Flavored Vitamin Water Market Size (2023 - 2030)

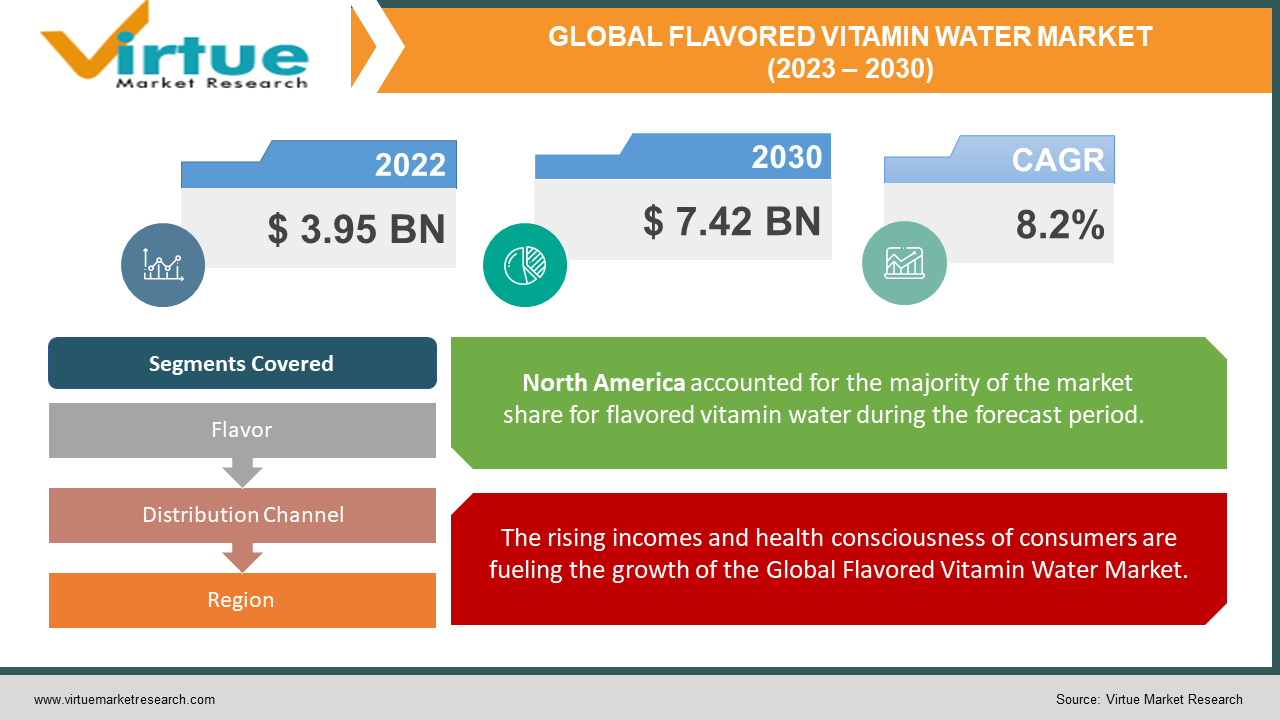

The global Flavored Vitamin Water Market is estimated to be worth USD 3.95 Billion in 2022 and is projected to reach a value of USD 7.42 Billion by 2030, growing at a CAGR of 8.2% during the forecast period 2023-2030.

Download FREE Sample Copy Of This Report

Vitamin water is a type of beverage comprising water supplemented with water-soluble vitamins. Multiple manufacturers offer an array of flavors for vitamin water, generally sweetened using either sugar or a combination of natural and artificial sweeteners.

Since its introduction in the United States over ten years ago, vitamin water sales have continuously surged, showcasing unwavering growth. This growth can be ascribed to consumers acknowledging the importance of vitamins in their diet and perceiving the benefits of vitamin water as outweighing the additional calories it may contain.

Electrolytes, including sodium, potassium, and magnesium, are vital minerals found within our blood as acids, bases, and salts. These essential electrolytes play pivotal roles in our bodies, aiding the movement of nutrients and waste across cell membranes, supporting proper muscle and nerve function (including the heart), maintaining pH balance, and regulating hydration levels. Consequently, electrolytes are vital for maintaining good overall health. In the context of vitamin water, the incorporation of electrolytes is instrumental in bolstering the optimal functioning of the body. Furthermore, individuals who consume vitamin water can enjoy the notable benefit of heightened energy levels.

Global Flavored Vitamin Water Market Drivers:

The rising incomes and health consciousness of consumers are fueling the growth of the Global Flavored Vitamin Water Market

Several factors, including elevated incomes and escalating health consciousness, are fueling the surging prevalence of non-carbonated beverages. This prevailing trend has compelled industry players to give utmost importance to health and energy beverages, consequently propelling the remarkable growth of the Flavored Vitamin Water Market.

Consumers are progressively opting for naturally healthy packaged meals and beverages, particularly those that are fortified, organic, or deemed superior in terms of their health benefits. These products are believed to offer vital nutrients derived from natural sources.

The thriving sports culture and government initiatives are other factors contributing to the growth of the Global Flavored Vitamin Water Market

The sports culture in nations like the United States and China, evident from the exceptional performance of athletes, has created a favorable environment for sports-related products.

Furthermore, major developing nations like India are actively promoting sports and investing in initiatives like "Khelo India." The Indian government's increased sports spending, as seen in the recently announced budget, further supports this trend.

Vitamin beverages are widely consumed by sports players to enhance performance and regain energy. Therefore, this factor also drives the demand for flavored vitamin water.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Flavored Vitamin Water Market Challenges:

The Global Flavored Vitamin Water Market is encountering challenges, primarily in terms of excessive amounts of sugar and fat-soluble vitamins. Vitamin water is a sweetened beverage, with one bottle containing around 30 grams of sugar, putting it on par with regular soft drinks.

The sweetener utilized like fructose can be detrimental to health in excessive amounts. Moreover, the added vitamins in these drinks often duplicate what individuals already get from their regular diet.

Consuming an excessive amount of the vitamins A and E present in these drinks can have severe repercussions on health, potentially leading to serious liver diseases. Thus, these challenges inhibit the growth of the Global Flavored Vitamin Water Market.

Global Flavored Vitamin Water Market Opportunities:

Sugar-free flavored vitamin water presents a lucrative, untapped market within the booming Global Flavored Vitamin Water Market. Consumers are increasingly drawn to flavored vitamin water for its perceived health benefits, including:

- Nutrient Transport

- Waste Removal

- Muscle & Nerve Function Support

- pH Balance

- Hydration

By introducing unsweetened options, beverage companies can capitalize on this trend and attract a wider customer base, particularly those seeking sugar-conscious alternatives. This strategic move can lead to:

- Increased Customer Acquisition

- Enhanced Brand Image

- Boosted Revenue

Global Flavored Vitamin Water Market Recent Developments:

- In March 2023, Vitaminwater® unveiled the launch of two fresh flavors, namely 'with love' and 'forever you,' to their existing lineup of zero-sugar options. Along with these additions, they have also implemented an innovative reformulation for all six zero-sugar flavors. The reformulated zero-sugar version now incorporates a new sweetener blend containing monk fruit and stevia, along with additional vitamins and nutrients.

- In January 2023, Flow Beverage Corp. introduced Flow Vitamin-Infused Water in Canada, gaining authorization from 22 retailers with over 800 locations and 8 national distributors. Positioned as a healthier alternative in the functional water segment, it offers 120% of the recommended daily value of Vitamin C and is a rich source of zinc.

- In May 2020, General Beverage Co., Ltd., a Thailand-based company known for its Vitaday functional drink, introduced two new functional water products. The vitamin water drinks contain added vitamin C and vitamin B complex, offering 2x the daily requirement of vitamin C and fulfilling the entire daily requirement of vitamin B. The aim is to boost the body's resilience, particularly amid the current pandemic.

FLAVORED VITAMIN WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Flavor, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company (United States), PepsiCo, Inc. (United States), Cloud Water Brands (United States), Roar Beverages, Inc. (United States), Fortenova Group (Croatia), Agua Enerviva LLC (United States), Beltek Canadian Beverages Pvt. Ltd. (India), Voll Sante Functional Foods & Nutraceuticals Pvt. Ltd. (India), Suncoast Brands International Corporation (Philippines), General Beverage Co., Ltd. (Thailand) |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Global Flavored Vitamin Water Market - By Flavor:

-

Apple

-

Blueberry

-

Dragonfruit

-

Lime

-

Mango

-

Orange

-

Others

In 2022, the orange segment held the highest market share. The growth can be attributed to the extensive utilization of orange flavor across various carbonated and non-carbonated beverages. Artificial orange flavors provide a cost-effective option, replicating the taste of oranges.

The health benefits of oranges, including cancer prevention and improved circulation, stem from their vitamin C and carotene content. The warm and happy psychological effects associated with the color orange make it appealing for advertisements and appetite stimulation.

Citrus fruits, including oranges, provide pleasant flavors that help alleviate stress. With high acidity, orange juice has a longer storage life, remaining fresh for several days after opening, offering convenience to consumers.

Global Flavored Vitamin Water Market - By Distribution Channel:

-

Convenience Stores

-

Supermarkets/Hypermarkets

-

E-commerce

-

Others

In 2022, the supermarkets/hypermarkets segment held the highest market share. The growth can be attributed to the wider reach and accessibility of supermarkets/hypermarkets, allowing for a larger consumer base. These locations are evolving into the go-to, one-stop store for daily necessities because of the abundance of goods offered at substantial savings.

Given the availability of an array of goods and discounts on them, the need for supermarkets/hypermarkets has gone up, delivering consumers with a one-of-a-kind shopping experience. Consumers often prefer to purchase beverages like flavored vitamin water in bulk, which is easier to do at supermarkets/hypermarkets.

Global Flavored Vitamin Water Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, North America rgion held the largest share of the Global Flavored Vitamin Water Market. The growth can be ascribed to the rising consumer preference for healthy and fortified beverages, the favorable guidelines for foreign direct investment (FDI) regarding product certification and the promotion of healthy drinking habits, and the thriving sports culture in nations, such as the United States and Mexico. Furthermore, the region is home to several significant market players, including The Coca-Cola Company, PepsiCo, Inc., Cloud Water Brands, Roar Beverages, Inc., and Agua Enerviva LLC.

Due to the increasing focus on boosting immunity, the growing habit of incorporating fortified food and beverages into the diet, and the strong presence of major market players, including Voll Sante Functional Foods & Nutraceuticals Pvt. Ltd., Beltek Canadian Beverages Pvt. Ltd., and General Beverage Co., Ltd., the region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Global Flavored Vitamin Water Market Key Players:

-

PepsiCo, Inc.

-

Cloud Water Brands

-

Roar Beverages, Inc.

-

Fortenova Group

-

Agua Enerviva LLC

-

Beltek Canadian Beverages Pvt. Ltd.

-

Voll Sante Functional Foods & Nutraceuticals Pvt. Ltd.

-

Suncoast Brands International Corporation

-

General Beverage Co., Ltd.

COVID-19 Impact on the Global Flavored Vitamin Water Market:

The outbreak of the COVID-19 pandemic substantially impacted the Global Flavored Vitamin Water Market. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the production and distribution of flavored vitamin water beverages. This factor negatively impacted the growth of the Global Flavored Vitamin Water market. However, the pandemic led to individuals becoming more health-conscious owing to the protection from COVID-19 disease, which resulted in elevated demand for flavored vitamin water beverages. This factor positively impacted the market's growth. Therefore, the Global Flavored Vitamin Water Market experienced both challenges and opportunities during the difficult time of the COVID-19 pandemic.

Chapter 1. Flavored Vitamin Water Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Flavored Vitamin Water Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Flavored Vitamin Water Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Flavored Vitamin Water Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Flavored Vitamin Water Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Flavored Vitamin Water Market - By Flavor

6.1 Apple

6.2 Blueberry

6.3 Dragonfruit

6.4 Lime

6.5 Mango

6.6 Orange

6.7 Others

Chapter 7. Flavored Vitamin Water Market - By Distribution Channel

7.1 Convenience Stores

7.2 Supermarkets/Hypermarkets

7.3 E-commerce

7.4 Others

Chapter 8. Flavored Vitamin Water Market - By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Rest of the World

Chapter 9. Flavored Vitamin Water Market - Key Players

9.1 The Coca-Cola Company (United States)

9.2 PepsiCo, Inc. (United States)

9.3 Cloud Water Brands (United States)

9.4 Roar Beverages, Inc. (United States)

9.5 Fortenova Group (Croatia)

9.6 Agua Enerviva LLC (United States)

9.7 Beltek Canadian Beverages Pvt. Ltd. (India)

9.8 Voll Sante Functional Foods & Nutraceuticals Pvt. Ltd. (India)

9.9 Suncoast Brands International Corporation (Philippines)

9.10 General Beverage Co., Ltd. (Thailand)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global Flavored Vitamin Water Market is estimated to be worth USD 3.95 Billion in 2022 and is projected to reach a value of USD 7.42 Billion by 2030, growing at a CAGR of 8.2% during the forecast period 2023-2030

The Global Flavored Vitamin Water Market Drivers are the Rising Incomes and Health Consciousness of Consumers and the Thriving Sports Culture and Government Initiatives.

Based on the Flavor, the Global Flavored Vitamin Water Market is segmented into Apple, Blueberry, Dragonfruit, Lime, Mango, Orange, and Others.

The United States is the most dominating country in the region of North America for the Global Flavored Vitamin Water Market.

The Coca-Cola Company, PepsiCo, Inc., and Cloud Water Brands are the leading players in the Global Flavored Vitamin Water Market.