Small Satellite Manufacturers Market Size (2024-2030)

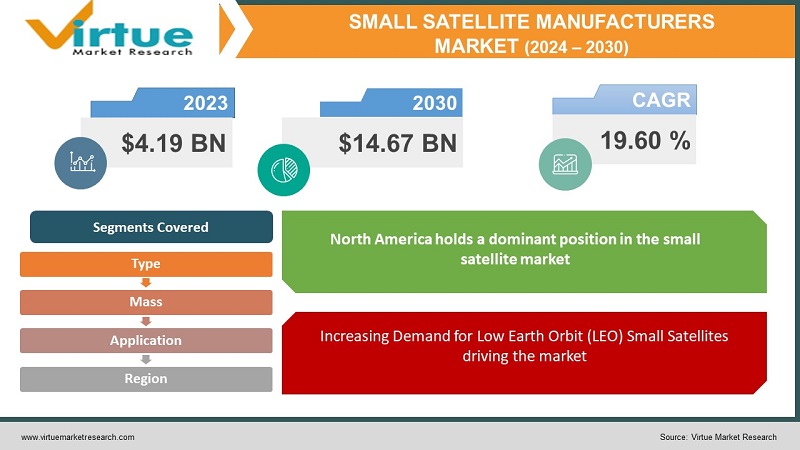

The small satellite market industry is projected to grow from USD 4.19 Billion in 2023 to USD 14.67 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 19.60% during the forecast period (2024 - 2030).

Recent progress in technology has facilitated the design, construction, and operation of small satellites in a more efficient and economical manner. Notably, advancements in miniaturization have enabled the incorporation of enhanced functionality within satellites of reduced size and weight. The escalating demand for earth observation data and imagery, particularly for applications like weather forecasting, crop monitoring, and environmental surveillance, aligns seamlessly with the capabilities of small satellites. These satellites excel in providing frequent and detailed imagery at a comparatively modest cost, rendering them well-suited for such missions. Moreover, small satellites find application in communications services, including the provision of internet connectivity to remote global regions. The surging demand for high-speed internet and the proliferation of interconnected devices are anticipated to sustain the need for satellite-based communication services, positioning small satellites for continued relevance. In the realm of defense and military applications, small satellites are gaining prominence for tasks such as intelligence gathering, surveillance, and reconnaissance, leveraging their compact size and maneuverability.

Key Market Insights:

The global Small Satellite Manufacturers Market is currently undergoing unprecedented growth, fueled by an escalating demand for agile and cost-effective satellite solutions. Essential drivers of this market expansion include technological strides in miniaturization, propulsion systems, and communication capabilities. Leading market players are strategically directing their efforts toward the development of innovative and compact satellite platforms, catering to a diverse range of applications such as Earth observation, communication, and scientific research. Collaborative initiatives between governmental bodies and private enterprises are on the rise, fostering increased competitiveness within the market. Despite initial challenges posed by the COVID-19 pandemic, the industry demonstrated resilience by capitalizing on opportunities in remote sensing and digital transformation. The market is poised for further expansion as both new entrants and established entities explore inventive business models and capitalize on emerging trends within the dynamic space economy.

Global Small Satellite Manufacturers Market Drivers:

Increasing Demand for Low Earth Orbit (LEO) Small Satellites driving the market

The demand for cost-effective small satellites with enhanced capacity is on the rise, particularly in sectors such as retail, banking, the energy industry (oil, gas, mining), and governments of industrialized nations. Additionally, there is an escalating need for affordable broadband services among individual consumers in less developed countries and rural areas lacking internet access. This surge in market expectations is fueling investments in LEO constellations based on small satellites. The industrialized countries are witnessing a substantial demand for low-cost, high-speed broadband. If the planned deployment of Geostationary Earth Orbit (GEO) High Throughput Satellites (HTS) and LEO constellations proves successful, there could be an oversupply compared to the anticipated demand, potentially leading to a reduction in the price per megabit.

Market expansion is being driven by the growing need for Earth observation imagery and analytics.

Earth observation services are becoming increasingly crucial, covering a spectrum of applications such as monitoring agricultural fields, detecting climatic changes, disaster mitigation, meteorology, and resource management. The demand for high-resolution earth imaging has surged across various sectors for precise management of land, water, and forest resources. Currently, the largest buyer of satellite imagery is the US government, positioning the United States as a key driver of small satellite technology. According to the Science and Technology Policy Institute, the smallsat imagery market is projected to experience a compound annual growth rate of 49%, potentially reaching USD 8.8 billion by 2030, assuming sustained high growth.

Global Small Satellite Manufacturers Market Constraints and Challenges:

The absence of unified regulations and government policies across nations poses a challenge to the evolution of the small satellite ecosystem and industry.

At present, there is no comprehensive global or domestic regulatory framework for on-orbit activities. While there are regulations related to satellite launch and re-entry, spectrum usage, and remote sensing in the US, on-orbit activities such as rendezvous and proximity operations, space-based Space Situational Awareness (SSA), and RF mapping lack specific regulations. The international community has not reached a consensus, with more than 75 countries engaging in small satellite activities. There are indications that a comprehensive global regime may be established, building upon the high-level principles outlined in the Outer Space Treaty.

Opportunities in the Global Small Satellite Manufacturers Market:

A significant opportunity lies in the development of satellite networks to provide internet access in areas lacking broadband connectivity. LEO satellite systems, including Starlink, TeleSat, and OneWeb, are already in orbit, enabling global satellite services in regions where terrestrial internet is unavailable. Companies are actively exploring this opportunity to offer internet connectivity to parts of the world with limited infrastructure. While the global telecommunications industry has invested heavily in terrestrial communication networks, satellite internet connectivity presents a cost-effective alternative, especially for rural and remote areas. With over 40% of the global population lacking internet access, satellite internet offers the potential for widespread connectivity, supporting activities such as remote work, education, and staying connected to friends, entertainment, and news.

SMALL SATELLITE MANUFACTURERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.60 % |

|

Segments Covered |

By Type, Mass, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gomspace, Planet Labs Inc., Thales Group, Airbus S.A.S., The Boeing Company, Northrop Grumman Corporation, L3harris Technologies, Inc, The Aerospace Corporation, Sierra Nevada Corporation, Lockheed Martin Corporation |

Global Small Satellite Manufacturers Market Segmentation

Global Small Satellite Manufacturers Market Segmentation by Application:

- Navigation

- Communication

- Scientific Research

In terms of application, the small satellite market's earth observation segment is expected to experience a growth rate of approximately 16% from 2024 to 2030. Notably, small satellites, including CubeSats and minisatellites, are extensively utilized for earth observation purposes. These satellites are equipped with hyperspectral sensors, high-resolution cameras, and remote sensing instruments, providing valuable data for various earth observation applications. The applications include agriculture, natural resource management, disaster management, climate monitoring, and urban planning. Small satellites, by delivering high-resolution imagery, contribute to mapping urban areas, encompassing transportation networks, infrastructure, and land use. This data aids policymakers and urban planners in making well-informed decisions regarding urban management and development. Furthermore, small satellites play a crucial role in providing climate change data, covering aspects such as precipitation, temperature, and sea level rise.

Global Small Satellite Manufacturers Market Segmentation by Type:

- Nano

- Micro

- Mini

Regarding the type of small satellites, the minisatellite segment claimed a dominant market share of approximately 45% in 2023. Minisatellites, falling within the weight range of 100 to 500 kg, offer expanded access to space and find extensive applications in scientific research. They are renowned for their cost-effectiveness in new space missions and scientific exploration. Minisatellites, equipped with high-resolution cameras and sensors, are primarily utilized for earth observation, contributing valuable data to areas such as natural resource management, agriculture, and urban planning. Additionally, minisatellites play a vital role in studying the earth's atmosphere, climate, and oceans. Their versatility extends to providing broadband internet and communication services to underserved and remote areas, showcasing significant operational efficiency and contributing to the overall growth of this segment.

Global Small Satellite Manufacturers Market Segmentation by Mass:

- Small Satellite

- CubeSat

Concerning mass, the CubeSat segment of the small satellite market surpassed USD 1.5 billion in value in 2023, experiencing robust growth that is expected to continue. CubeSats, characterized by their standardized form factor of 10x10x10 cm and a mass of up to 1.33 kg, offer ease of manufacturing and launching compared to traditional satellites. This segment's growth is attributed to the increasing interest of governments and private companies in leveraging small satellites for space missions and scientific research. CubeSats serve as risk-tolerant and cost-effective platforms for conducting experiments and testing new technologies in space. The broad range of features suitable for various applications positions the CubeSat segment for continued expansion.

Global Small Satellite Manufacturers Market Segmentation by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

As of 2023, North America holds a dominant position in the small satellite market, capturing a substantial 35% market share. The region stands as one of the largest markets for small satellites, boasting leading manufacturers, ground station operators, and launch service providers within a highly developed space industry ecosystem. The active involvement of the U.S. government, particularly agencies like NASA and the U.S. Department of Defense, significantly contributes to the business development of small satellite missions and programs. These missions focus on advancing scientific research and enhancing national security within the United States.

Impact of COVID-19 on the Global Small Satellite Manufacturers Market:

The global small satellite market experienced significant repercussions due to the COVID-19 pandemic. However, it demonstrated resilience, driven by sustained high demand in applications such as communication, navigation, and earth observation. A key challenge faced by the small satellite industry was the disruption of the global supply chain. The lockdowns and travel restrictions resulted in delays in the delivery of essential equipment and components required for satellite development and launch.

The closure of certain satellite manufacturing facilities and launch sites further contributed to the cancellation and postponement of small satellite missions. Despite these challenges, the market witnessed growth during the pandemic, propelled by increased investments in small satellite development and the emergence of numerous startups entering the market.

Recent Trends/Developments:

In January 2022, Virgin Orbit achieved a milestone by successfully launching seven CubeSats for three customers into orbit during the third consecutive successful operational flight of their LauncherOne air-launch system. SatRevolution, a Polish small satellite developer, supplied two of the satellites. Spire produced one satellite in collaboration with the Austrian Space Forum and Findus Venture GmbH to measure the orbital debris environment. The remaining four satellites were acquired under the Defense Department's Space Test Program.

In April 2023, the joint venture between Leonardo and Thales Alenia Space secured a contract from the Italian space agency for the development of the space factory 4.0 program. Thales Alenia Space is leading a consortium, including Argotec, Sitael, and CIRA, to create an interconnected system with various facilities located across Italy, set to commence operations by 2026.

In August 2022, Blue Canyon Technologies inaugurated a small satellite manufacturing facility in Colorado, significantly boosting the company's production capacity to 85 space vehicles per year. This move solidified the company's position as a market leader in the small satellite manufacturing sector.

Key Players:

- Gomspace

- Planet Labs Inc.

- Thales Group

- Airbus S.A.S.

- The Boeing Company

- Northrop Grumman Corporation

- L3harris Technologies, Inc

- The Aerospace Corporation

- Sierra Nevada Corporation

- Lockheed Martin Corporation

Chapter 1. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– BY APPLICATION

6.1. Introduction/Key Findings

6.2. Navigation

6.3. Communication

6.4. Scientific Research

6.5. Y-O-Y Growth trend Analysis By Application

6.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– BY TYPE

7.1. Introduction/Key Findings

7.2. Nano

7.3. Micro

7.4. Mini

7.5. Y-O-Y Growth trend Analysis By TYPE

7.6. Absolute $ Opportunity Analysis By TYPE , 2024-2030

Chapter 8. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– BY Mass

8.1. Introduction/Key Findings

8.2. Small Satellite

8.3. CubeSat

8.4. Y-O-Y Growth trend Analysis Mass

8.7. Absolute $ Opportunity Analysis Mass, 2024-2030

Chapter 9. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By TYPE

9.1.3. By Application

9.1.4. By Mass

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By TYPE

9.2.3. By Mass

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By TYPE

9.3.3. By Application

9.3.4. By Mass

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By TYPE

9.4.3. By Application

9.4.4. By Mass

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By TYPE

9.5.3. By Application

9.5.4. By Mass

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL SMALL SATELLITE MANUFACTURERS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Gomspace

10.2. Planet Labs Inc.

10.3. Thales Group

10.4. Airbus S.A.S.

10.5. The Boeing Company

10.6. Northrop Grumman Corporation

10.7. L3harris Technologies, Inc

10.8. The Aerospace Corporation

10.9. Sierra Nevada Corporation

10.10. Lockheed Martin Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The small satellite market industry is projected to grow from USD 4.19 Billion in 2023 to USD 14.67 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 19.60% during the forecast period (2024 - 2030).

The worldwide Global Small Satellite Manufacturers Market growth is estimated to be 19.60% from 2024 to 2030

The Global Small Satellite Manufacturers Market is Segmentation By Type (Nano, Micro, Mini), By Mass (Small Satellite, CubeSat), By Application (Navigation, Communication, Scientific Research).

The Small Satellite Manufacturers Market on a global scale is positioned for expansion, driven by the rapid progress in miniaturization and cost-effective satellite technologies. The escalating requirements for Earth observation, communication, and scientific missions, along with the increasing involvement of private entities in space activities, create favorable conditions for both market growth and innovative advancements

While the COVID-19 pandemic introduced disruptions to the global Small Satellite Manufacturers Market, manifesting in supply chain complexities, production setbacks, and financial uncertainties, it also acted as a catalyst for digital transformation and heightened demand for remote sensing capabilities. This dynamic environment stimulated resilience and innovation within the industry, laying the foundation for sustained growth and adaptability in the long run