Asia-Pacific Flavored Water Market Size (2024-2030)

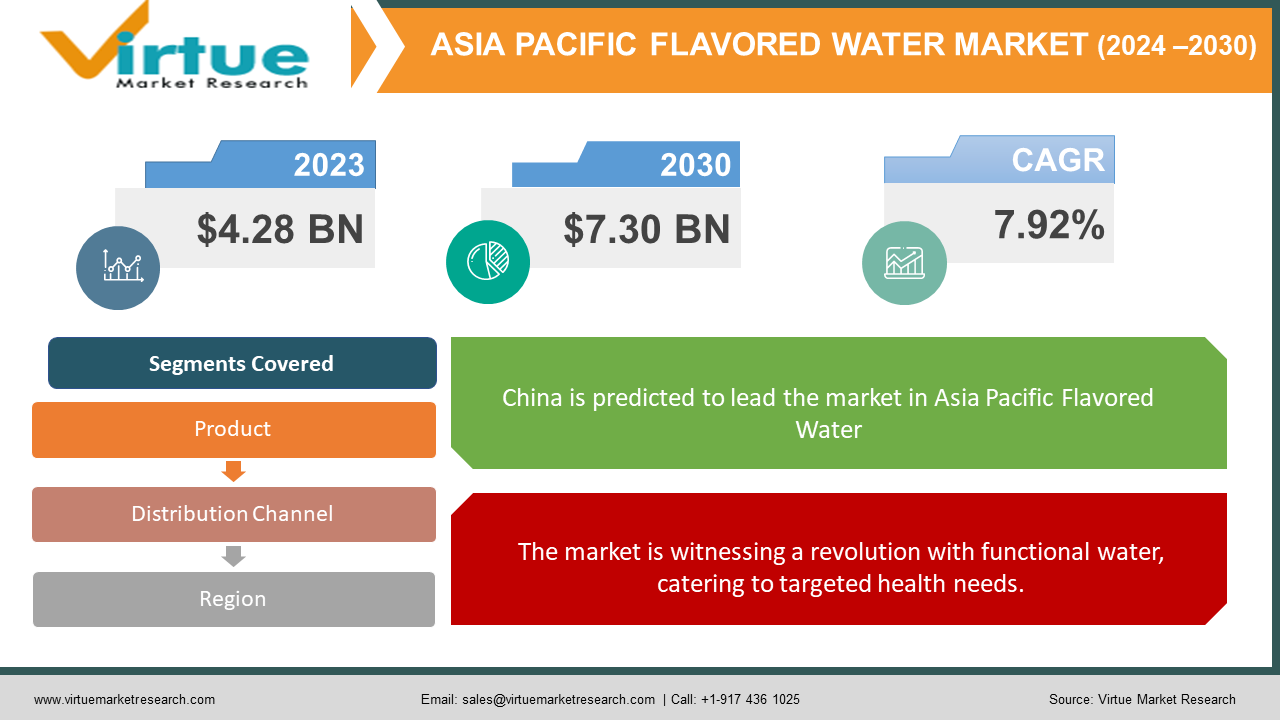

The Asia-Pacific flavored water market was valued at USD 4.28 billion in 2023 and is projected to reach a market size of USD 7.30 billion by the end of 2030. Over the forecast period of 2024 – 2030, the market is projected to grow at a CAGR of 7.92%.

Flavored water is made with natural or artificial flavorings added to enhance its flavor. Flavored water can also be enhanced with the addition of spring water, vitamins, minerals, spices, and sweeteners. Water typically doesn't have enough flavoring added to it to noticeably alter its nutritional value. However, some flavored waters, such as maple water, may naturally contain significant amounts of antioxidants and minerals. Like functional drinks, flavored waters may also provide additional health benefits like vitamins, minerals, or infusions.

Key Market Insights:

- The Asia-Pacific region dominates the global flavored water market, driven by a perfect storm of consumer trends and economic factors. Health consciousness is a major driver. As disposable incomes rise across the region, consumers increasingly prioritize wellness.

- Flavored water offers a refreshing and perceived healthier alternative to sugary drinks, boasting a low-calorie profile and essential hydration. This trend is particularly strong in China, India, Japan, and South Korea, where large populations with growing spending power create a robust consumer base.

- This focus on health extends beyond basic-flavored water. The market is witnessing a surge in functional water infused with vitamins, minerals, and electrolytes. This segment is expected to see the fastest growth due to its targeted appeal to health-conscious consumers seeking beverages that address specific needs.

- Uneven tap water quality in some parts of the region presents another opportunity. Concerns about safety lead consumers to turn to bottled water options, including flavored varieties. This highlights the potential for companies to position flavored water as a reliable and refreshing source of hydration, further propelling the market forward.

Asia-Pacific Flavored Water Market Drivers:

As disposable incomes rise, health-conscious consumers seek refreshments with a perceived healthier twist.

As disposable incomes across the region rise, consumers are increasingly prioritizing their well-being. This newfound focus on health creates a demand for products perceived as healthier alternatives. Flavored water steps in as a hero, offering a refreshing and lower-calorie option compared to sugary drinks, all while keeping them hydrated. This trend is particularly strong in China, India, Japan, and South Korea, where large populations with growing spending power create a robust consumer base for flavored water.

The market is witnessing a revolution with functional water, catering to targeted health needs.

The market is witnessing a revolution with the rise of functional water. These flavored waters go beyond basic taste, becoming infused with vitamins, minerals, and electrolytes. This caters perfectly to the growing health-conscious population seeking beverages that address specific needs, like boosting immunity or enhancing athletic performance. Functional water is poised for the fastest growth within the flavored water market, driven by its targeted appeal to a health-focused consumer segment.

Concerns about tap water safety are leading consumers to turn to flavored water as a reliable hydration source.

Concerns about tap water safety in some parts of Asia-Pacific play a crucial role in driving the flavored water market. Consumers who are unsure about the quality of their tap water seek out reliable and refreshing alternatives. Bottled water options, including flavored varieties, have become a go-to solution. This creates an opportunity for companies to position flavored water not just as a tasty beverage but also as a dependable source of clean hydration, further propelling market growth.

Economies with booming populations create a strong consumer base for flavored water.

China, India, Japan, and South Korea are seeing significant progress in their economies. These countries, with their large populations and booming economies, create a strong foundation for the flavored water market. Their growing spending power fuels the market's success as consumers have more resources to explore non-essential beverages like flavored water. This economic strength, coupled with the increasing disposable income of a growing population, creates a perfect environment for sustained market growth.

Asia-Pacific Flavored Water Market Restraints and Challenges:

Despite its impressive growth, the Asia-Pacific flavored water market isn't without its challenges. The market faces competition from a well-established beverage landscape. Natural juices, sparkling water, functional drinks, and even classic sodas compete for consumer loyalty. This diverse range of options makes it difficult for flavored water brands to stand out and secure a dominant market share. Price sensitivity also plays a role, particularly in regions with a strong focus on budget-conscious spending. Consumers might choose cheaper alternatives like tap water or homemade flavored drinks to fulfill their hydration needs. Additionally, while functional water is a rising star within the flavored water category, some consumers might not be fully aware of the specific health benefits it offers. A lack of understanding about the functional water segment can hinder its potential to capture a larger market share. Finally, environmental concerns regarding bottled water, including flavored water, are a growing hurdle. The plastic waste associated with bottled water production and consumption can be a deterrent for environmentally conscious consumers. Companies in the flavored water market will need to address these challenges strategically to maintain their growth trajectory. This might involve innovative packaging solutions to minimize environmental impact, targeted marketing campaigns to educate consumers about functional water benefits, and competitive pricing strategies to cater to budget-conscious segments.

Asia-Pacific Flavored Water Market Opportunities:

The potential for future growth in the Asia-Pacific flavored water market is as vast as the region itself. One key opportunity lies in riding the functional water wave. By developing innovative flavored waters infused with targeted health benefits, companies can cater to the ever-growing health-conscious consumer base. Additionally, the diverse cultures and preferences across the region present a wealth of opportunities for localization. Companies that incorporate regional fruits, herbs, and botanicals can create unique and appealing flavored water options that resonate with local tastes. Environmental concerns are another factor to consider. Companies that develop sustainable packaging solutions using recycled plastic, biodegradable materials, or even refillable water bottle systems can capitalize on this growing trend and attract environmentally conscious consumers. Furthermore, a rising disposable income segment presents an opportunity for premiumization. Offering high-end flavored water options with unique flavors, organic ingredients, and sleek packaging can cater to this discerning group. Finally, the rise of digital marketing and e-commerce platforms creates significant opportunities for companies to directly engage with consumers, promote their products, and offer convenient purchasing options through these channels. By strategically addressing these opportunities, companies in the Asia-Pacific flavored water market can ensure their continued success in this dynamic and ever-evolving market.

ASIA-PACIFIC FLAVOURED WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

20223- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.92% |

|

Segments Covered |

By Product, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Rest of the Asia-Pacific |

|

Key Companies Profiled |

Coca-Cola, PepsiCo, Suntory, Nongfu Spring, Lotte, Tata Group, Nestle, Talking Rain, Hint Water, Kraft Foods, Balance Water Company |

Asia-Pacific Flavored Water Market Segmentation:

Asia-Pacific Flavored Water Market Segmentation: By Product:

- Sparkling

- Still

The sparkling segment is the largest and fastest-growing product type. Sparkling waters enhanced with fruit and herb benefits are becoming increasingly popular as a healthier substitute for carbonated beverages. Over time, young, health-conscious consumers have become more and more interested in sparkling drinks that have little to no sugar and no calories. The taste, fizz, and health advantages of effervescent variants are drawing more and more attention. Numerous companies provide a range of fruit-flavored, low-calorie, low-sugar products.

Asia-Pacific Flavored Water Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

Within distribution channels, supermarkets and hypermarkets reign supreme due to their vast product selection and convenience. However, the fastest-growing segment is online retail. E-commerce platforms offer a wider variety of flavored water options, competitive pricing, and ease of home delivery, perfectly aligned with the growing internet penetration and consumer preference for online shopping in the Asia-Pacific region.

Asia-Pacific Flavored Water Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China is the largest growing market. China boasts a massive population with rising disposable incomes, making it the most lucrative market in the region. Consumers are increasingly health-conscious, driving the demand for functional water. Local players like Nongfu Spring are strong contenders, but international giants like Coca-Cola and PepsiCo are also vying for market share. India is the fastest-growing market. With a booming population and rapidly increasing disposable income, India presents a promising market for flavored water. Affordability is a key factor here, with mass-market brands dominating the landscape. However, the rise of health consciousness is creating space for functional water options, offering exciting growth potential.

COVID-19 Impact Analysis on the Asia-Pacific Flavored Water Market:

The COVID-19 pandemic sent ripples of disruption through the Asia-Pacific flavored water market. Lockdowns and movement restrictions caused an initial dip in demand as consumers prioritized essentials. Production and distribution channels also faced challenges due to supply chain disruptions and labor shortages. However, the pandemic also triggered some shifts that could benefit the market in the long run. With a heightened focus on hygiene, bottled water, including flavored varieties, was perceived as a safer option compared to tap water in some regions, potentially leading to increased demand for packaged flavored water. Additionally, the surge in e-commerce due to movement restrictions propelled online sales of flavored water, offering a convenient and safe way for consumers to fulfill their needs. Furthermore, the pandemic's emphasis on health might have boosted the functional water segment as consumers sought beverages that could contribute to their well-being. Looking ahead, the flavored water market is expected to regain its growth trajectory as restrictions ease and economic activity resumes. The underlying drivers of rising disposable income and health consciousness remain strong, and the increased adoption of e-commerce platforms offers a lasting advantage for convenient online purchases. The focus on health might also benefit the functional water segment as consumers continue to seek beverages with specific health benefits. In conclusion, the COVID-19 pandemic presented a complex scenario for the Asia-Pacific flavored water market, but the market's strong fundamentals and potential for adaptation position it well for continued growth in the post-pandemic era.

Latest Trends/ Developments:

The Asia-Pacific flavored water market is constantly evolving, with exciting trends shaping its future. Consumers are drawn to natural and unique flavors, leading to a rise in botanical infusions where flavored water is infused with herbs, spices, and even floral essences. This trend not only offers exciting taste profiles but may also be perceived as having health benefits. Environmental concerns are also pushing companies to develop sustainable packaging solutions, such as using recycled plastic, biodegradable materials, or even refillable water bottle systems. Catering to convenience and the desire to discover new flavors, subscription services are gaining traction, delivering curated selections of flavored water directly to consumers' doorsteps. With a focus on health and calorie reduction, sugar reduction and alternative sweeteners are in high demand. Companies are exploring options like stevia, monk fruit extract, or natural fruit extracts to create flavored water with minimal or no added sugar. Finally, companies are capitalizing on the diverse cultures and preferences across the region by incorporating local ingredients. This focus on regional fruits, herbs, and botanicals creates unique and appealing flavored water options that resonate with local tastes and cultural identity. These trends highlight the dynamism of the Asia-Pacific flavored water market and its potential for continued innovation and growth.

Key Players:

- Coca-Cola

- PepsiCo

- Suntory

- Nongfu Spring

- Lotte

- Tata Group

- Nestle

- Talking Rain

- Hint Water

- Kraft Foods

- Balance Water Company

Chapter 1. Asia-Pacific Flavored Water Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Flavored Water Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Flavored Water Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Flavored Water Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Flavored Water Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Flavored Water Market– By Product

6.1. Introduction/Key Findings

6.2. Sparkling

6.3. Still

6.4. Y-O-Y Growth trend Analysis By Product

6.5. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. Asia-Pacific Flavored Water Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Asia-Pacific Flavored Water Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Flavored Water Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Coca-Cola

9.2. PepsiCo

9.3. Suntory

9.4. Nongfu Spring

9.5. Lotte

9.6. Tata Group

9.7. Nestle

9.8. Talking Rain

9.9. Hint Water

9.10. Kraft Foods

9.11. Balance Water Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific flavored water market was valued at USD 4.28 billion in 2023 and is projected to reach a market size of USD 7.30 billion by the end of 2030. Over the forecast period of 2024 – 2030, the market is projected to grow at a CAGR of 7.92%.

Health consciousness, demand for functional water, water safety concerns, and economic progress are the main drivers of the flavored water market

Based on distribution channels, the market is divided into supermarkets & hypermarkets, convenience stores, online retail, and others.

China reigns supreme as the most dominant region within the Asia-Pacific flavored water market, boasting a massive population with rising disposable incomes and a strong demand for flavored water

Coca-Cola, PepsiCo, Suntory, Nongfu Spring, Lotte, Tata Group, Nestle, Talking Rain, Hint Water, Kraft Foods, and Balance Water Company are some of the leading players in the Asia-Pacific flavored water market.