Emulsifiers Market Size (2025-2030)

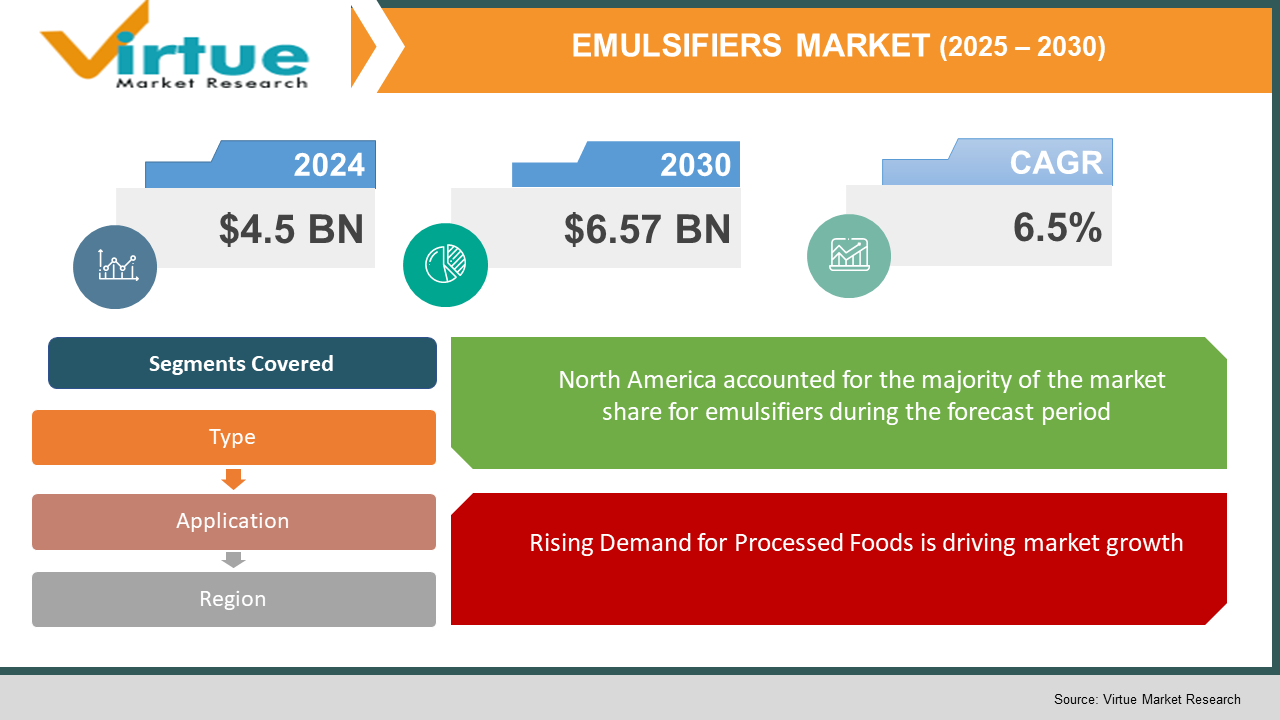

The Global Emulsifiers Market was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 6.57 billion by 2030.

Emulsifiers are critical agents used to stabilize mixtures of immiscible substances like oil and water, primarily in the food, beverage, pharmaceutical, and personal care industries. With the growing demand for processed and convenience foods, coupled with rising consumer preferences for natural and clean-label ingredients, the emulsifiers market is set for substantial growth in the forecast period.

Key Market Insights:

- The food and beverage industry accounts for the largest share of the emulsifiers market, driven by the increasing demand for bakery products, confectionery, and processed foods. For instance, the use of lecithin in bakery items surged by 15% from 2022 to 2024 due to its multifunctional properties.

- Natural emulsifiers are gaining traction, with an estimated 40% of new product launches in 2023 emphasizing clean-label claims. This shift is expected to dominate the market, particularly in North America and Europe.

- Technological advancements in emulsifier production, such as enzymatic synthesis and nano-emulsion techniques, are enhancing product performance and expanding applications in niche areas like nutraceuticals and plant-based products.

- The personal care and cosmetics sector is emerging as a significant growth area, with emulsifiers being used extensively in formulations of lotions, creams, and hair care products.

- Asia-Pacific is the fastest-growing region for emulsifiers, accounting for 35% of the market's growth, supported by rising disposable incomes and rapid urbanization in countries like China and India.

- Regulatory changes, such as restrictions on synthetic emulsifiers in the European Union, are pushing manufacturers to innovate with plant-based alternatives, creating new opportunities in the market.

Global Emulsifiers Market Drivers:

Rising Demand for Processed Foods is driving market growth:

The increasing global population and busy lifestyles have fueled the demand for processed and convenience foods, propelling the growth of the emulsifiers market. Emulsifiers are essential in maintaining the texture, stability, and shelf life of products like sauces, spreads, and bakery goods. According to a 2023 study, over 60% of consumers in developed economies prefer processed foods, driving the adoption of food emulsifiers. Moreover, the versatility of emulsifiers in creating low-fat and low-calorie food options aligns with current health trends, boosting market growth. The growing preference for plant-based and allergen-free emulsifiers further expands the market's potential, particularly among health-conscious consumers.

Shift Toward Natural Ingredients is driving market growth:

Consumer demand for clean-label and natural food products is a major driver for the emulsifiers market. Natural emulsifiers, derived from sources like soy, sunflower, and seaweed, are increasingly being preferred due to their non-toxic, sustainable, and eco-friendly attributes. This shift is particularly evident in developed regions like Europe and North America, where regulatory bodies emphasize transparency in ingredient labeling. The rise of vegan and organic product lines also complements this trend. By 2024, natural emulsifiers are expected to account for 50% of all emulsifiers used in food applications, marking a paradigm shift in the industry.

Expanding Applications Beyond Food and Beverages is driving market growth:

The versatility of emulsifiers has driven their adoption in non-food sectors, including pharmaceuticals, personal care, and industrial applications. In personal care, emulsifiers are integral to formulating stable and aesthetically pleasing products like creams, lotions, and hair conditioners. Similarly, the pharmaceutical sector uses emulsifiers in drug formulations, particularly in creating emulsions and suspensions. In industrial applications, emulsifiers enhance the efficacy of lubricants, paints, and coatings. This broad application scope ensures a steady demand for emulsifiers across diverse industries, contributing to their market growth.

Global Emulsifiers Market Challenges and Restraints:

Stringent Regulatory Landscape is restricting market growth:

The emulsifiers market faces challenges from stringent regulations imposed by agencies such as the FDA, EFSA, and others. Synthetic emulsifiers like mono- and diglycerides often face scrutiny due to potential health risks, leading to restrictions or outright bans in some regions. Complying with these regulations adds to production costs, especially when switching to natural or organic alternatives. Furthermore, the time-consuming process of gaining approvals for new products hinders the pace of innovation in the market. Small and medium-sized enterprises, in particular, struggle to cope with these regulatory requirements, limiting their ability to compete effectively.

Price Volatility of Raw Materials is restricting market growth:

The fluctuating prices of raw materials like lecithin, sorbitan esters, and glycerol pose significant challenges to emulsifier manufacturers. Factors such as unpredictable climatic conditions, geopolitical tensions, and supply chain disruptions contribute to this volatility. For example, the global supply chain crisis in 2022 led to a 20% surge in the price of soy lecithin, impacting the profit margins of manufacturers. Additionally, the transition toward plant-based and non-GMO raw materials often involves higher production costs, which can make products less competitive in price-sensitive markets.

Market Opportunities:

The emulsifiers market presents significant opportunities for growth, driven by the increasing demand for sustainable and innovative products across industries. The rising popularity of plant-based foods and beverages opens up new avenues for natural emulsifiers derived from soy, sunflower, and algae. Furthermore, the clean-label trend offers opportunities for manufacturers to create premium products that align with consumer preferences for transparency and health benefits. Emerging markets, particularly in Asia-Pacific and South America, offer untapped potential due to rapid urbanization, growing disposable incomes, and the expansion of retail networks. The growing adoption of emulsifiers in pharmaceuticals and personal care products also presents an avenue for diversification, as these sectors prioritize high-quality and multifunctional ingredients. Additionally, advancements in technology, such as microencapsulation and bio-based emulsifiers, are expected to revolutionize the market by enhancing product performance and sustainability.

EMULSIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, ADM, BASF SE, Dow Inc., Kerry Group, Corbion, Ingredion, Incorporated, Palsgaard, Stepan Company, Solvay |

Emulsifiers Market Segmentation:

Emulsifiers Market Segmentation By Type:

- Lecithin

- Mono- and Diglycerides

- Sorbitan Esters

- Polyglycerol Esters

- Others

Mono- and diglycerides dominate the emulsifiers market, accounting for 40% of total revenue in 2024. Their widespread application in bakery, confectionery, and dairy products due to their cost-effectiveness and multifunctional properties makes them the most sought-after emulsifier type.

Emulsifiers Market Segmentation By Application:

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Industrial Applications

The food and beverages sector is the largest application segment, contributing to over 60% of the market revenue in 2024. The increasing demand for processed and convenience foods, coupled with the functionality emulsifiers offer in enhancing texture and stability, drives this dominance.

Emulsifiers Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America leads the emulsifiers market, accounting for 35% of the global revenue in 2024. This dominance is attributed to the high demand for processed foods, advanced food processing technologies, and the growing preference for natural and clean-label ingredients. The region also benefits from robust R&D activities and the presence of key players who are actively innovating in the field. The U.S. and Canada drive the market growth, supported by favorable regulations promoting the use of natural emulsifiers.

COVID-19 Impact Analysis on the Emulsifiers Market:

The COVID-19 pandemic had a mixed impact on the emulsifiers market, affecting various sectors in different ways. In the food and beverage industry, the demand for processed and packaged foods surged as lockdowns and work-from-home policies altered consumer behavior. With more people staying at home, there was a notable increase in the consumption of ready-to-eat and convenience foods, driving the need for emulsifiers that ensure product stability and quality. However, supply chain disruptions and shortages of raw materials caused production delays and led to rising costs for manufacturers in this sector. The personal care industry, on the other hand, faced a temporary decline during the pandemic, particularly in the demand for non-essential products like cosmetics, as consumers focused on essential items. Despite this setback, the sector experienced a strong recovery as interest in skincare, hygiene products, and personal wellness grew. The increased emphasis on hygiene, driven by the pandemic, led to higher demand for products such as hand sanitizers, soaps, and moisturizers, which require emulsifiers to improve texture and stability. Additionally, the pandemic accelerated the shift toward natural and sustainable ingredients, as consumers became more health-conscious and environmentally aware. This growing preference for clean-label products and natural formulations led to an increased demand for plant-based and eco-friendly emulsifiers. Overall, despite the challenges faced by various sectors, the emulsifiers market demonstrated resilience. As the global economy recovers and consumer preferences continue to evolve, the market is expected to grow further, driven by innovations in sustainability, health-conscious formulations, and the ongoing demand for functional ingredients in a wide range of applications.

Latest Trends/Developments:

The emulsifiers market is currently experiencing significant trends that are shaping its future. One prominent trend is the growing demand for plant-based and vegan emulsifiers, which are derived from natural sources such as algae and soy. As consumers increasingly seek healthier and more sustainable products, these natural emulsifiers offer a clean and eco-friendly alternative to traditional ingredients. This shift aligns with the broader movement towards plant-based and vegan formulations across various industries. In addition to plant-based alternatives, clean-label emulsifiers are gaining popularity. Consumers are increasingly prioritizing transparency in ingredient lists, seeking products that meet health standards and contain fewer artificial additives. Clean-label emulsifiers, which are simple, recognizable, and free from unnecessary chemicals, are therefore in high demand as manufacturers respond to these consumer preferences. Technological advancements are also playing a key role in the evolution of emulsifiers. Innovations such as enzymatic synthesis and nanotechnology are enhancing the functionality and stability of emulsifiers, allowing them to be used more effectively across a range of applications. These advancements enable emulsifiers to perform better, providing improved texture, stability, and performance in products like food, cosmetics, and pharmaceuticals. The demand for emulsifiers is also expanding beyond the food industry, particularly in non-food sectors like personal care and pharmaceuticals. In these industries, manufacturers are developing multifunctional emulsifiers that serve a variety of purposes, such as improving product texture, enhancing shelf life, and boosting performance. This trend reflects the increasing need for versatile ingredients in a wide range of consumer goods. Sustainability remains a central focus in the emulsifiers market. Companies are investing in bio-based and eco-friendly emulsifier solutions to meet both regulatory requirements and growing consumer expectations for sustainable products. These efforts are helping to drive the market toward more responsible and environmentally-conscious formulation.

Key Players:

- Cargill

- ADM

- BASF SE

- Dow Inc.

- Kerry Group

- Corbion

- Ingredion Incorporated

- Palsgaard

- Stepan Company

- Solvay

Chapter 1. Global Emulsifiers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Emulsifiers Market– Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Emulsifiers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Emulsifiers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Emulsifiers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Emulsifiers Market – By Type

6.1 Introduction/Key Findings

6.2 Lecithin

6.3 Mono- and Diglycerides

6.4 Sorbitan Esters

6.5 Polyglycerol Esters

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Global Emulsifiers Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Personal Care and Cosmetics

7.4 Pharmaceuticals

7.5 Industrial Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Emulsifiers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Emulsifiers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill

9.2 ADM

9.3 BASF SE

9.4 Dow Inc.

9.5 Kerry Group

9.6 Corbion

9.7 Ingredion Incorporated

9.8 Palsgaard

9.9 Stepan Company

9.10 Solvay

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Emulsifiers Market was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 6.57 billion by 2030.

Key drivers include the rising demand for processed foods, the shift toward natural and clean-label ingredients, and expanding applications in non-food sectors such as personal care and pharmaceuticals

The market is segmented by product (lecithin, mono- and diglycerides, sorbitan esters, polyglycerol esters, and others) and by application (food and beverages, personal care and cosmetics, pharmaceuticals, industrial applications).

North America is the dominant region, accounting for 35% of global revenue in 2024, driven by high demand for processed foods and advancements in food processing technologies.

Leading players include Cargill, ADM, BASF SE, Dow Inc., Kerry Group, Corbion, Ingredion Incorporated, Palsgaard, Stepan Company, and Solvay.