Internet of Things (IoT) Market Size (2024 – 2030)

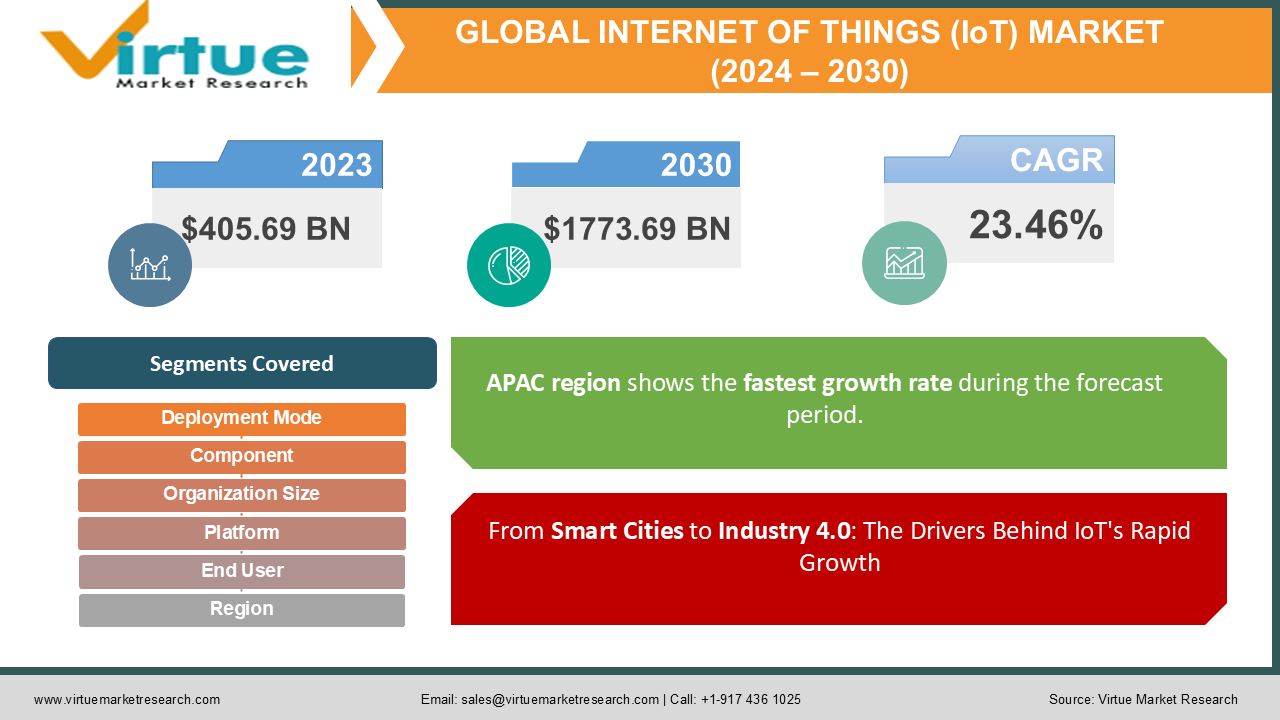

The global Internet of Things (IoT) market was valued at USD 405.69 billion and is projected to reach a market size of USD 1773.69 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 23.46%.

IoT is a physical device network that may communicate via other communications networks or the Internet to exchange data with other devices and systems. People may live and work smarter with the use of IoT devices. In the past, the market had a considerable presence. However, the applications were limited. Presently, the market has seen good growth owing to technological advancements and rapid adoption. In the future, with a focus on R&D activities and innovative solutions, the market is anticipated to witness a notable upsurge. During the forecast period, heightened demand is predicted.

Key Market Insights:

- Globally, there are around 16.7 billion IoT devices by 2023. By 2030, there will be nearly twice as many IoT devices, which is around 29.42 billion.

- By 2025, the IoT market for healthcare is projected to be valued at $534.3 billion.

- By 2025, it is expected that 48.4% of American households will have smart home technology.

- 82% of IoT-enabled healthcare organizations had a security breach. To tackle this, robust security measures are being implemented by the companies. The network is being segmented, access is being controlled, and network monitoring tools are being employed.

Internet of Things (IoT) Market Drivers:

The advantages of these devices are contributing to their success.

Digital transformation is taking place in many businesses to enhance consumer experiences, optimize processes, and increase productivity. IoT technologies provide connection, data collection, and automation across diverse objects and systems.

IoT solutions are being used by businesses more often to obtain real-time information, optimize workflows, and generate new income streams through creative goods and services. Large volumes of data are produced by sensors, actuators, and linked systems in Internet of Things devices. This data offers insightful information on the behavior, performance, and condition of environments, processes, and assets.

Organizations can foresee maintenance requirements, allocate resources optimally, make data-driven choices, and increase operational efficiency by utilizing IoT data analytics. These actionable insights from IoT-generated data promote informed decision-making and improve business results. These benefits provide better results, creating a market elevation.

Technological advancements are helping with the development.

The capabilities and reach of IoT deployments have increased with the development of wireless communication technologies like 5G, NB-IoT (Narrowband IoT), and LPWAN (Low-Power Wide-Area Network). These technologies are perfect for connecting a variety of IoT devices and applications because they provide high-speed, low-latency communication, wider coverage, and enhanced energy efficiency.

The expansion of IoT deployments across sectors and the creation of new use cases, like smart cities, linked cars, and industrial automation, are being facilitated by the availability of reliable connection solutions. Research and developmental activities are being prioritized to advance human understanding of this technology.

Internet of Things (IoT) Market Restraints and Challenges:

Data privacy, interpretability, complex integration, power consumption, and associated costs are the main issues that the market is currently facing.

These devices are vulnerable to fraud attacks. There have been numerous cases of misuse and leakage of critical information due to inadequate security measures. This has resulted in significant financial and ethical losses for the companies. Additionally, these devices take a lot of sensitive information about the individual and their homes when they are used for smart applications. This can create misassumptions, hindering growth.

Secondly, there is a lack of standard rules and protocols among different states and countries. This fragmentation complicates the data exchange and management, creating complexities between the teams.

Thirdly, difficulties can be faced while integrating this technology with old and outdated systems. This can lead to the need for a legal framework, certifications, and other adherence requirements.

Furthermore, they have a limited life. This is because they are dependent on batteries. They get easily drained from complicated applications and use. As such, it is vital to look for measures to extend their battery life. Apart from this, high expenses are required for the installation of hardware and software. Maintenance and other service charges add up. This can be a barrier for smaller and niche applications.

Internet of Things (IoT) Market Opportunities:

A smart city is a technologically advanced metropolitan region that gathers specialized data using various electrical systems and sensors. The data is utilized to enhance operations throughout the city by providing information that is utilized to manage resources, assets, and services effectively.

Connected sensors, lights, and meters that gather data in real-time are examples of IoT-enabled equipment. These devices help in collecting data on construction, traffic, and other such amenities. These insights can be used to prevent accidents and traffic jams. Similarly, they are used for weather monitoring, parking guidance, air quality monitoring, etc.

Secondly, their use in industrial applications is beneficial. These devices can be planted in equipment to gain input about reducing costs & downtime, streamlining operations, and optimizing the process. Additionally, they can predict any sort of failure that is bound to happen in the future.

Agriculture is another field where their use is being explored. They are adopted in this area to gain insights into crop, disease, pest, & resource management. This helps farmers maximize their yield. Apart from this, they are being employed in online retail to predict consumer behavior by tracking their choices and needs, delivering targeted promotions, and looking after the inventory. This market has an ample number of opportunities. By knowing the needs and requirements of each industry, they can be employed for better causes and outcomes.

GLOBAL INTERNET OF THINGS (IoT) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.46% |

|

Segments Covered |

By Deployment Mode, Component, Organization Size, Platform, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, IBM, Microsoft, Intel Corporation, Siemens AG, Huawei Technologies Co., Ltd., Bosch, General Electric (GE), Amazon Web Services (AWS), Google |

SEGMENTATION ANALYSIS

Global Internet of Things (IoT) Market Segmentation: By Deployment Mode

-

Cloud-based

-

On-premise

Cloud-based mode is both the largest and fastest-growing segment. A network that facilitates IoT devices and apps is known as a cloud-based IoT. It consists of the servers, storage, and underlying infrastructure required for processing and activities in real-time.

It is a completely managed solution that enables users to safely connect, control, and consume data from devices with internet access. It also enables real-time IoT data collection, processing, management, and visualization for platform services. It offers functions like machine learning, data processing, data visualization, and data storage. All these advantages help in gathering a broader client base.

Global Internet of Things (IoT) Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The hardware segment has the largest market share in 2023. This is because hardware elements like sensors, devices, and gateways are necessary for establishing communication and gathering information in Internet of Things systems. These hardware elements are essential to the effective deployment of IoT solutions and serve as the cornerstone of IoT infrastructure.

However, the service segment is the fastest-growing. A vast array of services are included, such as managed services, integration, deployment, maintenance, and consulting. Organizations are depending more on specialized services to design, execute, and oversee their Internet of Things initiatives as deployments grow more complex and diversified.

Service providers assist enterprises in overcoming obstacles and achieving their IoT goals by providing expertise in IoT architectural design, solution integration, data analytics, and cybersecurity.

Global Internet of Things (IoT) Market Segmentation: By Organization Size

-

Large-Scale Organization

-

Small and medium-scale organizations

Large-scale organizations have the largest market share in 2023. IoT technology can lower errors and boost worker productivity. It enables machines to operate 24/7. IoT security solutions are necessary to keep companies safe from data leaks and hackers.

Businesses may gather, store, and analyze data from linked devices due to IoT. Businesses may use this to learn more about their clients, staff, goods, and services. These organizations have the necessary funding and other resources to employ this technology, contributing to their dominance.

Small and medium-scale organizations are the fastest-growing. These businesses work with bigger organizations by offering distinctive solutions. These firms are receiving assistance from the government in the form of grants, funds, and different initiatives. Economic stability in many developing countries is accelerating the growth rate in this category.

Global Internet of Things (IoT) Market Segmentation: By Platform

-

Device Management

-

Application Management

-

Network Management

Device management is both the largest and fastest-growing platform. The practice of overseeing Internet of Things (IoT) devices and sensors during their whole lifespan is known as IoT device management. Planning, onboarding, monitoring, maintenance, and retirement are all included in this. By providing a means of remotely managing and monitoring devices, IoT device management aids in the prevention of cyberattacks and unauthorized access. Device management solutions provide precise asset management by keeping track of the kinds, locations, and statuses of devices. These advantages drive the growth of this category.

Internet of Things (IoT) Market Segmentation: By End-User

-

Energy & Utility

-

Healthcare

-

Transportation and Logistics

-

IT & Telecommunication

-

BFSI

-

Manufacturing

-

E-commerce

-

Others

Manufacturing is the category with the majority market in 2023. This industry was an early adopter of this technology. IoT boosts production, facilitates predictive maintenance, and increases operational efficiency. Manufacturers may get data in real-time from sensors built into manufacturing systems and machines due to the Internet of Things. By giving manufacturers access to information on supply chain optimization, quality assurance, and production trends, this data enables them to make more informed decisions and increase productivity.

The healthcare industry is one of the fastest-growing end users. The requirement for remote patient monitoring, an aging population, and the rise in chronic illnesses have all contributed to the rapid adoption of IoT in the healthcare sector.

Personalized medicine, telemedicine, smart healthcare facilities, and remote patient monitoring are all made possible by IoT technologies, which are completely changing the way healthcare is delivered. The need for digital health platforms, contactless patient monitoring, and telemedicine solutions has surged as a result of the COVID-19 epidemic, further propelling the use of IoT in healthcare.

Global Internet of Things (IoT) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market share in 2023. Leading the charge are the US and Canada. This is a result of their strong infrastructure, abundant resources, top-tier technological firms, and rapid adoption rates. There are several reputable businesses in this field. Google, Microsoft, Schneider Electric, and IBM are a few notable examples. In addition, this region is seeing an increase in investments, which is helping with the expansion.

During the projection, Asia-Pacific shows the fastest growth rate. Among the noteworthy ones are China, India, South Korea, and Japan. The use of IoT sensors is increasing rapidly due to the region's developing economy. Urbanization has led to a change in the standard of living and has increased investments in smart city initiatives. The region's rapidly growing industrial sector and government initiatives to promote IoT adoption are responsible for the growth.

COVID-19 Impact Analysis on the Global Internet of Things (IoT) Market:

The outbreak of the virus had a mixed impact on the market. Movement limitations, social seclusion, and lockdowns were implemented. Most of the businesses were closed to prevent the virus from spreading. There was a general sense of economic uncertainty. This resulted in several budgetary restrictions.

A 50% decrease in new orders was observed by several IoT providers as a result of COVID-19 forcing their clients to postpone or freeze IT/IoT investment, as per the IoT Analytics report. Import-export trade was affected because of disruptions in the supply chain. However, there was a positive impact amidst this.

Remote work became the new normal. Digitalization gained prominence. Companies started to recognize the necessity for automation, contactless operation, and remote monitoring. Adopting IoT devices enabled smooth monitoring virtually. These devices were implemented in energy, manufacturing, retail, and other such industries.

The healthcare sector saw an upsurge in demand. IoT solutions were used for telemedicine to monitor and analyze the patient's health. IoT medical devices like wearable bands and health monitoring watches gained popularity. IoT tracking devices were used for tracing the virus and infected patients to prevent the contamination cycle. A report by Simplilearn stated that 73% stated that the epidemic will hasten their future intentions to utilize IoT. Post-pandemic, the market has continued to grow due to its rapid adoption.

Latest Trends/ Developments:

- Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

- Sustainability is being emphasized in each industry to have minimal impacts on our planet. Energy management is being given prominence. Real-time energy consumption monitoring, pinpointing inefficient regions, and optimizing energy usage are being achieved with IoT. Energy expenses associated with lighting can be lowered by up to 80% with IoT-enabled smart lighting.

Key Players:

-

Huawei Technologies Co., Ltd.

-

Bosch

-

General Electric (GE)

-

Amazon Web Services (AWS)

-

Google

-

In March 2024, leading technology firm ALifecom announced the debut of its Non-Terrestrial Networks (NTN) IoT Platform for Satellite Communication UE Testing. This platform is the first integrated solution in the industry that integrates a channel emulator with ALifecom's NE6000 network emulator to efficiently simulate and test NTN communications in a system that is affordable, easy to use, and compact.

-

In March 2024, ASUS IoT, a pioneer in IoT solutions globally, launched the MDS-M700. A medical box PC intended for several healthcare environments is the MDS-M700. NVIDIA RTX graphics cards and Intel Core CPUs power it. Alcohol resistance and compliance with medical safety industry requirements, such as CE, FCC, and IEC 60601-1-2 certification, are features of the MDS-M700.

-

In February 2024, Vi Business, the corporate division of Vodafone Idea, introduced Vi Business IoT Smart Central, a new IoT connection and device management platform. The platform's goal is to assist businesses in remotely managing, controlling, and observing their IoT equipment. Additionally, it gives businesses a complete picture of all IoT assets and enables them to oversee and manage SIM lifecycle initiatives from a distance.

Chapter 1. Internet of Things (IoT) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Internet of Things (IoT) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Internet of Things (IoT) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Internet of Things (IoT) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Internet of Things (IoT) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Internet of Things (IoT) Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-premise

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Internet of Things (IoT) Market – By Component

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Software

7.4 Services

7.5 Y-O-Y Growth trend Analysis By Component

7.6 Absolute $ Opportunity Analysis By Component, 2023-2030

Chapter 8. Internet of Things (IoT) Market – By Organization Size

8.1 Introduction/Key Findings

8.2 Large-Scale Organization

8.3 Small and medium-scale organizations

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Internet of Things (IoT) Market – By Platform

9.1 Introduction/Key Findings

9.2 Device Management

9.3 Application Management

9.4 Network Management

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Internet of Things (IoT) Market – By End-User

10.1 Introduction/Key Findings

10.2 Energy & Utility

10.3 Healthcare

10.4 Transportation and Logistics

10.5 IT & Telecommunication

10.6 BFSI

10.7 Manufacturing

10.8 E-commerce

10.9 Others

10.10 Y-O-Y Growth trend Analysis By End-User

10.11 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 11. Internet of Things (IoT) Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Deployment Mode

11.1.2.1 By Component

11.1.3 By Organization Size

11.1.4 By End-User

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Deployment Mode

11.2.3 By Component

11.2.4 By Organization Size

11.2.5 By Platform

11.2.6 By End-User

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Deployment Mode

11.3.3 By Component

11.3.4 By Organization Size

11.3.5 By Platform

11.3.6 By End-User

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Deployment Mode

11.4.3 By Component

11.4.4 By Organization Size

11.4.5 By Platform

11.4.6 By End-User

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Deployment Mode

11.5.3 By Component

11.5.4 By Organization Size

11.5.5 By Platform

11.5.6 By End-User

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Internet of Things (IoT) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Cisco Systems

12.2 IBM

12.3 Microsoft

12.4 Intel Corporation

12.5 Siemens AG

12.6 Huawei Technologies Co., Ltd.

12.7 Bosch

12.8 General Electric (GE)

12.9 Amazon Web Services (AWS)

12.10 Google

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Internet of Things (IoT) Market was valued at USD 485.6 billion in 2022 and is projected to reach a market size of USD 2969.3 billion by the end of 2030 with a CAGR of 25.4%.

The primary drivers include technological advancements and industry 4.0 initiatives, cost-effectiveness, resource optimization, and the ability of remote monitoring and control

In 2022, the Hardware segment held the largest market share in the Internet of Things (IoT) segment.

Asia-Pacific dominated the Internet of Things (IoT) market. The region is a manufacturing hub, with China and India leading in terms of the adoption of the Industrial Internet of Things (IIoT)

Google Ads, AppNexus, Rubicon Project Exchange, OpenX, Smaato, and Right Media Exchange, are some of the key players in the Internet of Things (IoT) market