Sustainable Packaging Market Size (2024-2030)

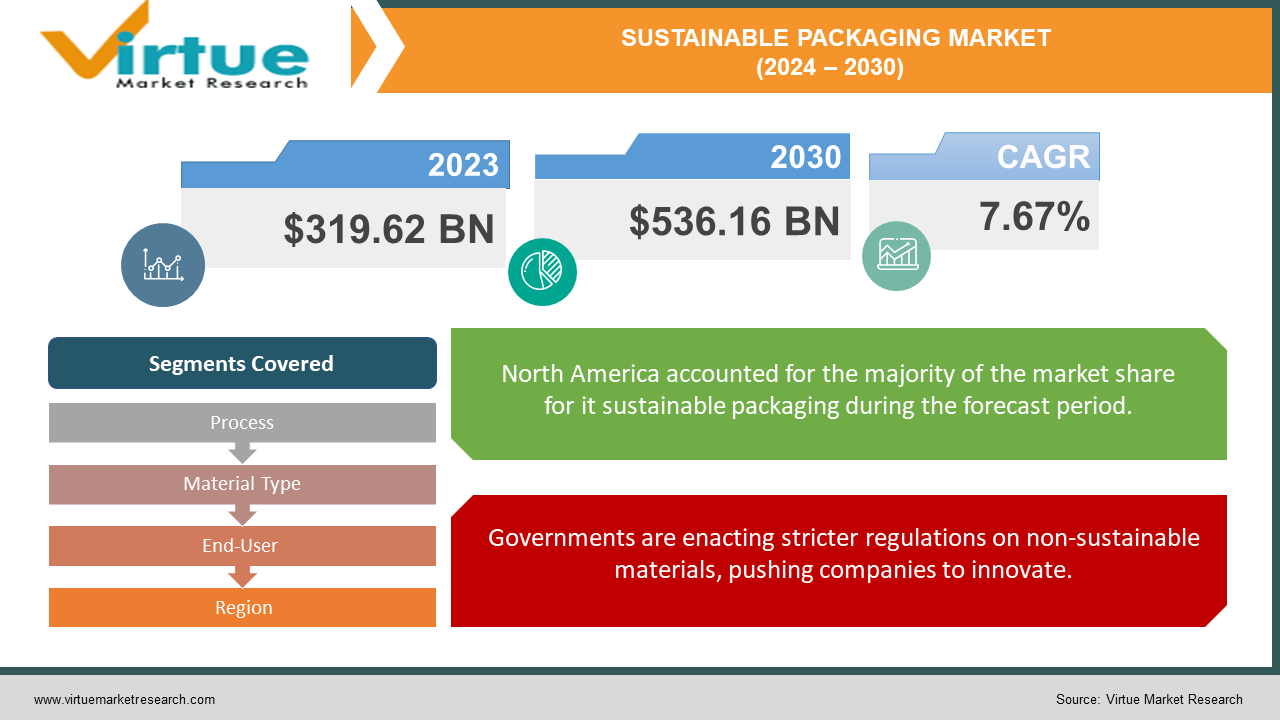

The Sustainable Packaging Market was valued at USD 319.62 billion in 2023 and is projected to reach a market size of USD 536.16 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.67%.

The sustainable packaging industry is experiencing a surge, fueled by a combination of environmental concerns, consumer preferences, and government regulations. Consumers are prioritizing eco-friendly products and are willing to pay more for packaging that minimizes environmental impact.

Key Market Insights:

The sustainable packaging industry is experiencing a boom driven by several key factors. Consumers are wielding their purchasing power for good, with a significant portion willing to pay more for products with eco-friendly packaging. A 2022 Trivium Packaging report found that over 80% of young consumers would pay extra for sustainable packaging solutions. This strong consumer preference is a clear message for businesses: greener packaging is not just good for the environment, it's good for business.

Sustainable Packaging Market Drivers:

Governments are enacting stricter regulations on non-sustainable materials, pushing companies to innovate.

Governments around the world are taking a proactive stance on environmental issues by enacting stricter regulations on non-sustainable materials. For instance, the European Union's ban on single-use plastic products like straws and cutlery exemplifies this policy shift. These regulations can present challenges for businesses that need to adapt their packaging practices to comply. However, they also create significant opportunities for companies that can develop innovative and compliant packaging solutions, positioning them as leaders in the sustainable packaging revolution.

Technological advancements are fueling the development of new sustainable materials like bioplastics.

Technology is playing a critical role in keeping pace with the demand for sustainable packaging. Advancements in material science are leading to the development of new, sustainable materials like bioplastics. These bio-based materials, often compostable or degradable, offer exciting possibilities for companies. They can create eco-friendly packaging options that not only meet consumer demand and comply with regulations but can also potentially boast superior functionality or aesthetics compared to traditional packaging materials.

The focus on lifecycle encourages a holistic approach to packaging, minimizing waste throughout its journey.

Sustainable packaging goes beyond just swapping out materials. It's about considering the entire lifecycle of the packaging, from minimizing its use altogether to designing products for easy reuse or composting. This holistic approach aims to reduce the environmental impact throughout the product's journey, from raw material extraction to disposal. By focusing on minimizing packaging use and maximizing recyclability or composability, companies can significantly reduce their environmental footprint and contribute to a more circular economy.

Sustainable Packaging Market Restraints and Challenges:

The sustainable packaging revolution faces hurdles despite its momentum. One key challenge is the complexity of the supply chain. While recycled materials are a popular choice, ensuring a consistent supply and maintaining high-quality standards can be difficult. Additionally, the infrastructure for collecting and processing these materials varies greatly by region. This inconsistency can create logistical challenges for companies that want to adopt sustainable packaging on a large scale.

Another hurdle is ensuring clear and consistent communication with consumers. Even with growing interest in eco-friendly products, confusion can persist around proper disposal of sustainable packaging options. Mixed messaging or unclear labeling can lead to contamination in recycling streams, rendering the packaging ineffective from a sustainability standpoint. Companies and industry leaders need to work together to develop clear and standardized labeling systems that educate consumers on responsible disposal practices.

Finally, developing effective and sustainable packaging solutions requires collaboration across the entire value chain. From raw material producers to packaging designers and manufacturers, all stakeholders need to be involved in the process. This collaborative approach can help identify and address challenges early on, leading to the development of truly sustainable packaging solutions that are not only eco-friendly but also commercially viable.

Sustainable Packaging Market Opportunities:

The sustainable packaging market offers a plethora of opportunities beyond material innovation. The booming e-commerce sector presents a chance to develop functional, eco-friendly packaging that protects products during transit while minimizing environmental impact. This could involve using the right amount of packaging, implementing bio-based cushioning materials, or designing for efficient returns. Reusable packaging systems, like refillable containers or returnable programs, are another exciting avenue. Companies can leverage subscription models or collaborate with retailers to create a more circular economy, reducing waste and encouraging sustainable consumption habits. Technology also plays a significant role. Smart packaging with integrated sensors can monitor product freshness and optimize storage conditions, leading to less food waste. Additionally, advancements in life cycle assessment tools can empower companies to make informed decisions about the environmental impact of their packaging choices, going beyond just material selection. Ultimately, collaboration across the entire value chain is key to unlocking the full potential of sustainable packaging. Partnerships between raw material suppliers, designers, retailers, and other stakeholders can foster innovation, address infrastructure challenges, and ensure clear communication with consumers about responsible disposal practices. By embracing these opportunities, the sustainable packaging market can move beyond simply replacing traditional materials and become a transformative force for a greener future.

SUSTAINABLE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.67% |

|

Segments Covered |

By Process, Material Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Plc, WestRock Company, Tetra Pak International SA, Sonoco Products Company, Smurfit Kappa Group PLC, International Paper, Berry Global Inc., Huhtamaki Oyj, DS Smith Plc, Mondi Plc |

Sustainable Packaging Market Segmentation: By Process

-

Recycled Packaging

-

Reusable Packaging

-

Degradable Packaging

The most dominant segment in the sustainable packaging market by process is Recycled Packaging, utilizing readily available materials like recycled paperboard and plastic. This segment is driven by established infrastructure and cost-effectiveness. However, the fastest-growing segment is Degradable Packaging, which includes bioplastics and compostable materials. This segment is propelled by growing consumer and regulatory emphasis on minimizing waste and creating a circular economy.

Sustainable Packaging Market Segmentation: By Material Type

-

Paper & Paperboard

-

Plastic

-

Glass

-

Metal

-

Others

The paper segment reigns supreme in the Material Type sector of sustainable packaging, currently holding the largest market share and projected for continued growth. On the other hand, bioplastics, a subcategory within the plastic segment, are experiencing the fastest growth. This is driven by rising consumer demand for eco-friendly options and technological advancements that are creating more functional and sustainable bioplastic materials.

Sustainable Packaging Market Segmentation: By End-User

-

Food & Beverage

-

Pharmaceutical & Healthcare

-

Cosmetics & Personal Care

-

Other End-User Industries

The sustainable packaging market caters to various needs through segmentation. By end-user industry, the food & beverage sector is currently the most dominant due to its high demand for fresh product packaging with minimal environmental impact. However, the fastest-growing segment is expected to be e-commerce, driven by the need for functional, eco-friendly packaging that protects products during transit and minimizes waste. This creates opportunities for companies to develop innovative solutions like right-sized packaging, bio-based cushioning materials, and designs that facilitate easy returns.

Sustainable Packaging Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is a pioneer in sustainable packaging innovation, with a strong focus on bioplastics, recycled content, and compostable materials. Stringent regulations and high consumer awareness drive market growth, particularly in the food & beverage and e-commerce sectors. However, challenges include ensuring consistent availability of recycled materials and managing the complexities of a geographically vast market.

Europe is a global leader in sustainable packaging regulations, with the EU's ban on single-use plastics being a prime example. This policy push has spurred innovation in reusable and compostable packaging solutions. The region also boasts a strong focus on recycling infrastructure, making it a mature market for recycled content packaging. However, high material costs and competition from lower-cost producers in other regions can be hurdles.

Asia-Pacific presents the most significant growth potential due to its large population, rising disposable incomes, and increasing environmental awareness. Abundant natural resources like bamboo and agricultural products offer feedstock for sustainable materials. The food & beverage sector is a major driver, but challenges include fragmented regulations and underdeveloped recycling infrastructure in some countries.

COVID-19 Impact Analysis on the Sustainable Packaging Market:

The COVID-19 pandemic caused ripples throughout the sustainable packaging market. While the overall packaging industry saw a temporary rise due to increased demand for essentials and e-commerce, the sustainable sector faced hurdles. Lockdowns disrupted supply chains for recycled materials, a key component of sustainable packaging, limiting availability and potentially raising costs. Additionally, some consumers initially prioritized affordability and hygiene over sustainability, potentially leading to a temporary dip in demand for eco-friendly options. With the immediate health crisis taking center stage, some businesses may have also delayed investments in long-term sustainable packaging solutions.

However, the pandemic also presented unforeseen opportunities. The e-commerce boom fueled a demand for functional and sustainable packaging solutions that ensure safe product delivery during transit. This could accelerate innovation in areas like right-sized packaging and bio-based cushioning materials. The heightened focus on hygiene during the pandemic could also lead to a long-term increase in demand for some sustainable packaging options, particularly those with inherent antimicrobial properties. Finally, the pandemic has raised public awareness of environmental issues, potentially leading to a renewed focus on sustainability in the post-pandemic world, which could benefit the sustainable packaging market in the long run.

Latest Trends/ Developments:

The focus on sustainable packaging is shifting beyond just materials. The concept of a circular economy is gaining momentum, where packaging is designed for multiple uses or easy composting. This could involve reusable systems, refillable containers, or packaging that can be broken down and reintegrated into the production cycle. Bioplastics are also evolving, with new materials boasting improved performance. These advancements offer better protection against elements, heat resistance, and longer shelf life, addressing limitations of earlier bioplastics and paving the way for wider adoption. Another trend is the rise of home composting. As consumers embrace composting food scraps at home, there's a growing demand for packaging that can be composted alongside them. This is driving innovation in home-compostable solutions made from plant-based materials. The integration of smart technology into packaging is another exciting development. Sensors can monitor factors like temperature and freshness during transport, optimize logistics, reduce food waste, and improve product quality. Finally, with a wider variety of sustainable options available, clear communication with consumers is crucial. Standardized labeling systems are being developed to educate consumers on proper disposal practices for different materials. This ensures these materials are recycled or composted effectively, maximizing their environmental benefits. These trends showcase the dynamic and innovative nature of the sustainable packaging market, paving the way for a more sustainable future.

Key Players:

-

Amcor Plc

-

WestRock Company

-

Tetra Pak International SA

-

Sonoco Products Company

-

Smurfit Kappa Group PLC

-

International Paper

-

Berry Global Inc.

-

Huhtamaki Oyj

-

DS Smith Plc

-

Mondi Plc

Chapter 1. Sustainable Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sustainable Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sustainable Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sustainable Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sustainable Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sustainable Packaging Market – By Process

6.1 Introduction/Key Findings

6.2 Recycled Packaging

6.3 Reusable Packaging

6.4 Degradable Packaging

6.5 Y-O-Y Growth trend Analysis By Process

6.6 Absolute $ Opportunity Analysis By Process, 2024-2030

Chapter 7. Sustainable Packaging Market – By Material Type

7.1 Introduction/Key Findings

7.2 Paper & Paperboard

7.3 Plastic

7.4 Glass

7.5 Metal

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material Type

7.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Sustainable Packaging Market – By End-User

8.1 Introduction/Key Findings

8.2 Food & Beverage

8.3 Pharmaceutical & Healthcare

8.4 Cosmetics & Personal Care

8.5 Other End-User Industries

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Sustainable Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Process

9.1.3 By Material Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Process

9.2.3 By Material Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Process

9.3.3 By Material Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Process

9.4.3 By Material Type

9.4.4 By Material Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Process

9.5.3 By Material Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sustainable Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amcor Plc

10.2 WestRock Company

10.3 Tetra Pak International SA

10.4 Sonoco Products Company

10.5 Smurfit Kappa Group PLC

10.6 International Paper

10.7 Berry Global Inc.

10.8 Huhtamaki Oyj

10.9 DS Smith Plc

10.10 Mondi Plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Sustainable Packaging Market was valued at USD 319.62 billion in 2023 and is projected to reach a market size of USD 536.16 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.67%.

Consumer Power, Regulatory Landscape, Technological Advancements, Focus on Lifecycle.

Food & Beverage, Pharmaceutical & Healthcare, Cosmetics & Personal Care, Other End-User Industries.

Based on estimated market share, the Asia-Pacific region is currently the most dominant in sustainable packaging, holding around 35-40% of the market.

Amcor Plc, WestRock Company, Tetra Pak International SA, Sonoco Products Company, Smurfit Kappa Group PLC, International Paper, Berry Global Inc., Huhtamaki Oyj, DS Smith Plc, Mondi Plc.