Artificial Sweeteners Market Size (2024 - 2030)

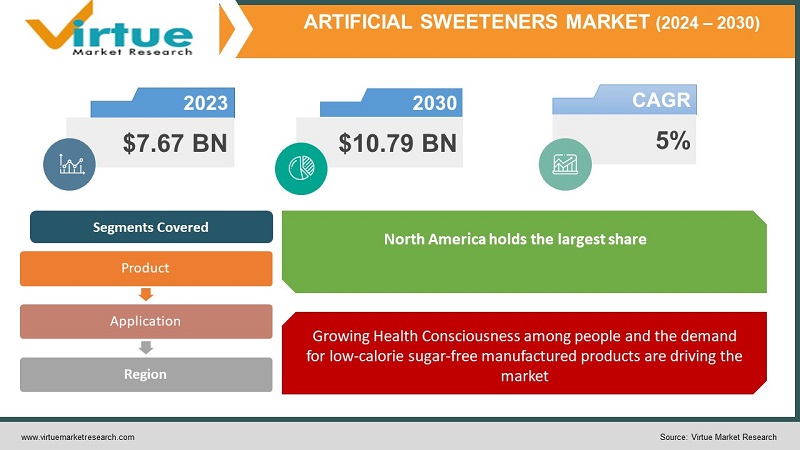

According to the recent analysis by Virtue Market Research, in 2022, the Global Artificial Sweeteners Market is valued at USD 7.67 billion in 2023 and is projected to reach a market size of USD 10.79 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

The global artificial sweetener market is a dynamic and rapidly expanding sector that caters to the increasing need for low-calorie and zero-calorie sweetening alternatives. This growth is driven by the rising health consciousness among consumers and growing concerns related to conditions like obesity and diabetes. As individuals seek healthier options to satisfy their cravings for sweetness, artificial sweeteners provide an appealing solution by delivering the desired sweetness without the added calories associated with traditional sugar. The primary objective of the artificial sweetener market is to offer a diverse range of sweetening substances suitable for various food and beverage products, including soft drinks, baked goods, confectionery, dairy items, and more. These sweeteners not only impart a sweet taste but also contribute to maintaining a healthier lifestyle by reducing sugar intake. Several factors propel the expansion of the global artificial sweetener market. Firstly, the increasing prevalence of health conditions such as diabetes and obesity is a significant driver, spurring the demand for sugar substitutes. Furthermore, consumers' growing preference for low-calorie and healthier food choices adds momentum to market growth. Additionally, the heightened awareness of the adverse effects of excessive sugar consumption on overall health and well-being acts as a catalyst for the continued expansion of this market.

Key Market Insights:

The global demand for no-calorie or low-calorie variants of food and beverages has witnessed a rapid surge in recent years, driven by the increasing number of health-conscious consumers worldwide. Artificial sweeteners, known for their higher sweetness intensity compared to table sugar while offering fewer calories, have found widespread application in the food and beverage industry. These sweeteners are commonly used in a wide array of products, including soft drinks, sauces, chewing gum, jellies, dressings, baked goods, candy, fruit juices, ice cream, and more. Notably, the soft drink industry has experienced a substantial uptick in the utilization of artificial sweeteners. This surge can be attributed to the growing consumer demand for low-sugar and diet beverages as individuals seek healthier alternatives while still enjoying sweet flavors. According to the World Sugar Organization's report, global sugar consumption is projected to reach 218 kg per capita by 2029. This upward trend is expected to contribute to an increase in cases of hyperglycemia, diabetes, and obesity among consumers. Consequently, there will be a heightened demand for artificial sweeteners in the foreseeable future. The global artificial sweetener market is poised to benefit from increased public awareness and a growing appetite for sugar-free products and low-calorie sugar substitutes. Additionally, food manufacturers are emphasizing the development of sugar-free and low-calorie alternatives, thereby propelling the expansion of the global artificial sweetener market.

Global Artificial Sweeteners Market Drivers:

Growing Health Consciousness among people and the demand for low-calorie sugar-free manufactured products are driving the market

The sweetener market is poised for substantial growth, driven by a rising health-conscious population, increasing disposable incomes, and urbanization trends. This product category has significantly replaced sugar in the food and beverage industry, with Aspartame playing a pivotal role as a sugar substitute, particularly in soft drinks. Moreover, artificial sweeteners enable beverage manufacturers to reduce sugar content in carbonated beverages without compromising taste or appearance, encouraging their adoption. The market's growth is further facilitated by lower production costs and improved economies of scale. Increasing consumer preferences for low-fat food options with minimal flavor compromises are significant drivers of Aspartame sales, expected to exceed USD 700 million by 2029. Aspartame finds extensive applications in the food and beverage industry, including soft drinks, chewing gum, jellies, candy, baked goods, ice cream, and more, contributing substantially to market expansion.

The government’s favourable policies are fueling the Artificial Sweetener Market

Consumers' increasing preference for healthier food choices and their heightened focus on well-being has led to a significant uptick in the consumption of products without added sugars and sweeteners. Notably, in France and the U.K., nationwide government initiatives aimed at reducing sugar intake through measures like selective taxation, reformulation of products, and clear front-of-packaging labels are anticipated to drive market growth. These actions align with the policy recommendations outlined in the World Health Organization's 2015-2020 European Food and Nutrition Action Plan, which seeks to create a healthier food environment.

Furthermore, as a response to the World Health Organization's 2013-2020 Global Action Plan for the Prevention and Control of Noncommunicable Diseases (GAP), implemented in 2015, numerous government agencies in 20 countries have introduced taxes specifically targeting the reduction of obesity and diabetes, particularly concerning Sugar-sweetened Beverages (SSB). By mid-2018, as many as 39 countries had adopted nutrition-related taxes and showed a heightened commitment to voluntary sugar reduction methods to promote improved nutritional choices.

The urgency for alternatives to sugar is propelling the Artificial Sweetener Market

The rapid pace of industrialization worldwide has led to a notable increase in urbanization in recent years. As a result, many individuals are adopting more sedentary lifestyles, spending extended hours in office settings with limited physical activity. This shift has given rise to an imbalance in their dietary habits, resulting in an excess of calorie consumption compared to calories burned by the body. The consumption of calorie-dense foods has consequently led to the accumulation of body fat and the emergence of obesity as a significant health concern. Obesity, in turn, is associated with a range of health problems, including type 2 diabetes, cardiovascular disease, hypertension, and cancer. In response to these health challenges, there is a growing consumer demand for low-calorie sweeteners in food and beverage products. The substantial consumption of sugar and sugar-based products in countries such as the United States, China, Japan, and India has contributed significantly to the global rise in the diabetic population. Diabetic individuals experience insulin resistance in their cells, making it challenging for them to absorb sugar efficiently. Consequently, the unregulated consumption of products containing sugar can have severe health implications for such individuals. This has underscored the importance of substituting sugar with alternative sweeteners that have lower calorie content while delivering similar levels of sweetness, addressing the needs of both diabetic and health-conscious consumers.

Global Artificial Sweetener Market Opportunities:

The artificial sweeteners market is poised to capitalize on several promising opportunities in the coming years. One significant avenue lies in the rising global awareness of health and wellness, with consumers actively seeking low-calorie and sugar-free alternatives in their diets. As the prevalence of health conditions such as obesity and diabetes continues to grow, there is a growing demand for artificial sweeteners to provide sweet tastes without the associated calories and adverse health effects of sugar. Additionally, government initiatives aimed at reducing sugar consumption, such as sugar taxes and labeling regulations, present an opportunity for the artificial sweeteners market to thrive, as food and beverage producers seek to reformulate their products to align with these regulations. Furthermore, the development of innovative and improved artificial sweeteners, catering to various taste profiles and applications, is expected to drive market growth. Overall, the artificial sweeteners market is well-positioned to seize these opportunities and cater to the evolving dietary preferences and health-conscious choices of consumers worldwide.

Global Artificial Sweetener Restraints and Challenges:

Prolonged usage of artificial sweeteners may pose certain health risks, potentially hindering market growth. Long-term consumption of artificial sweeteners has been associated with conditions such as diabetes, which can disrupt the body's ability to regulate blood sugar levels, presenting challenges for market expansion. Moreover, extended use of these sweeteners has been linked to adverse gastrointestinal effects like bloating, diarrhea, and other digestive disorders. A recent study has also raised concerns about high-intensity sweeteners like saccharin and aspartame, suggesting a potential link to blood-related disorders, including leukemia, which can have severe consequences, including fatality. These health-related considerations may impede the growth trajectory of the global artificial sweetener industry.

ARTIFICIAL SWEETENERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zydus Wellness, Hermes Sweeteners, JK Sucralose, Ajinomoto Co. Inc., Roquette Freres, McNeil Nutrition, NutraSweet Property Holdings, PureCircle, Cargill Incorporated, Nestle |

Global Artificial Sweetener Market Segmentation: By Product

-

Aspartame

-

Acesulfame K

-

Saccharin

-

Sucralose

-

Neotame

-

Others

The aspartame segment is expected to experience a compound annual growth rate (CAGR) of 4% throughout the forecast period and it has gained the market share by 47% in 2022. Aspartame holds a prominent position among artificial sweeteners due to its considerably sweeter taste compared to sugar, which translates to lower production costs than other artificial sweeteners. Furthermore, the growing adoption of aspartame as a tabletop sweetener is contributing to the segment's growth. Manufacturers of artificial sweeteners are also exploring opportunities in the pharmaceutical sector, aiming to cater to the increasing demand for aspartame as a sweetening and flavor-enhancing agent in pharmaceutical products.

Saccharin is the fastest growing market in the segments which is in demand for consumers who need to restrict their carbohydrates or calories and consumers suffering from sugar and obesity.

Global Artificial Sweetener Market Segmentation: By Application

-

Bakery Products

-

Dairy Products

-

Confectionery

-

Beverages

-

Others

In 2022, the food and beverage sectors have captured more than 35% of the global market share in artificial sweeteners. Artificial sweeteners have emerged as predominant substitutes for sugar, particularly in the beverage industry, with carbonated beverages being a prime example. The appeal of artificial sweeteners lies in their natural profiles and clean labeling attributes, which have been driving market growth. In the realm of soft drinks, these sweeteners facilitate the reduction of sugar content without compromising the appearance and taste of the beverages, empowering manufacturers to seamlessly replace sugar with artificial alternatives. Additionally, the confectionery sector stands out as the fastest-growing market segment. Health-conscious consumers are increasingly gravitating towards confectionery products featuring artificial sweeteners, allowing them to indulge in their favorite sweet treats without having to forgo their sweet cravings. This shift in consumer preferences is fueling the growth of artificial sweeteners in the confectionery industry

Global Artificial Sweetener Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The North American region is poised to achieve a CAGR of 2.24% by 2029, capturing approximately 39% of the global market share. This growth can be attributed to the region's expanding footprint and the increasing influence of Western lifestyles on consumers. The surging prevalence of diabetes patients in the region is closely linked to regional demand trends. Moreover, a substantial portion of the population in North America consists of overweight and obese individuals. As a result, the consumption of zero-calorie and low-calorie foods is on the rise, driven by heightened health consciousness among consumers. Countries like the United States, Canada, and Mexico exhibit robust demand for sweeteners, as health-consciousness prevails in this region.

The Asia Pacific region is anticipated to experience the fastest growth rate during the forecast period. This growth can be attributed to shifting lifestyles, increasing disposable incomes, and significant alterations in dietary preferences. Countries such as China and India are at the forefront of the sweeteners market, primarily driven by urbanization and a growing inclination towards health-conscious food products. These factors collectively contribute to the robust expansion of the sweeteners market in the Asia Pacific region.

COVID-19 Impact on the Global Artificial Sweetener Market:

The outbreak of the COVID-19 pandemic triggered a global standstill across various sectors, notably impacting the food and beverage industry and sending shockwaves through the global economy. Manufacturing and transportation sectors were particularly disrupted, leading to widespread repercussions across related industries and effectively bringing the entire global economy to a halt. This period also witnessed significant shifts in consumer consumption patterns, as people adapted to the challenges posed by the pandemic. Furthermore, manufacturing companies grappled with disruptions in their supply chains, largely stemming from transportation restrictions during the pandemic's peak. This disruption had a cascading effect on the import and export of raw materials, resulting in reduced product availability and hindering companies' abilities to introduce new products to the market. However, as the world enters the post-pandemic phase, there has been a notable shift in consumer behavior, with a heightened emphasis on health and wellness. This shift has rekindled interest in artificial sweeteners as consumers seek healthier alternatives. This trend is expected to propel the artificial sweeteners market in the coming years, ultimately contributing to its growth and recovery.

Latest Trends/ Developments:

As the need for sugar reduction in food products intensifies, manufacturers are increasingly emphasizing not only the reduction of sugar but also the preservation of appealing taste, texture, and mouthfeel. To address the functional shortcomings resulting from sugar removal, manufacturers are directing their efforts toward the use of multiple ingredients, aiming to deliver cost-effective sweeteners while ensuring the extended shelf life of their products. Additionally, there is a concerted focus on enhancing the overall taste and mitigating the bitter aftertaste associated with certain sweeteners. Furthermore, manufacturers are venturing into combining plant-based sweeteners with plant-based product formulations, aligning with the growing shift away from animal-derived ingredients. The concepts of sugar-free and sugar reduction are also gaining traction in emerging economies, presenting fresh opportunities for processed food manufacturers to innovate and introduce new products to meet evolving consumer preferences in the years to come.

Key Market Players:

-

Zydus Wellness

-

Hermes Sweeteners

-

JK Sucralose

-

Ajinomoto Co. Inc.

-

Roquette Freres

-

McNeil Nutrition

-

NutraSweet Property Holdings

-

PureCircle

-

Cargill Incorporated

-

Nestle

-

In July 2021, PepsiCo unveiled its strategy to decrease the sugar content by 25% within its soda and iced tea beverage offerings throughout the European Union (EU) by the year 2025. This initiative, which involves the introduction of products with reduced sugar content, is designed to appeal to health-conscious consumers in the EU region.

-

In January 2021, Tate & Lyle and Codexis grew their collaboration to maximize the production of Tate & Lyle’s newest sweetener, Tasteva M Stevia Sweetener.

Chapter 1. Artificial Sweeteners Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Artificial Sweeteners Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Artificial Sweeteners Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Artificial Sweeteners Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Artificial Sweeteners Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Artificial Sweeteners Market – By Product

6.1 Introduction/Key Findings

6.2 Aspartame

6.3 Acesulfame K

6.4 Saccharin

6.5 Sucralose

6.6 Neotame

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis by By Product, 2024-2030

Chapter 7. Artificial Sweeteners Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery Products

7.3 Dairy Products

7.4 Confectionery

7.5 Beverages

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Artificial Sweeteners Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Product

8.1.2 By Application

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Artificial Sweeteners Market – Company Profiles – (Overview, Artificial Sweeteners Market Portfolio, Financials, Strategies & Developments)

9.1 Zydus Wellness

9.2 Hermes Sweeteners

9.3 JK Sucralose

9.4 Ajinomoto Co. Inc.

9.5 Roquette Freres

9.6 McNeil Nutrition

9.7 NutraSweet Property Holdings

9.8 PureCircle

9.9 Cargill Incorporated

9.10 Nestle

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Artificial Sweeteners Market is valued at USD 7.67 billion in 2023 and is projected to reach a market size of USD 10.79 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Health-conscious consumers shifting towards low-calorie or zero-calorie sweets and education about the harmful effects of sugar.

Based on Product Type, the Global Artificial Sweeteners can be segmented into Aspartame, Acesulfame K, Saccharin, Sucralose, Neotame, and Others.

China is the most dominant country in the Region of the Global Artificial Sweetener.

Zydus Wellness, Hermes Sweeteners, JK Sucralose, Ajinomoto Co. Inc, Roquette Freres, McNeil Nutrition, NutraSweet Property Holdings, PureCircle, Cargill Incorporated, Nestle.