Synthetic Lipid Market Size (2024 – 2030)

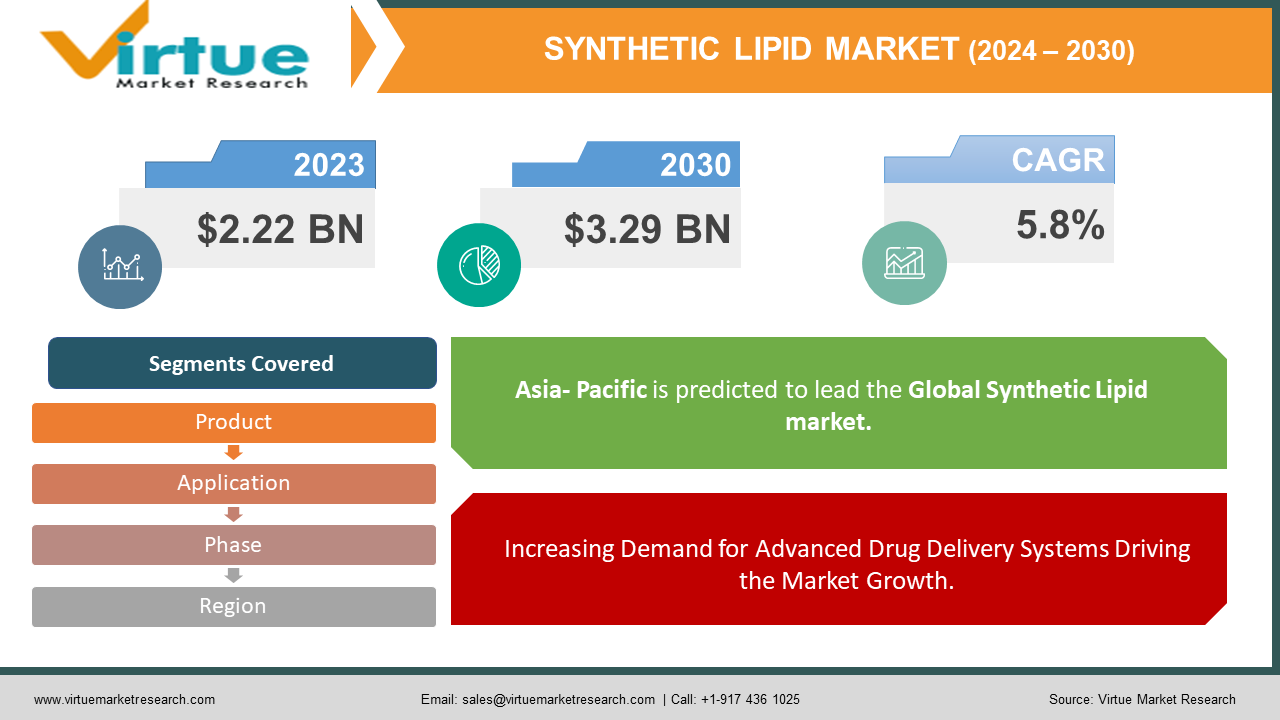

The Global Synthetic Lipid Market was valued at USD 2.22 billion in 2023 and is projected to reach a market size of USD 3.29 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.8% between 2024 and 2030.

Tiny, waxy, fatty, and oily microbes known as pids can dissolve in a variety of organic solvents, including methanol, ethers, ketones, and amines. They are derived from a variety of foods, including cheese, butter, oil, avocados, corn, and olives. They can be broadly categorized into three groups: phospholipids, which help build a barrier around cells to aid in maintenance; triglycerides, which reduce inflammation; and sterols, which aid in the manufacturing of hormones. Lipids are essential signaling molecules, a source of energy, and they help maintain the structural integrity of cell membranes.

Key Market Insights:

- Synthetic lipids are extensively used in pharmaceuticals, accounting for a significant portion of the market share due to their role in enhancing drug delivery systems.

- The cosmetic industry utilizes approximately 25% of synthetic lipids for skincare and haircare products, driven by their moisturizing and emollient properties.

- Nutraceutical applications constitute about 15% of the market, as synthetic lipids are increasingly integrated into dietary supplements aimed at improving health and wellness.

- The food industry accounts for about 10% of synthetic lipid usage, focusing on applications such as emulsifiers and stabilizers in processed foods and beverages.

- Research and development activities in lipid nanotechnology contribute to about 20% of market growth, fueling innovations in targeted drug delivery and personalized medicine.

- Environmental concerns and sustainable practices influence about 5% of market strategies, prompting companies to explore bio-based and renewable sources for synthetic lipid production.

Global Synthetic Lipid Market Drivers:

Increasing Demand for Advanced Drug Delivery Systems Driving the Market Growth.

The global synthetic lipid market is experiencing significant growth due to the rising demand for advanced drug delivery systems. Synthetic lipids, particularly lipid nanoparticles, are crucial in the formulation of targeted drug delivery mechanisms. These systems offer enhanced bioavailability, controlled release, and improved stability of therapeutic agents, making them ideal for treating various chronic and complex diseases such as cancer, cardiovascular diseases, and neurodegenerative disorders.

The COVID-19 pandemic has further highlighted the importance of synthetic lipids, as they are essential components in the development of mRNA vaccines. This surge in demand for effective and efficient drug delivery systems is driving pharmaceutical companies to invest heavily in research and development, thereby propelling the synthetic lipid market forward. Additionally, the growing interest in personalized medicine, which requires precise delivery mechanisms, is expected to sustain this market growth in the coming years.

Expanding Applications in Cosmetic and Nutraceutical Industries Fueling the Market Growth

Another significant driver of the global synthetic lipid market is the expanding applications of these compounds in the cosmetic and nutraceutical industries. Synthetic lipids are increasingly used in the formulation of skincare and haircare products due to their excellent emollient and moisturizing properties. They help in enhancing the texture and stability of cosmetic products while providing beneficial effects to the skin, such as improved hydration and barrier function. Moreover, the rising consumer awareness about the benefits of natural and bio-based ingredients is pushing manufacturers to incorporate synthetic lipids derived from renewable sources.

In the nutraceutical sector, synthetic lipids are gaining popularity as they play a vital role in the formulation of dietary supplements aimed at improving heart health, cognitive function, and overall well-being. The growing trend towards preventive healthcare and the increasing disposable income of consumers are further driving the demand for lipid-based nutraceuticals, thus contributing to the growth of the synthetic lipid market.

Global Synthetic Lipid Market Restraints and Challenges:

The global synthetic lipid market faces significant restraints and challenges, primarily due to stringent regulatory hurdles and high production costs. Regulatory authorities such as the FDA and EMA impose rigorous guidelines and approval processes for synthetic lipid products, particularly those used in pharmaceuticals and cosmetics. These stringent regulations ensure safety and efficacy but often result in prolonged development timelines and increased costs for manufacturers.

Additionally, the complexity of lipid synthesis and the need for specialized equipment and raw materials contribute to high production costs. This financial burden can be particularly challenging for smaller companies and startups, limiting their ability to compete with established players.

Furthermore, the market is also constrained by the availability of raw materials, which can fluctuate due to geopolitical factors and supply chain disruptions. The high cost of research and development to innovate and improve synthetic lipid formulations further exacerbates these challenges. These combined factors create a barrier to market entry and growth, slowing the overall advancement of the synthetic lipid market despite the high demand and potential for innovation.

Global Synthetic Lipid Market Opportunities:

The global synthetic lipid market is poised with significant opportunities, particularly in personalized medicine and gene therapy applications. Synthetic lipids play a crucial role in the development of advanced drug delivery systems tailored to individual patient needs. As personalized medicine gains traction, there is a growing demand for targeted therapies that can deliver therapeutic agents directly to diseased cells while minimizing systemic side effects. Lipid-based nanoparticles and liposomes are at the forefront of these innovations, offering enhanced stability and bioavailability for a wide range of pharmaceutical compounds.

Moreover, in the field of gene therapy, synthetic lipids are instrumental in delivering gene-editing tools like CRISPR-Cas9 safely and effectively into target cells. This application holds promise for treating genetic disorders and chronic diseases with a genetic component. The increasing investment in biotechnology and pharmaceutical research further underscores these opportunities, as companies strive to develop novel lipid-based formulations that can overcome current limitations in drug delivery and therapeutic efficacy. By leveraging advancements in lipid chemistry and nanotechnology, the synthetic lipid market is well-positioned to capitalize on these emerging trends and drive future growth in personalized medicine and gene therapy.

GLOBAL SYNTHETIC LIPID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Application, Product, Phase, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Avanti Polar Lipids, Inc., Cayman Chemical Company, NOF Corporation, Lipoid GmbH, Merck KGaA, Matreya LLC, Croda International Plc, Laysan Bio, Inc., CordenPharma International, Nanostellar, Inc. |

SEGMENTATION ANALYSIS

Global Synthetic Lipid Market Segmentation - By Application:

-

Pharmaceutical

-

Food & Beverage

Food & Beverage market share is poised to maintain its dominance throughout the forecast period. Owing to their high energy and vitamin content, lipids are mostly used in the preparation of functional food and beverages. The appalling COVID-19 situation and rising health risks have driven the demand for nutrient-dense food and drink products. Over the predicted years, the food and beverage industry is expected to see a rise in demand for the product due to an excess of demand for nutrient-dense food and healthful beverages.

Due to their growing use in drug development and numerous other pharmaceutical applications, lipids are predicted to become more and more in demand in the pharmaceutical industry. In the pharmaceutical business, it is considered an essential ingredient for creating most dosage forms. Pharmaceutical demand is expected to rise due to the growing importance of medications and drugs in light of expanding health concerns, which will support the segment's expansion. Key growth factors include rising supplement and nutrition intake as well as rising public awareness of fitness and health. Dietary lipids influence the feel, taste, and calorie count of meals as well as aid in the absorption of vitamins and fat-soluble elements, which provide the body with stored energy.

Global Synthetic Lipid Market Segmentation - By Product:

-

Triglycerides

-

Phospholipids

Triglycerides holds the largest market share throughout the forecast period. Its high percentage can be attributed to the growing demand from end-use sectors such as functional beverages and dietary supplements for triglyceride derivatives, specifically medium-chain and long-chain triglycerides. Because they are a major source of energy, triglycerides are widely used in a wide range of functional foods and beverages.

Over the course of the projection period, the phospholipids segment is anticipated to experience significant expansion. This is attributable to the exceptional qualities of phospholipids, which make them prominent ingredients in the development of functional foods and dietary supplements. Phospholipids are also expected to boost the market due to their increasing application in a variety of pharmaceutical technologies as emulsifiers, wetting agents, and builders of micelles, cubosomes, liposomes, and other structures.

Global Synthetic Lipid Market Segmentation - By Phase:

-

Clinical

-

Pre-clinical

Clinical market segment is expected to maintain a dominant market share throughout the forecast period. Its large proportion is due to the rising demand for lipids as specialized chemicals in the manufacturing of fuels, lubricants, surfactants, printing inks, and pesticide adjuvants, among other products used in many industrial applications. In the petroleum and plastics industries, they are becoming more and more popular as a practical and environmentally responsible substitute.

Lipids are used in clinical settings by taking specific dietary supplements that include the chemical to treat a range of chronic inflammatory disorders that are prevalent worldwide. Over the course of the forecast period, key functional firms' growing usage of distinct mRNA patterns in clinical techniques for treating a range of human health issues is expected to positively boost segment growth.

There are fewer drug approvals from regulatory organizations and vaccine development programs as a result of strict regulatory circumstances pertaining to the production of lipids. This has an impact on how widely it is used in pre-clinical applications. However, it is projected that in the upcoming years, the expansion of the pre-clinical phase segment will slow down due to increased government engagement in pre-clinical investigations.

Global Synthetic Lipid Market Segmentation - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

By region, Asia-Pacific Synthetic Lipid Market is expected to hold a dominant market share throughout the forecast period. Because of the pandemic, people's priorities and lifestyles have changed in ways never seen before, and consumers in the APAC region are now more concerned about their health than ever before. As a result, the consumption of dietary supplements, functional foods, pharmaceuticals, and other products has increased dramatically in the last few years and is expected to continue to grow in the years to come.

North America was particularly hard hit by the pandemic, with the United States reporting the highest number of fatalities out of all the countries in the world. In recent years, heightened awareness of health precautions and the emphasis on immune-boosting diets have made dietary supplements and functional foods integral to daily consumption for many. This trend has significantly propelled market growth in North America.

Meanwhile, Europe stands out with its robust pharmaceutical and medical sectors. The research-driven pharmaceutical industry in Europe, highlighted by the European Federation of Pharmaceutical Industries and Associations (EFPIA), has played a pivotal role, making Europe the second-largest pharmaceutical products seller in recent years. The extensive use of lipids in vaccine production and the substantial in-house manufacturing by various European companies are anticipated to further bolster market expansion. These factors underscore Europe's pivotal position and its positive influence on global market dynamics.

COVID-19 Impact Analysis on the Global Synthetic Lipid Market

The COVID-19 pandemic has had a mixed impact on the global synthetic lipid market. Initially, the market experienced disruptions in supply chains and manufacturing operations due to lockdowns and restrictions imposed globally. This led to delays in production and distribution of synthetic lipid products, affecting various industries reliant on these compounds, including pharmaceuticals and cosmetics.

However, as the pandemic progressed, there was a notable surge in demand for lipid-based formulations, particularly for mRNA vaccines developed to combat COVID-19. Synthetic lipids, such as lipid nanoparticles, played a pivotal role in the formulation and delivery of these vaccines, driving significant growth and innovation in the market.

Moreover, the pandemic highlighted the importance of advanced drug delivery systems, where synthetic lipids offer advantages such as improved stability, controlled release, and enhanced efficacy of therapeutic agents. Looking forward, the increased awareness and investment in healthcare infrastructure and biotechnology are expected to sustain the momentum in the synthetic lipid market, fostering further research and development in lipid-based therapies and vaccines beyond COVID-19.

Latest trends / Developments:

The global synthetic lipid market is witnessing several key trends and developments that are shaping its trajectory. One prominent trend is the increasing focus on sustainability and bio-based alternatives. Companies are investing in research and development to explore renewable sources for synthetic lipids, aiming to reduce environmental impact and meet consumer demand for eco-friendly products.

Another significant development is the integration of artificial intelligence and machine learning in lipidomics, facilitating advanced lipid profiling and personalized medicine. This technology enables precise characterization of lipid structures and functions, enhancing the design of lipid-based drug delivery systems tailored to individual patient needs.

Additionally, there is growing interest in lipid nanoparticles for targeted drug delivery across various therapeutic areas, including oncology and infectious diseases. These nanoparticles offer advantages such as improved pharmacokinetics, reduced toxicity, and enhanced cellular uptake of therapeutic agents.

Moreover, collaborations between pharmaceutical companies and research institutions are accelerating innovation in lipid-based formulations, expanding their applications in gene therapy, regenerative medicine, and vaccine development. Overall, these trends underscore a dynamic landscape in the synthetic lipid market, driven by advancements in technology, sustainability initiatives, and expanding therapeutic opportunities.

Key Players:

-

Lipoid GmbH

-

Merck KGaA

-

Matreya LLC

-

Croda International Plc

-

Laysan Bio, Inc.

-

CordenPharma International

-

Nanostellar, Inc.

Chapter 1. Synthetic Lipid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Synthetic Lipid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Synthetic Lipid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Synthetic Lipid Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Synthetic Lipid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Synthetic Lipid Market – By Application

6.1 Introduction/Key Findings

6.2 Pharmaceutical

6.3 Food & Beverage

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Synthetic Lipid Market – By Product

7.1 Introduction/Key Findings

7.2 Triglycerides

7.3 Phospholipids

7.4 Y-O-Y Growth trend Analysis By Product

7.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. Synthetic Lipid Market – By Phase

8.1 Introduction/Key Findings

8.2 Clinical

8.3 Pre-clinical

8.4 Y-O-Y Growth trend Analysis By Phase

8.5 Absolute $ Opportunity Analysis By Phase, 2024-2030

Chapter 9. Synthetic Lipid Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Product

9.1.4 By Phase

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Product

9.2.4 By Phase

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Product

9.3.4 By Phase

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Product

9.4.4 By Product

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Product

9.5.4 By Phase

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Synthetic Lipid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Avanti Polar Lipids, Inc.

10.2 Cayman Chemical Company

10.3 NOF Corporation

10.4 Lipoid GmbH

10.5 Merck KGaA

10.6 Matreya LLC

10.7 Croda International Plc

10.8 Laysan Bio, Inc.

10.9 CordenPharma International

10.10 Nanostellar, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Synthetic Lipid market is expected to be valued at US$ 2.22 million.

Through 2030, the Global Synthetic Lipid market is expected to grow at a CAGR of 5.8%.

By 2030, Global Synthetic Lipid Market expected to grow to a value of US$ 3.29 million.

Asia- Pacific is predicted to lead the Global Synthetic Lipid market.

The Global Synthetic Lipid Market has segments By Application, Phase, Product and Region.