Global Military Satellite Payloads and Subsystems Market Size (2023 – 2030)

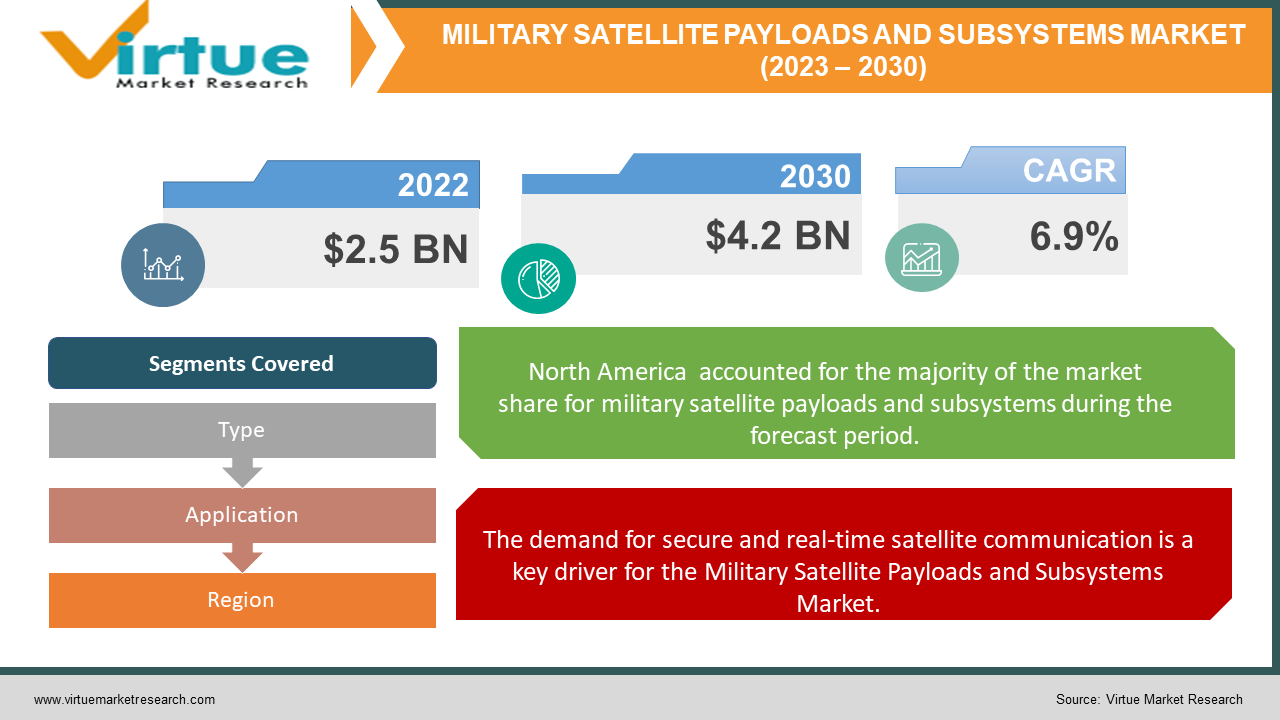

The Global Military Satellite Payloads and Subsystems Market was valued at USD 2.5 billion and is projected to reach a market size of USD 4.2 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.9%.

The Military Satellite Payloads and Subsystems Market is a dynamic sector characterized by continuous technological advancements and global demand. The market has attracted attention from academic, professional, and government communities worldwide. The consistent growth in this industry is driven by the need for advanced satellite payloads and subsystems for military applications, including communication, surveillance, navigation, and intelligence gathering. Over the next decade, the market is poised for further expansion, offering numerous career opportunities in the defense and aerospace sectors. To excel in this field, leaders must develop new skills and stay well-versed in various factors influencing the military satellite payloads and subsystems market while keeping a comprehensive perspective on its evolving landscape.

Key Market Insights:

The Military Satellite Payloads and Subsystems Market is marked by several key insights that shape its dynamics. Firstly, there is a growing demand for advanced satellite payloads and subsystems to support modern military operations. This includes the need for high-capacity communication payloads, high-resolution imaging systems, and secure navigation subsystems. Additionally, miniaturization and the development of small satellites are gaining prominence, enabling more flexible and cost-effective solutions for military applications. Furthermore, the market is witnessing increased investment in research and development to enhance the capabilities of satellite payloads and subsystems. Lastly, the importance of cybersecurity in protecting satellite communication and data transmission is a critical focus area. These insights collectively drive innovation and growth in the military satellite payloads and subsystems market, ensuring its relevance in modern defense strategies.

Military Satellite Payloads and Subsystems Market Drivers:

The demand for secure and real-time satellite communication is a key driver for the Military Satellite Payloads and Subsystems Market.

The Military Satellite Payloads and Subsystems Market is driven by several key factors. Firstly, the increasing need for real-time, secure, and resilient communication is a major driver. Military operations rely heavily on satellite communication for command and control, intelligence, surveillance, and reconnaissance (ISR), making advanced payloads essential. Secondly, the growing demand for high-resolution imaging and earth observation capabilities for military intelligence and surveillance purposes is fueling the development of sophisticated imaging payloads. Thirdly, the miniaturization of satellites and payloads is opening new possibilities for cost-effective, agile, and versatile solutions in space. Additionally, the emergence of advanced technologies like artificial intelligence and machine learning is enhancing the capabilities of payloads and subsystems, making them more efficient and adaptable. Lastly, the increasing focus on space security and cybersecurity is driving investment in secure and resilient satellite systems. These drivers collectively propel the growth and innovation in the military satellite payloads and subsystems market.

The increasing need for advanced reconnaissance and surveillance capabilities also contributes to the growth of the Military Satellite Payloads and Subsystems Market.

The growing demand for advanced reconnaissance and surveillance capabilities plays a pivotal role in driving the growth of the Military Satellite Payloads and Subsystems Market. In an era where national security concerns are paramount, the ability to monitor and gather critical intelligence from space is of utmost importance. Military satellites equipped with advanced payloads and subsystems enable nations to enhance their situational awareness, monitor potential threats, and respond effectively to emerging security challenges. These capabilities are essential for both national defense and the protection of strategic interests worldwide. As a result, the market for military satellite payloads and subsystems is propelled by the imperative need to maintain a technological edge in modern warfare and ensure the security of nations.

The increasing government funding and partnerships drive innovation in the Military Satellite Payloads and Subsystems Market, fostering national security and technological advancement.

Government support plays a pivotal role in driving the growth of the Military Satellite Payloads and Subsystems Market. Defense and space-related programs are often heavily funded and backed by governments to enhance national security and technological prowess. Governments invest in research and development initiatives to create cutting-edge satellite payloads and subsystems that can provide advanced communication, surveillance, and reconnaissance capabilities. These investments not only stimulate innovation within the defense industry but also bolster the domestic manufacturing and technology sectors. Additionally, governments often form partnerships with private aerospace and defense companies to develop and deploy military satellites, further fostering growth in the market. The regulatory framework established by governments also plays a crucial role in ensuring the secure and responsible use of military satellite technology. All these factors combined contribute to a favorable environment for the Military Satellite Payloads and Subsystems Market.

Military Satellite Payloads and Subsystems Market Restraints and Challenges:

Space debris and budget constraints are key challenges in the Military Satellite Payloads and Subsystems Market.

The Military Satellite Payloads and Subsystems Market faces various challenges and restraints. Firstly, stringent regulatory and compliance requirements can significantly slow down the development and deployment of satellite systems, adding complexity and costs to the process. Additionally, the increasing threat of cyberattacks poses a significant challenge, as the military needs to ensure the security and resilience of satellite communication systems against evolving cyber threats. Moreover, budget constraints in defense spending can limit investment in satellite technology, impacting the development of advanced payloads and subsystems. Lastly, the space debris problem is a growing concern, as the accumulation of space junk can pose risks to satellite systems in orbit. Addressing these challenges will be crucial for the industry's sustained growth and innovation.

Military Satellite Payloads and Subsystems Market Opportunities:

The Military Satellite Payloads and Subsystems Market presents exciting opportunities in the field of space technology advancement and international collaboration. As the demand for secure and high-performance communication and surveillance systems grows, the market has the potential to innovate in satellite payload and subsystem development. Collaborative efforts between governments and private players are also on the rise, offering opportunities for cost-effective solutions and shared resources. Moreover, the emergence of new satellite constellations for various applications, including Earth observation and global connectivity, opens doors for payload and subsystem providers to cater to a diverse range of missions. These opportunities, coupled with advancements in miniaturization and modular satellite design, can drive growth in the Military Satellite Payloads and Subsystems Market.

MILITARY SATELLITE PAYLOADS AND SUBSYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus SE, BAE Systems Plc, Ball Corp., Eutelsat SA, General Dynamics Corp., GomSpace Group AB, Honeywell International Inc., Intelsat US LLC, Israel Aerospace Industries Ltd., L3Harris Technologies Inc. |

Military Satellite Payloads and Subsystems Market Segmentation:

Market Segmentation: By Type:

-

Optical sensors and other sensor payloads

-

Avionics and subsystems

-

Data link and communication systems

In the Military Satellite Payloads and Subsystems Market, data link and communication systems hold the largest segment, playing a vital role in ensuring secure and reliable military communication. Meanwhile, optical sensors and other sensor payloads emerge as the fastest-growing segment, driven by the increasing demand for high-resolution imaging, remote sensing, and intelligence gathering in modern military applications. These technologies enhance situational awareness and reconnaissance capabilities, reflecting the growing need for advanced sensor payloads in military satellites.

Market Segmentation: By Application

-

Communication

-

Navigation

-

Reconnaissance

The segment with the largest market share is Communication, which is vital for secure and efficient military operations. Meanwhile, the segment experiencing the fastest growth is Reconnaissance, driven by the growing demand for real-time intelligence and situational awareness. Reconnaissance payloads offer advanced imaging and data collection capabilities, making them indispensable for modern military applications. As defense forces seek enhanced surveillance and intelligence-gathering capabilities, the demand for reconnaissance payloads and subsystems is expected to grow rapidly, while communication remains a dominant force in the market.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the largest market share, driven by significant defense investments and a well-established aerospace and defense sector. In contrast, the Asia-Pacific region is witnessing the fastest growth, fueled by rising defense budgets and increasing security concerns, leading to heightened demand for military satellite capabilities in communication, navigation, and reconnaissance. This growth trend positions Asia-Pacific as a key player in the evolving landscape of military satellite technology.

COVID-19 Impact Analysis on the Global Military Satellite Payloads and Subsystems Market:

The COVID-19 pandemic had multifaceted impacts on the Military Satellite Payloads and Subsystems Market. On one hand, disruptions in global supply chains and manufacturing processes led to delays in the production and deployment of military satellites and their associated payloads and subsystems. These delays, coupled with budgetary constraints brought about by the pandemic, posed challenges for defense agencies worldwide. On the other hand, the pandemic underscored the importance of secure and resilient communication systems, as remote operations and communication became critical during lockdowns and travel restrictions. This heightened awareness of the need for robust satellite communication solutions could potentially drive future investments and innovations in the military satellite sector. Overall, the pandemic's impact on the market was a complex interplay of delays and a heightened recognition of the strategic importance of satellite technology in defense operations.

Latest Trends/ Developments:

The Military Satellite Payloads and Subsystems Market plays a pivotal role in supporting various other markets and industries. One of the most notable areas is the commercial satellite industry, where technologies and innovations developed for military satellites often find their way into civilian applications. For instance, advancements in satellite communication systems, data links, and imaging technologies developed for military purposes can be adapted for use in telecommunications, weather forecasting, and Earth observation. Additionally, the defense sector's significant investments in research and development contribute to technological advancements that can later benefit sectors like aerospace, telecommunications, and even healthcare through satellite-based telemedicine. Moreover, the robust demand for military satellites drives innovation in the broader space industry, leading to advancements in launch technology and satellite manufacturing, which can be leveraged by both governmental and private space exploration initiatives. Consequently, the Military Satellite Payloads and Subsystems Market catalyze technological progress across various sectors, fostering collaboration and innovation beyond defense applications.

Key Players:

-

Airbus SE

-

BAE Systems Plc

-

Ball Corp.

-

Eutelsat SA

-

General Dynamics Corp.

-

GomSpace Group AB

-

Honeywell International Inc.

-

Intelsat US LLC

-

Israel Aerospace Industries Ltd.

-

L3Harris Technologies Inc.

There are no recent developments for the Military Satellite Payloads and Subsystems Market.

Chapter 1. Military Satellite Payloads and Subsystems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Military Satellite Payloads and Subsystems Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Military Satellite Payloads and Subsystems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Military Satellite Payloads and Subsystems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Military Satellite Payloads and Subsystems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Military Satellite Payloads and Subsystems Market – By Type

6.1 Introduction/Key Findings

6.2 Optical sensors and other sensor payloads

6.3 Avionics and subsystems

6.4 Data link and communication systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis by By Type, 2023-2030

Chapter 7. Military Satellite Payloads and Subsystems Market – By Application

7.1 Introduction/Key Findings

7.2 Communication

7.3 Navigation

7.4 Reconnaissance

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Military Satellite Payloads and Subsystems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By INDUSTRY VERTICAL

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Military Satellite Payloads and Subsystems Market – Company Profiles – (Overview, Military Satellite Payloads and Subsystems Market Portfolio, Financials, Strategies & Developments)

9.1 Airbus SE

9.2 BAE Systems Plc

9.3 Ball Corp.

9.4 Eutelsat SA

9.5 General Dynamics Corp.

9.6 GomSpace Group AB

9.7 Honeywell International Inc.

9.8 Intelsat US LLC

9.9 Israel Aerospace Industries Ltd.

9.10 L3Harris Technologies Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Military Satellite Payloads and Subsystems Market was valued at USD 2.5 billion and is projected to reach a market size of USD 4.2 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.9%.

Key drivers include increasing demand for secure and reliable communication, advancements in sensor technology for reconnaissance, and the need for enhanced navigation capabilities.

North America holds the largest market share in the Military Satellite Payloads and Subsystems Market, driven by its advanced defense infrastructure and investments in satellite technologies.

COVID-19 led to disruptions in the supply chain and delayed manufacturing processes in the aerospace and defense industry, affecting the production and deployment of military satellites and their payloads.

Military satellites are primarily used for communication, navigation, and reconnaissance applications to support various defense operations.