Lipid Market Size (2024 – 2030)

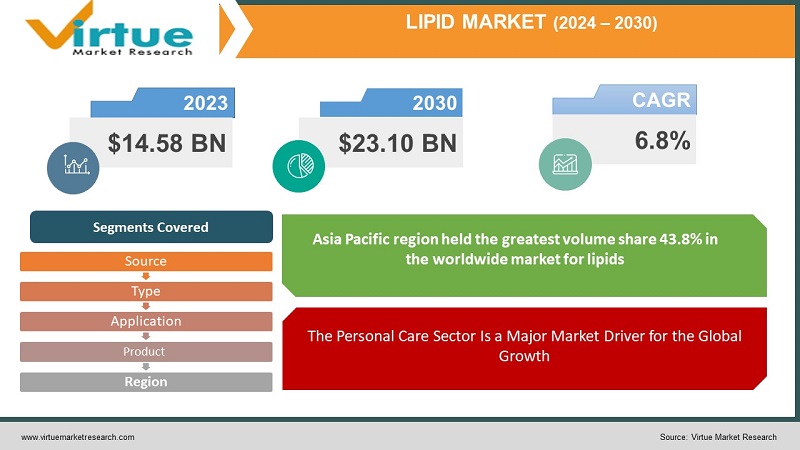

The Global Lipid Market was valued at USD 14.58 billion and is projected to reach a market size of USD 23.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.8%.

A collection of chemical substances known as lipids may be found in microorganisms, plants, and mammals. They consist of waxes, fats, waxes, sterols, and fat-soluble vitamins. Lipids can carry out a variety of tasks. They are also renowned for having minimal levels of toxicity. These characteristics of lipids aid in the efficient distribution of drugs. As a result, they are being employed as excipients in the manufacture of drugs more often. The pharmaceutical lipids market is expanding globally as a result of this aspect.

Key Market Insights:

Deerland Probiotics & Enzymes, a probiotic, prebiotic, and enzyme-based global supplier of nutritional supplements with headquarters in Kennesaw, Georgia, was purchased by Archer Daniels Midland. The purchase aided ADM in better servicing clients throughout the world and enabling it to maintain its innovation leadership in functional foods and dietary supplements.

The biotechnology business Avanti Polar Lipids was fully acquired by Croda International. The acquisition combined Croda's array of life science products and cGMP manufacturing capabilities with Avanti's expertise in lipid-based drug delivery solutions to expand each company's offering of goods and services to biotechnology companies, academic institutions, and pharmaceutical companies around the world.

High-quality oil for maternal and early-life nutrition was launched by DSM under the name DHA SF55-0200DS. This product, the only 550 mg/g natural triglyceride DHA made for use in maternal nutrition, was created for use by women who are trying to get pregnant, already pregnant, nursing, or postpartum women who are not breastfeeding.

Global Lipid Market Drivers:

The market is driven by awareness of superior functional properties:

Increased fast food consumption, sedentary lifestyles, and rapid urbanization are all contributors to the rise in obesity and other health issues. As a result, there is an increase in the demand for nutritional lipids globally and in people's awareness of their health. Numerous food manufacturing enterprises are also switching lipids for synthetic flavoring carriers to maintain the flavor and scent of their goods. These superior functional properties that account for this include density, hydrogenation, and emulsification.

The Personal Care Sector Is a Major Market Driver for the Global Growth:

As lipids become more widely used as a natural component in the personal care industry, it is projected that the global market will expand. Significant companies are also developing healthy components to expand their impact in the pharmaceutical and food and beverage (F&B) industries. To boost total sales, they also heavily rely on marketing strategies like celebrity endorsements. Because of the expanding populations of vegans and vegetarians as well as the growing desire for dietary supplements that provide adequate nutrition, there is an increase in the market for lipid supplements globally.

Global Lipid Market Challenges:

Lipids' health risks might hinder the market's expansion:

Eating too much lipids can raise the risk of liver and heart disease even though they are essential for optimum health and the preservation of human existence. Low-density lipoprotein (LDL) buildup can cause atherosclerosis, which can cause a heart attack or stroke by blocking the arteries. By reducing dietary cholesterol and fat intake and raising HDL levels, high LDL levels can be avoided. Additionally, animal meats, butter, and full-fat dairy products include saturated fats (a lipid type), which can raise the risk of heart disease. When ingested in excess, these fats increase bad cholesterol while lowering good cholesterol. Therefore, these lipid-related health hazards are limiting the market's expansion.

Global Lipid Market Opportunities:

The Pandemic and Technological Advances Open Up New Opportunities:

Throughout the projected period, the main market drivers including technical advancements such as microencapsulation will support industry expansion, including growing usage of baby formula and dietary supplements. Additionally, the advent of well-known raw material suppliers has opened up a lot of opportunities for this industry. Due to the increasing introduction of new lipids over the past ten years that have shown tremendous potential for medicinal and dietary applications, lipids are expected to have a beneficial influence on the industry in the years to come. To keep healthy amid the COVID-19 pandemic and lockdown scenario, people are more health-conscious and focused on bolstering their immune systems. This would prevent the COVID-19 assault from infecting users. Customers are spending more money on nutritious and healthful meals as a consequence. Therefore, it is projected that the sector will see a positive market development rate over the forecast period.

LIPID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Source, Type, Application, Product and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill Inc., BASF SE, Archer Daniels Midland Company (ADM), Kerry, Nordic Naturals Inc.,Clover Corporation, Croda International Plc, Lipoid Kosmetik AG, Omega Protein Corporation, DSM Polaris |

Global Lipid Market Segmentation: By Source

-

Plant

-

Animals

The lipid market is divided into plant and animal sources based on the source. With 61% of the market in 2022, the plant-based category had the largest share as well and is anticipated to hold that position throughout the forecast period growing at the fastest pace. Natural lipids may be found in a variety of plant-based foods, such as avocado, olive, dark chocolate, broccoli, etc. The body receives energy and muscle power from the plentiful healthy fats found in plant-based goods, which are rich in lipid sources.

Global Lipid Market Segmentation: By Type

-

Omega-3

-

Omega-6

-

MCT

-

Others

The lipid market is divided into categories for omega 3 and omega 6, medium-chain triglycerides (MCTs), and others based on type. The omega 3 and omega 6 segments are anticipated to hold a significant market share during the forecast period due to their importance as building blocks for cell membranes and as precursors to many substances in the body, including those involved in blood pressure control and inflammatory responses.

Global Lipid Market Segmentation: By Application

-

Food & Beverages

-

Nutrition & Supplement

-

Feed

-

Others

According to the applications, food and beverage applications accounted for a market share of above 39% in 2022. A CAGR of 8.4% is anticipated for its growth. The expanding significance of lipids in human bodies and their functional advantages is one of the primary drivers of the expansion of the food and beverage industry. Lipids are used in the manufacturing process of commercial foods to improve the flavor, consistency, and density.

Because lipids are used more often in drug development and several other pharmaceutical applications, the demand for them is anticipated to rise. It was one of the essential components used in the creation of the COVID-19 vaccines in 2022. In the pharmaceutical business, it is recognized as a crucial excipient for the creation of the majority of dosage forms. Pharmaceuticals are projected to see an increase in demand as people's concerns about their health continue to grow, which will drive category growth. Increasing dietary consumption and supplement use as well as public awareness of fitness and health are other important development factors. Lipids have a role in the diet by influencing the caloric content, texture, flavor, and absorption of fat-soluble vitamins and minerals, which serve as a form of energy storage.

Global Lipid Market Segmentation: By Product

-

Triglycerides

-

Phospholipids

In 2022, the triglycerides market segment led the sector and generated 44% of the total revenue. Its significant market share can be attributed to the rising demand for triglyceride derivatives, namely medium-chain and long-chain triglycerides, from end-use sectors including nutritional supplements and functional drinks, among others. Triglyceride lipids are widely employed in a range of functional foods and beverages because they are a significant source of energy. Over the course of the projection period, the phospholipids segment is anticipated to experience significant expansion. This is because phospholipids have outstanding qualities that make them important components in the creation of functional meals and dietary supplements.

The industry is also expected to be driven by the expanding usage of phospholipids in a variety of pharmaceutical technologies as wetting agents, emulsifiers, and builders of micelles, cubosomes, liposomes, and other structures. The expansion of the category will be supported by the rising demand for sphingolipids from a range of end-use industries, including cosmetic and personal care and other applications. The growing awareness of the benefits of sphingolipids is another factor driving and fueling the expansion of this market. The considerable generation of ionizable lipids with better in vivo potency allowed for the creation of lipid nanoparticles and the current clinical studies for mRNA-based COVID-19 vaccines. As a result of research efforts to produce ionizable lipids with improved characteristics, the market might grow. The market's expansion may also be ascribed to ongoing research and financial investments made in the development of medication delivery systems.

Global Lipid Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, the Asia Pacific region held the greatest volume share 43.8% in the worldwide market for lipids. India and China have a favorable impact on the area. A growing population, shifting lifestyles, supportive governmental regulations, and investments by big businesses are what are driving the industry. The rising demand for nutraceutical goods and the development of the local pharmaceutical sector serve as indicators of this. Due to increased demand in the nutraceutical business, India would likely have the highest share of the Asia Pacific lipids market.

In 2022, North America's market was expected to account for 24.8% of the worldwide market and rise by 8.3%. The United States has a favorable effect on the market. Growing interest in health & and fitness in the area is assisting the industry. Fortified foods and nutritional supplements have a substantial industry in this region.

COVID-19 Impact on Global Lipid Market:

To ensure a steady supply of lipid products throughout the coronavirus crisis, manufacturers in the lipids industry are maintaining optimal inventory levels. To lessen reliance on imports of raw materials, they are expanding their domestic manufacturing capacity. Businesses use mergers and acquisitions (M&As) to increase their market reach before branching out into new regions. To maintain the economies, chemical businesses are concentrating on applications in the food and pharmaceutical sectors that are necessary. To deal with the effects of the pandemic, domestic and international businesses are undergoing a fast change in supply chain planning, operations, and inventory management.

Global Lipid Market Recent developments:

DSM and Firmenich have decided to collaborate to create a new business named "DSM-Firmenich," which will be a prominent partner in the industries of well-being, nutrition, and beauty. Combining the premier Perfumery and Taste businesses, research platforms, and co-creation capabilities of Firmenich with DSM's Health and Nutrition portfolio and scientific know-how will play to each company's strengths.

To form a cooperation with Evonik, Royal DSM acquired a 200 million USD market share of produced omega 3s, which allowed it to launch Veramaris 50-50. Here, marine algae that are useful in salmon aquaculture are used to make the lipid.

OZiva produced omega-3 multivitamins in line with the emerging dietary lipid market trend. A few supplements were produced based on the expectations for the nutritional lipid industry, which contributed to fueling the marketing fad.

Key Players:

-

Cargill Inc.

-

BASF SE

-

Archer Daniels Midland Company (ADM)

-

Kerry

-

Nordic Naturals Inc.

-

Clover Corporation

-

Croda International Plc

-

Lipoid Kosmetik AG

-

Omega Protein Corporation

-

DSM

-

Polaris

Chapter 1. Lipid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Lipid Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lipid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lipid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lipid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lipid Market – By Source

6.1 Introduction/Key Findings

6.2 Plant

6.3 Animals

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Lipid Market – By Type

7.1 Introduction/Key Findings

7.2 Omega-3

7.3 Omega-6

7.4 MCT

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Lipid Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Nutrition & Supplement

8.4 Feed

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 9. Lipid Market – By Product

9.1 Introduction/Key Findings

9.2 Triglycerides

9.3 Phospholipids

9.4 Y-O-Y Growth trend Analysis By Product

9.5 Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 10. Lipid Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Source

10.1.2.1 By Product

10.1.3 By By Application

10.2 By Type

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By Source

10.3.3 By Type

10.3.4 By By Application

10.3.5 By Product

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By Source

10.4.3 By Type

10.4.4 By By Application

10.4.5 By Product

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By Source

10.5.3 By Type

10.5.4 By By Application

10.5.5 By Product

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By Source

10.6.3 By Type

10.6.4 By By Application

10.6.5 By Product

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Lipid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Cargill Inc.

11.2 BASF SE

11.3 Archer Daniels Midland Company (ADM)

11.4 Kerry

11.5 Nordic Naturals Inc.

11.6 Clover Corporation

11.7 Croda International Plc

11.8 Lipoid Kosmetik AG

11.9 Omega Protein Corporation

11.10 DSM

11.11 Polaris

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lipid Market was valued at USD 14.58 billion and is projected to reach a market size of USD 23.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.8%.

The market is driven by awareness of superior functional properties and The Personal Care Sector Is the Market Driver are the factors driving the Global Lipid Market.

Lipids' health risks might hinder the market's expansion.

Pharmaceutical application type is the fastest growing in the Global Lipid Market.

North America region is the fastest growing in the Global Lipid Market.