Plant Based Vitamins and Minerals Market Size (2025-2030)

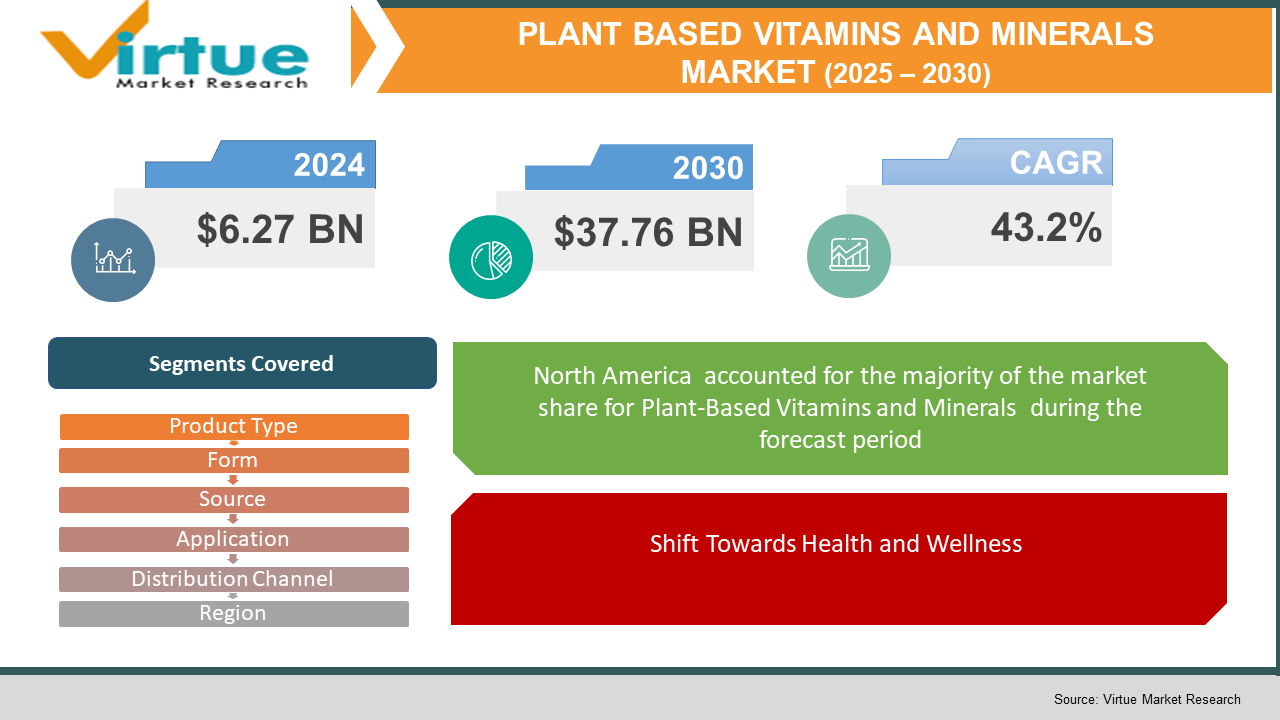

The Plant-Based Vitamins and Minerals Market was valued at $6.27 billion and is projected to reach a market size of $37.76 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 43.2%.

The expansion of deficiency diseases such as vitamin D, anemia, and iodine deficiency is driving global demand for vitamins and minerals, especially of plant origin. Public health promotion of micronutrients has generated interest in nutrition supplements. With increased health awareness, fortification of foods with vitamins and minerals is also gaining traction, further driving demand. Greater emphasis on mind health has driven consumption of B vitamins, magnesium, and nootropics. Online shopping is making vitamins and minerals of plant origin more accessible, which are also perceived as safer alternatives to synthetic or animal-derived forms. Vegan culture, promoted by ethical considerations and concern for animal welfare, drives consumer behavior and purchasing decisions. This is in line with a general interest in clean-label foods and food safety, for which reason plant-based products are appealing in the health space. Moreover, manufacturers are investing in research and development of new plant-based ingredients to address changing consumer needs, making it a dynamic market.

Key Market Insights:

Growing Veganism and Ethical Consumption growing usage of vegan and vegetarian diets due to health, ethical, and environmental reasons is greatly fueling demand for plant-based supplements. For example, in 2021, there were around 2.7 million households in the UK that turned vegan for improved health.

More than 68% of world consumers today link everyday supplementation with long-term disease prevention. This movement away from reactive to preventive health measures is instilling more consumption of plant vitamins and minerals, particularly for immunity, bones, and brain function.

Across the world, over 30% of individuals are afflicted with micronutrient deficiencies like vitamin D, iron, and iodine. The increasing incidence of these disorders is leading to increased dependency on plant-based supplementation, especially in countries with a high proportion of vegetarians, like South Asia and portions of Europe.

The world food market is now more and more fortifying dairy alternatives, beverages, and snacks with plant-based minerals and vitamins. By 2030, more than 40% of food and beverage products fortified will utilize plant-based nutrients as demand for clean-label ingredients increases.

Plant-Based Vitamins and Minerals Market Key Drivers:

Shift Towards Health and Wellness.

Buyers are more concerned about health and wellness, resulting in increased demand for plant-based supplements. These supplements are viewed as natural and do not contain synthetic additives, reflecting the demand for clean-label and whole-food-based health products. Enhanced understanding of the health effects of plant-based diets, such as better digestion and lower risk of chronic diseases, is driving this trend. As a consequence, the market for plant-derived vitamins and minerals is growing very fast to satisfy the growing interest of consumers in healthier choices.

Environmental and Ethical Considerations.

The growing interest in environmental sustainability and animal welfare is driving consumer behavior. Plant-based vitamins and minerals are becoming more popular as they are seen to have a minimal environmental footprint relative to animal-based products. Consumers are choosing products based on their values, such as cruelty-free and environmentally friendly products. The trend is also driving manufacturers to create and sell plant-based vitamins and minerals, thus contributing to market growth.

Improvements in Product Innovation and Availability.

Growth in technology and greater investment in R&D are fostering the development of innovative plant-based supplements with better efficacy and bioavailability. Moreover, growth in e-commerce platforms has expanded the availability of these products to a wider population. Online channels for retailing are making it easier to distribute plant-based vitamins and minerals, driving market growth and enabling consumers to easily buy these products.

Plant-Based Vitamins and Minerals Market Restraints and Challenges:

Operating through the Plant-Based Vitamins and Minerals Market.

Even with a robust upward trend, the plant-based vitamins and minerals market is characterized by significant restraints that may impede its growth. One of the most significant of these challenges is the comparatively higher price of plant-based supplements as opposed to their traditional counterparts. This is primarily because of the complicated and costly processes necessary for sourcing and processing plant-based ingredients, which in many cases call for sustainable or organic agriculture methods. Consequently, most consumers in price-sensitive markets make these goods less accessible. Moreover, maintaining product purity, with no cross-contamination by animal-derived materials, contributes to added manufacturing difficulty and expense. Yet another significant limitation is in the sourcing of superior raw materials. The availability of most plant-based ingredients is subject to seasonal change and climate variability, and thus it can be challenging to ensure product consistency in terms of quality and delivery. Also adding to the challenge is consumer reluctance about the effectiveness of plant-based supplements. Most continue to wonder whether nutrients from plants are equally bioavailable or as potent as animal-derived ones, which tethers adoption back. Additionally, the absence of harmonized global regulations for plant dietary supplements results in disparities in labeling, quality control, and health claims, causing confusion or distrust among consumers. Misleading promotion or unsubstantiated claims may similarly erode brand credibility and consumer trust. These problems, though real, can be overcome through better regulation, increased transparency, education of the consumer, and investment in research to lower the cost of production and enhance efficacy. Overcoming all these barriers will be crucial to maintaining long-term growth in the market for plant-based vitamins and minerals.

Plant-Based Vitamins and Minerals Market Opportunities:

Opportunities in the Plant-Based Vitamins and Minerals Market.

The plant-based vitamins and minerals market is set to grow with strong momentum, fueled by changing consumer attitudes and worldwide trends in health. The most important opportunity is in the growth of plant-based diets, as consumers increasingly demand sustainable and ethical nutritional choices. This change is also driven by the increasing recognition of the health properties found in plant-based nutrients, such as enhanced digestion and protection against chronic diseases. The trend for clean-label and allergen-free supplements is also opening doors for innovation in product development. The industry is also being helped by developments in biotechnology, which make possible the creation of bioavailable plant-based nutrients with the ability to correct key deficiencies. Additionally, the growth of e-commerce websites is making products more accessible, and global consumers can discover and buy a wide variety of plant-based supplements. With more liberal regulatory environments for plant-based products, manufacturers can increase their product lines and markets. Together, all of these influences create a positive setting for the continued growth of the plant-based vitamins and minerals market in the years to come.

PLANT BASED VITAMINS AND MINERALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

43.2% |

|

Segments Covered |

By Product Type, form, source, application, distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ora Organic, Pure Synergy, Naturelo, Future Kind, DR.VEGAN, Garden of Life, PlantFusion, Vital Nutrients, NOW Foods, Ritual |

Plant-Based Vitamins and Minerals Market Segmentation:

Plant Based Vitamins and Minerals Market Segmentation: By Product Type

- Vitamins & Minerals

- Protein Supplements

- Omega-3 Fatty Acids

- Herbal & Botanical Supplements

Protein supplements are becoming the quickest-growing category within the plant-based vitamins and minerals market. The reason lies in the growing demand for plant-based diets among athletes, fitness enthusiasts, and health-aware consumers in search of animal-free protein alternatives. Plant-based protein sources such as pea, hemp, and brown rice are preferred for being allergen-free and non-GMO, and suit individuals with dietary needs and wants. The convenience of these proteins, which can be added to a range of food items like smoothies, baked foods, and shakes, also increases their popularity. As knowledge about the health advantages of plant-based proteins increases, this category is likely to keep growing at a fast pace. Vitamins and minerals account for the largest category in plant-based supplements with a high revenue share.

The leadership of this category is due to the crucial role these supplements play in counteracting possible deficiencies prevalent in plant-based diet and vegan diet-based meals, such as vitamin B12, vitamin D, iron, and calcium. An expanding global vegan base and heightened engagement in plant-based lifestyle movements have spurred demand for these supplements in large quantities. Suggestive innovations in sourcing, for example, vitamin D3 from lichen and calcium from red algae, have rendered plant-based vitamins and minerals more readily available and even superior in efficacy. This segment's capacity to appeal to a wide consumer base desirous of sustaining optimal health through natural and ethical practices consolidates its market leadership position.

Plant Based Vitamins and Minerals Market Segmentation: By Form

- Capsules & Tablets

- Powders

- Gummies & Chewable

- Liquids

Among plant-based vitamins and minerals, capsules have become the most popular format, and this is mainly attributed to their convenience, accurate dosing, and ready consumption. Capsules are liked for their capability to provide nutrients without any need for flavor or sweetener; thus, healthy consumers prefer them for choosing clean-label products. Their popularity is also supported by developments in encapsulation technologies, which have increased bioavailability and enabled the use of complex formulations. The broad appeal of capsules to multiple demographics highlights their market-leading status.

On the other hand, gummies are growing at the quickest rate among all form factors in the plant-based vitamins and minerals market. Their swift rise is credited to their tasty flavor, simplicity of swallowing, and popularity among children and adults with swallowing problems for regular pills. Gummies are an enjoyable method of taking supplements, typically using natural colors and flavors to make them more desirable. The innovation in the formulation of gummies, such as sugar-free and vegetarian, addresses a wide variety of dietary needs and limitations, driving their rapid penetration and expansion in the market.

Plant Based Vitamins and Minerals Market Segmentation: By Source

- Fruits & Vegetables

- Herbs

In the market for plant-based vitamins and minerals, vegetables and fruits lead as the main sources. Their universal consumer popularity is due to their high content of nutrients, such as vitamins, minerals, and antioxidants. Amongst the fruits, berries, citrus fruits, and tropical fruits are perhaps most revered for their capacity for phytochemicals, while leafy vegetables like spinach, kale, and broccoli provide rich nutrients and fiber. The appeal of vegetable and fruit-based supplements is also supported by the convenience they provide in filling nutritional needs, particularly in busy lifestyles where compliance with daily recommended intake can be high. This dominance is seen in their large market share, with fruits alone contributing more than 45% of the world's revenue in 2024.

Conversely, herbs are proving to be the quickest-growing category in the plant-based vitamins and minerals market. Their growth is being fueled by growing consumer interest in natural and herbal foods to lead a healthy lifestyle. Herbs are famous for their reputed health benefits and are gaining popularity owing to their use in culinary and medicinal purposes. The increasing trend of consumption of herbs for their functional benefits, combined with the demand for traditional and functional ingredients with health benefits, supports the growing importance of this segment. As consumers continue to search for natural sources of vitamins and minerals, the herbs segment is likely to see considerable expansion in future years.

Plant Based Vitamins and Minerals Market Segmentation: By Application

- Dietary Supplements

- Functional Foods & Beverages

- Pharmaceuticals

Within the plant-based vitamins and minerals segment, functional foods and beverages are the leading application category. The reason behind this leadership is the growing consumer need for fortified foods and beverages that provide health benefits in addition to essential nutrition. Fortification of daily consumables such as cereals, snack foods, and beverages with plant-based vitamins and minerals has provided easy access to increased nutrient consumption for consumers. This is in tune with the increased demand for clean-label products as well as the move towards preventive healthcare, where consumers actively seek foods that contribute to overall health.

The dietary supplements category is, however, witnessing the most rapid growth within the market. This increase is fueled by the increased awareness of nutrient deficiencies, particularly among those following vegan and vegetarian lifestyles. Vegetarian dietary supplements in the form of capsules, tablets, and powders provide focused nutritional solutions, targeting certain health issues like bone health, immunity, and energy. The ease of supplementation and the wide availability of such products through offline and online platforms have driven their swift adoption. Furthermore, the focus on customized nutrition and the popularity of natural, plant-based ingredients have pushed this segment to grow even faster.

Plant Based Vitamins and Minerals Market Segmentation: By Distribution Channel

- Online Retailers

- Health Food Stores & Pharmacies

- Supermarkets/Hypermarkets

Among plant-based vitamins and minerals, online retailers are the most rapidly growing distribution channel. The increase in e-commerce popularity has been complemented by the ability to shop from home, thereby further increasing online sales. Online shoppers are turning more towards online products for their supplements, swayed by simplicity in comparison shopping, reviews, and easy access to a vast range of choices. The COVID-19 crisis further hastened this trend, as health-conscious consumers looked for safe and contactless shopping experiences. Online stores also provide personalized recommendations and subscription plans, which increase customer loyalty and repeat buys. This shift to digital is likely to continue with the growth in technology and consumer behavior. On the other hand, pharmacies and drug stores are the leading distribution channels in the market for plant-based vitamins and minerals.

These pharmacies are authoritative sources of health-related products, providing expert advice and carefully curated supplements. Customers tend to prefer buying from pharmacies because of the guarantee of product authenticity and the accessibility of expert advice. Pharmacies also serve a wide population, including customers seeking particular health solutions or those with dietary restrictions. The physical location of pharmacies enables instant access to the products, which is essential for consumers who need the supplements in a hurry. Even with the rise in online platforms, the integrity and convenience provided by pharmacies guarantee they remain the leaders in the market.

Plant Based Vitamins and Minerals Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The plant-based vitamins and minerals market has diverse growth patterns geographically. North America dominates the market with about 40% of the revenue globally in 2023, fueled by high health and wellness consciousness and the mass adoption of plant-based diets. Europe has a 30% market share, backed by high consumer awareness and supportive regulatory environments for plant-based nutrition. Asia-Pacific represents a 20% share but is the most dynamic region and is driven by growing health awareness, rising disposable incomes, and the expansion of the middle class demanding sustainable foods. Latin America and the Middle East & Africa each account for 5% of the world market. In Latin America, nations such as Brazil are experiencing high demand for organic and natural foods, such as plant-based vitamins, whereas the Middle East and Africa are coming to adopt plant-based nutrition increasingly, driven by urbanization and changes in consumer behavior.

COVID-19 Impact Analysis on the Plant-Based Vitamins and Minerals Market:

The pandemic of COVID-19 had a major influence on the plant-based vitamins and minerals industry by hastening the demand for immune-boosting supplements from consumers due to increased health consciousness. Several consumers who did not use supplements in the past started using them during the pandemic, indicating a significant change towards preventive healthcare. Even so, supply chains were disrupted, and there were shortages and delays in delivery temporarily, testing manufacturers' ability to provide the same products continuously. Yet the market was resilient as demand for vitamins like C and D spiked, underpinning long-term growth opportunities. This health-conscious, pandemic-driven emphasis on well-being drove consumer spending on plant-based vitamins and minerals and should continue to shape consumer buying habits, setting the plant-based vitamins and minerals market up for continued growth in the years to come.

Trends/Developments:

In July 2023, UK-based new vegan products creator Pulsin added to its range of vegan protein powders with new products in four flavors: Berry, Chocolate, Chocolate Hazelnut, and Vanilla. These proteins are created from pea, faba, and pumpkin seed proteins, providing consumers with varied plant-based choices.

In October 2022, India's former cricket sensation M.S. Dhoni invested in Shaka Harry, a plant-based protein start-up from India. Shaka Harry also raised around USD 2 million in seed funding from Better Bite Venture, Blue Horizon, and Panthera Peak Ventures, which reflects robust investor interest in India's increasing plant-based protein space.

In July 2022, Dymatize, a brand under global nutrition company BellRing Brands, Inc., launched its new high-performing plant-based protein powder called Dymatize Complete Plant Protein™. This product combines five types of plant proteins to ensure maximum delivery of quality protein suitable for pre- or post-workout consumption.

In February 2022, Ingredion Incorporated, a global food ingredient manufacturer, strategically invested (amount not disclosed) in InnovoPro, a Foodtech firm with a focus on chickpea solutions. This collaboration is set to leverage the increasing consumer appetite for chickpea protein concentrates, an eco-friendly and healthy plant-based food ingredient.

Key Players:

- Ora Organic

- Pure Synergy

- Naturelo

- Future Kind

- DR.VEGAN

- Garden of Life

- PlantFusion

- Vital Nutrients

- NOW Foods

- Ritual

Chapter 1 Plant Based Vitamins and Minerals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 Plant Based Vitamins and Minerals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 Plant Based Vitamins and Minerals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 Plant Based Vitamins and Minerals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 Plant Based Vitamins and Minerals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Plant Based Vitamins and Minerals Market – By Product Type

6.1 Introduction/Key Findings

6.2 Vitamins & Minerals

6.3 Protein Supplements

6.4 Omega-3 Fatty Acids

6.5 Herbal & Botanical Supplements

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Service Delivery models, 2025-2030

Chapter 7 Plant Based Vitamins and Minerals Market – By Form

7.1 Introduction/Key Findings

7.2 Capsules & Tablets

7.3 Powders

7.4 Gummies & Chewable

7.5 Liquids

7.6 Y-O-Y Growth trend Analysis By Form

7.7 Absolute $ Opportunity Analysis By Form , 2025-2030

Chapter 8 Plant Based Vitamins and Minerals Market – By Source

8.1 Introduction/Key Findings

8.2 Fruits & Vegetables

8.3 Herbs

8.4 Y-O-Y Growth trend Analysis Source

8.5 Absolute $ Opportunity Analysis Source , 2025-2030

Chapter 9 Plant Based Vitamins and Minerals Market – By Application

9.1 Introduction/Key Findings

9.2 Dietary Supplements

9.3 Functional Foods & Beverages

9.4 Pharmaceuticals

9.5 Y-O-Y Growth trend Analysis Application

9.6 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10 Plant Based Vitamins and Minerals Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Online Retailers

10.3 Health Food Stores & Pharmacies

10.4 Supermarkets/Hypermarkets

10.5 Y-O-Y Growth trend Analysis Distribution Channel

10.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 11 Plant Based Vitamins and Minerals Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Distribution Channel

11.1.3. By Application

11.1.4. By Source

11.1.5. Form

11.1.6. Product Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Distribution Channel

11.2.3. By Application

11.2.4. By Source

11.2.5. Form

11.2.6. Product Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Distribution Channel

11.3.3. By Application

11.3.4. By Source

11.3.5. Form

11.3.6. Product Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Distribution Channel

11.4.3. By Application

11.4.4. By Source

11.4.5. Form

11.4.6. Product Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Distribution Channel

11.5.3. By Application

11.5.4. By Source

11.6.5. Form

11.5.6. Product Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 Plant Based Vitamins and Minerals Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

12.1 Ora Organic

12.2 Pure Synergy

12.3 Naturelo

12.4 Future Kind

12.5 DR.VEGAN

12.6 Garden of Life

12.7 PlantFusion

12.8 Vital Nutrients

12.9 NOW Foods

12.10 Ritual

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is driven by rising health awareness, growing demand for vegan and clean-label products, and increasing prevalence of nutritional deficiencies.

Dietary supplements, functional food and beverages, and personal care sectors are leading adopters, incorporating plant-based ingredients into their formulations.

Innovation is enhancing ingredient bioavailability, expanding product formats, and introducing novel plant sources such as algae, seaweed, and moringa.

Asia-Pacific is growing rapidly due to rising disposable income and health trends, while Europe and North America maintain strong market presence driven by consumer lifestyle shifts.

Trends include personalized nutrition, clean and transparent labeling, eco-friendly packaging, and increased focus on mental wellness and immunity support