Food Emulsifiers Market Size (2024 – 2030)

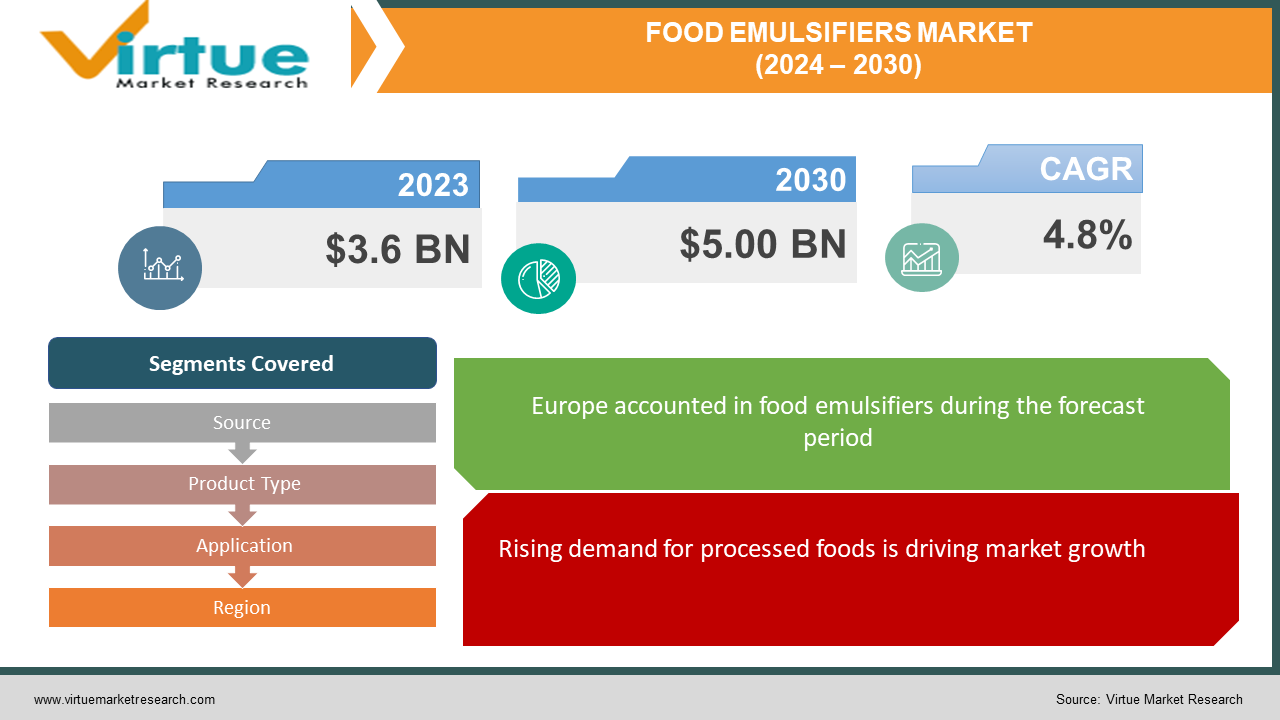

The valuation of the global food emulsifier market stood at USD 3.6 billion in 2023, with projections indicating a substantial growth trajectory to reach USD 5.00 billion by the conclusion of 2030. Forecasted for the period spanning 2024 to 2030, the market anticipates a robust compound annual growth rate (CAGR) of 4.8%.

Food additives called emulsifiers stabilize emulsions and keep liquids that don't usually mix from separating. They are added to a lot of food goods to improve their texture, look, and shelf life. Emulsifiers such as mustard, soy, and egg lecithin, polysorbates, carrageenan, guar gum, and canola oil are frequently employed in the manufacture of modern cuisine.

Key Market Insights:

Food emulsifier’s market growth is fueled by the ever-increasing demand for convenient processed foods. Emulsifiers are crucial ingredients in these products, ensuring texture, stability, and extended shelf life. However, the market faces challenges in the form of stricter regulations and lingering consumer concerns about the safety of certain emulsifiers. Transparency regarding sourcing and safety is key to building trust with health-conscious consumers, who increasingly seek clean-label ingredients.

Food Emulsifier Market Drivers:

Rising demand for processed foods is driving market growth.

The fast-paced lifestyle of many consumers fuels the demand for convenient, processed food options. Food emulsifiers play a crucial role in these products by creating stable emulsions, improving texture, and extending shelf life. This translates to a growing demand for emulsifiers by food manufacturers catering to the convenience food market.

Expanding the bakery and confectionery sector is accelerating market growth.

The global bakery and confectionery sector is witnessing steady growth. Food emulsifiers are essential ingredients in these products, helping achieve desired textures, improving volume, and enhancing overall mouthfeel. This expansion creates a ripple effect, driving the demand for emulsifiers within these sectors.

The clean-label movement is boosting the market.

While consumers appreciate the functionality of emulsifiers, there's a growing interest in clean-label ingredients. Manufacturers are responding by developing natural or organic emulsifiers derived from plant sources like soy lecithin or sunflower lecithin. This caters to consumer preferences for natural and recognizable ingredients.

Demand for low-fat and fat-reduced products is contributing to its success.

The health-conscious consumer trend has led to a rise in demand for low-fat and fat-reduced products. Food emulsifiers play a vital role in maintaining the texture and mouthfeel of these products, which can sometimes lack the richness of full-fat versions. This creates an opportunity for emulsifiers specifically designed for low-fat applications.

Food Emulsifier Market Restraints and Challenges:

Stringent regulations and consumer concerns can hinder market growth.

Regulatory bodies around the world are constantly evaluating the safety of food additives, including emulsifiers. Public concerns regarding certain emulsifiers and their potential health effects can create a negative perception and impact consumer purchasing decisions. The market needs to navigate these concerns by ensuring transparency and clear communication about the safety and functionality of emulsifiers.

Fluctuations in raw material prices can be a challenge.

Food emulsifiers are often derived from natural sources like vegetable oils or soy lecithin. Fluctuations in the prices of these raw materials due to weather patterns, global economic factors, or geopolitical instability can squeeze profit margins for manufacturers and potentially lead to price hikes for consumers. This market instability can affect purchasing decisions and overall market growth.

Increasing competition can create losses.

The food emulsifiers market is becoming increasingly competitive, with new players entering the scene and established brands vying for market share. This competition can lead to price wars and pressure on manufacturers to differentiate their products. Innovation in emulsifier functionality, focusing on natural ingredients, and catering to specific dietary needs can be key differentiators.

Sustainability concerns create obstacles.

Consumers are increasingly environmentally conscious and expect brands to be sustainable. This puts pressure on the food emulsifier market to address issues like sustainable sourcing of raw materials, eco-friendly production processes, and minimizing waste throughout the supply chain. Embracing sustainability practices can attract environmentally conscious consumers and build brand loyalty.

Food Emulsifier Market Opportunities:

Emulsifiers for plant-based products are beneficial.

The plant-based food sector is witnessing explosive growth. However, replicating the texture and mouthfeel of animal-derived products can be challenging. Food emulsifiers can play a crucial role in achieving this by stabilizing plant-based emulsions, mimicking fat texture, and improving the overall sensory experience. Developing emulsifiers specifically designed for plant-based applications presents a lucrative opportunity.

Tailored solutions for specific diets provide many possibilities.

Consumers with dietary restrictions like gluten-free, vegan, or keto are increasingly seeking delicious food options. Food emulsifiers can be instrumental in creating baked goods and processed foods that cater to these specific needs. Innovation in emulsifier functionality to ensure compatibility with these dietary restrictions can open doors to new market segments.

Emulsifiers with added functionality increase revenue.

The demand for functional foods continues to rise. Food emulsifiers can go beyond their traditional roles by offering additional benefits. These could include emulsifiers with prebiotic properties to promote gut health, emulsifiers that enhance nutrient delivery, or those that extend shelf life while minimizing the need for preservatives. Focusing on multi-functional emulsifiers caters to the health-conscious consumer and adds value to food products.

Enabling transparency builds trust.

Consumers are increasingly interested in understanding the ingredients in their food. Manufacturers can leverage this by promoting transparency in their emulsifier usage. This can involve using consumer-friendly language on labels, highlighting the functionality of emulsifiers, and educating consumers about their safety and benefits. Building trust through transparency can foster brand loyalty and a positive perception of food emulsifiers.

FOOD EMULSIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Source, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer-Daniels-Midland Company, Koninklijke DSM N.V, Cargill Inc., BASF SE, Ingredion Incorporated, Kerry Group Plc., E.I Dupont De Nemours and Company, Lonza Group AG., Puratos Group, Wilmar International Limited |

Food Emulsifiers Market Segmentation: By Source

-

Plant-derived

-

Animal-derived

Plant-derived emulsifiers emerge as the largest and fastest-growing segment, driven by various factors. Firstly, consumers' growing preference for natural and clean-label ingredients fuels the demand for plant-derived options like soy lecithin or sunflower lecithin. These ingredients are perceived as more natural and familiar, aligning well with the clean-label trend. Additionally, sustainability concerns play a significant role in the dominance of plant-derived emulsifiers. As consumers become more environmentally conscious, they gravitate towards products with lower environmental impact, making plant-derived options a preferred choice due to their sustainable practices. Moreover, the versatility and functionality of plant-derived emulsifiers contribute to their prominence in the market. These emulsifiers offer a wide range of functionalities similar to animal-derived options, effectively stabilizing emulsions, improving texture, and enhancing mouthfeel across various food applications. Furthermore, plant-derived emulsifiers address allergen concerns, catering to a growing segment of the population with allergies to animal-derived products.

Food Emulsifiers Market Segmentation: By Product Type

-

Lecithin

-

Derivatives of Mono- and Di-glycerides

-

Sorbitan Esters

-

Polyglycerol Esters

-

Stearoyl

-

Lactylates

-

Others

In the food emulsifier market, the largest segment comprises derivatives of mono-di-glycerides (MDGs), owing to their distinct qualities and functionalities. MDGs, on the other hand, offer a diverse range of functionalities within the emulsifier category, contributing to their prominence in the market. These compounds serve as multifunctional ingredients, acting as emulsifiers, dispersants, and texturizers, catering to specific requirements of food products. Notably, MDGs are often utilized in low-fat applications to maintain texture and mouthfeel, making them particularly relevant in a health-conscious market where consumers seek reduced-fat alternatives. Lecithin is the fastest-growing segment. Because of its natural origin and useful qualities, lecithin—which comes from sources including eggs and soybeans—is a flexible emulsifier that is frequently employed in a wide range of food items. It is essential for enhancing the texture, stability, and shelf life of products, including baked goods, sauces, and dressings. Additionally, lecithin's rise in the food emulsifier industry may have been aided by customer desires for clean-label goods and natural ingredients.

Food Emulsifiers Market Segmentation: By Application

-

Bakeries

-

Confectionaries

-

Dairy Products

-

Convenience Foods

-

Functional Foods

-

Salads and Sauces

-

Infant Formula

-

Others

The bakery & confectionery segment emerges as the leading application category, commanding significant dominance even when considered collectively. This prominence stems from various factors, including the widespread consumption and high volume of baked goods globally. Emulsifiers play a pivotal role in ensuring the stability of batters and frostings, enhancing texture and volume, and improving overall mouthfeel in products ranging from bread to pastries and cakes. Given the extensive use of emulsifiers across the diverse bakery and confectionery applications, this sector witnesses a substantial demand for these essential ingredients. Moreover, emulsifiers offer bakers and confectioners unparalleled functional versatility, extending beyond their fundamental emulsifying properties. These ingredients serve as indispensable tools, facilitating the achievement of specific textures, enhancing machinability in dough production for better handling, and contributing to shelf-life extension, thereby minimizing waste. The growth and innovation observed in the artisanal baking segment further drive the demand for high-quality emulsifiers tailored to meet specific requirements, fostering continuous development and introducing specialty options that elevate the taste, texture, and overall quality of artisanal baked goods. Convenience foods represent the fastest-growing application sector. The need for food emulsifiers has increased due to the rising popularity of convenience meals. A range of processed foods with extended shelf lives and ease of use may be found in this section. For consumers, convenience food items' primary qualities are their packaging, safety, use, nutritional content, diversity, and attractiveness. A rise in purchasing power, more knowledge of nutritious foods, the desire to try new cuisines, changes in social and economic patterns, and changes in meal patterns and eating habits are all contributing to the quicker growth of the convenience food market.

Food Emulsifiers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the region that leads the global market for food emulsifiers. This is because of its sizable and varied food and beverage sector as well as the importance placed on food quality and texture in Germany, France, and the UK. Emulsifiers are widely used in dairy products, confections, and bakeries. Furthermore, Europe leads the world market for food emulsifiers due to its well-established food processing sector, stringent quality regulations, dedication to natural ingredients, and clear labels. Plant-based emulsifiers are supported by the region's clean-label movement and the need for sustainable food production. Asia-Pacific is the fastest-growing market. Firstly, the region's flourishing food processing industry, propelled by urbanization and increasing disposable income, generates substantial demand for emulsifiers. These additives play a pivotal role in upholding texture, prolonging shelf life, and enhancing the overall quality of processed foods. Secondly, the region's burgeoning bakery and confectionery sector significantly contributes to the demand for emulsifiers. These essential ingredients aid in achieving desired textures, improving volume, and enhancing mouthfeel in various bakery and confectionery products, further fueling market growth in Asia. Moreover, this region exhibits a unique approach to the clean-label movement, with a strong emphasis on natural and traditional ingredients. Manufacturers respond to this preference by developing natural emulsifiers sourced from familiar elements like soy lecithin, which resonate well with Asian consumers. Additionally, the region's increasing focus on plant-based innovation, particularly in countries like China, poses challenges in replicating the texture of animal-derived products. Here, emulsifiers play a crucial role in stabilizing emulsions and mimicking fat texture, catering to the growing demand for plant-based alternatives.

COVID-19 Impact Analysis on the Global Food Emulsifiers Market:

The COVID-19 pandemic delivered a mixed impact on the food emulsifier market. Initial lockdowns triggered a surge in demand for shelf-stable processed foods, which heavily rely on emulsifiers for texture, stability, and extended shelf life. This presented a temporary boom for the market.

However, the pandemic also disrupted supply chains, causing temporary shortages and price fluctuations of raw materials used in emulsifier production. This squeezed profit margins for manufacturers and could have potentially impacted product availability. Additionally, with a shift towards health and immunity during lockdowns, some consumers opted for fresh ingredients over processed foods, leading to a potential decline in demand for some emulsifier applications. The long-term impact of COVID-19 remains to be seen. While the initial surge in processed food consumption may have subsided, the market is likely to adapt. Manufacturers focusing on emulsifier solutions for healthy, convenient, and shelf-stable food options can position themselves for continued success in the post-pandemic landscape. A focus on transparency regarding sourcing and safety can also address any lingering consumer concerns.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

Archer-Daniels-Midland Company

-

Koninklijke DSM N.V

-

Cargill Inc.

-

BASF SE

-

Ingredion Incorporated

-

Kerry Group Plc.

-

E.I Dupont De Nemours and Company

-

Lonza Group AG.

-

Puratos Group

-

Wilmar International Limited

Chapter 1. FOOD EMULSIFIERS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FOOD EMULSIFIERS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FOOD EMULSIFIERS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FOOD EMULSIFIERS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FOOD EMULSIFIERS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FOOD EMULSIFIERS MARKET – By Source

6.1 Introduction/Key Findings

6.2 Plant-derived

6.3 Animal-derived

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. FOOD EMULSIFIERS MARKET – By Product Type

7.1 Introduction/Key Findings

7.2 Lecithin

7.3 Derivatives of Mono- and Di-glycerides

7.4 Sorbitan Esters

7.5 Polyglycerol Esters

7.6 Stearoyl

7.7 Lactylates

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Product Type

7.10 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. FOOD EMULSIFIERS MARKET – By Application

8.1 Introduction/Key Findings

8.2 Bakeries

8.3 Confectionaries

8.4 Dairy Products

8.5 Convenience Foods

8.6 Functional Foods

8.7 Salads and Sauces

8.8 Infant Formula

8.9 Others

8.10 Y-O-Y Growth trend Analysis By Application

8.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. FOOD EMULSIFIERS MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Product Type

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Product Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Product Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Product Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Product Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. FOOD EMULSIFIERS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer-Daniels-Midland Company

10.2 Koninklijke DSM N.V

10.3 Cargill Inc.

10.4 BASF SE

10.5 Ingredion Incorporated

10.6 Kerry Group Plc.

10.7 E.I Dupont De Nemours and Company

10.8 Lonza Group AG.

10.9 Puratos Group

10.10 Wilmar International Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global food emulsifier market was valued at USD 3.6 billion and is projected to reach a market size of USD 5.0 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4.8%.

Rising demand for processed foods, an expanding bakery and confectionery sector, the clean label movement, and demand for low-fat and fat-reduced products are propelling the global food emulsifier market.

Based on source, the global food emulsifier market is segmented into plant-derived and animal-derived.

Europe is the most dominant region for the global food emulsifier market.

Archer-Daniels-Midland Company, Koninklijke DSM N.V., Cargill Inc., BASF SE, Ingredion Incorporated, Kerry Group Plc., E. I. Dupont De Nemours and Company, Lonza Group AG., Puratos Group, and Wilmar International Limited are the key players operating in the global food emulsifier market.