Asia Pacific Energy Drinks Market Size (2024-2030)

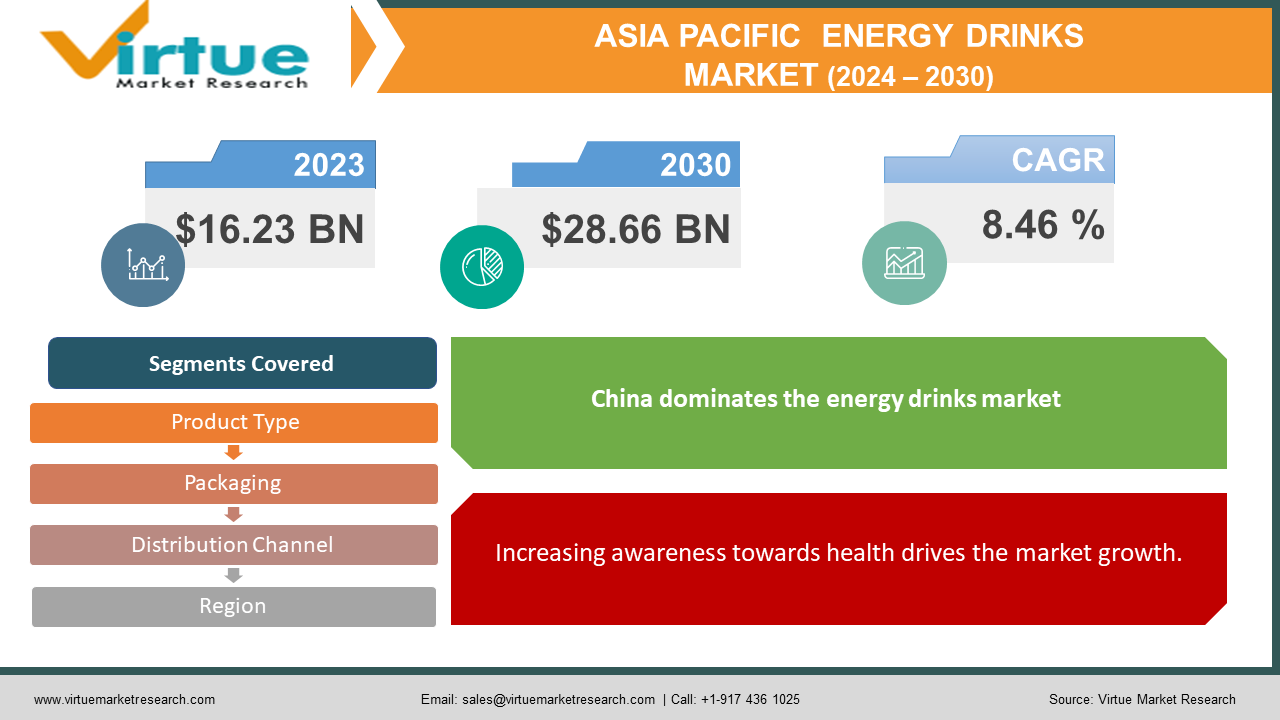

The Asia Pacific Energy Drinks Market was valued at USD 16.23 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 28.66 billion by 2030, growing at a CAGR of 8.46%.

Energy beverages contain stimulating compounds like caffeine, providing both mental and physical stimulation. These beverages might come in a carbonated form and may include sweeteners, herbal extracts, and amino acids. It's important to distinguish them from sports drinks, designed for replenishing electrolytes and water during or after physical activity to enhance athletic performance. Furthermore, energy drinks differ from tea and coffee, as the latter are either brewed or decaffeinated.

Taurine, an essential component for cardiovascular function and skeletal muscle development, is present in energy drinks. The enhanced cognitive performance associated with these beverages is attributed to the inclusion of caffeine. The dietary supplements found in energy drinks may yield perceived benefits, contributing to an increased consumption of these products.

Key Market Insights:

Beverages formulated to rapidly enhance both physical and mental energy are commonly known as energy drinks. These beverages are typically composed of stimulants like caffeine, alongside other elements such as vitamins, amino acids, and herbs. Marketed with the intention of elevating alertness, mitigating fatigue, and optimizing overall performance, energy drinks have gained popularity among individuals in need of a quick energy boost. This demand is particularly evident in situations requiring heightened alertness and endurance, such as during sports activities or extended work hours. It is advisable, however, to exercise moderation in their consumption, considering potential health concerns linked to excessive intake of caffeine.

Asia Pacific Energy Drinks Market Drivers:

Changing lifestyle is increasing the market growth.

Rapid urbanization and changing lifestyles in the Asia-Pacific region have generated a heightened demand for convenient energy drinks. The accelerated pace of life has resulted in an increasing requirement for readily available energy sources, a demand effectively met by energy drinks. This factor serves as a catalyst for the rising consumption of energy drinks, offering a prompt and efficient solution to combat fatigue and enhance alertness amidst the demands of hectic schedules.

Increasing awareness towards health drives the market growth.

An additional significant driving force is the increasing awareness of health and fitness among consumers. A growing number of individuals are adopting a more health-conscious approach, actively seeking beverages that not only supply energy but also deliver additional health advantages. In response to this trend, manufacturers of energy drinks are integrating vitamins, natural components, and other functional elements into their products. Consequently, energy drinks are now viewed as a healthier option compared to beverages with high sugar content or excessive caffeine, making them particularly appealing to health-conscious consumers who desire both energy and well-being.

Consumers prefer Low Calories drinks increasing the demand for the market.

The escalating demand for low-sugar energy drinks reflects a growing health consciousness among consumers. Concerns about the elevated sugar content in conventional energy drinks have been associated with various health issues, including obesity, diabetes, and heart disease. Given the heightened prevalence of diabetes in the region, consumers are increasingly recognizing the significance of maintaining a healthy diet and an active lifestyle. As reported by GOQii, 13.2% of the Indian population was diagnosed with diabetes last year, underscoring the urgency of health considerations. In response to these health concerns and the heightened efforts to prevent lifestyle diseases, consumers are shifting towards dietary patterns featuring low-calorie, low-sugar, or sugar-free options in both foods and beverages. Natural sweeteners, such as stevia, are particularly favored by consumers seeking healthier alternatives in their beverage choices.

Asia Pacific Energy Drinks Market Restraints and Challenges:

New approach and innovation may hinder the market growth.

Within the energy drinks market, there exist prospects for innovation and diversification. Manufacturers have the opportunity to explore novel flavors, formulations, and packaging strategies to cater to a wide array of consumer preferences. Through the consistent introduction of fresh and appealing options, these manufacturers can broaden their product portfolios and secure a more extensive share of the market. This proactive approach enables them to stay relevant and responsive to evolving consumer tastes, fostering sustained growth and competitiveness within the industry.

Preferring organic products restrain the market.

With the escalating momentum of health and wellness trends in the Asia-Pacific region, energy drink companies have the chance to strategically position their products as more than just energy sources—emphasizing them as functional beverages that promote overall well-being. By innovating and marketing energy drinks with natural ingredients, reduced sugar content, and supplementary health benefits, these companies can effectively tap into the expanding market of health-conscious consumers. This approach aligns seamlessly with the regional shift towards healthier beverage choices and provides a competitive advantage in a market where consumers are progressively prioritizing their physical and mental health.

Asia Pacific Energy Drinks Market Opportunities:

Stringent regulation may slow down the opportunities that the market offer.

Energy drink manufacturers encounter regulatory challenges due to increasingly stringent labeling requirements and regulations across various countries in the Asia-Pacific region. Navigating these diverse and evolving regulatory landscapes poses a complex task, and ensuring compliance may necessitate adjustments to both product formulations and marketing strategies. These adaptations have the potential to impact market entry and expansion, as adherence to regulatory standards becomes a pivotal factor in sustaining a successful presence in the energy drinks market within the region.

ASIA PACIFIC ENERGY DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.46% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, rest of asia-pacific |

|

Key Companies Profiled |

Red Bull (Austria), PepsiCo, Suntory , Tan Hiep Phat Group , Osotspa Public Company Limited, Osotspa Co., Ltd., Fraser and Neave Beverages, Otsuka Pharmaceutical , Yakult Honsha Co., Ltd., Oishi Group |

Asia Pacific Energy Drinks Market Segmentation:

Asia Pacific Energy Drinks Market Segmentation By Product Type:

- Drinks

- Shots

- Mixers

During the forecast period, the mixer segment is anticipated to hold a significant market share, driven by the rising utilization of energy drinks as mixers for alcoholic beverages. The increasing demand for energy drinks as a potential energy enhancer, contributing to improved physical and cognitive performance, is a key factor influencing the growth of the market. This trend underscores the evolving consumer preferences and the versatile applications of energy drinks beyond standalone consumption, positioning them as integral components in mixed beverages for various occasions.

Asia Pacific Energy Drinks Market Segmentation By Packaging:

- Bottles

- Cans

- Others

The market is currently dominated by the bottle segment, while the cans segment is projected to experience growth in the forecasted years. The ascendancy of bottles is attributed to certain factors, including familiarity and established consumer preferences. However, the forecasted growth in the cans segment can be attributed to the advantages offered by aluminum cans. These cans are recognized for their enhanced durability compared to plastic, as they are less prone to cracking or breaking. Furthermore, their 100% recyclability sets them apart, as plastic bottles can only undergo recycling a limited number of times before necessitating disposal in landfills. These factors contribute to the increasing popularity and anticipated growth of the cans segment in the market.

Asia Pacific Energy Drinks Market Segmentation By Distribution Channel:

- Supermarkets/Hypermarkets

- Food Services

- Online Retail

- Specialist Stores

- Others Distribution Channels

The online retail segment is poised for rapid expansion in the upcoming years, primarily driven by the widespread availability of energy drinks on e-commerce platforms. The convenience and comfort offered by e-commerce play a pivotal role in this anticipated growth. Moreover, online platforms provide comprehensive information about products, including details on prices, benefits, and thorough value assessments. This transparency allows consumers to make informed decisions by evaluating various aspects before committing to the purchase of energy drinks, further contributing to the projected surge in the online retail segment.

Asia Pacific Energy Drinks Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

China is poised to dominate the energy drinks market, propelled by its extensive consumer base, ongoing urbanization, and the rise in disposable income. These factors contribute to increased consumption and overall market growth. Canned and bottled energy drinks are widely available in various retail outlets in China, ranging from supermarkets and hypermarkets to convenience stores and online retailers. This broad distribution network significantly boosts the sales of energy drink products throughout the country.

India, on the other hand, is anticipated to experience substantial growth in the energy drinks market. This growth is fueled by a rising trend of health consciousness among consumers, ongoing urbanization, and a youthful population that actively embraces energy-boosting beverages. The combination of these factors positions India as a significant market for energy drinks, with the potential for considerable expansion in the foreseeable future.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 pandemic in 2020 had a moderate impact on the market. Manufacturers encountered significant challenges, including disruptions in the supply chain, shortages of labor, partial or complete closures of manufacturing facilities, and difficulties in procuring raw materials. These issues collectively posed substantial hurdles for energy drink manufacturers during the unprecedented circumstances of the pandemic. The resulting operational constraints and uncertainties in the market underscored the broader economic impact of the global health crisis on the energy drinks industry.

Latest Trends/ Developments:

- As of July 31, 2023, the acquisition of Bang Energy by Monster Beverage, inclusive of their beverage production facility in Phoenix, Arizona, signifies a strategic move to strengthen Monster Beverage's presence in the Asia-Pacific energy drink market. This development is aimed at better serving the expanding consumer base in the region.

- On February 13, 2023, the introduction of Chris Bumstead's Bum Energy drink marked a notable entry into the energy drink market. Distinguished by its lower caffeine content and unique ingredients, this beverage provides consumers with a distinctive option in the energy drink landscape, contributing to the diversification of choices available in the market.

Key Players:

These are top 10 players in the Asia Pacific Energy Drinks Market:-

- Red Bull (Austria)

- PepsiCo

- Suntory

- Tan Hiep Phat Group

- Osotspa Public Company Limited

- Osotspa Co., Ltd.

- Fraser and Neave Beverages

- Otsuka Pharmaceutical

- Yakult Honsha Co., Ltd.

- Oishi Group

Chapter 1. Asia Pacific Energy Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Packaging s

1.5. Secondary Product Packaging s

Chapter 2. Asia Pacific Energy Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Energy Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Energy Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Energy Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Energy Drinks Market– By Product Type

6.1. Introduction/Key Findings

6.2. Drinks

6.3. Shots

6.4. Mixers

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Asia Pacific Energy Drinks Market– By Packaging

7.1. Introduction/Key Findings

7.2 Bottles

7.3. Cans

7.4. Others

7.5. Y-O-Y Growth trend Analysis By Packaging

7.6. Absolute $ Opportunity Analysis By Packaging , 2024-2030

Chapter 8. Asia Pacific Energy Drinks Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Food Services

8.4. Online Retail

8.5. Specialist Stores

8.6. Others Distribution Channels

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Asia Pacific Energy Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By product type

9.1.3. By Packaging

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Energy Drinks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Red Bull (Austria)

10.2. PepsiCo

10.3. Suntory

10.4. Tan Hiep Phat Group

10.5. Osotspa Public Company Limited

10.6. Osotspa Co., Ltd.

10.7. Fraser and Neave Beverages

10.8. Otsuka Pharmaceutical

10.9. Yakult Honsha Co., Ltd.

10.10. Oishi Group

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Energy Drinks Market was valued at USD 16.23 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 28.66 billion by 2030, growing at a CAGR of 8.46%.

The Top Players operating in the Asia Pacific Energy Drinks Market are - Red Bull PepsiCo, Suntory, Tan Hiep Phat Group, Osotspa Public Company Limited, Osotspa Co., Ltd., Fraser and Neave Beverages, Otsuka Pharmaceutical, Yakult Honsha Co., Ltd., Oishi Group

The onset of the COVID-19 pandemic in 2020 had a moderate impact on the market.

The acquisition of Bang Energy by Monster Beverage, inclusive of their beverage production facility in Phoenix, Arizona, signifies a strategic move to strengthen Monster Beverage's presence in the Asia-Pacific energy drink market. This development is aimed at better serving the expanding consumer base in the region

India is anticipated to experience substantial growth in the energy drinks market. This growth is fueled by a rising trend of health consciousness among consumers, ongoing urbanization, and a youthful population that actively embraces energy-boosting beverages.