories (Pedialyte)

- Glanbia plc (Optimum Nutrition)

- Otsuka Pharmaceutical Co., Ltd. (Pocari Sweat)

- Danone S.A. (Evian)

- Monster Beverage Corporation (Monster Hydro)

- BodyArmor SuperDrink (Dr Pepper Snapple Group)

Chapter 1. Asia Pacific Electrolyte Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Electrolyte Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Electrolyte Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Electrolyte Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Electrolyte Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Electrolyte Drinks Market– By Product Type

6.1. Introduction/Key Findings

6.2. Natural

6.3. Artificial

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Asia Pacific Electrolyte Drinks Market– By Sales Channel

7.1. Introduction/Key Findings

7.2. Independent Retailers

7.3. Convenience Stores

7.4. Specialist Retailers

7.5. Supermarkets & Hypermarkets

7.6. Online Retailers

7.7. Y-O-Y Growth trend Analysis By Sales Channel

7.8. Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 8. Asia Pacific Electrolyte Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By product Type

8.1.3. By Sales Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Electrolyte Drinks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo, Inc. (Gatorade)

9.2. The Coca-Cola Company (Powerade)

9.3. Red Bull GmbH

9.4. Lucozade Ribena Suntory (Lucozade Sport)

9.5. Abbott Laboratories (Pedialyte)

9.6. Glanbia plc (Optimum Nutrition)

9.7. Otsuka Pharmaceutical Co., Ltd. (Pocari Sweat)

9.8. Danone S.A. (Evian)

9.9. Monster Beverage Corporation (Monster Hydro)

9.10. BodyArmor SuperDrink (Dr Pepper Snapple Group)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Asia Pacific Electrolyte Drinks market is expected to be valued at US$ 2.99 billion

Through 2030, the Asia Pacific Electrolyte Drinks market is expected to grow at a CAGR of 5.4%.

By 2030, the Asia Pacific Electrolyte Drinks Market is expected to grow to a value of US$ 4.32 billion

China is predicted to lead the Asia Pacific Electrolyte Drinks market

The Asia Pacific Electrolyte Drinks has segments By Sales Channel, Product Type, and Region