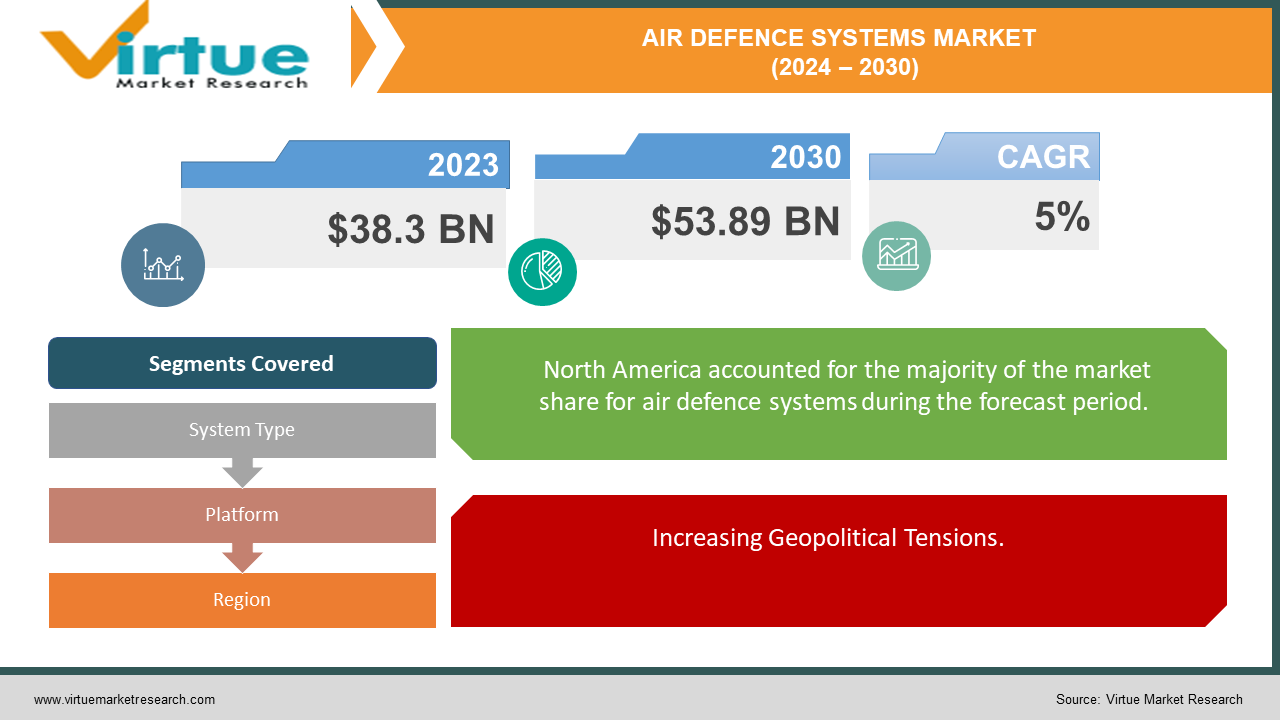

Air Defence Systems Market Size (2024 – 2030)

The Global Air Defence Systems Market was valued at USD 38.3 billion in 2023 and is projected to reach a market size of USD 53.89 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5% between 2024 and 2030.

The global air defense systems market is crucial for safeguarding national and international security against airborne threats like ballistic missiles, UAVs, and enemy aircraft. Driven by geopolitical tensions and evolving military strategies, nations are increasingly investing in advanced technologies to enhance their defense capabilities. Technological innovations in radar, missile systems, and command and control infrastructure have significantly improved the effectiveness of air defense systems. Developments such as hypersonic missiles, directed energy weapons, and AI-driven autonomous systems are reshaping the market by offering enhanced speed, precision, and adaptability in countering modern threats. Leading defense companies like Lockheed Martin, Raytheon Technologies, and Thales Group play pivotal roles in developing and delivering these advanced systems, collaborating closely with governments worldwide to meet stringent security demands. As defense modernization remains a priority, the global air defense systems market continues to expand, driven by ongoing technological advancements and strategic investments aimed at maintaining superiority in an increasingly complex global security landscape.

Key Market Insights:

Land-based systems dominate the market, capturing over 50% share due to their versatility in defending against various threats.

Increased global defense spending is driving rising demand for air defense systems, contributing to market growth.

Technological advancements such as long-range missile defense and counter-drone technologies are significant growth factors, driving innovation in the sector.

Modern systems prioritize friend-or-foe identification to enhance operational effectiveness and reduce accidental engagements, reflecting the industry's focus on improving safety and efficiency.

Global Air Defence Systems Market Drivers:

Increasing Geopolitical Tensions.

Rising geopolitical tensions across regions such as the Middle East, Asia-Pacific, and Eastern Europe have significantly heightened the perception of threats, leading nations to boost their defense spending. The primary focus of this increased expenditure is on acquiring advanced air defense systems capable of countering potential threats like ballistic missiles, drones, and enemy aircraft. Countries are responding to the evolving threat landscape by investing in sophisticated technologies that offer enhanced protection and operational capabilities. The ongoing regional conflicts and the imperative of military modernization further propel this trend, as nations seek to upgrade their defense arsenals with state-of-the-art air defense technologies. For example, India and China are actively enhancing their air defense capabilities to mitigate the risks posed by regional adversaries and to ensure robust national security. This drive for modernization is characterized by the procurement of advanced systems that incorporate the latest technological advancements in radar, missile systems, and sensors, providing a comprehensive shield against aerial threats. The collective efforts of these nations to fortify their air defense infrastructure underscore the critical importance of maintaining a strategic edge in an increasingly volatile global environment, thereby fueling the growth of the global air defense systems market.

Technological Advancements and Innovation.

Continuous advancements in radar, missile, and sensor technologies have led to the development of more effective and sophisticated air defense systems, significantly enhancing the capabilities of air defense forces worldwide. Innovations such as hypersonic missiles, directed energy weapons, and integrated air and missile defense systems are at the forefront of this technological evolution, providing unparalleled protection against a wide range of aerial threats. These advanced systems offer improved accuracy, speed, and lethality, thereby bolstering national defense infrastructures. Additionally, the integration of artificial intelligence (AI) and automation into air defense systems is revolutionizing decision-making processes and response times. AI-enabled systems are capable of rapidly analyzing threats and autonomously engaging targets, thereby providing a significant tactical advantage in modern warfare scenarios. This integration not only enhances the efficiency and effectiveness of air defense operations but also reduces the reliance on human intervention, allowing for quicker and more precise responses to potential threats. The convergence of these technological advancements is driving the global air defense systems market, as nations seek to equip their military forces with cutting-edge technologies to maintain a strategic edge in an increasingly complex and dynamic threat environment.

Global Air Defence Systems Market Restraints and Challenges:

Despite the robust growth prospects, the global air defense systems market faces several restraints and challenges that could hinder its expansion. One significant challenge is the high cost of development and procurement of advanced air defense systems, which can strain national defense budgets, especially for developing countries. The complexity and technological sophistication required for modern air defense systems demands substantial investment in research and development, as well as skilled personnel for operation and maintenance. Additionally, stringent regulatory frameworks and export controls on defense technologies can limit market accessibility and slow down the acquisition process. Another critical challenge is the rapid evolution of threats, such as the development of stealth technologies and hypersonic missiles, which can outpace current defense capabilities and necessitate continuous upgrades. Cybersecurity threats also pose a significant risk, as air defense systems increasingly rely on interconnected networks that can be vulnerable to cyber-attacks. Furthermore, geopolitical factors and shifting alliances can impact defense procurement strategies and create uncertainties in the market. These challenges underscore the need for continuous innovation, international collaboration, and strategic planning to ensure that air defense systems remain effective and adaptable in the face of evolving global threats.

Global Air Defence Systems Market Opportunities:

The global air defense systems market is poised for significant opportunities driven by evolving threats, technological advancements, and strategic defense initiatives. One of the primary opportunities lies in the increasing adoption of unmanned aerial vehicles (UAVs) and drones, which necessitates advanced counter-drone systems and technologies. As UAVs become more prevalent in both military and civilian applications, the demand for sophisticated air defense systems capable of detecting, tracking, and neutralizing these threats will rise. Additionally, the growing focus on network-centric warfare and integrated defense systems presents a lucrative opportunity for manufacturers to develop interoperable and scalable solutions that can seamlessly integrate with existing defense infrastructures. The rise of smart technologies, such as artificial intelligence (AI) and machine learning, offers further prospects for enhancing the capabilities of air defense systems, enabling faster threat detection and more efficient resource allocation. Emerging markets, particularly in the Asia-Pacific and Middle East regions, are also expected to contribute to market growth as countries in these areas continue to modernize their military capabilities and invest in advanced defense systems. Moreover, increasing defense budgets and government initiatives aimed at strengthening national security provide a favorable environment for the development and deployment of cutting-edge air defense technologies.

AIR DEFENCE SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By System Type, Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation (USA), Raytheon Technologies Corporation (USA), Northrop Grumman Corporation (USA), Thales Group (France), BAE Systems plc (UK), Saab AB (Sweden), Rafael Advanced Defense Systems Ltd. (Israel), MBDA (European missile manufacturer), Leonardo S.p.A. (Italy), L3Harris Technologies, Inc. (USA) |

Global Air Defence Systems Market Segmentation: By System Type

-

Missile Defense Systems (MD)

-

Anti-Aircraft Systems (AA)

-

Counter-Unmanned Aerial Systems (C-UAS)

-

Counter-Rocket, Artillery, and Mortar (C-RAM) Systems

The Global Air Defence Systems Market by System Type, Missile Defense System (MD) had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Rising ballistic missile threats have become a significant catalyst for increased spending on missile defense (MD) systems worldwide. The proliferation of ballistic missiles among various countries has heightened security concerns, prompting governments to prioritize investments in advanced MD technologies. These systems are specifically designed to detect, track, and intercept ballistic missiles, thereby safeguarding critical infrastructure, military installations, and densely populated areas. Technological advancements play a crucial role in the continuous evolution of MD systems, encompassing improvements in radar capabilities, interceptor missiles with enhanced precision and range, and sophisticated command and control systems. This ongoing development ensures that MD systems remain at the forefront of air defense technology, capable of adapting to increasingly complex missile threats. The strategic importance of MD systems cannot be overstated, as they provide a vital layer of defense against one of the most potent and devastating forms of attack. Despite their complexity and high costs relative to other air defense solutions, MD systems command a significant share of the market in terms of total revenue. Governments and defense contractors focus on developing robust MD capabilities to meet national security imperatives, driving continuous innovation, and sustaining a high-value market niche within the broader air defense sector.

Global Air Defence Systems Market Segmentation: By Platform

-

Land-Based Systems

-

Air-Based Systems

-

Sea-Based Systems

Land-based air defense systems offer unparalleled versatility and strategic advantages in addressing a diverse range of threats across different operational scenarios. These systems can be configured for Short-Range Air Defense (SHORAD), Medium-Range Air Defense (MRAD), and Long-Range Air Defense (LRAD), providing comprehensive protection against low-flying drones to high-altitude missiles. Strategically The Global Air Defence Systems Market by Platform, Air-Based System had the largest market share last year and is poised to maintain its dominance throughout the forecast period. positioned, they ensure extensive area coverage, safeguarding critical infrastructure, military bases, and densely populated areas, thereby establishing a robust air defense network. While not as mobile as air or sea-based counterparts, some land-based systems can be mounted on vehicles for enhanced mobility and deployment flexibility. Cost-effectiveness is a significant advantage of land-based systems compared to their airborne and maritime counterparts, making them more accessible for many nations looking to bolster their defense capabilities within constrained budgets. Moreover, leveraging existing infrastructure further enhances their attractiveness, as many countries already possess established networks for land-based air defense, facilitating easier integration of new technologies and upgrades. While advancements in air-based systems continue to expand their role in specific applications, the adaptable nature and cost-efficiency of land-based systems position them as a cornerstone of global air defense strategies, ensuring continued growth and relevance in the evolving security landscape.

Global Air Defence Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Air Defence Systems Market by Region, North America had the largest market share last year. North America, led by the United States, has historically dominated the global air defense systems market, buoyed by its substantial military budgets and leadership in advanced defense technology development. The US's robust investment in cutting-edge air defense technologies not only fortifies its defenses but also stimulates demand from allied nations seeking state-of-the-art systems. However, the landscape is shifting with the rapid expansion of defense spending in the Asia-Pacific region, driven notably by countries like China, India, and Japan. These nations are increasingly investing in air defense systems to address regional threats and territorial disputes, potentially challenging North America's market supremacy in the foreseeable future. Reports indicate that Asia-Pacific could surpass North America in market share as these countries continue to modernize their defense capabilities. Moreover, the emergence of new and diverse air defense threats, such as hypersonic missiles and advanced drones, is reshaping the market dynamics. Different regions may prioritize specific technologies and capabilities tailored to their unique threat landscapes, leading to a more diversified global market. As a result, while North America currently holds a significant share, the market is expected to become more balanced over time, with Asia-Pacific playing an increasingly influential role in shaping the future direction of the air defense systems market.

COVID-19 Impact Analysis on the Global Air Defence Systems Market.

The COVID-19 pandemic has had a multifaceted impact on the global air defense systems market, disrupting supply chains, delaying procurement and development projects, and shifting government priorities. The pandemic-induced economic slowdown forced many countries to reallocate resources to public health and economic recovery efforts, leading to budget constraints and delays in defense spending. Production and delivery schedules of air defense systems were affected by lockdown measures, labor shortages, and disruptions in the supply of critical components. Additionally, travel restrictions and social distancing measures hindered international collaboration and slowed down testing and evaluation processes. However, the pandemic also highlighted the importance of resilient defense infrastructures, as geopolitical tensions and security threats persisted. Some nations accelerated their defense modernization plans to ensure readiness against potential threats, recognizing the need for robust air defense capabilities. The crisis also spurred innovation, with increased investment in remote operation technologies, automation, and AI to enhance the efficiency and effectiveness of air defense systems. As the world recovers, the market is expected to rebound, driven by the resumption of delayed projects and a renewed focus on national security. The pandemic underscored the critical need for adaptable and resilient defense systems, shaping future strategies and investments in the air defense sector.

Latest trends / Developments:

The global air defense systems market is witnessing several key trends and developments that are shaping its future landscape. One significant trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) into air defense systems, enhancing threat detection, decision-making, and automated response capabilities. AI-driven systems can analyze vast amounts of data in real time, improving the accuracy and speed of threat identification and engagement. Additionally, the development and deployment of hypersonic missiles and counter-hypersonic defense systems are gaining momentum, driven by the need to counteract advanced missile threats. There is also a growing emphasis on network-centric warfare, leading to the development of integrated and interoperable air defense systems that can seamlessly connect with other military platforms and sensors, providing a comprehensive defense network. The use of directed energy weapons, such as high-energy lasers and microwave systems, is being explored for their potential to provide cost-effective and precise targeting solutions against a variety of aerial threats, including drones and missiles. Furthermore, advancements in stealth technology and the miniaturization of components are enabling the development of more agile and mobile air defense systems. These trends reflect the continuous innovation and strategic investment aimed at maintaining a technological edge in air defense capabilities amidst evolving global threats.

Key Players:

-

Lockheed Martin Corporation (USA)

-

Raytheon Technologies Corporation (USA)

-

Northrop Grumman Corporation (USA)

-

Thales Group (France)

-

BAE Systems plc (UK)

-

Saab AB (Sweden)

-

Rafael Advanced Defense Systems Ltd. (Israel)

-

MBDA (European missile manufacturer)

-

Leonardo S.p.A. (Italy)

-

L3Harris Technologies, Inc. (USA)

Chapter 1. Air Defence Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Air Defence Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Air Defence Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Air Defence Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Air Defence Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Air Defence Systems Market – By System Type

6.1 Introduction/Key Findings

6.2 Missile Defense Systems (MD)

6.3 Anti-Aircraft Systems (AA)

6.4 Counter-Unmanned Aerial Systems (C-UAS)

6.5 Counter-Rocket, Artillery, and Mortar (C-RAM) Systems

6.6 Y-O-Y Growth trend Analysis By System Type

6.7 Absolute $ Opportunity Analysis By System Type, 2024-2030

Chapter 7. Air Defence Systems Market – By Platform

7.1 Introduction/Key Findings

7.2 Land-Based Systems

7.3 Air-Based Systems

7.4 Sea-Based Systems

7.5 Y-O-Y Growth trend Analysis By Platform

7.6 Absolute $ Opportunity Analysis By Platform, 2024-2030

Chapter 8. Air Defence Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By System Type

8.1.3 By Platform

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By System Type

8.2.3 By Platform

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By System Type

8.3.3 By Platform

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By System Type

8.4.3 By Platform

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By System Type

8.5.3 By Platform

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Air Defence Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lockheed Martin Corporation (USA)

9.2 Raytheon Technologies Corporation (USA)

9.3 Northrop Grumman Corporation (USA)

9.4 Thales Group (France)

9.5 BAE Systems plc (UK)

9.6 Saab AB (Sweden)

9.7 Rafael Advanced Defense Systems Ltd. (Israel)

9.8 MBDA (European missile manufacturer)

9.9 Leonardo S.p.A. (Italy)

9.10 L3Harris Technologies, Inc. (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Air Defence Systems market is expected to be valued at US$ 38.3 billion.

Through 2030, the Global Air Defence Systems market is expected to grow at a CAGR of 5%.

By 2030, the Global Air Defence Systems Market is expected to grow to a value of US$ 53.89 billion.

North America is predicted to lead the Global Air Defence Systems market.

The Global Air Defence Systems Market has segments By System Type, Platform, and Region.