Flavored Water Market Size (2024 – 2030)

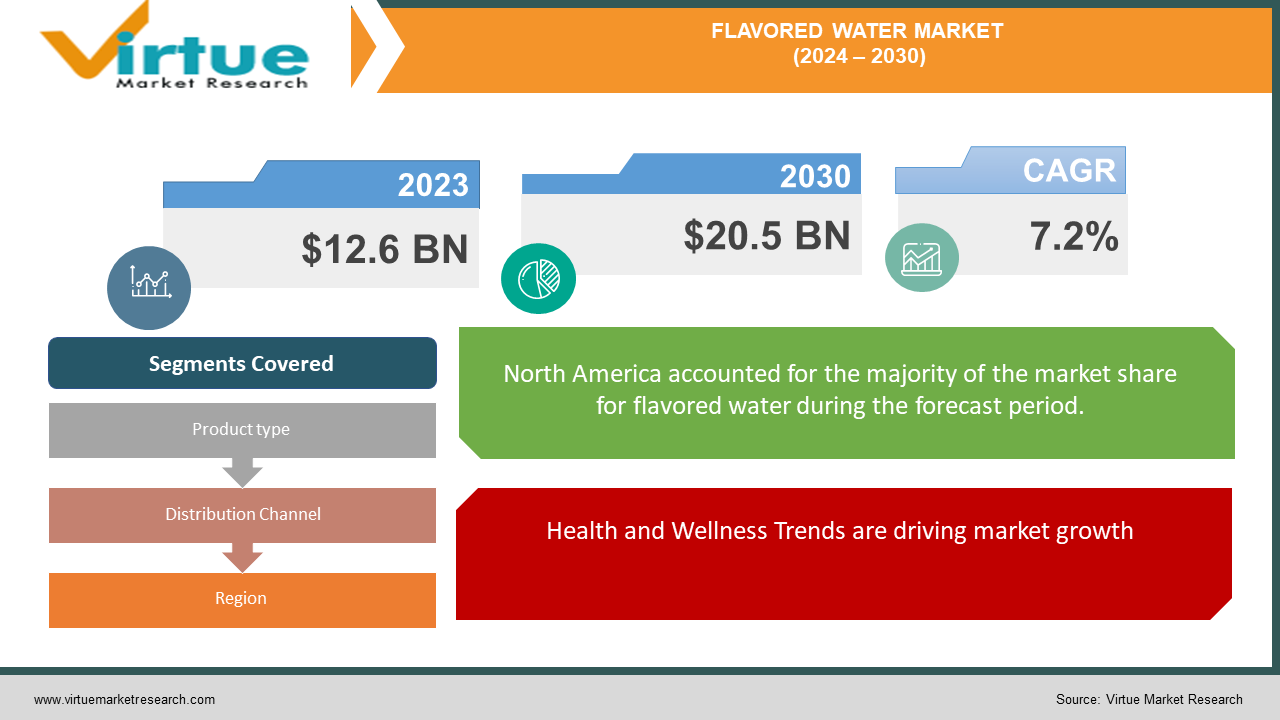

The global flavored water market was valued at USD 12.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. The market is projected to reach USD 20.5 billion by 2030.

The flavored water market encompasses a range of products that combine water with natural or artificial flavors, often with added vitamins and minerals. The growing consumer preference for healthy and low-calorie beverages is a significant driver for this market. Flavored water offers a refreshing alternative to sugary sodas and juices, appealing to health-conscious consumers who seek hydration with added taste.

Key Market Insights

Continuous product innovation and the introduction of new flavors are key strategies adopted by manufacturers to attract consumers. Exotic and unique flavors, such as cucumber-mint and pomegranate-lime, are gaining popularity.

The increase in disposable income, especially in emerging economies, is enabling consumers to spend more on premium and health-oriented beverages, boosting the flavored water market.

Flavored water is often marketed in convenient, portable packaging, making it an ideal on-the-go hydration solution. This convenience factor is appealing to busy lifestyles and contributes to market growth.

Manufacturers are increasingly focusing on sustainable packaging solutions, such as recyclable bottles and eco-friendly production processes, to attract environmentally conscious consumers.

Effective marketing campaigns and celebrity endorsements are enhancing brand visibility and consumer engagement. Brands are leveraging social media platforms to reach a wider audience and promote their products.

Global Flavored Water Market Drivers

Health and Wellness Trends are driving market growth:

The growing trend of health and wellness among consumers is a primary driver for the flavored water market. With increasing awareness about the adverse health effects of sugary beverages, consumers are shifting towards healthier alternatives. Flavored water, with its low-calorie and often sugar-free options, is becoming a preferred choice. The addition of vitamins and minerals to flavored water products also appeals to health-conscious consumers seeking functional benefits from their beverages. This trend is particularly strong among millennials and Generation Z, who prioritize health and fitness in their lifestyle choices. The rising incidence of obesity and diabetes globally further underscores the need for healthier beverage options, driving the demand for flavored water.

Product Innovation and Variety are driving market growth:

Continuous innovation in product offerings is a significant driver of the flavored water market. Manufacturers are constantly developing new flavors and combinations to cater to diverse consumer preferences. Unique flavors such as watermelon-mint, blackberry-lavender, and lemon-ginger are attracting consumers looking for novel and exciting taste experiences. Additionally, the introduction of functional ingredients, such as electrolytes for hydration and antioxidants for health benefits, is enhancing the appeal of flavored water. Innovations in packaging, such as eco-friendly materials and convenient formats, are also contributing to market growth. The ability to offer a wide variety of flavors and functional benefits sets flavored water apart from traditional beverages and attracts a broad consumer base.

Expansion of Distribution Channels is driving market growth:

The expansion and diversification of distribution channels are crucial drivers of the flavored water market. Flavored water products are increasingly available across various retail formats, including supermarkets, hypermarkets, convenience stores, and online platforms. The rise of e-commerce has made it easier for consumers to purchase flavored water, with the added convenience of home delivery. Additionally, the presence of flavored water in food service establishments, such as cafes, restaurants, and gyms, is boosting its visibility and accessibility. The growing number of health-focused retail outlets and specialty stores is also contributing to market expansion. Effective distribution strategies ensure that flavored water products are readily available to consumers, driving market growth.

Global Flavored Water Market Challenges and Restraints

High Competition from Alternative Beverages is restricting market growth:

The flavored water market faces intense competition from a wide range of alternative beverages, including functional drinks, sports drinks, and natural juices. These alternatives often offer similar health benefits and appeal to the same health-conscious consumer base. For instance, coconut water, herbal teas, and infused waters are popular choices that compete directly with flavored water. The presence of numerous options in the market can dilute consumer loyalty and make it challenging for flavored water brands to retain their customer base. Additionally, the marketing and promotional efforts of competing beverage segments can overshadow flavored water products, posing a significant challenge to market growth.

Regulatory and Compliance Issues Restricting Market Growth:

Compliance with food safety regulations and labeling requirements is a significant challenge for the flavored water market. Different countries have varying standards for ingredients, nutritional claims, and labeling practices, which can complicate the manufacturing and marketing processes for flavored water producers. Ensuring that products meet the regulatory standards in multiple regions requires substantial investment in quality control and legal expertise. Additionally, any changes in regulations, such as the introduction of sugar taxes or restrictions on artificial ingredients, can impact the formulation and pricing of flavored water products. Navigating these regulatory complexities is essential for market players to maintain compliance and avoid legal issues.

Market Opportunities

The flavored water market presents significant growth opportunities driven by several factors. The increasing consumer shift towards healthier lifestyles and the preference for low-calorie, functional beverages is a primary opportunity for market expansion. Innovations in flavor profiles and functional ingredients can attract a broader consumer base, offering unique taste experiences and health benefits. The rise of e-commerce and online retail platforms provides a convenient avenue for reaching a larger audience and enhancing product accessibility. Additionally, the growing emphasis on sustainable packaging and eco-friendly practices can appeal to environmentally conscious consumers, further boosting market demand. Collaborations with health and wellness influencers and targeted marketing campaigns can enhance brand visibility and consumer engagement. Exploring untapped markets in emerging economies, where urbanization and disposable income are rising, also offers substantial growth potential. Overall, the flavored water market is poised for robust growth, driven by health trends, innovation, and expanding distribution channels.

FLAVORED WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo, Inc., Nestlé Waters, Danone S.A., Hint Water, Inc., Talking Rain Beverage Company, Keurig Dr Pepper Inc., National Beverage Corp., LaCroix Sparkling Water, Vitamin Well AB |

Flavored Water Market Segmentation - By Product Type

-

Sparkling Flavored Water

-

Still Flavored Water

Sparkling flavored water is the dominant segment in the flavored water market. The effervescent quality and refreshing taste appeal to a wide range of consumers seeking a healthier alternative to sodas and other carbonated drinks. The perception of sparkling flavored water as a sophisticated and premium product further drives its popularity.

Flavored Water Market Segmentation - By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Food Service Outlets

Supermarkets and hypermarkets are the dominant distribution channels for flavored water. These retail formats offer a wide variety of products, providing consumers with the convenience of choice. The extensive shelf space and promotional activities in supermarkets and hypermarkets enhance product visibility and accessibility, contributing to their dominance in the market.

Flavored Water Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the flavored water market. The high health awareness among consumers, coupled with the presence of major market players and extensive retail infrastructure, drives the market growth in this region. Additionally, the growing trend of healthy living and the preference for low-calorie beverages contribute to the strong demand for flavored water in North America.

COVID-19 Impact Analysis on the Flavored Water Market

The COVID-19 pandemic had a mixed impact on the flavored water market. On one hand, the heightened focus on health and wellness during the pandemic increased the demand for healthy beverages, including flavored water. Consumers sought out products that could support their immune systems and overall well-being, driving the sales of functional and fortified flavored waters. On the other hand, the closure of food service outlets, gyms, and other establishments where flavored water is commonly consumed led to a temporary decline in demand. Supply chain disruptions and logistical challenges also affected the market during the initial phases of the pandemic. However, the shift towards e-commerce and online retail platforms mitigated some of these challenges, as consumers increasingly purchased flavored water online. Post-pandemic, the market is expected to recover and grow, driven by the sustained focus on health and the increased adoption of e-commerce for grocery shopping.

Latest Trends/Developments

The flavored water market is currently experiencing several notable trends and developments. One key trend is the increasing consumer demand for natural and organic flavored waters. With growing awareness about the health implications of artificial additives, preservatives, and sweeteners, consumers are gravitating towards products that offer natural ingredients and clean labels. This shift is encouraging manufacturers to innovate and launch new products that highlight their natural and organic credentials. Functional flavored waters are also gaining traction. These products are fortified with vitamins, minerals, antioxidants, and electrolytes, catering to consumers who seek additional health benefits from their beverages. For instance, flavored waters with added probiotics for gut health or electrolytes for enhanced hydration are becoming increasingly popular. Sustainability is another critical trend shaping the flavored water market. Consumers are becoming more environmentally conscious, leading companies to adopt eco-friendly packaging solutions. This trend is particularly prominent among millennials and Generation Z, who are more adventurous with their beverage choices. Personalized nutrition is emerging as a future trend, with some companies exploring the possibility of offering customized flavored water options tailored to individual health needs and preferences. This trend aligns with the broader movement towards personalized health and wellness products. Overall, the flavored water market continues to evolve, driven by health trends, sustainability initiatives, and innovative product offerings that cater to diverse consumer preferences.

Key Players

-

The Coca-Cola Company

-

PepsiCo, Inc.

-

Nestlé Waters

-

Danone S.A.

-

Hint Water, Inc.

-

Talking Rain Beverage Company

-

Keurig Dr Pepper Inc.

-

National Beverage Corp.

-

LaCroix Sparkling Water

-

Vitamin Well AB

Chapter 1. Flavored Water Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flavored Water Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flavored Water Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flavored Water Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flavored Water Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flavored Water Market – By Product Type

6.1 Introduction/Key Findings

6.2 Sparkling Flavored Water

6.3 Still Flavored Water

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Flavored Water Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retailers

7.5 Food Service Outlets

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Flavored Water Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flavored Water Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Coca-Cola Company

9.2 PepsiCo, Inc.

9.3 Nestlé Waters

9.4 Danone S.A.

9.5 Hint Water, Inc.

9.6 Talking Rain Beverage Company

9.7 Keurig Dr Pepper Inc.

9.8 National Beverage Corp.

9.9 LaCroix Sparkling Water

9.10 Vitamin Well AB

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global flavored water market was valued at USD 12.6 billion in 2023 and is expected to reach USD 20.5 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030.

The main drivers include the increasing health and wellness trends, continuous product innovation and variety, and the expansion of distribution channels.

The market is segmented by product type (sparkling flavored water and still flavored water) and by distribution channel (supermarkets/hypermarkets, convenience stores, online retailers, and food service outlets).

North America is the most dominant region in the flavored water market, driven by high health awareness among consumers and a strong retail infrastructure.

Leading players in the market include The Coca-Cola Company, PepsiCo, Inc., Nestlé Waters, Danone S.A., Hint Water, Inc., and Talking Rain Beverage Company.