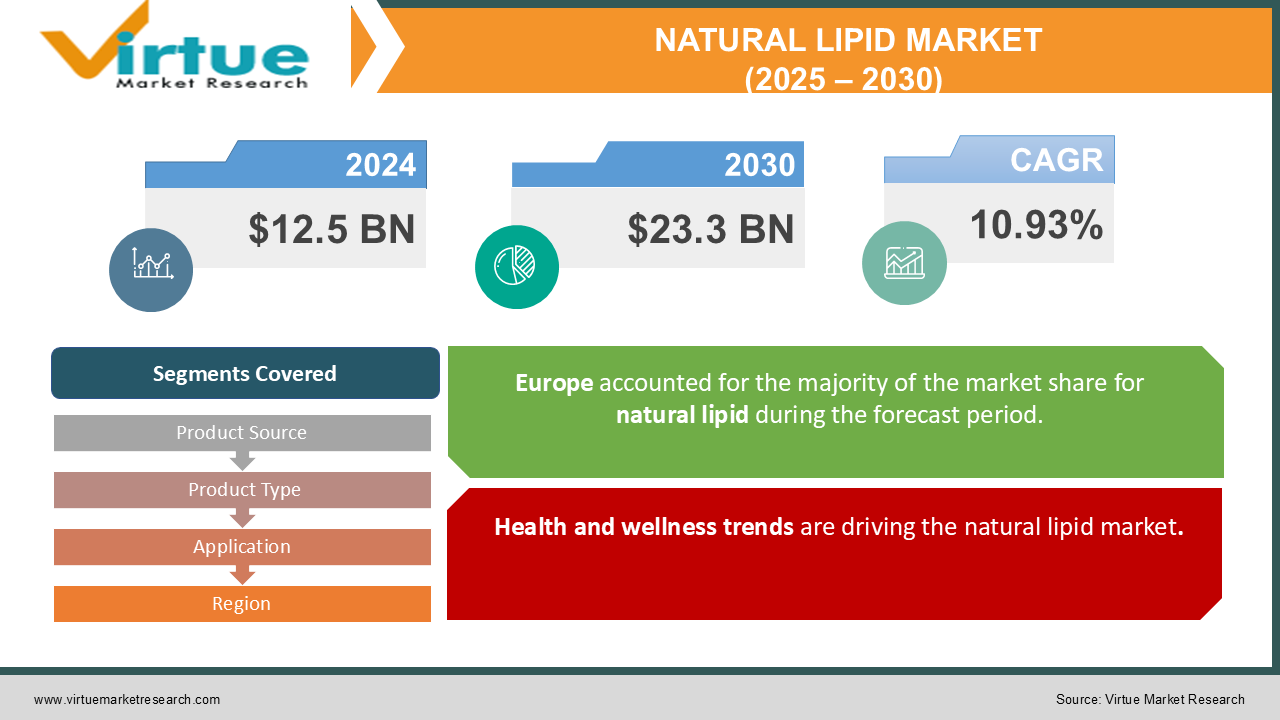

Natural Lipid Market Size (2025 – 2030)

The Natural Lipid Market was valued at USD 12.5 Billion and is projected to reach a Market size of USD 23.3 Billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 10.93%.

The natural lipid market encompasses a broad variety of plant and animal fats and oils used extensively in the food and beverage, cosmetic, pharmaceutical, and nutraceutical industries. With consumers becoming increasingly concerned with natural, sustainable, and healthy ingredients, the market for these products has expanded enormously. Key drivers are increasing awareness about health benefits associated with natural lipids, demand for clean-label products, and preference for plant-based alternatives. Advances in extraction and processing technologies drive the market; natural lipids are now an essential constituent in all applications ranging from functional foods to bio-based personal care products.

Key Market Insights:

-

Increasing consumer interest in natural, minimally processed ingredients has sparked a growing demand for plant-based lipids such as algal, nut, and seed lipids. The COVID-19 pandemic also contributed to increasing awareness of natural lipids.

-

Consumers are demanding lipids enriched with functional ingredients such as omega-3 fatty acids, antioxidants, and phytosterols for health-promoting products. A lot of these lipids are very beneficial for eye health and immunity.

-

Innovations in technologies for the extraction and processing of lipids allow manufacturers to make higher-quality, more sustainable lipid products.

-

Strict quality, safety, and environmental standards applicable to the production of lipids can result in higher costs of production for manufacturers and added complexity.

-

Lipid prices have been fluctuating due to raw material costs, supply chain disruptions, and geopolitical events that have made the management of costs and profit margins challenging.

-

AI-driven optimization is enhancing the design and efficacy of lipid nanoparticles used in drug delivery systems, such as mRNA vaccines and gene therapies.

Natural Lipid Market Drivers:

Health and wellness trends are driving the natural lipid market.

Consumers are increasingly concerned with health and wellness, which has increased demand for natural lipids that provide functional benefits such as omega-3 fatty acids, antioxidants, and phytosterols. This is driven by increasing awareness of the health benefits associated with natural ingredients and a shift towards clean-label products. Increasing use of chemicals can cause harm to health and naturally occurring ingredients can be much safer and thus preference for natural contents is significantly increasing.

Role of lipids in medicinal use and research.

Lipids play a crucial role in the treatment of cancers, metabolic disorders, drug discovery and development, neuroscience, and cardiovascular health. Also, natural lipids are central to numerous physiological processes, making them indispensable for life. Understanding the functions of lipids is crucial in comprehending their significance in biological systems. They also play a crucial role in energy storage, cell membrane structure, hormone regulation, vitamin absorption, insulation, cushioning in the joints, and even signal transduction. Due to the variety of roles they play in the body, they are always studied and used in the medicine market.

Innovation and advancements in lipid extraction.

Innovations in lipid extraction and processing technologies are allowing for the production of higher quality and more sustainable lipid products. This is making natural lipids more accessible and cost-effective, which further boosts market growth.

Natural Lipid Market Restraints and Challenges:

Raw material availability and costing.

One major limitation lies in the availability of high-quality raw materials, including specific plant oils and animal fats. Supply chain disruption and higher costs due to these shortfalls can have devastating impacts on market stability. Competing demands from other industries like biofuels and cosmetics further fuel this problem. As demand grows, securing a consistent supply of raw materials sustainably becomes a gigantic challenge. The manufacturers would need to seek other sources or synthetics for such risks.

Regulatory compliance can be difficult for some manufacturers.

The natural lipid market is heavily regulated in terms of quality, safety, and environmental impact. Meeting these regulations may increase the cost of production and complexity for manufacturers. Moreover, the varying regulations across different regions and markets make it even more complicated. Non-compliance can lead to product recalls, legal issues, and damage to brand reputation. Companies must invest in robust quality control and compliance systems to meet these requirements.

The market can be unstable frequently.

Market instability may arise through fluctuations in raw material cost, supply chain disruption, and geopolitical events. Unpredictability renders it difficult for manufacturers to control their cost of production, thereby eroding profit margins. Such external factors as weather patterns affecting crop yield or political instability in a producing region may compound price volatility further. Firms may then have to resort to hedging or diversification of their supplies. Effective risk management practice is necessary for the management of uncertainties in the market.

NATURAL LIPID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.93% |

|

Segments Covered |

By Product Source, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DSM, Cargill, Omega Protein Corporation, Archer Daniels Midland Company (ADM), BASF SE, Koninklijke DSM N.V., Croda International Plc., Moderna, BioNTech SE, Pfizer |

Natural Lipid Market Segmentation: by Product Source

-

Plant-based

-

Animal-based

In product sources, the market is subdivided into plant and animal-based forms. The production of plant-based types, like seed oils and vegetable oils, overshadows the consumption of natural sources due to better availability and environment-friendly aspects and holds a strong 60% market share in the industry.

Animal-based is classified into fish and dairy fats because of the maximum content of Omega-3 acid and its abundance in the dietary supplement and pharmaceutical industry, thus retaining a 40% market share.

Natural Lipid Market Segmentation: by Product Type

-

Glycerophospholipid

-

Cholesterol

-

Monoglycerols

-

Diacylglycerols

-

Fatty acids

When it comes to product type, the market is divided into glycerophospholipids, cholesterol, monoglycerols, diacylglycerols, and fatty acids. Glycerophospholipids are the top segment, primarily used in food and pharmaceutical industries, sharing about 35% of the market.

Cholesterol is essential for maintaining cell membrane structure and is widely used in dietary supplements, holding 25% of the market share.

Monoglycerols and diacylglycerols are used in food processing and functional foods, respectively, and each share about 15% and 10% of the market share.

Fatty acids, especially omega-3 and omega-6, are essential for overall health and wellness, accounting for the remaining 15% of the market share.

Natural Lipid Market Segmentation: by Application

-

Food and beverages

-

Dietary supplements and nutraceuticals

-

Pharmaceuticals

-

Animal Nutrition

The natural lipid market is further segmented into food and beverages, dietary supplements and nutraceuticals, pharmaceuticals, and animal nutrition, by application. Food and beverages are the largest application segment, due to the consumer demand for healthier food options, accounting for 40% of the market share.

Dietary supplements and nutraceuticals come at the second position, benefiting from the growing awareness of health and wellness, representing 30% of the market share.

The pharmaceuticals segment uses lipids in drug delivery systems and vaccine formulations, holding about 20% of the market share. The smallest segment is animal nutrition, which focuses on improving livestock health and productivity, with 10% of the market share.

Natural Lipid Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Among all the regions, the largest share of the natural lipid market is held by the North American region, there is very high consumer awareness of health and wellness as well as a strong demand for natural and clean-label products. The region accounts for around 35% of the market share, which is mainly driven by the food and beverage, dietary supplements, and pharmaceutical industries.

Europe is another significant market for natural lipids, focusing very much on sustainability and regulatory compliance. It accounts for approximately 25% of the market share, as the food industry is strong, and consumer demand for more plant-based and eco-friendly products is on the rise.

The Asia-Pacific region is growing rapidly in the natural lipid market, driven by rising incomes, urbanization, and a growing middle class. This region accounts for about 20% of the market share, with significant demand from the food and beverage, pharmaceutical, and personal care industries.

South America represents a growing market for natural lipids, thanks to the awareness of healthiness and the shift in preference towards using natural ingredients. The region currently accounts for a share of approximately 10%, with Brazil and Argentina being prominent contributors.

Natural lipids have a considerably increasing demand from the food and beverage and pharmaceutical sectors, and the Middle East and Africa represent an emerging market in this segment. This region approximately shares 10% of the market share, with growth opportunities stemming from increasing health awareness and economic development.

COVID-19 Impact Analysis on the Natural Lipid Market:

The COVID-19 pandemic had a mixed impact on the Natural Lipid market. Due to the pandemic, and increasing medical awareness through social media, people started to prefer dietary supplements to boost immunity. This resulted in increased demand for natural lipids from the nutraceutical industry. On the other hand, typical industrial issues like labor shortages, supply chain disruptions, increased raw material costs, and transportation issues hampered the growth of the industry. Also, several countries imposed restrictions on the import/export domain, which resulted in shortages of raw materials as well as products.

Latest Trends/ Developments in the Natural Lipid Market:

Several key trends and developments are ongoing in the natural lipid market. Consumer demand for functional ingredients continues to impart the use of lipids in food and personal care products. The development of lipid-based drug delivery systems is also taking place, with recent momentum around mRNA vaccines and gene therapies.

At the same time, there is a growing interest in sustainable and plant-based sources of lipids, coupled with investments in research and development to produce "green" products. These reflect the industry trends going more towards health, sustainability, and advanced technologies.

Key Players:

-

DSM

-

Cargill

-

Omega Protein Corporation

-

Archer Daniels Midland Company (ADM)

-

BASF SE

-

Koninklijke DSM N.V.

-

Croda International Plc.

-

Moderna

-

BioNTech SE

-

Pfizer

Chapter 1. Natural Lipid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Lipid Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Lipid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Lipid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Lipid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Lipid Market – By Product Source

6.1 Introduction/Key Findings

6.2 Plant-based

6.3 Animal-based

6.4 Y-O-Y Growth trend Analysis By Product Source

6.5 Absolute $ Opportunity Analysis By Product Source, 2025-2030

Chapter 7. Natural Lipid Market – By Product Type

7.1 Introduction/Key Findings

7.2 Glycerophospholipid

7.3 Cholesterol

7.4 Monoglycerols

7.5 Diacylglycerols

7.6 Fatty acids

7.7 Y-O-Y Growth trend Analysis By Product Type

7.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 8. Natural Lipid Market – By Application

8.1 Introduction/Key Findings

8.2 Food and beverages

8.3 Dietary supplements and nutraceuticals

8.4 Pharmaceuticals

8.5 Animal Nutrition

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Natural Lipid Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Source

9.1.3 By Product Type

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Source

9.2.3 By Product Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Source

9.3.3 By Product Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Source

9.4.3 By Product Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Source

9.5.3 By Product Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Natural Lipid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DSM

10.2 Cargill

10.3 Omega Protein Corporation

10.4 Archer Daniels Midland Company (ADM)

10.5 BASF SE

10.6 Koninklijke DSM N.V.

10.7 Croda International Plc.

10.8 Moderna

10.9 BioNTech SE

10.10 Pfizer

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Natural Lipid Market was valued at USD 12.5 Billion and is projected to reach a Market size of USD 23.3 Billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 10.93%.

Preference for more and more natural ingredients in medicines, advancements in the technology for the extraction of lipids, increasing health awareness, and the advantage of natural lipids are driving the natural lipid market.

By Application, Food and beverages, Dietary supplements and nutraceuticals, Pharmaceuticals, and Animal nutrition are the segments under the Natural Lipid market.

North America is the most dominant region for the Natural Lipid Market.

DSM, Cargill, Omega Protein Corporation, Archer Daniels Midland Company (ADM), BASF SE, Koninklijke DSM N.V., Croda International Plc., Moderna, BioNTech SE, Pfizer etc.