Managed Services Market Size (2024–2030)

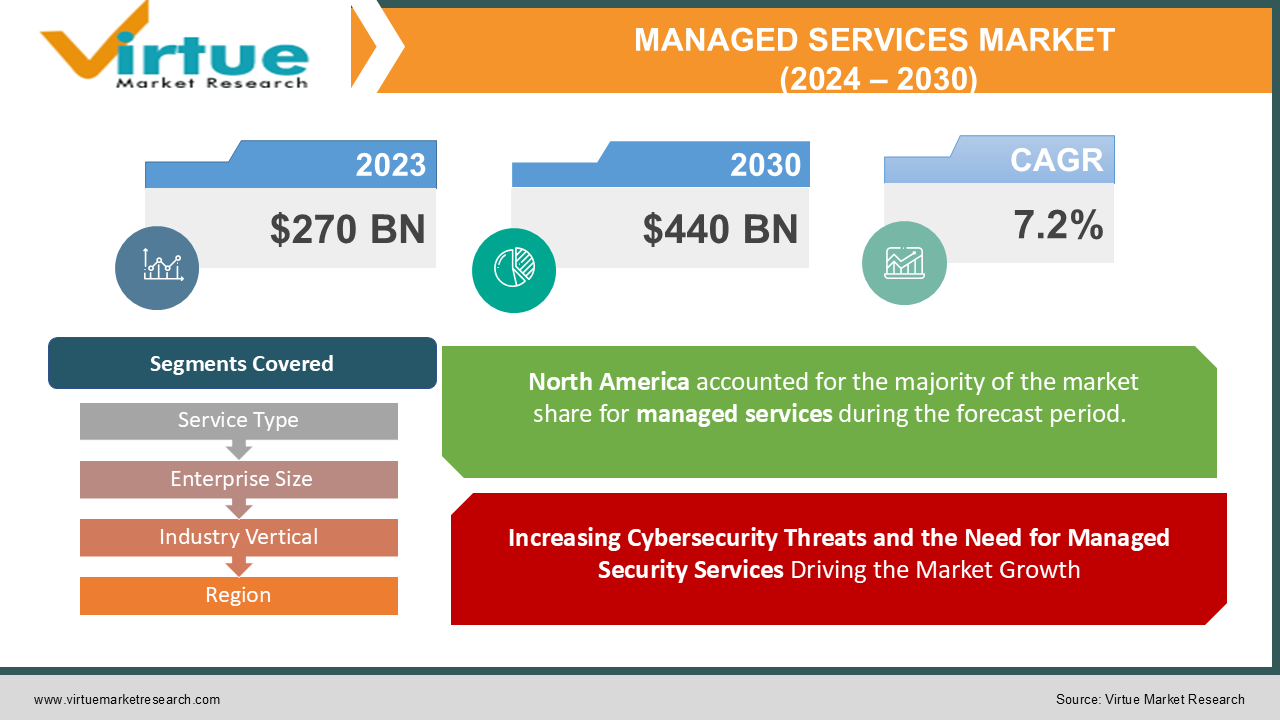

The Global Managed Services Market was valued at USD 270 billion in 2023 and is projected to reach USD 440 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030.

Managed services encompass a wide range of outsourced IT services, including managed security, managed network services, cloud-based managed services, and IT infrastructure management, which enable organizations to optimize their IT functions, reduce costs, and focus on core business objectives. The growth of this market is largely driven by the need for cost-effective and efficient IT management solutions, cybersecurity concerns, and the rapid pace of digital transformation.

The managed services market refers to the outsourcing of IT services to specialized providers. These providers manage and maintain IT infrastructure, applications, and other IT operations on behalf of their clients. This allows businesses to focus on their core competencies, reduce operational costs, and improve efficiency. Managed services encompass a wide range of offerings, including network management, cybersecurity, cloud services, data center management, and help desk support. By leveraging the expertise of managed service providers, organizations can benefit from proactive monitoring, 24/7 support, and advanced security solutions.

Key Market Insights:

-

Managed security services are expected to grow significantly, reaching nearly 30% of market share due to rising cybersecurity threats.

-

Organizations continue to transition to cloud-based services, with managed cloud services accounting for 40% of the market. Small and medium-sized enterprises (SMEs) are increasingly turning to managed services for cost-effective IT management.

-

North America remains the largest market, holding approximately 35% of the market share due to a high concentration of technology companies. Managed services are increasingly incorporating artificial intelligence (AI) to enhance automation, efficiency, and security. The rise of hybrid IT environments has created demand for managed services that can oversee both on-premises and cloud resources.

Global Managed Services Market Drivers:

Increasing Cybersecurity Threats and the Need for Managed Security Services Driving the Market Growth

With the growing frequency and sophistication of cyberattacks, there is an increased demand for managed security services. Companies across sectors are seeking expert assistance in monitoring, detecting, and mitigating cyber threats, which often require advanced security technologies and round-the-clock surveillance. Managed service providers (MSPs) bring expertise and infrastructure to manage cybersecurity proactively, addressing vulnerabilities, and ensuring compliance with regulatory standards. This has driven the managed security services segment to become one of the fastest-growing areas within the managed services market.

Growing Complexity of IT Infrastructure and Need for Cost Reduction Fuelling the Market Growth

The modern IT landscape is complex, combining on-premises infrastructure, cloud solutions, and remote working capabilities. Managing this hybrid infrastructure is both challenging and costly, particularly for organizations with limited in-house IT resources. Managed services allow companies to outsource their IT management to specialists, reducing costs associated with hiring and training IT staff. Additionally, MSPs offer scalable solutions, enabling organizations to adjust their IT resources as needed without committing to costly infrastructure investments, making managed services a cost-effective alternative.

Rapid Digital Transformation Across Industries

The push towards digital transformation has led many organizations to adopt new technologies, from IoT and AI to big data analytics. As companies expand their digital operations, there is a growing need for efficient IT management that can keep up with rapid technological changes. Managed services provide the expertise needed to implement and maintain these digital technologies effectively, enabling companies to focus on innovation without the burden of managing IT infrastructure. This trend is particularly prominent in industries like healthcare, finance, and manufacturing, where digital transformation is reshaping operations.

Global Managed Services Market Challenges and Restraints:

Data Privacy and Security Concerns

While managed services offer enhanced IT management, data privacy and security remain significant concerns, especially in regulated sectors like healthcare and finance. Organizations are often hesitant to outsource sensitive data to third-party providers, fearing potential data breaches and loss of control over proprietary information. Additionally, compliance with regulations such as GDPR and HIPAA mandates strict data protection standards, requiring managed service providers to ensure robust security measures. These privacy concerns can limit the adoption of managed services, as organizations weigh the risks of third-party access to their data.

Dependence on Third-Party Vendors and Service Reliability

Relying on managed services can lead to dependency on third-party vendors, raising concerns about service reliability and provider accountability. Service disruptions, poor performance, or vendor lock-in can negatively impact business operations, especially if the managed service provider lacks flexibility or fails to meet agreed-upon service levels. Organizations must carefully evaluate providers and establish detailed service-level agreements (SLAs) to mitigate risks associated with vendor dependency. However, the challenges of selecting a reliable MSP can slow down market growth, particularly for businesses seeking long-term stability and control over their IT operations.

Market Opportunities:

The Global Managed Services Market presents substantial opportunities as organizations worldwide continue to prioritize digital transformation. Managed services allow companies to optimize IT resources, reduce operational costs, and improve security, making them essential for businesses striving to stay competitive. Emerging technologies, such as AI and machine learning, offer MSPs the chance to develop innovative solutions that enhance automation and efficiency, further driving the demand for managed services. In the healthcare, finance, and retail sectors, there is a high potential for growth, as these industries face stringent compliance requirements and require robust IT solutions. Additionally, the trend toward hybrid cloud environments has created a demand for managed services that can oversee both cloud and on-premises resources, ensuring seamless integration and operational efficiency. Expansion into emerging markets, particularly in the Asia-Pacific region, also offers significant growth potential due to increased IT adoption and rapid economic development. s organizations increasingly adopt cloud technologies, IoT devices, and AI-driven applications, they require sophisticated management and security services. Managed service providers can offer comprehensive solutions, including cloud migration, cybersecurity, network management, and data center operations. Additionally, the rise of remote work and digital transformation has accelerated the need for remote IT support and managed endpoint solutions. By specializing in niche areas like cybersecurity, AI, and IoT, managed service providers can differentiate themselves and command premium pricing. Moreover, strategic partnerships with technology vendors and cloud providers can enhance service offerings and expand market reach.

MANAGED SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Service Type, Enterprise Size, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corporation, Accenture, Cisco Systems, Inc., Atos SE, Fujitsu Ltd., HCL Technologies, Cognizant, DXC Technology, TCS (Tata Consultancy Services), Infosys Ltd. |

Managed Services Market Segmentation: By Service Type

-

Managed Network Services

-

Managed Security Services

-

Managed IT Infrastructure

-

Managed Data Center Services

-

Managed Cloud Services

Managed security services dominate due to the growing cybersecurity threats and the need for continuous monitoring and protection. This segment is expected to grow as companies prioritize security as a fundamental aspect of their IT infrastructure.

Managed Services Market Segmentation: By Enterprise Size

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

Large enterprises lead the adoption of managed services due to their extensive IT infrastructure needs and significant investments in security and compliance. These organizations benefit from the scalability and expertise of managed service providers to address complex IT demands.

Managed Services Market Segmentation: By Industry Vertical

-

Healthcare

-

BFSI (Banking, Financial Services, and Insurance)

-

IT & Telecom

-

Manufacturing

-

Retail

The IT & telecom sector is the largest adopter of managed services, leveraging these services to manage complex networks, ensure cybersecurity, and support cloud infrastructure. This segment remains at the forefront as telecom companies integrate advanced technologies like 5G.

Managed Services Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest market share, driven by the presence of major IT companies and high adoption of managed services across sectors. The region’s focus on digital transformation, data security, and cloud migration has strengthened the demand for managed services, especially in industries like finance and healthcare.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly accelerated the adoption of managed services as organizations shifted to remote work environments. With many businesses facing resource constraints, managed service providers offered essential support in cloud management, cybersecurity, and IT infrastructure, ensuring business continuity during lockdowns. The need for remote IT solutions increased demand for managed services, especially in sectors like healthcare and retail, where digital transformation was prioritized to adapt to new consumer behaviors and remote access requirements. Additionally, the pandemic highlighted the importance of cybersecurity, leading to a surge in managed security services as organizations sought to protect their data and networks from increasing cyber threats. This trend is expected to continue post-pandemic, as companies maintain hybrid work environments and require managed services for ongoing IT support.

Latest Trends/Developments:

AI-powered managed services can predict potential IT failures, optimize network performance, and enhance cybersecurity. Additionally, there is a shift toward managed service models that focus on hybrid cloud management, as organizations increasingly utilize both public and private clouds. Service providers are also expanding their portfolios to include compliance management solutions, especially in highly regulated sectors like healthcare and finance. Moreover, MSPs are investing in developing multi-cloud and edge computing capabilities to support the evolving needs of clients with decentralized IT environments. The managed services market is undergoing significant transformation, driven by the increasing complexity of IT environments and the growing demand for specialized expertise. Key trends also include the integration of artificial intelligence (AI) and machine learning to automate routine tasks and improve operational efficiency. Cybersecurity remains a top priority, with managed service providers offering advanced threat detection and response capabilities. Cloud-based managed services are gaining traction, providing scalable and flexible solutions. The Internet of Things (IoT) is driving the need for comprehensive device management and security services. Furthermore, the convergence of IT and operational technology (OT) is creating new opportunities for managed service providers to address the challenges of industrial automation and digital transformation.

Key Players:

-

IBM Corporation

-

Accenture

-

Cisco Systems, Inc.

-

Atos SE

-

Fujitsu Ltd.

-

HCL Technologies

-

Cognizant

-

DXC Technology

-

TCS (Tata Consultancy Services)

-

Infosys Ltd.

Chapter 1. Managed Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Managed Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Managed Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Managed Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Managed Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Managed Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Managed Network Services

6.3 Managed Security Services

6.4 Managed IT Infrastructure

6.5 Managed Data Center Services

6.6 Managed Cloud Services

6.7 Y-O-Y Growth trend Analysis By Service Type

6.8 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Managed Services Market – By Enterprise Size

7.1 Introduction/Key Findings

7.2 Small and Medium Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Enterprise Size

7.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 8. Managed Services Market – By Industry Vertical

8.1 Introduction/Key Findings

8.2 Healthcare

8.3 BFSI (Banking, Financial Services, and Insurance)

8.4 IT & Telecom

8.5 Manufacturing

8.6 Retail

8.7 Y-O-Y Growth trend Analysis By Industry Vertical

8.8 Absolute $ Opportunity Analysis By Industry Vertical, 2024-2030

Chapter 9. Managed Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By Enterprise Size

9.1.4 By Industry Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By Enterprise Size

9.2.4 By Industry Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By Enterprise Size

9.3.4 By Industry Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By Enterprise Size

9.4.4 By Industry Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By Enterprise Size

9.5.4 By Industry Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Managed Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 IBM Corporation

10.2 Accenture

10.3 Cisco Systems, Inc.

10.4 Atos SE

10.5 Fujitsu Ltd.

10.6 HCL Technologies

10.7 Cognizant

10.8 DXC Technology

10.9 TCS (Tata Consultancy Services)

10.10 Infosys Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 270 billion in 2023 and is projected to reach USD 440 billion by 2030, with a CAGR of 7.2% from 2024 to 2030.

Key drivers include increasing cybersecurity threats, the growing complexity of IT infrastructure, and the ongoing digital transformation across industries.

The market is segmented by service type (managed network, security, IT infrastructure, cloud), enterprise size (SMEs, large enterprises), and industry vertical (healthcare, BFSI, IT & telecom, manufacturing).

North America leads with a 35% market share, driven by high demand for managed IT services and a robust technology infrastructure.

Leading players include IBM Corporation, Accenture, Cisco Systems, Inc., Atos SE, and Fujitsu Ltd., among others.