Energy Drinks Market Size (2024 – 2030)

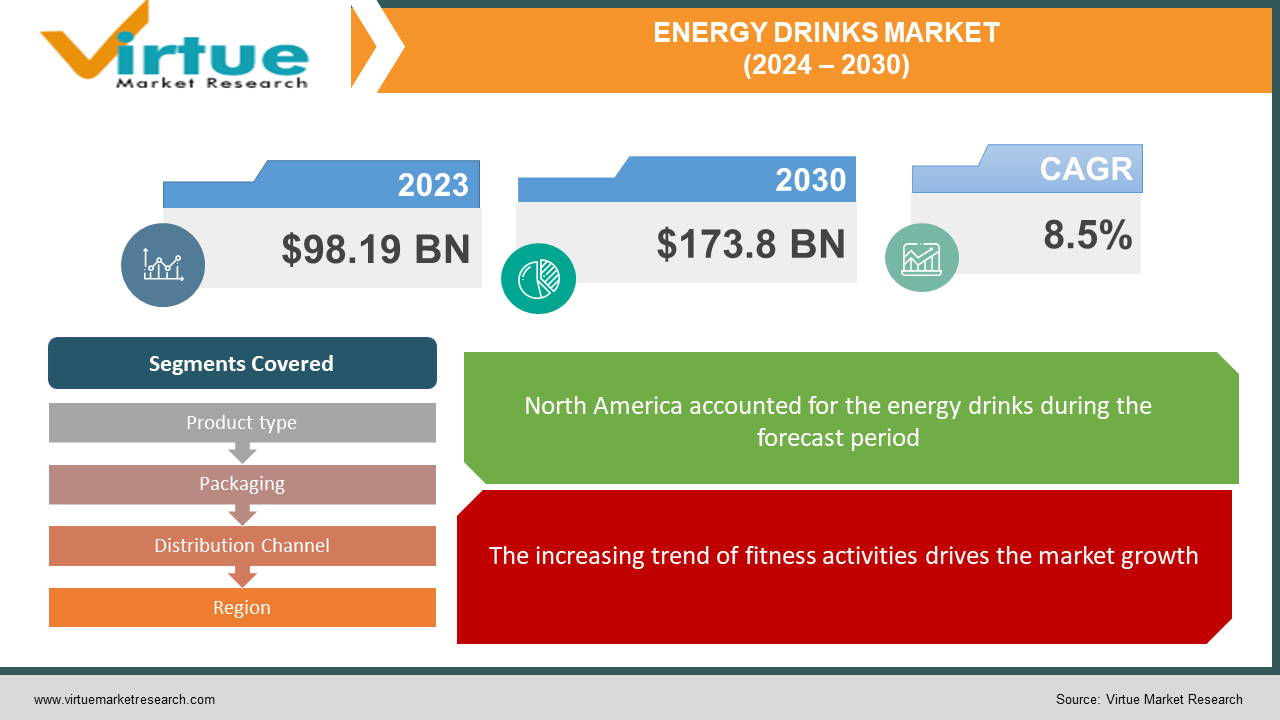

The Energy Drinks Market was valued at USD 98.19 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 173.8 Billion by 2030, growing at a CAGR of 8.5%.

Functional beverages, commonly referred to as electrolyte drinks, serve as a replenishment aid for athletes seeking to restore hydration, electrolyte balance, and stamina before, during, and following physical exertion or competitive events. These beverages offer individuals advantages including revitalization, immediate energy boost, heightened focus, and enhanced reaction speed. Comprising a diverse array of components such as taurine, caffeine, botanical extracts, and vitamins, among others, energy drinks cater to the needs of a wide demographic.

Key Market Insights:

In response to the global trend towards improved fitness and health consciousness, food and beverage enterprises have diligently sought to leverage this opportunity. This strategic approach has notably propelled the energy drink sector, which has adeptly tailored its offerings to align with evolving consumer preferences. A significant driving force behind this market surge is the demand for rapid energy replenishment during physical exercise or aerobic endeavors. Athletes, particularly, are attracted to the immediate energy surge offered by these beverages, leading to substantial growth witnessed by industry stakeholders in this segment.

Energy Drinks Market Drivers:

The increasing trend of fitness activities drives the market growth.

The surge in interest surrounding alternative fitness activities like yoga and aerobics, coupled with the increasing participation in half and full marathons globally, has driven up the demand for energy drinks. Moreover, heightened consumer awareness regarding the health hazards linked to conventional non-organic sports and energy beverages has led to a growing preference for products containing natural ingredients.

Awareness regarding the health risks associated with liquid calorie consumption has become widespread among consumers, prompting a call for greater transparency from businesses regarding their offerings. Manufacturers of energy drinks are urged to disclose the composition of their products to meet the demands of increasingly discerning consumers. Consequently, the popularity of natural energy drinks and health-conscious non-alcoholic beverages is on the rise.

The duration of the public health crisis induced by the COVID-19 pandemic remains uncertain, but there is a greater accessibility to data about it. Caffeinated energy drinks stand out as an excellent pre-workout option, thanks to their inclusion of essential components such as taurine, caffeine, sugars, and vitamins, which aid in sustaining energy levels and enhancing focus during workouts. Additionally, the presence of taurine and B vitamins in energy drinks contributes to improved workout performance.

The popularity of packaged beverages like non-alcoholic beers is steadily increasing among sports enthusiasts, reflecting a broader trend towards convenient and refreshing options for hydration and enjoyment.

Energy Drinks Market Restraints and Challenges:

Strict health regulations restrain market growth.

However, stringent government regulations regarding the health aspects of sports and energy drinks, coupled with increased public awareness regarding their adverse effects on children, are anticipated to restrain market expansion. The proliferation of deceptive marketing practices by a minority of vendors, exacerbated by negative media coverage, also poses a potential threat to the growth trajectory of the sports and energy drinks market.

The energy drinks market offers comprehensive insights into recent developments, trade regulations, import-export dynamics, production analysis, value chain optimization, market share assessment, impact of domestic and localized competitors, exploration of emerging revenue opportunities, analysis of market regulation changes, strategic growth analysis, market sizing, category-specific growth patterns, application niches and dominance, product approvals, launches, geographic expansions, and technological advancements.

Energy Drinks Market Opportunities:

Market growth is anticipated to be propelled by the rising proliferation of fitness centers and the increasing involvement of women in physical activities. Furthermore, the expanding millennial demographic and heightened utilization of social media platforms for marketing purposes are expected to unlock additional opportunities, driving the energy drinks market forward throughout the forecast period.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Product type, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo. Inc., Taisho Pharmaceutical Co. Ltd., Red Bull, Lucozade, AriZona Beverages USA, Xyience Energy, Amway, Monster Energy, The Coca-Cola Company, Living Essentials LLC |

Energy Drinks Market Segmentation - By Product Type

-

Drinks

-

Shots

-

Mixers

During the projected period, the drinks segment is forecasted to lead to market growth. This preference among consumers stems from the immediate hydration benefits and essential nutrients offered by drinks, essential for optimal bodily functions. Moreover, the diverse range of options within the drinks category appeals to a broader customer base. The versatility of drinks allows consumers to enjoy them during leisure activities, post-exercise recovery, and work, consequently driving demand.

Conversely, the mixers segment is poised for rapid growth during the forecast period. Increased accessibility of these products as mixers has been a significant driver of market expansion. Additionally, customers are selecting mixers to craft upscale cocktails and alcoholic beverages. Manufacturers are also capitalizing on this trend by experimenting with novel mixer flavors to attract new customers. Studies have demonstrated that moderate alcohol consumption combined with caffeinated mixers like cola or energy drinks mitigates the adverse effects of alcohol consumption, resulting in less severe outcomes compared to alcohol consumption alone.

Energy Drinks Market Segmentation - By Packaging

-

Cans

-

Bottles

-

Others

The cans segment is poised to assert dominance in the market throughout the forecast period. These beverages are gaining traction among increasingly discerning consumers who are opting for alternatives to canned wine and other alcoholic beverages. The popularity of metal cans stems from their portability and durability, especially appealing to younger demographics due to their resistance to shattering, unlike glass containers.

The closure of bars, pubs, and restaurants amid the coronavirus pandemic has led to a significant surge in demand for canned products, a trend expected to persist during the projection period. This heightened demand is particularly notable in the functional energy drinks market, where many offerings are packaged in cans. Consequently, manufacturers are introducing more products in this format to capitalize on the growing market for functional beverages.

Energy Drinks Market Segmentation - By Distribution Channel

-

Convenience Stores

-

Supermarket/Hypermarket

-

Mass Merchandiser

-

Drug Stores

-

Online Retail

-

Food Service/ Sports Nutrition Chains

-

Other Distribution Channels

The cans segment is poised to assert dominance in the market throughout the forecast period. These beverages are gaining traction among increasingly discerning consumers who are opting for alternatives to canned wine and other alcoholic beverages. The popularity of metal cans stems from their portability and durability, especially appealing to younger demographics due to their resistance to shattering, unlike glass containers.

The closure of bars, pubs, and restaurants amid the coronavirus pandemic has led to a significant surge in demand for canned products, a trend expected to persist during the projection period. This heightened demand is particularly notable in the functional energy drinks market, where many offerings are packaged in cans. Consequently, manufacturers are introducing more products in this format to capitalize on the growing market for functional beverages.

Energy Drinks Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is forecasted to maintain a significant market share throughout the forecast period. This is attributed to the increasing emphasis on marketing and promotional activities aimed at stimulating product growth, the emergence of numerous domestic brands, and the rise in disposable income among consumers in the region. North America stands out as the leading consumer of energy drinks globally, owing to shifting consumer preferences, tastes, and drinking habits. The phenomena of migration and market globalization have also played pivotal roles in reshaping consumer drinking patterns, offering new opportunities for market participants to diversify their beverage offerings.

Furthermore, the Asia Pacific region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. Economies such as China, India, and Japan are poised for substantial expansion in the beverage industry, fueled by consumers' inclination towards exploring new flavors and the strong demand from immigrant populations seeking a variety of beverages. The region's demand for products has been further buoyed by the introduction of new beverage offerings tailored to appeal to a broad spectrum of consumers.

COVID-19 Pandemic: Impact Analysis

The effects of the COVID-19 pandemic ripple through the global sports landscape. Stringent restrictions on sports and outdoor activities were enforced for much of the year 2020, significantly disrupting the sports ecosystem. Moreover, the uncertainty surrounding the situation led to the postponement of numerous leagues, tournaments, and even the Olympic Games, curtailing sports and gaming events and inevitably dampening sales revenues of sports drinks. However, with the gradual improvement of the situation and the resumption of professional and public sports activities, the sports drinks market is anticipated to embark on a recovery trajectory during the forecast period.

Latest Trends/ Developments:

-

In February 2022, PepsiCo, Inc. unveiled a hemp-infused energy drink in the United States, featuring hemp oil, vitamin B, spearmint, lemon balm, and caffeine among its key ingredients.

-

In January 2022, Starbucks, in collaboration with PepsiCo, Inc., introduced its range of energy beverages, now available for purchase in grocery stores, major retail outlets, and convenience stores across the United States. Beginning in March 2022, these products will also be accessible at Starbucks outlets nationwide.

-

Also in January 2022, Anheuser-Busch Companies LLC announced its plans to introduce energy drinks in India, citing the millennial demographic and affluent consumers in major urban centers as the main catalysts for growth in the energy drink segment.

Key Players:

These are the top 10 players in the Energy Drinks Market: -

-

PepsiCo. Inc.

-

Taisho Pharmaceutical Co. Ltd.

-

Red Bull

-

Lucozade

-

AriZona Beverages USA

-

Xyience Energy

-

Amway

-

Monster Energy

-

The Coca-Cola Company

-

Living Essentials LLC

Chapter 1. Energy Drinks Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Energy Drinks Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Energy Drinks Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Energy Drinks MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Energy Drinks Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Energy Drinks Market– By Product Type

6.1 Introduction/Key Findings

6.2 Drinks

6.3 Shots

6.4 Mixers

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Energy Drinks Market– By Packaging

7.1 Introduction/Key Findings

7.2 Cans

7.3 Bottles

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Packaging

7.6 Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. Energy Drinks Market– By Distribution Channel

8.1 Introduction/Key Findings

8.2 Convenience Stores

8.3 Supermarket/Hypermarket

8.4 Mass Merchandiser

8.5 Drug Stores

8.6 Online Retail

8.7 Food Service/ Sports Nutrition Chains

8.8 Other Distribution Channels

8.9 Y-O-Y Growth trend Analysis By Distribution Channel

8.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Energy Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Packaging

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Packaging

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Packaging

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Packaging

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Packaging

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Energy Drinks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 PepsiCo. Inc.

10.2 Taisho Pharmaceutical Co. Ltd.

10.3 Red Bull

10.4 Lucozade

10.5 AriZona Beverages USA

10.6 Xyience Energy

10.7 Amway

10.8 Monster Energy

10.9 The Coca-Cola Company

10.10 Living Essentials LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The surge in interest surrounding alternative fitness activities like yoga and aerobics, coupled with the increasing participation in half and full marathons globally, has driven up the demand for energy drinks.

The top players operating in the Energy Drinks Market are - PepsiCo. Inc., Taisho Pharmaceutical Co. Ltd., Red Bull, Lucozade, AriZona Beverages USA.

The effects of the COVID-19 pandemic ripple through the global sports landscape. Stringent restrictions on sports and outdoor activities were enforced for much of the year 2020, significantly disrupting the sports ecosystem.

In February 2022, PepsiCo, Inc. unveiled a hemp-infused energy drink in the United States, featuring hemp oil, vitamin B, spearmint, lemon balm, and caffeine among its key ingredients.

The Asia Pacific region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period.