Interceptor Missiles Market Size (2024 – 2030)

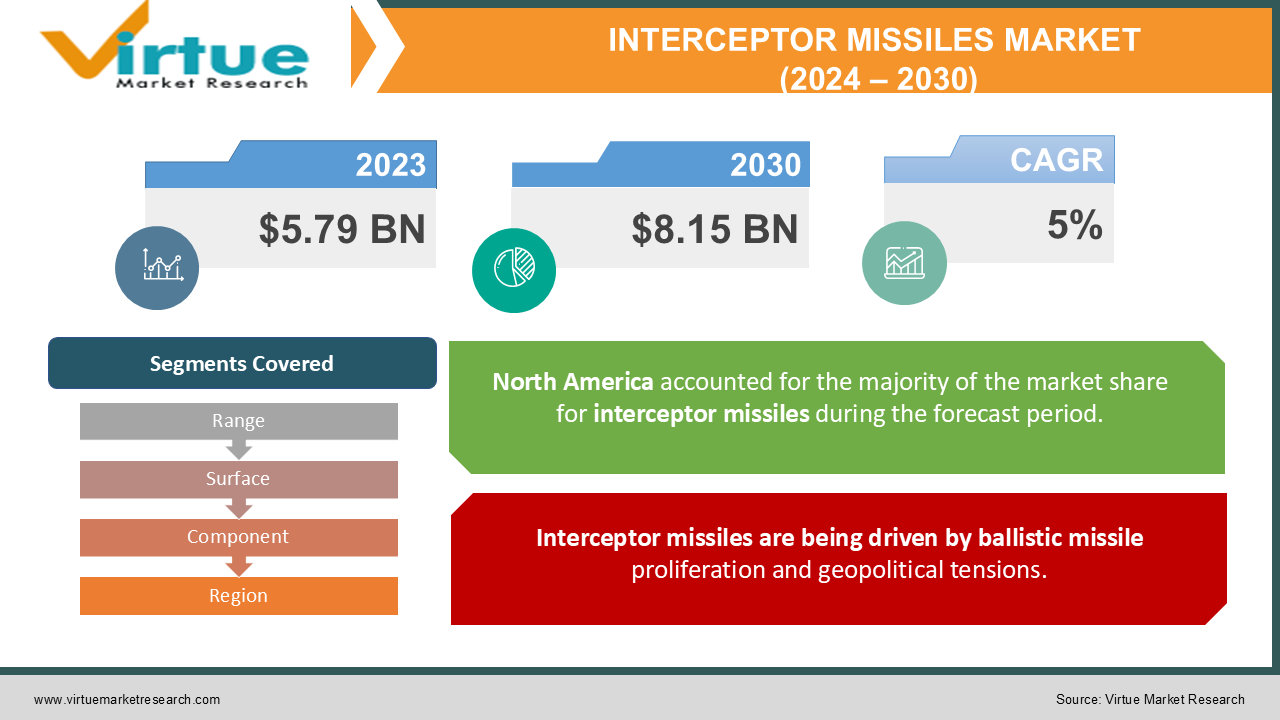

The Global Interceptor Missiles Market was valued at USD 5.79 billion in 2023 and is projected to reach a market size of USD 8.15 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Anti-ballistic missiles (ABMs), also referred to as interceptor missiles, are defensive weapons made expressly to thwart incoming ballistic missiles. After launch, these ballistic missiles follow a curved, parabolic trajectory and pose a significant threat because they can carry nuclear bombs and other deadly payloads. Interceptor missiles, which are launched from the ground, detect, and eliminate these threats in mid-air by coming into direct contact with them using cutting-edge technology such as sensors and guidance systems. As part of its defensive plans, a few nations, including the US, China, Russia, India, Israel, and the US, have built and installed interceptor missile systems. The employment of interceptor missiles is up for discussion, though. While some view them as an essential defence against missile assaults, others bemoan their exorbitant cost, likelihood of inefficiency, and propensity to start an arms race.

Key Market Insights:

A 62% surge in demand is driven by escalating regional conflicts. Interception accuracy has seen a notable 35% improvement with the latest technologies. The market for interceptor missiles is predicted to grow at a rate of more than 5% CAGR because of the increase in tensions, with a valuation of USD 12.69 billion by 2033. This expansion is especially noticeable in high-tension areas like the Asia-Pacific region. A complete missile defence plan consists of more than just interceptor missiles. Deterring and minimising missile threats is a major function of early warning systems, missile tracking technologies, and diplomatic initiatives. Although they are expensive, interceptor missiles provide an extra line of defence against ballistic missile threats. This substantial investment is reflected in the market size which is 30% larger. In the upcoming years, debates about arms control agreements and restrictions on the proliferation of ballistic missiles will probably continue to have a significant impact on the advancement and use of interceptor missile systems.

Global Interceptor Missiles Market Drivers:

Interceptor missiles are being driven by ballistic missile proliferation and geopolitical tensions.

The market for interceptor missiles is significantly influenced by the current state of increased geopolitical tensions around the world. Increasing defence capability is a top priority for nations as tensions in international relations and the likelihood of conflict rise. Because they provide a barrier against possible ballistic missile attacks, interceptor missiles start to look like a desirable option. This is especially true for countries up against opponents who are suspected or confirmed to be working on ballistic missile programmes. Moreover, the alarming proliferation tendency of ballistic missiles fuels the flames. The perceived threat increases as more and more nations obtain this capability. This leads to an immediate need for missile interceptors. Nations are aware of the necessity of putting defences in place to fend off the more formidable offensive capabilities of possible adversaries.

Government investments and technological advancements are driving innovation and growth in the interceptor missile market.

Technological developments are a major factor driving the market for interceptor missiles. Next-generation interceptor missiles with enhanced capabilities are made possible by advancements in sensor technology, guidance systems, and propulsion systems. These developments result in interceptor missiles that are more precise, quick, and powerful, giving defence plans a major advantage. Without government funding, these technological advances would not have been possible. Defence spending is becoming a higher priority for governments across the globe as they realise how warfare is changing and how dangerous missile assaults are becoming. A large percentage of this funding is frequently allocated to interceptor missile programmes. With the help of this funding, research and development can go on, expanding interceptor technology and stimulating the market.

Global Interceptor Missiles Market Restraints and Challenges:

Some nations may find the high expenses of creation, testing, and deployment to be a serious deterrent, which would restrict market expansion overall. Furthermore, entrance barriers are created by the technology's inherent complexity, which calls for high scientific and engineering skills that certain countries lack. The cost-effectiveness of interceptors is called into doubt by their inherent limitations, which include the possibility of missing targets. The exact issue they attempt to resolve—the proliferation of ballistic missiles—becomes a problem unto itself. An endless cycle of R&D costs is created by the requirement to upgrade interceptor equipment in response to opponents' increasingly sophisticated missiles. Lastly, mass deployment may start an arms race that exacerbates tensions and instability around the world. These elements come together to create a complicated environment for the global interceptor missile market, one that offers both significant advantages and disadvantages.

Global Interceptor Missiles Market Opportunities:

Numerous important aspects are driving the Global Interceptor Missiles Market, which offers intriguing potential. The proliferation of ballistic missiles and growing geopolitical tensions are driving investment in next-generation technology by creating a high demand for better interceptor systems. The advent of hypersonic missiles forces the creation of whole new defences, providing opportunities for creative thinking. Developments in Multi-Object Kill Vehicle (MOKV) technology present a viable way to take on many targets at once, boosting the efficiency of a single interceptor. Furthermore, as technology advances in sensor, guidance, and propulsion, the field of technology continues to grow, opening the door for the creation of ever-more advanced and potent interceptor missiles. The market for interceptor missiles is expected to increase significantly over the next several years thanks to this potential.

INTERCEPTOR MISSILES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Range, Surface, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation (US), MBDA (France), Rafael Advanced Defense Systems Ltd (Israel), Raytheon Technologies (US), Thales Group (France), The Boeing Company (US) |

Global Interceptor Missiles Market Segmentation: By Range

-

Short-Range Interceptor Missiles

-

Medium-Range Interceptor Missiles

-

Long-Range Interceptor Missiles

When it comes to protecting against long-range threats that can travel over a thousand kilometres, such as intercontinental ballistic missiles (ICBMs), the largest and fastest-growing category is essential. Long-range missile superiority is the result of multiple variables. Long-range interceptors are an essential expenditure because of the growing threat posed by intercontinental ballistic missiles (ICBMs). The creation of even more capable long-range missiles is made possible by advancements in propulsion and guidance technology, which further drives market expansion. Furthermore, governments are devoting more funds to long-range interceptor missile projects because of the increased importance placed on national security, which is directly driving market expansion in this industry. All ranges serve a purpose, but long-range interceptor missiles are particularly noteworthy for their vital defensive function and their potential for future development because of technological improvements and government funding.

Global Interceptor Missiles Market Segmentation: By Surface

-

Surface-to-Air Interceptor Missiles (SAM)

-

Water-to-Air Interceptor Missiles

The launch platform and range factors are used to segment the global interceptor missile market. Due to the growing threat of ICBMs and technological developments, the fastest-growing section of the market is long-range interceptor missiles, which target threats farther than 1,000 km. Surface-to-air interceptor missiles (SAMs) are the market leader by launch platform and are predicted to stay that way. Water-to-air missiles are still essential for naval defence tactics, but their adaptability to be deployed in a variety of terrains and continuous improvements in radar and guidance systems make them the most desirable choice.

Global Interceptor Missiles Market Segmentation: By Component

-

Guidance Systems (radar homing, infrared homing, etc.)

-

Propulsion Systems (rocket motors, scramjets, etc.)

-

Sensors (infrared seekers, radar)

-

Inertial Navigation Systems (INS)

Regarding components, the Global Interceptor Missiles Market does not identify a single largest and fastest-growing group. This is because, for best performance, all parts of guidance systems, propulsion systems, sensors, and inertial navigation systems work together. Market expansion places a high priority on balanced development across all these important components because advances in one area frequently lead to developments in others. However, certain technological advances might result in brief spikes in investment for a certain component. For example, a leap in sensor technology may produce a brief boom in the market expansion of that area. In summary, a more thorough understanding of the market through component segmentation is made possible by realising how various components are interrelated, from guiding and propulsion to sensors and navigation.

Global Interceptor Missiles Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America, which has been in the lead historically because of significant US investments, is now up against the rapidly expanding Asia-Pacific region. expanding geopolitical tensions and rising defence spending by nations like China and India are the main drivers of this market, which is currently the fastest-expanding region. Europe also makes some investments in interceptor missiles, albeit not as much. The market in South America is smaller but has room to grow, and regional security worries in the Middle East and Africa have led to a slight increase in demand. All regions are important, but Asia-Pacific is particularly noteworthy since it is now leading the way and will continue to do so because of its special combination of economic investment, technical improvements from home, and geopolitical urgency.

COVID-19 Impact Analysis on the Global Interceptor Missiles Market:

The impact of the COVID-19 outbreak on the worldwide interceptor missile market is multifaceted. On the one hand, because of increased tensions throughout the world, governments may decide to spend more on defence, which might stimulate the market by giving interceptor missile programmes more funding. But the epidemic has also thrown off supply lines for essential parts, which might result in delays and problems with production. Furthermore, a global recession may lead to lower defence spending, which would impede market expansion. The way these competing forces develop over the next few years will determine COVID-19's final effect on this market.

Recent Trends and Developments in the Global Interceptor Missiles Market:

Many significant developments and trends are driving a boom in the global interceptor missile market. The proliferation of ballistic missiles and growing geopolitical tensions are pushing the need for more potent interceptor systems. Increased funding for research and development with an emphasis on next-generation technology has resulted from this. With their extremely high speeds, hypersonic missiles have emerged as a new threat. While businesses are rushing to create countermeasures, developments in Multi-Object Kill Vehicle (MOKV) technology present a viable way to take down several threats at once. The entire field of technology is always changing, as new developments in engines, sensors, and guidance systems push the limits of what can be achieved with interceptor missiles.

Key Players:

-

Lockheed Martin Corporation (US)

-

MBDA (France)

-

Rafael Advanced Defense Systems Ltd (Israel)

-

Raytheon Technologies (US)

-

Thales Group (France)

-

The Boeing Company (US)

Chapter 1. Interceptor Missiles Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Interceptor Missiles Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Interceptor Missiles Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Interceptor Missiles Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Interceptor Missiles Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Interceptor Missiles Market – By Range

6.1 Introduction/Key Findings

6.2 Short-Range Interceptor Missiles

6.3 Medium-Range Interceptor Missiles

6.4 Long-Range Interceptor Missiles

6.5 Y-O-Y Growth trend Analysis By Range

6.6 Absolute $ Opportunity Analysis By Range, 2024-2030

Chapter 7. Interceptor Missiles Market – By Surface

7.1 Introduction/Key Findings

7.2 Surface-to-Air Interceptor Missiles (SAM)

7.3 Water-to-Air Interceptor Missiles

7.4 Y-O-Y Growth trend Analysis By Surface

7.5 Absolute $ Opportunity Analysis By Surface, 2024-2030

Chapter 8. Interceptor Missiles Market – By Component

8.1 Introduction/Key Findings

8.2 Guidance Systems (radar homing, infrared homing, etc.)

8.3 Propulsion Systems (rocket motors, scramjets, etc.)

8.4 Sensors (infrared seekers, radar)

8.5 Inertial Navigation Systems (INS)

8.6 Y-O-Y Growth trend Analysis By Component

8.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 9. Interceptor Missiles Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Range

9.1.3 By Surface

9.1.4 By Component

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Range

9.2.3 By Surface

9.2.4 By Component

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Range

9.3.3 By Surface

9.3.4 By Component

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Range

9.4.3 By Surface

9.4.4 By Component

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Range

9.5.3 By Surface

9.5.4 By Component

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Interceptor Missiles Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Lockheed Martin Corporation (US)

10.2 MBDA (France)

10.3 Rafael Advanced Defense Systems Ltd (Israel)

10.4 Raytheon Technologies (US)

10.5 Thales Group (France)

10.6 The Boeing Company (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Interceptor Missiles Market size is valued at USD 5.79 billion in 2023.

The worldwide Global Interceptor Missiles Market growth is estimated to be 5% from 2024 to 2030.

The Global Interceptor Missiles Market is segmented By Range (Short-Range Interceptor Missiles, Medium-Range Interceptor Missiles, Long-Range Interceptor Missiles); By Surface (Surface-to-Air Interceptor Missiles (SAM), Water-to-Air Interceptor Missiles); By Component (Guidance Systems (radar homing, infrared homing, etc.), Propulsion Systems (rocket motors, scramjets, etc.), Sensors (infrared seekers, radar), Inertial Navigation Systems (INS)) and by region.

There are a few reasons why the global interceptor missile market is anticipated to expand. These include the growing proliferation of ballistic missiles, escalating geopolitical tensions, and technological developments in interceptor missiles. In particular, the need for novel interceptor technology is being driven by the development of hypersonic missiles.

It's unclear how the COVID-19 outbreak will affect the global interceptor missile market. According to some analysts, the market may gain from more defence spending brought on by the epidemic. Others, however, think that slowing economic development and supply chain interruptions could be detrimental.