Smart Weapons Market Size (2025-2030)

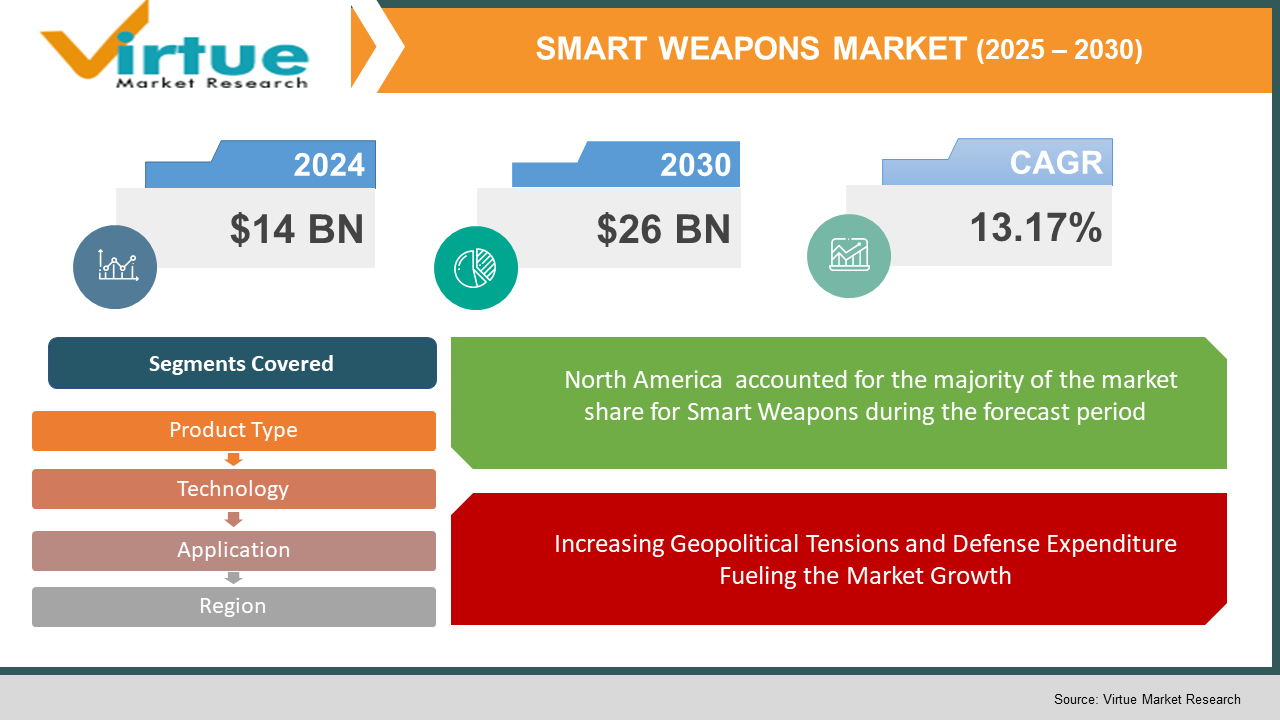

The Smart Weapons Market was valued at USD 14 billion and is projected to reach a market size of USD 26 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.17%.

The smart weapons market is growing rapidly, with advances in technology enabling weapon systems to be more effective and accurate. These weapons use advanced technologies like GPS, artificial intelligence, and sensors to sharpen their targets while reducing errors. Targeting requires high precision in an aim to avoid causing unintended confusion. Consequently, smart weapons are herein defined by their potential as guided missiles, drones, and smart bombs that could precisely down a specific target. The growing demand for these systems stems from the continuous increased need for national security and better defense capabilities. Various countries are pouring resources into smart weapons development in an attempt to bolster their military capabilities and remain competitive on global defense capabilities. Such products are also being identified for possible law enforcement applications in the overall support of precision and avoiding collateral damage situations for authorities. Furthermore, the development of autonomous weapons that can perform near-exclusively without human intervention is one major site of research going in the market. This growing emphasis on reducing the exposure of both personnel and civilians will likely mostly preserve the widening of the market. The smart weapons market is expected to be vital to modern defense approaches as technology continues to evolve.

Key Market Insights:

- In 2024, geopolitical tensions, especially the ongoing conflict in Ukraine and Russia and a few other issues are continuing to prompt nations to invest heavily in advanced defense technology, including smart weapons. Nations are spending more on defense budgets in order to modernize military holdings, boosting demand for smart weapons.

- Firms such as Anduril Industries are taking great leaps in creating autonomous systems and AI-based smart weapons. These technologies are attracting attention as military forces look to boost their operational capabilities with little human intervention.

- North America is the leading region in the development of smart weapons in 2024, with the U.S. military spending on next-generation weapons that utilize AI, robotics, and precision guidance. These technologies are viewed as central to preserving technological dominance.

- With the rise of increased global security issues, defense expenditure has shot up in 2024. This has seen governments focus on innovative technologies such as intelligent weapons, as countries aim to update and enhance their defense systems.

Smart Weapons Market Drivers:

Artificial Intelligence and Automation Technology Upgrades is Driving the Market Growth

The combination of artificial intelligence (AI), Machine Learning (ML) and automation has transformed the smart weapons industry. AI enables more precise targeting, decision-making, and quicker response times, enhancing the efficiency of weapons systems. For example, in 2024, AI-driven systems like autonomous drones are being created to conduct missions autonomously, greatly enhancing operational efficiency. This has created increasing interest among military institutions that want to have a technological advantage. As AI continues to progress, it is likely to facilitate even more innovation in smart weapons, making them increasingly accurate and effective.

Increasing Geopolitical Tensions and Defense Expenditure Fueling the Market Growth

Geopolitical conflicts globally are one of the main drivers for the expansion of the smart weapons market. As nations attempt to improve their defense mechanisms considering regional instability, demand for advanced military technology, such as smart weapons, grows. For instance, the increasing tensions in areas such as Eastern Europe and the Middle East have led nations to spend more on advanced defense systems in 2024. The increased demand for high-tech weapons, including precision-guided munitions and unmanned systems, is driving market growth. National defense spending is on the rise, creating a positive environment for the growth of the smart weapons market.

Enhanced Cost-Effectiveness and Operational Efficiency

Smart weapons, though initially costly, have become more affordable with advances in manufacture and materials. The savings in the main technologies of sensors, electronics, and communications are making smart weapons accessible to military forces globally. In 2024, the innovation of low-cost, high-efficiency smart munitions has been a major boost to defense forces, enabling precision and less collateral damage at a small fraction of the cost of conventional weapons. This cost-performance efficiency is projected to keep on fueling growth in the smart weapons market.

Smart Weapons Market Restraints and Challenges:

High Development and Maintenance Costs

Although smart weapons have numerous benefits, their production and maintenance are still a significant challenge. The development, testing, and manufacturing of high-end technologies such as AI, sensors, and autonomous systems are costly. The manufacture of advanced drones and precision-guided munitions is still costly, hindering their mass adoption, particularly in lower-budget defense agencies. These hefty prices may discourage some nations or firms from investing in smart weapons, particularly when they are under budget constraints. As a result, the market for smart weapons might experience slower growth because of financial constraints.

Ethical and Legal Concerns

The deployment of smart weapons, specifically autonomous systems, poses serious legal and ethical questions. Fears that machines might make life-or-death choices on their own are becoming increasingly prominent. International debate regarding the regulation of autonomous weapon systems is increasing, with governments and institutions working to prevent such weapons from being abused. The absence of wide-ranging international legal frameworks and disagreement over accountability for autonomous actions might hinder the adoption of such systems in most countries. Such ethical and legal issues are a significant brake on the development of the smart weapons market.

Cybersecurity Risks and Vulnerabilities

Smart weapons depend vastly on advanced software, communication networks, and data systems, making them vulnerable to cyber-attacks. The more connected these weapons become, they pose possible targets to malicious attackers who may sabotage their functionality. There have been increased concerns regarding the possibility of hacking autonomous weapon systems, and it may have catastrophic effects. The necessity of strong cybersecurity mechanisms and the susceptibility of these systems to attacks will hinder market growth, as defense agencies will not be willing to completely depend on digital technologies in the absence of solutions to these threats.

Smart Weapons Market Opportunities:

The market for smart weapons presents a number of growth opportunities fueled by advances in technology and changing global requirements. The ongoing advancement of AI provides a tremendous opportunity for embedding in weapon systems, enhancing autonomy, accuracy, and decision-making capabilities. As nations continue to invest in autonomous systems, including drones and unmanned vehicles, demand for such smart technologies will increase. Also, the expansion of non-lethal weapons provides a means of fulfilling the demand for reducing civilian casualties, especially in peacekeeping and law enforcement missions. The demand for stronger cybersecurity measures to secure weapon systems from cyber-attacks also provides new market opportunities, especially for secure military technology companies. In addition, the upgrading of current military equipment with intelligent technologies provides an economical option for most countries, paving the way for retrofitting previous systems. As defense spending across the world keeps increasing, particularly in research and development, investment in sophisticated weaponry rises, leading to further market growth. Demand for precision-guided munitions in both the military and civilian markets, including counterterrorism and anti-piracy, also offers tremendous growth opportunities.

SMART WEAPONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.17% |

|

Segments Covered |

By Product Type, technology, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, General Dynamics |

Smart Weapons Market Segmentation:

Smart Weapons Market Segmentation: By Product Type

- Missiles

- Munitions

- Guided Rockets

- Guided Projectiles

- Guided Firearm

- Others

Missiles represent one of the largest segments in the smart weapons market. These weapons are designed for precision strikes over long distances and are used primarily in military defense and offensive operations. The missile segment holds a dominant share, accounting for around 35-40% of the market.

Munitions are a broad category that includes projectiles and other ordnance used in warfare. These are typically less expensive than missiles and are used in a variety of land, maritime, and airborne military applications. Munitions hold a market share of approximately 25-30%.

Guided rockets are becoming increasingly popular due to their precision and versatility. This category includes a range of rockets, typically fired from ground or airborne platforms, that are equipped with guidance systems for greater accuracy. They make up around 10-15% of the market share. These are similar to guided rockets but typically refer to larger projectiles launched from artillery systems.

Guided projectiles provide precise targeting and can be used in a variety of terrains. This segment holds approximately 5-10% of the overall market share.

Guided firearms represent a smaller yet emerging segment, combining conventional firearms with smart technology such as target acquisition and automatic correction systems. This segment is gaining traction in specialized military applications, especially in close combat. It holds a relatively smaller market share of about 3-5%.

The "Others" segment includes less common types of smart weapons, such as directed energy weapons or hybrid systems.

Smart Weapons Market Segmentation: by Technology

- Infrared

- Laser

- Radar

- Positioning System (GPS)

- Others

Infrared technology is commonly applied in intelligent weapons for target location and tracking, particularly under low-visibility situations. Infrared-guided systems are especially favored in missiles and rockets. This segment captures a major market share, about 30-35%, propelled by the evolution of thermal imaging and night vision.

Laser guidance technology finds common applications in precision-guided weapons, missiles, and weapons. Laser-guided technology makes for extremely accurate targeting, particularly in intense operations. The segment of laser technology represents approximately 25-30% of market share with growth seen in both ground and airborne platforms.

Radar is most critical in guidance for several smart weapons, particularly air-to-air and surface-to-air missile systems. Radar technology ensures accurate detection and tracking of targets in all environments. This sector controls approximately 20-25% of the market, and development is being led by improvement in radar-based target systems.

GPS technology is inherent in contemporary intelligent weapons for precision navigation and targeting. It is widely employed by guided missiles and bombs, achieving precise accuracy across long ranges. The GPS market share is also a major proportion of around 15-20%, as GPS is used by most contemporary smart weapons.

Others include newer technologies like electromagnetic and acoustics-based systems. Though the size of this segment is small as of now, its future scope of applications in next-generation smart weapons may be responsible for growth, with a probable share of 5-10%.

Smart Weapons Market Segmentation: by Application

- Land

- Maritime

- Airborne

Applications on land hold the largest share in the market for smart weapons, with missiles, ammunition, and guided projectiles being utilized mostly in land warfare. This segment holds a large share of the market, approximately 45-50%, as defense forces aim to improve ground combat capabilities.

Marine smart weapons involved in maritime usage are naval missiles and guided torpedoes that are meant to provide precision firepower in maritime battles. The maritime market accounts for approximately 20-25% of the business, with interest growing in naval defense systems as well as refurbishing fleets.

Airborne systems, such as air-to-ground and air-to-air missiles, are a critical component of contemporary warfare. The smart weapons used in this category have high mobility and accuracy. The airborne market share is approximately 25-30%, and the growth is spurred by the proliferation of advanced air defense systems and UAVs (Unmanned Aerial Vehicles).

Smart Weapons Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America leads the smart weapons industry with a market share of approximately 40-45%, fueled by the military superiority of the United States and huge defense expenditure, especially in missile technologies, drones, and radar systems.

The Asia-Pacific is witnessing a high growth rate, with a market share of approximately 25-30%, as major nations such as China, India, and Japan are splurging on smart weapons for modernization and military defense purposes.

Europe takes the next with a 20-25% market share, with countries like France, the UK, and Germany developing missiles, guided weapons, and radar technologies, in many cases through NATO and EU partnerships.

South America has a smaller 5-10% share, where Brazil and Argentina are leading the defense spending, mainly on ground-based systems.

The Middle East and Africa account for approximately 10-15% of the market, fueled by local security issues and increasing investments in air defense and missile technologies in nations such as Saudi Arabia, the UAE, and Egypt.

COVID-19 Impact Analysis on the Global Smart Weapons Market:

The COVID-19 pandemic initially disrupted the smart weapons market owing to supply chain disruption, production shutdowns, and delays in defense projects. Numerous defense contracts were delayed or reassigned as governments focused on pandemic response and recovery of the economy. The pandemic, however, also brought into focus the demands for cutting-edge defense technology and elevated interest in unmanned systems as well as remote warfare. As the international military emphasis turned towards modernization, particularly in cybersecurity and autonomous systems, the demand for smart weapons recovered in the post-pandemic era. Although the market's long-term growth trend was initially derailed, it was sustained by continued defense spending and technological progress.

Latest Trends/ Developments:

The market for smart weapons is seeing greater investment in autonomous platforms, including unmanned aerial vehicles (UAVs) and drones for reconnaissance and precision strikes. Improvements in artificial intelligence (AI) and machine learning are increasing the accuracy and decision-making abilities of smart weapons, especially in missile guidance and targeting. It is trending towards the integration of multi-domain technologies, for example, merging radar, infrared, and GPS for more adaptable and accurate weapon systems. In addition, military forces are embracing hypersonic weapons, which provide quicker, more challenging-to-intercept attacks. Finally, cyber warfare technologies are being blended into intelligent weapons, providing enhanced protection against electronic threats and improving the general performance of these systems.

Key Players:

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- General Dynamics

- Thales Group

- Leonardo S.p.A.

- Rafael Advanced Defense Systems

- MBDA

- L3 Technologies

Chapter 1. Smart Weapons Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Smart Weapons Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Smart Weapons Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & End User Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Smart Weapons Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Smart Weapons Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Smart Weapons Market – By Product Type

6.1 Introduction/Key Findings

6.2 Missiles

6.3 Munitions

6.4 Guided Rockets

6.5 Guided Projectiles

6.6 Guided Firearm

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. Smart Weapons Market – By Technology

7.1 Introduction/Key Findings

7.2 Infrared

7.3 Laser

7.4 Radar

7.5 Positioning System (GPS)

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Technology

7.8 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 8. Smart Weapons Market – By Application

8.1 Introduction/Key Findings

8.2 Land

8.3 Maritime

8.4 Airborne

8.5 Y-O-Y Growth trend Analysis Application

8.6 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Smart Weapons Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Technology

9.1.3. By Application

9.1.4. By Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Technology

9.2.3. By Application

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Technology

9.3.3. By Application

9.3.4. By Product Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Technology

9.4.4. By Product Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Technology

9.5.4. By Product Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Smart Weapons Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Lockheed Martin

10.2 Raytheon Technologies

10.3 BAE Systems

10.4 Northrop Grumman

10.5 General Dynamics

10.6 Thales Group

10.7 Leonardo S.p.A.

10.8 Rafael Advanced Defense Systems

10.9 MBDA

10.10 L3 Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Weapons Market was valued at USD 14 billion and is projected to reach a market size of USD 26 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.17%.

The rapid growth of AI and ML in defense, growing opportunities in the automated weapons due to consistent political tensions and cost-effective military technology are some of the key market drivers in the Smart Weapons Market

Land, Maritime, and Airborne are the segments by application in the Smart Weapons Market.

North America is the most dominant region for the Global Smart Weapons Market

Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, General Dynamics, etc., are a few leading market players