Space Militarization Market Size (2024 – 2030)

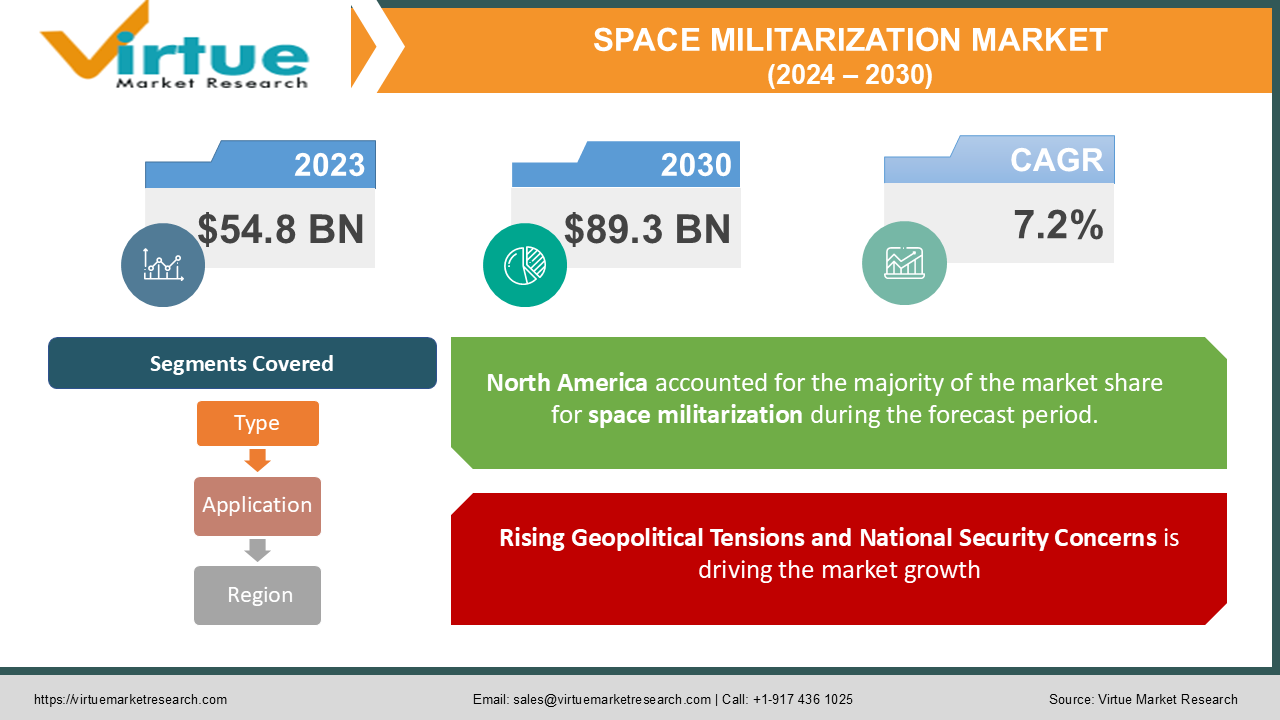

The Global Space Militarization Market was valued at USD 54.8 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030, reaching a market size of USD 89.3 billion by 2030.

Space militarization refers to the use of space technology and systems for military purposes, encompassing a broad spectrum of applications such as surveillance, communication, missile tracking, and the development of space-based weapons. As countries seek to secure their strategic interests in space, the global space militarization market is seeing significant growth, driven by advancements in satellite technology, rising geopolitical tensions, and increasing defense budgets. This market includes satellite systems, space-based weapons, missile defense, and ground-based space control systems.

Key Market Insights:

- Satellite systems account for over 40% of the total market, providing critical support for intelligence gathering, communication, navigation, and missile detection.

- The growing use of space-based surveillance for military purposes, particularly in missile defense and early warning systems, is a key driver for market growth.

- The U.S. is the dominant player in the global space militarization market, with initiatives like the establishment of the U.S. Space Force and significant defense spending on space-based military technologies.

- The rise of space weaponization is accelerating, with emerging technologies such as directed-energy weapons, anti-satellite (ASAT) weapons, and hypersonic missile defense systems gaining prominence.

Global Space Militarization Market Drivers:

Rising Geopolitical Tensions and National Security Concerns is driving the market growth

Geopolitical tensions between major world powers, particularly the U.S., China, and Russia, are one of the most significant drivers of the global space militarization market. As these nations engage in an escalating competition for global dominance, securing strategic military advantages in space has become a priority. Space is increasingly viewed as a critical domain for national security, as it provides the infrastructure for communication, surveillance, navigation, and missile defense systems that are essential for modern warfare.

The U.S. has taken significant steps toward space militarization with the creation of the U.S. Space Force in 2019, a new branch of the military dedicated to space operations. Similarly, China has been ramping up its space capabilities, launching satellites for military purposes, developing anti-satellite (ASAT) weapons, and pursuing advancements in space-based intelligence and missile defense.

Russia is also expanding its space military programs, focusing on developing ASAT technologies and enhancing its satellite communication systems for defense. The growing militarization of space is expected to intensify as nations seek to secure their assets in space and protect against potential threats.

Advancements in Satellite Technology and Space-Based Defense Systems is driving the market growth

The rapid advancements in satellite technology have been a key driver of the global space militarization market. Satellites play a crucial role in military operations by providing real-time intelligence, communication, and navigation support. Military satellites are used for surveillance, missile tracking, early warning systems, and secure communications, making them essential components of modern warfare.

One of the most significant advancements in satellite technology is the development of smaller, more efficient satellites, known as smallsats or CubeSats. These satellites offer cost-effective solutions for military applications, as they can be deployed in large constellations to provide global coverage for intelligence gathering, surveillance, and communication.

The miniaturization of satellite components has also made it possible to deploy advanced sensors and cameras on these small satellites, enhancing their capabilities for military use. In addition to satellite technology, space-based defense systems are becoming increasingly sophisticated. Space-based missile defense systems, which use satellites to detect and track ballistic missiles, are a critical component of modern missile defense strategies. These systems provide early warning of missile launches, allowing nations to respond quickly to potential threats.

The development of space-based weapons, such as directed-energy weapons and anti-satellite (ASAT) technologies, is also gaining momentum as countries seek to develop the capability to neutralize enemy satellites and space-based threats. As these technologies continue to advance, the demand for space-based defense systems is expected to grow, driving further investment in the space militarization market.

Increasing Defense Budgets and Government Initiatives is driving the market growth

The growing focus on space militarization is reflected in the increasing defense budgets of major countries, particularly in the U.S., China, and Russia. These countries are investing heavily in space-based military capabilities as part of their broader defense strategies.

In the U.S., defense spending on space programs has risen significantly in recent years, with the Department of Defense allocating billions of dollars to the development of military satellites, missile defense systems, and space-based weapons. The establishment of the U.S. Space Force, which operates under the U.S. Department of Defense, highlights the government's commitment to maintaining space dominance.

Similarly, China has made substantial investments in its space military programs, with the Chinese government prioritizing the development of space-based intelligence, surveillance, and reconnaissance (ISR) capabilities. China's space ambitions include the deployment of military satellites for communication and navigation, as well as the development of ASAT weapons to counter potential threats from other nations. Russia, too, is focused on expanding its space military capabilities, with significant investments in satellite technology and ASAT systems.

Global Space Militarization Market Challenges and Restraints:

International Regulations and Concerns over Space Weaponization is restricting the market growth

One of the major challenges facing the global space militarization market is the regulatory environment governing the use of space for military purposes. The Outer Space Treaty, signed in 1967, forms the foundation of international space law and prohibits the placement of nuclear weapons or any other weapons of mass destruction in space. The treaty also emphasizes the peaceful exploration of space and discourages the militarization of celestial bodies like the moon and other planets.

However, as nations continue to develop space-based military capabilities, there is growing concern about the potential weaponization of space. The deployment of anti-satellite (ASAT) weapons, directed-energy weapons, and other space-based weapons has raised alarms about the escalation of an arms race in space. While no country has yet deployed offensive space-based weapons, the development of technologies that could disrupt or destroy satellites poses a significant threat to the stability and security of space as a global commons.

International efforts to regulate space militarization, such as the Prevention of an Arms Race in Outer Space (PAROS) initiative, have faced challenges due to the lack of consensus among major space-faring nations. The absence of a comprehensive legal framework to address space weaponization has created an environment where countries are free to pursue their own space military programs, leading to increased tensions and the risk of conflict in space. This regulatory uncertainty and the potential for international conflict are key challenges that could hinder the growth of the space militarization market.

High Costs and Technological Barriers is restricting the market growth

The development of space-based military technologies is highly capital-intensive, requiring significant investment in research, development, and infrastructure. The costs associated with launching satellites, maintaining space-based systems, and developing advanced technologies such as anti-satellite weapons and missile defense systems can be prohibitive for many countries.

While major space powers like the U.S., China, and Russia have the financial resources to invest in space militarization, smaller nations may struggle to compete in this domain. In addition to the high costs, there are also significant technological barriers to overcome in the development of space-based military systems.

Space is an inherently challenging environment, with extreme temperatures, radiation, and the risk of space debris posing threats to the operation of military satellites and systems. The development of space-based missile defense systems and directed-energy weapons, in particular, requires cutting-edge technologies that are still in the early stages of development. Overcoming these technological challenges will require continued investment in innovation and collaboration between governments, defense contractors, and private space companies.

Global Space Militarization Market Opportunities:

The global space militarization market presents numerous opportunities for growth as countries increasingly prioritize space-based defense systems and technologies. One of the most significant opportunities lies in the development of advanced satellite systems for military applications. Military satellites are critical for a wide range of functions, including intelligence gathering, communication, navigation, and missile tracking. As the demand for real-time intelligence and secure communication continues to grow, the market for military satellites is expected to expand significantly. Additionally, the miniaturization of satellite components and the development of smallsat constellations offer cost-effective solutions for nations looking to enhance their military capabilities in space.

The rise of private sector involvement in space technologies also presents new opportunities for collaboration between governments and companies such as SpaceX, Blue Origin, and Boeing Defense. These companies are developing innovative solutions for space-based military applications, including satellite launch services, space exploration technologies, and reusable rockets. By partnering with private space firms, governments can access cutting-edge technologies and reduce the costs associated with space militarization.

Another key opportunity in the space militarization market is the development of space-based missile defense systems and anti-satellite (ASAT) weapons. As nations seek to defend their space assets from potential threats, the demand for missile defense systems and ASAT technologies is expected to grow. The increasing reliance on space for communication, navigation, and surveillance makes the protection of military satellites a top priority for defense strategies.

Space-based missile defense systems, which use satellites to detect and track ballistic missiles, provide early warning and interception capabilities, making them essential for modern defense strategies. As research and development efforts continue, advancements in directed-energy weapons and other space-based defense technologies will drive further growth in this market.

Lastly, the global emphasis on the peaceful use of space and the prevention of space weaponization offers opportunities for countries and organizations to collaborate on the development of regulatory frameworks and initiatives aimed at promoting the responsible use of space.

International cooperation on space security, including efforts to prevent an arms race in space, could lead to the establishment of new norms and agreements that shape the future of space militarization. Governments, defense contractors, and private space companies have the opportunity to work together to ensure the security and stability of space as a global commons, while also developing advanced military technologies to protect national interests.

GLOBAL SPACE MILITARIZATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Boeing Defense, Space & Security, SpaceX, Blue Origin, Airbus Defence and Space, Thales Group, BAE Systems, Maxar Technologies |

SEGMENTATION ANALYSIS

Space Militarization Market Segmentation: By Type

-

Satellite Systems

-

Space-Based Weapons

-

Ground-Based Space Control

Satellite systems dominate the global space militarization market, accounting for over 40% of the market revenue in 2023. Military satellites are used for a variety of functions, including communication, surveillance, missile tracking, and intelligence gathering. With the increasing demand for real-time intelligence and secure communication, satellite systems are critical to modern military operations.

Advancements in satellite technology, such as miniaturization and the development of smallsat constellations, are further driving the demand for military satellite systems. As nations prioritize space-based defense systems, the satellite systems segment is expected to experience significant growth over the forecast period.

Space Militarization Market Segmentation: By Application

-

Defense

-

Intelligence

-

Communications

The defense application segment dominates the space militarization market, accounting for over 45% of the market in 2023. Military defense operations rely heavily on space-based technologies, including satellite communication, missile tracking, and early warning systems.

The development of space-based missile defense systems, anti-satellite (ASAT) weapons, and space-based surveillance technologies is central to modern military strategies. As geopolitical tensions continue to rise, the demand for advanced space-based defense systems is expected to grow, driving the expansion of the defense segment.

Space Militarization Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the dominant region in the global space militarization market, accounting for over 50% of the total market share in 2023. The U.S. is the leading player in this region, driven by its significant investment in space defense programs and the establishment of the U.S. Space Force. The U.S. government has allocated billions of dollars to the development of military satellites, missile defense systems, air defence systems, and space-based weapons, making it the largest contributor to the global space militarization market.

North America’s dominance is also supported by its robust private sector, with companies like SpaceX and Boeing Defense playing a key role in the development of space-based military technologies. As the U.S. continues to prioritize space dominance, the North American market is expected to experience sustained growth over the forecast period.

COVID-19 Impact Analysis on the Global Space Militarization Market:

The COVID-19 pandemic had both short-term disruptions and long-term strategic impacts on the global space militarization market. In the early stages of the pandemic, lockdowns, travel restrictions, and supply chain disruptions led to delays in space launches and the production of military satellites and other space-based technologies.

Many defense contractors and space agencies faced operational challenges, with project timelines being pushed back and budgets reallocated to address the immediate effects of the pandemic. However, as the global economy began to recover, governments and defense agencies recognized the strategic importance of space militarization, particularly in the context of national security and geopolitical competition. The pandemic underscored the need for resilient and secure communication and surveillance systems, which are heavily reliant on military satellites and space-based technologies. As a result, investments in space militarization rebounded, with countries like the U.S., China, and Russia continuing to prioritize their space defense programs.

In the long term, the COVID-19 pandemic has accelerated the focus on space as a critical domain for national security, with governments increasing their investments in space-based defense systems to ensure resilience in future crises. Additionally, the pandemic has highlighted the importance of private sector partnerships in the space militarization market, as companies like SpaceX and Blue Origin demonstrated their ability to adapt and continue operations during the crisis.

Latest Trends/Developments:

Several key trends are shaping the global space militarization market. One of the most significant trends is the growing investment in anti-satellite (ASAT) weapons and missile defense systems. As nations seek to protect their space assets from potential threats, the development of ASAT technologies is gaining momentum. These systems are designed to neutralize enemy satellites and disable their capabilities, providing a critical advantage in space-based warfare.

The increasing militarization of space is also driving the development of space-based missile defense systems, which use satellites to detect and track ballistic missiles. These systems provide early warning and interception capabilities, making them essential components of modern defense strategies.

Another key trend in the space militarization market is the rise of private sector involvement in the development of space-based military technologies. Companies like SpaceX, Blue Origin, and Boeing Defense are playing an increasingly important role in the space defense ecosystem, providing innovative solutions for satellite launches, space exploration technologies, and reusable rockets. Private sector involvement is helping to drive down the costs associated with space militarization and enabling governments to access cutting-edge technologies more quickly and efficiently.

The development of small satellite constellations, or smallsats, is also transforming the space militarization landscape. These small satellites can be deployed in large numbers to provide global coverage for military communication, surveillance, and navigation. Smallsats offer a cost-effective and flexible solution for enhancing military capabilities in space, and their adoption is expected to increase in the coming years.

Finally, the increasing emphasis on international cooperation and the development of regulatory frameworks for space militarization is shaping the future of the market. International efforts to prevent the weaponization of space, such as the Prevention of an Arms Race in Outer Space (PAROS) initiative, are gaining traction as countries recognize the need to establish norms and agreements for the responsible use of space. However, the lack of consensus among major space-faring nations remains a challenge, and the potential for conflict in space continues to drive investment in space-based military technologies.

Key Players:

-

Lockheed Martin Corporation

-

Northrop Grumman Corporation

-

Raytheon Technologies Corporation

-

Boeing Defense, Space & Security

-

SpaceX

-

Blue Origin

-

Airbus Defence and Space

-

Thales Group

-

BAE Systems

-

Maxar Technologies

Chapter 1. Space Militarization Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Space Militarization Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Space Militarization Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Space Militarization Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Space Militarization Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Space Militarization Market – By Type

6.1 Introduction/Key Findings

6.2 Satellite Systems

6.3 Space-Based Weapons

6.4 Ground-Based Space Control

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Space Militarization Market – By Application

7.1 Introduction/Key Findings

7.2 Defense

7.3 Intelligence

7.4 Communications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Space Militarization Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Space Militarization Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lockheed Martin Corporation

9.2 Northrop Grumman Corporation

9.3 Raytheon Technologies Corporation

9.4 Boeing Defense, Space & Security

9.5 SpaceX

9.6 Blue Origin

9.7 Airbus Defence and Space

9.8 Thales Group

9.9 BAE Systems

9.10 Maxar Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Space Militarization Market was valued at USD 54.8 billion in 2023 and is expected to reach USD 89.3 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include rising geopolitical tensions, advancements in satellite technology and space-based defense systems, and increasing defense budgets and government initiatives.

The market is segmented by type (Satellite Systems, Space-Based Weapons, Ground-Based Space Control) and by application (Defense, Intelligence, Communications).

North America is the dominant region, accounting for over 50% of the market share, driven by the U.S.’s significant investment in space defense programs and the establishment of the U.S. Space Force.

Leading players include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Boeing Defense, SpaceX, and Blue Origin.