Europe Electrolyte Drinks Market Size (2024-2030 )

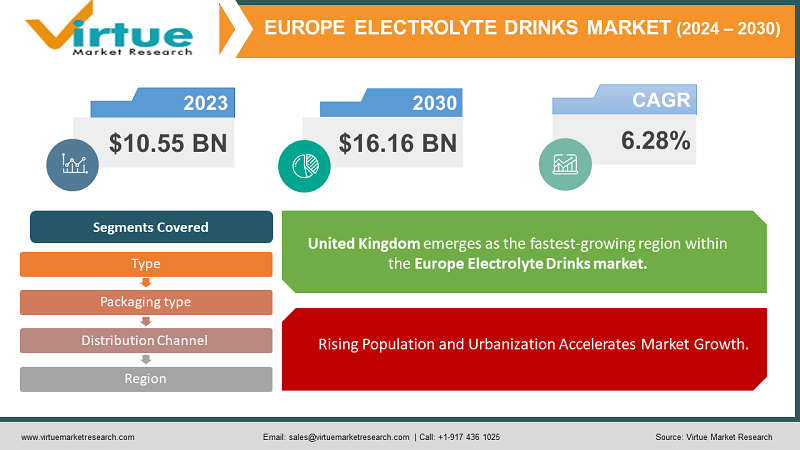

Europe's Electrolyte Drinks Market was valued at USD 10.55 billion in 2023 and is projected to reach a market size of USD 16.16 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.28%.

The term electrolyte is the scientific name for salt. Electrolyte drinks contain sugar and salt in an ionized substance such as water. The benefits of electrolyte drinks are that they help maintain energy and recovery after exercise. It helps replenish the electrolytes lost by athletes or people who exercise regularly. The amount of electrolytes varies from person to person and depends on other factors such as gender, age, body type, and exercise duration. Electrolyte Drinks contain a variety of electrolytes such as potassium, magnesium, calcium and sodium, which further regulate blood pH by balancing fluid pressure in the brain. Electrolyte drinks are designed to provide energy during intense exercise. Electrolyte Drinks has grown from a niche product to one of the biggest brands in the world. These changes often result from consumers' clear views on health and wellness. Additionally, demand for electrolyte beverages has increased due to reduced soda consumption in many major markets around the world, and this demand is expected to have a significant impact on sales and revenue this year. The global electrolyte beverage market is expected to witness the emergence of new consumers in the coming years as electrolyte beverages are not an option for male and female athletes. Electrolyte Drinks provide instant energy, both mentally and physically. The main ingredients of electrolyte drinks include caffeine and taurine, which provide important support for the development of skeletal muscles and the cardiovascular system.

Key Market Insights:

Electrolyte beverage companies are known to spend a lot of money promoting major campaigns. Sponsorship has emerged as the best marketing strategy and the best form of communication that allows businesses to build relationships and, in some cases, generate interest. The electrolyte beverage industry has expanded recently due to the previously mentioned advances.

The Electrolyte Drinks market is highly competitive with a mix of established companies and startups. Beverage giants such as The Coca-Cola Company and PepsiCo dominate the market with popular brands such as "PowerAde" and "Gatorade". These industry leaders use their extensive distribution, brand names, and marketing capabilities to dominate the market. In recent years there has been a growth in new products in the new market. Companies known for their athlete endorsements and healthy ingredients, such as BodyArmor, are delighting consumers by offering alternatives to sports drinks. Nuun appeals to athletes looking for customized hydration options with effervescent electrolyte tablets.

Electrolyte Drinks Market Drivers:

Rising Population and Urbanization Accelerates Market Growth.

There is no denying the fact that increasing population will result in increasing demand for electrolyte drinks as more people will naturally consume more drinks and hence, electrolyte drinks. On the other hand, Urbanization further fuels the market as people have healthy purchasing power and are willing to invest in higher-quality drinks. As spending on these premium drinks increases, it will enhance the market growth. Consumers often like to be stuck with a particular brand because of their unique properties, and health benefits which solidify the position of key players in the market and enable them to produce more of these types of drinks which in turn drives the market.

Growing Research and Development Activities helps in the market growth.

Research and development in the drinks industry focuses on identifying new trends in electrolyte drinks, discovering their compounds, and understanding their potential uses. These conditions aim to unlock the potential of Electrolyte drinks and create new products for various industries.

Electrolyte Drinks Market Restraints and Challenges:

Maintaining quality and Standardization provides a challenge to market growth.

Maintaining consistency in quality and standardization of Electrolyte Drinks can be difficult due to differences between material and processing. Ensure batch-to-batch consistency and compatibility requirements, especially for companies sourcing from multiple suppliers or regions.

The volatility in electrolyte prices brings a challenge to market growth.

Europe Electrolyte Drinks prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Sustainability and Environmental Impact restrain market growth.

The increasing demand for Electrolyte Drinks has led to concerns about their sustainability and environmental impact. Maintaining sustainable practices and supporting local communities are key challenges facing the Electrolyte Drinks industry.

Electrolyte Drinks Market Opportunities:

The electrolyte alcohol market has many exciting opportunities for international expansion. Considering the importance of health and well-being, emphasis is placed on developing new products with low sugar, natural ingredients, and designs that suit many customer preferences. The development of distribution channels, especially focusing on healthcare e-commerce platforms and suppliers, has led to a further expansion of the product range.

Additionally, by investing in sports and health promotion, especially in emerging markets, electrolyte drinks can be key to hydration and performance. Athletes, fitness professionals, and healthcare professionals can work together to create a trusted customer experience. As sustainability becomes more popular, creating eco-friendly and ethical packaging can appeal to environmentally conscious consumers.

EUROPE ELECTROLYTE DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.28% |

|

Segments Covered |

By Type, Packaging type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany , France , Italy , Spain , Rest Of Europe |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo Inc., Suntory Holdings Limited, Oshee Polska Sp zoo, Associated British Food PLC, Abbott, PURE Sports Nutrition, The Vita Coco Company, SOS Hydration, DRINKWEL |

Europe Electrolyte Drinks Market Segmentation:

Europe Electrolyte Drinks Market Segmentation by Type:

- Isotonic

- Hypotonic

- Hypertonic

In 2023, based on Type, Isotonic drinks account for 55% share of the European market and currently lead the market. The isotonic segment has become more sophisticated due to the widespread use of this drink by competitors and buyers. The main purpose of isotonic drinks is to supplement food and water, provide rehydration and improve sports performance. The benefits of isotonic electrolyte beverages will cause the category to expand faster than the overall market during the analysis period. However, the high osmotic pressure segment should be evaluated without hindering the growth rate of the Electrolyte Beverage market during the study period.

Europe Electrolyte Drinks Market Segmentation by Packaging Type:

- PET Bottles

- Cartons

- Beverage Cans

- Tetra pack

- Pouches & Sachets

In 2023, based on Packaging Type segment, PET Bottles account for more than 40% share of the European market. PET Bottles are widely used by beverage companies. There has been significant growth in the PET Bottles market, which started with the emergence of all kinds of breakthroughs in PET Bottles.

The emergence of new developments is expected to lead to the growth of PET containers in the electrolyte drinks industry during the forecasting period. Additionally, the Tetra Pack electrolyte water container is in greater demand due to its convenience (ease of storage, recycling, and opening), availability, and ease of movement. These are the benefits that increase the demand for electrolyte drinks.

Europe Electrolyte Drinks Market Segmentation by Distribution Channel:

- Offline

- Online

In 2023, based on the Distribution Channel segment, Offline accounts for more than 70% share of the European market. The electrolyte beverage offline market is expected to grow rapidly during the forecasting period. The electrolyte beverage market in sports and exercise will grow due to the increasing number of sportspersons such as athletes, weightlifters, etc. Additionally, increasing consumption of energy drinks among young people and the elderly may also lead to market growth in the coming years. Many energy drink companies are using new technologies to improve the quality of their drinks, which is positively affecting the sports and fitness market over time. Offline showcasing of such drinks is profitable for market players hence offline market has a dominance over online.

|

Europe Electrolyte Drinks Market Segmentation: Country Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest Of Europe

In 2023, based on Country, the United Kingdom accounts for a 35% share of the European market. Convenience is king in the UK, with flexible pouches and single-serve packaging dominating. E-commerce food sales are booming, driving demand for sturdy and sustainable packaging solutions.

On the other hand, Germany has shown a higher CAGR in recent times and is expected to witness significant growth in the forecasting period. Germany is Europe's economic powerhouse leading in sustainability solutions, embracing bioplastics and recycled content.

France stands third in the queue followed by Italy, Spain, and the Rest of Europe.

COVID-19 Impact Analysis on the Europe Electrolyte Drinks Market:

Two outcomes have been seen during the COVID-19 pandemic. The industry saw sales fall and profits shrink as restrictions and quarantines were tightened at the height of the crisis. Factories are being closed to prevent the spread of the disease. On the other hand, when the disease curve flattened, production maintained its pre-pandemic estimates. The need for electrolytes is even greater during a global pandemic, as hydration is essential to maintain the overall health of COVID-19 patients. In addition, people are becoming more health conscious, want to eat healthy, and engage in physical activity, resulting in increased demand in the electrolyte alcohol market.

Latest Trends/ Developments:

Several important factors can be seen influencing the European electrolyte drinks market. Based on health and wellness trends, the demand for electrolyte-enriched beverages is increasing as consumers look for products that help them stay hydrated and promote health. As people become more health-conscious, there is a growing preference for products with clear labels, fewer additives, and natural ingredients, encouraging companies to rethink and improve their products. Incorporating electrolyte drinks into overall lifestyle choices is another important factor. The company partners with the sports and fitness community, marketing its products as essential lifestyle items. This is especially true for ads featuring endorsements from athletes and powerful figures. Additionally, electrolyte drinks are encouraged as a recovery service.

Sustainability issues are now permeating the business. As environmental awareness continues to grow, consumers are looking for environmentally friendly packaging options and open spaces. Sustainability and recycling practices give products a competitive advantage and make them more attractive to green consumers.

Electrolyte drink sales have a bright future due to the growth of e-commerce. Thanks to the easy access and convenience provided by online stores, customers can make informed decisions by examining various products.

Key Players:

- The Coca-Cola Company

- PepsiCo Inc.

- Suntory Holdings Limited

- Oshee Polska Sp zoo

- Associated British Food PLC

- Abbott

- PURE Sports Nutrition

- The Vita Coco Company

- SOS Hydration

- DRINKWEL

- In October 2022, Coca-Cola launched Powerade ION4, a new electrolyte drink focused on hydration and recovery.

- In August 2022, PepsiCo expanded its Gatorade portfolio with Gatorade Zero Sugar Fit and Gatorade Flow.

- In March 2022, PURE Sports Nutrition expanded its presence in Europe and launched new products like Hydrate & Perform.

- In March 2022, SOS Hydration gained traction with its plant-based electrolyte drink and sustainable packaging.

Chapter 1. Europe Electrolyte Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Electrolyte Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Electrolyte Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Electrolyte Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Electrolyte Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Electrolyte Drinks Market– By Type

6.1. Introduction/Key Findings

6.2 Isotonic

6.3. Hypotonic

6.4. Hypertonic

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Electrolyte Drinks Market– By Packaging Type

7.1. Introduction/Key Findings

7.2 PET Bottles

7.3. Cartons

7.4. Beverage Cans

7.5. Tetra pack

7.6. Pouches & Sachets

7.7. Y-O-Y Growth trend Analysis By Packaging Type

7.8. Absolute $ Opportunity Analysis By Packaging Type , 2024-2030

Chapter 8. Europe Electrolyte Drinks Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Offline

8.3. Online

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Electrolyte Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Packaging Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Electrolyte Drinks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The Coca-Cola Company

10.2. PepsiCo Inc.

10.3. Suntory Holdings Limited

10.4. Oshee Polska Sp zoo

10.5. Associated British Food PLC

10.6. Abbott

10.7. PURE Sports Nutrition

10.8. The Vita Coco Company

10.9. SOS Hydration

10.10. DRINKWEL

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Europe's Electrolyte Drinks Market was valued at USD 10.55 billion in 2023 and is projected to reach a market size of USD 16.16 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.28%.

The segments under the Europe Electrolyte Drinks Market based on Type are Isotonic, Hypotonic, and Hypertonic

. The United Kingdom is dominant in Europe's Electrolyte Drinks Market.

The Coca-Cola Company, PepsiCo Inc., Suntory Holdings Limited, Oshee Polska Sp zoo, Associated British Food PLC, Abbott, PURE Sports Nutrition, The Vita Coco Company, SOS Hydration, DRINKWEL, etc.

The industry saw sales fall and profits shrink as restrictions and quarantines were tightened at the height of the crisis. Factories are being closed to prevent the spread of the disease. On the other hand, when the disease curve flattened, production maintained its pre-pandemic estimates. The need for electrolytes is even greater during a global pandemic, as hydration is essential to maintain the overall health of COVID-19 patients. In addition, people are becoming more health conscious, want to eat healthy, and engage in physical activity, resulting in increased demand in the electrolyte alcohol market.