MRNA Vaccines Market Size (2024 – 2030)

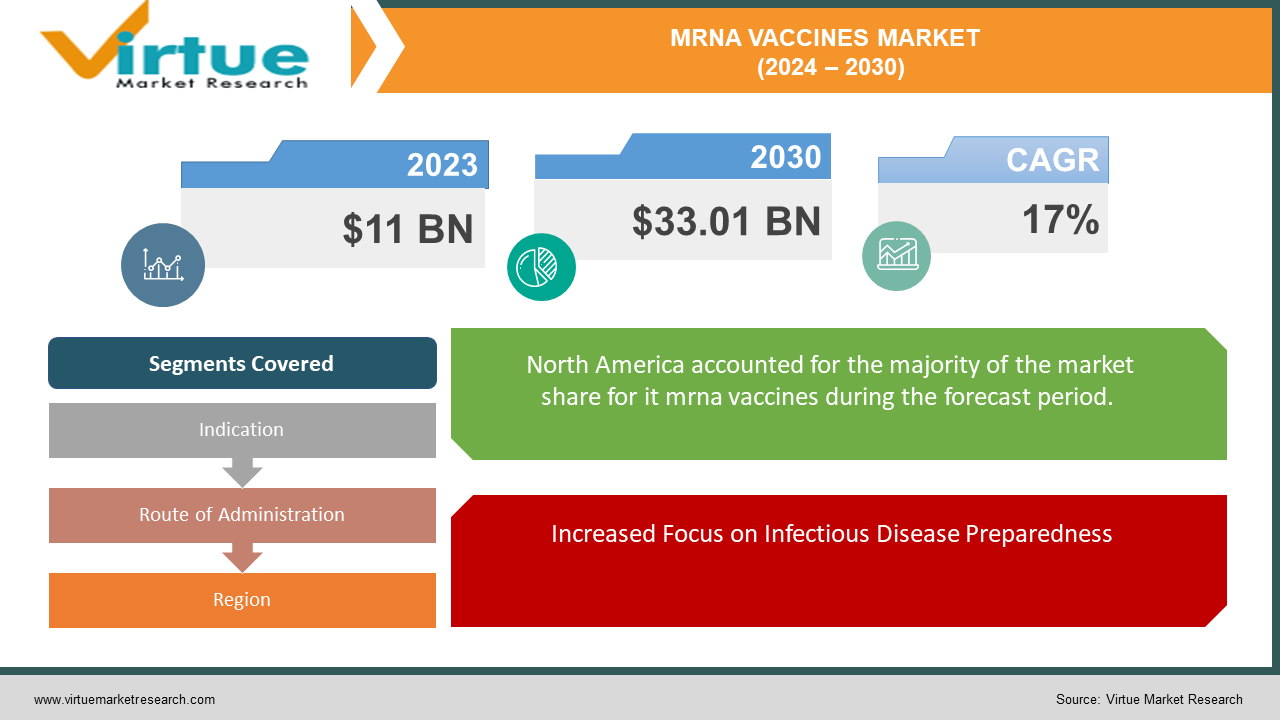

The Global mRNA Vaccines Market was valued at USD 11 billion in 2023 and is projected to reach a market size of USD 33.01 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 17% between 2024 and 2030.

The global mRNA vaccines market is experiencing robust growth, driven by the transformative potential of mRNA technology in addressing a wide range of medical challenges. The unprecedented success of mRNA vaccines in combating the COVID-19 pandemic has significantly accelerated research and investment in this field. Key players such as Moderna, Pfizer-BioNTech, and CureVac are leading the charge, expanding their pipelines to include vaccines for other infectious diseases like influenza, Zika, and HIV, as well as exploring mRNA-based cancer therapies. Advances in delivery systems, such as lipid nanoparticles, are enhancing the stability and efficacy of mRNA vaccines, while innovations in storage solutions are making these vaccines more accessible globally. Collaborations between biotech firms, pharmaceutical companies, and research institutions are fostering an environment of rapid innovation, facilitating the development of next-generation mRNA vaccines. Moreover, regulatory agencies worldwide are increasingly supportive, streamlining approval processes in light of the technology’s demonstrated success. The market is also benefiting from the application of artificial intelligence and machine learning to optimize vaccine design and testing. With expanding applications and continuous technological advancements, the mRNA vaccines market is poised for sustained growth, heralding a new era in preventive and therapeutic medicine.

Key Market Insights:

An estimated 30–40% of COVID-19 infections worldwide were avoided in 2023 due to mRNA vaccines, the World Health Organization (WHO) reported.

The Biotechnology Industry Organization announced that the mRNA technology sector saw a spike in investment, obtaining over USD 10 billion in funding in 2023 alone, suggesting substantial investor confidence.

According to data from ClinicalTrials.gov, as of June 2024, there were more than 150 active clinical trials conducted worldwide to assess mRNA vaccines and treatments for a range of illnesses.

According to an industry assessment, vaccines presently control a large portion of the market—roughly 65-70%—and are mostly used to fight infectious diseases.Industry statistics indicate that the mRNA therapies area is undergoing significant growth, with clinical trials rising by an estimated 40-50% annually.

According to a biotechnology industry assessment, the Asia Pacific area is quickly catching up to North America, which now dominates the global market in mRNA clinical trials with an estimated 35–40% of trials now underway.

According to the Biotechnology Sector Organization, North America has seen a notable growth in job listings of roughly 20–25% year-over-year, indicating that the mRNA sector is also helping to create jobs.

Global mRNA Vaccines Market Drivers:

Increased Focus on Infectious Disease Preparedness

One of the primary drivers of the global mRNA vaccines market is the heightened focus on infectious disease preparedness. The COVID-19 pandemic underscored the necessity for rapid, scalable, and effective vaccine development technologies, with mRNA vaccines leading the charge. Governments and health organizations worldwide have recognized the critical need for preparedness against future pandemics and outbreaks. This recognition has translated into substantial investments in mRNA technology, both from public funds and private sector investments. The ability of mRNA vaccines to be quickly adapted to new pathogens and variants, as demonstrated during the COVID-19 crisis, positions them as a cornerstone of global health strategies. This focus on preparedness is fostering continuous research, development, and enhancements in mRNA vaccine technologies, ensuring they remain at the forefront of combating infectious diseases.

Advancements in mRNA Vaccine Technology

The rapid advancements in mRNA vaccine technology are another significant driver of market growth. Over the past few years, mRNA technology has evolved dramatically, improving its stability, delivery methods, and overall efficacy. Innovations such as lipid nanoparticles for efficient delivery and storage advancements ensuring vaccine stability at higher temperatures have made mRNA vaccines more accessible and practical for global distribution. These technological improvements have not only boosted confidence in mRNA vaccines but have also expanded their potential applications beyond infectious diseases to areas like cancer and genetic disorders. The continuous evolution of this technology is driving the market by attracting new investments, enabling the development of next-generation mRNA vaccines, and opening new therapeutic avenues that were previously unattainable with traditional vaccine technologies.

Global mRNA Vaccines Market Restraints and Challenges:

Despite the promising outlook for the global mRNA vaccines market, significant restraints and challenges persist, primarily revolving around high costs and complex manufacturing processes. The development and production of mRNA vaccines require sophisticated technologies and highly specialized facilities, leading to substantial capital investment and operational costs. These expenses can be prohibitive, especially for smaller biotech firms and emerging markets, limiting their ability to compete and innovate within the mRNA space. Additionally, the production of mRNA vaccines involves intricate steps, such as the synthesis of mRNA, encapsulation in lipid nanoparticles, and stringent quality control measures to ensure stability and efficacy. These complexities not only increase production times and costs but also necessitate a skilled workforce, which is currently in limited supply. Furthermore, the cold chain logistics required for the distribution of some mRNA vaccines, which must be stored at ultra-low temperatures, present additional logistical challenges, particularly in low-resource settings. Together, these factors create significant barriers to the widespread adoption and scalability of mRNA vaccines, potentially slowing down the market's growth and its ability to reach a broader global population effectively. Addressing these challenges is crucial for the sustainable development and equitable distribution of mRNA vaccine technologies.

Global mRNA Vaccines Market Opportunities:

The global mRNA vaccines market is poised for significant growth, driven by expanding applications beyond infectious diseases. The success of mRNA vaccines in combating COVID-19 has spurred extensive research into their potential for treating various other medical conditions. Notably, mRNA technology is being explored for cancer immunotherapies, with promising early results in targeting specific tumor antigens and enhancing the body’s immune response against cancer cells. Additionally, mRNA vaccines are being developed for rare genetic disorders, offering the potential to correct genetic mutations at the molecular level. This versatility of mRNA technology extends to personalized medicine, where vaccines can be tailored to an individual’s genetic profile, improving efficacy and reducing adverse effects. Moreover, advancements in delivery mechanisms and formulations are enabling mRNA vaccines to target a wider range of diseases, including autoimmune and cardiovascular disorders. This broadening scope is attracting significant investment from both the public and private sectors, fostering collaborations between biotech companies and research institutions. These opportunities are not only expanding the market but also paving the way for breakthroughs in medical science, potentially transforming the landscape of disease prevention and treatment, and underscoring the vast potential of mRNA technology in addressing a myriad of health challenges.

MRNA VACCINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17% |

|

Segments Covered |

By Indication, Route of Administration, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CureVac N.V., Translate Bio, Inc., Arcturus Therapeutics Holdings Inc., GSK (GlaxoSmithKline plc), Sanofi, eTheRNA Immunotherapies NV, SABIN Vaccine Institute, Ethris GmbH, Providence Therapeutics, Chiron Corporation (now part of Novartis), Vertex Pharmaceuticals Incorporated |

Global mRNA Vaccines Market Segmentation: By Indication

-

Infectious Diseases

-

Non-Infectious Diseases

The Global mRNA Vaccines Market Segmented by Indication, Infectious Diseases had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The mRNA vaccine market is currently dominated by infectious diseases, primarily driven by the remarkable success of COVID-19 vaccines. This dominance is a result of the rapid and widespread adoption of mRNA technology to combat the global pandemic, showcasing its effectiveness and scalability. Infectious diseases remain a significant public health concern, necessitating constant advancements in vaccine development to address emerging variants and new pathogens. This ongoing need underscores the importance of mRNA vaccines, which can be quickly adapted to counteract evolving threats. The development pipeline is robust, with extensive research and clinical trials underway for mRNA vaccines targeting other infectious diseases such as respiratory syncytial virus (RSV), cytomegalovirus (CMV), and influenza. These efforts are expected to bolster the infectious disease segment's market share as new vaccines gain regulatory approval and enter the market. While mRNA vaccines for non-infectious diseases like cancer hold great promise, they are still in the developmental stages and are not yet ready for widespread use. As such, their impact on the market share remains limited in the near term. The current focus on infectious diseases ensures that this segment will continue to lead the mRNA vaccine market, driven by the need for improved protection and the ongoing development of new vaccines.

Global mRNA Vaccines Market Segmentation: By Route of Administration

-

Intramuscular

-

Intranasal

-

Intravenous

The Global mRNA Vaccines Market Segmented by Route of Administration, Intramuscular had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Intramuscular injection remains the gold standard for vaccine administration due to its well-established safety, efficacy, and healthcare infrastructure support. Healthcare providers possess the necessary equipment and expertise for safe and efficient intramuscular delivery, ensuring widespread and reliable use. This route of administration has a proven track record of inducing strong immune responses, making it a dependable method for achieving effective immunization. The infrastructure for intramuscular vaccine delivery is robust, with existing systems and processes tailored to this method, minimizing the need for additional investments or significant changes. Although emerging alternatives like intranasal delivery are being explored for mRNA vaccines, these methods are still under development and face challenges related to efficacy and infrastructure adaptation. Intranasal vaccines could offer benefits such as easier administration and mucosal immunity, but these advantages must be carefully evaluated against potential drawbacks like lower immune response effectiveness. Until these alternative routes are fully developed and validated, intramuscular injection remains the most reliable and efficient method for vaccine delivery, ensuring that new vaccines can be rapidly and effectively distributed within the existing healthcare framework. This adaptability and established efficacy make intramuscular injection the preferred choice for ongoing and future vaccine initiatives.

Global mRNA Vaccines Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global mRNA Vaccines Market Segmented by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. North America is poised to maintain its leadership in the global mRNA vaccines market, driven by robust research funding, a well-established pharmaceutical industry, and a supportive regulatory environment. The United States, in particular, benefits from significant healthcare research investments, facilitating the development and clinical trials of mRNA vaccines. Major pharmaceutical companies in the region possess the resources and expertise necessary to expedite the market introduction of these vaccines. Additionally, regulatory bodies like the FDA have demonstrated a willingness to fast-track approvals, particularly during public health crises such as the COVID-19 pandemic. North America's high vaccine adoption rates further solidify its strong market presence. However, the Asia Pacific region, with its growing population and increasing healthcare expenditure, is emerging as a formidable contender. Countries in this region are making substantial investments in mRNA vaccine development, indicating potential future growth. Similarly, Europe's focus on healthcare innovation and its robust research infrastructure may lead to significant advancements in mRNA technology. Government policies and affordability will be crucial in determining regional market shares moving forward. While North America is expected to dominate in the near term, the strategic investments and policy decisions in Asia Pacific and Europe could challenge this dominance in the long run.

COVID-19 Impact Analysis on the Global mRNA Vaccines Market.

The COVID-19 pandemic has profoundly impacted the global mRNA vaccines market, acting as a powerful catalyst for unprecedented growth and innovation. The urgent need for an effective vaccine led to an accelerated development timeline for mRNA vaccines, exemplified by the rapid success of Pfizer-BioNTech and Moderna vaccines. This urgency drove significant investments in mRNA technology, infrastructure, and supply chain capabilities, fundamentally transforming the landscape of vaccine development. The pandemic highlighted the adaptability and scalability of mRNA platforms, which could be swiftly modified to address emerging variants, showcasing their potential for responding to future infectious disease threats. The widespread adoption and successful deployment of mRNA vaccines during the pandemic have also increased public and institutional confidence in this technology. Furthermore, the pandemic spurred global collaborations, regulatory flexibility, and fast-tracked approvals, which are likely to benefit future mRNA vaccine initiatives. The experience gained and the infrastructure developed during the pandemic have laid a robust foundation for the mRNA vaccine market, enabling its expansion into other therapeutic areas. Thus, while COVID-19 posed significant global health challenges, it simultaneously accelerated the mRNA vaccines market, establishing mRNA technology as a pivotal tool in modern medicine and opening new avenues for its application.

Latest trends / Developments:

The global mRNA vaccines market is witnessing several cutting-edge trends and developments, reflecting its dynamic and rapidly evolving nature. One prominent trend is the diversification of mRNA vaccine applications beyond COVID-19 to target other infectious diseases such as influenza, Zika, and HIV, demonstrating the broad versatility of mRNA technology. Additionally, significant progress is being made in the development of mRNA cancer vaccines, with several candidates entering clinical trials aimed at harnessing the immune system to target and destroy cancer cells. Another notable trend is the advancement in mRNA delivery systems, such as lipid nanoparticles and novel carrier molecules, which enhance the stability, efficacy, and distribution of mRNA vaccines. There is also a growing focus on improving mRNA vaccine accessibility and distribution, particularly in low- and middle-income countries, through innovations in formulation that allow for more flexible storage conditions. Moreover, collaborations and partnerships between biotech companies, pharmaceutical giants, and research institutions are intensifying, fostering an environment of shared knowledge and resources that accelerates innovation. Lastly, the use of artificial intelligence and machine learning in mRNA vaccine development is emerging, optimizing the design and testing processes to rapidly identify promising candidates. These trends collectively underscore a vibrant future for the mRNA vaccines market, marked by scientific breakthroughs and expanding therapeutic horizons.

Key Players:

-

CureVac N.V.

-

Translate Bio, Inc.

-

Arcturus Therapeutics Holdings Inc.

-

GSK (GlaxoSmithKline plc)

-

Sanofi

-

eTheRNA Immunotherapies NV

-

SABIN Vaccine Institute

-

Ethris GmbH

-

Providence Therapeutics

-

Chiron Corporation (now part of Novartis)

-

Vertex Pharmaceuticals Incorporated

Chapter 1. MRNA Vaccines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MRNA Vaccines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MRNA Vaccines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MRNA Vaccines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MRNA Vaccines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MRNA Vaccines Market – By Indication

6.1 Introduction/Key Findings

6.2 Infectious Diseases

6.3 Non-Infectious Diseases

6.4 Y-O-Y Growth trend Analysis By Indication

6.5 Absolute $ Opportunity Analysis By Indication, 2024-2030

Chapter 7. MRNA Vaccines Market – By Route of Administration

7.1 Introduction/Key Findings

7.2 Intramuscular

7.3 Intranasal

7.4 Intravenous

7.5 Y-O-Y Growth trend Analysis By Route of Administration

7.6 Absolute $ Opportunity Analysis By Route of Administration, 2024-2030

Chapter 8. MRNA Vaccines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Indication

8.1.3 By Route of Administration

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Indication

8.2.3 By Route of Administration

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Indication

8.3.3 By Route of Administration

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Indication

8.4.3 By Route of Administration

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Indication

8.5.3 By Route of Administration

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. MRNA Vaccines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 CureVac N.V.

9.2 Translate Bio, Inc.

9.3 Arcturus Therapeutics Holdings Inc.

9.4 GSK (GlaxoSmithKline plc)

9.5 Sanofi

9.6 eTheRNA Immunotherapies NV

9.7 SABIN Vaccine Institute

9.8 Ethris GmbH

9.9 Providence Therapeutics

9.10 Chiron Corporation (now part of Novartis)

9.11 Vertex Pharmaceuticals Incorporated

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global mRNA Vaccines market is expected to be valued at USD 11 billion.

Through 2030, the Global mRNA Vaccines market is expected to grow at a CAGR of 17 %.

By 2030, the Global mRNA Vaccines Market is expected to grow to a value of USD 33.01 billion.

North America is predicted to lead the Global mRNA Vaccines market.

The Global mRNA Vaccines Market has segments By Indication ( Infectious Diseases, Non-Infectious Diseases); By Route of Administration ( Intramuscular, Intranasal, Intravenous); and By Region