Cyber Security Market Size (2024 – 2030)

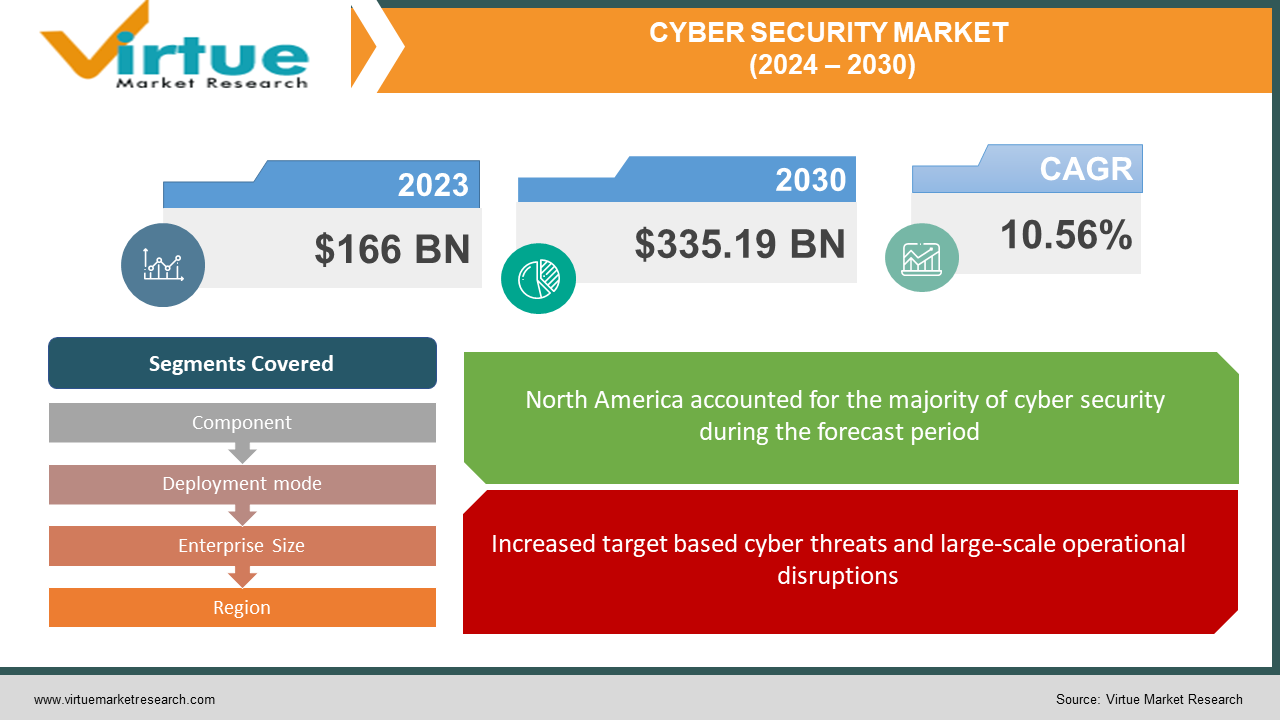

The Global Cyber Security Market was valued at USD 166 Billion in 2023 and is projected to reach a market size of USD 335.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.56%.

The global cyber security market presents a lucrative opportunity for vendors offering innovative solutions and services. The ever-evolving threat landscape and increasing cybersecurity awareness are fueling the market's rapid expansion. The market encompasses a wide range of products and services aimed at protecting computer systems, networks, and data from unauthorized access, attacks, and damage. The escalating number and complexity of cyber threats, including ransomware, data breaches, and other types of cyber-attacks, have driven organizations to invest in robust cybersecurity solutions. The global cybersecurity market is diverse and includes a variety of products and services, such as antivirus software, firewalls, intrusion detection and prevention systems, secure web gateways, encryption solutions, identity and access management, and security consulting services. The cybersecurity industry has attracted significant investment from venture capitalists and private equity firms. This investment has supported the development of innovative cybersecurity technologies. Therefore, market trends and dynamics keep on evolving.

Key Market Insights:

The global cybersecurity market has been experiencing significant growth, driven by the increasing frequency and sophistication of cyber threats. Factors such as the rising adoption of digital technologies, cloud computing, IoT (Internet of Things), and the expansion of e-commerce contribute to the growing demand for cybersecurity solutions. The sophistication and frequency of cyberattacks are constantly evolving, pushing businesses and individuals to invest in stronger defenses. Cyber threats continue to evolve, encompassing a wide range of attack vectors such as ransomware, phishing, DDoS attacks, and advanced persistent threats (APTs). The shift to remote work during the COVID-19 pandemic has also introduced new challenges, with an increased focus on securing remote access and endpoints. Governments and regulatory bodies worldwide are implementing and enforcing stricter cybersecurity regulations to protect sensitive data and critical infrastructure. Compliance requirements, such as GDPR (General Data Protection Regulation) in Europe and similar regulations in other regions, are driving organizations to invest in cybersecurity measures. Adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) for threat detection and response.

Global Cyber Security Market Drivers:

Increased target based cyber threats and large-scale operational disruptions.

Cybercriminals are constantly evolving their tactics, making it more challenging for organizations to defend themselves. Businesses of all sizes are increasingly targeted for ransomware, data breaches, and other malicious activities. Cybercriminals are adopting increasingly complex tactics, employing automation, artificial intelligence, and social engineering to bypass traditional security measures. This necessitates continuous adaptation and investment in advanced defense technologies. The growing number of connected devices and the adoption of cloud technologies create more entry points for attackers. Attacks are no longer solely focused on large corporations; small and medium-sized businesses (SMBs), government agencies, and critical infrastructure are increasingly targeted due to perceived vulnerabilities. This broadens the market for security solutions across sectors. The financial losses and operational disruptions caused by cyberattacks are staggering. State-sponsored attacks can target government institutions, critical infrastructure, and private enterprises to gain access to sensitive information or disrupt operations. This geopolitical dimension further emphasizes the importance of cybersecurity at both national and organizational levels.

Digital transformation and Interconnectedness is Driving the global Security Market.

The global trend towards digital transformation, accelerated by the adoption of cloud computing, IoT, and remote work solutions, has expanded the attack surface for cyber threats. The proliferation of interconnected devices and the reliance on cloud services create new opportunities for cybercriminals to exploit vulnerabilities. As organizations embrace digital technologies for efficiency and innovation, the need for robust cybersecurity solutions becomes paramount to safeguard digital assets and maintain business continuity. The Internet of Things (IoT) and the proliferation of mobile devices introduce a vast attack surface with numerous entry points for hackers securing these devices and their data necessitates specialized solutions and constant vigilance. The shift towards remote work expands the attack surface as employees connect to corporate networks from unsecured personal devices and remote locations. This necessitates endpoint security solutions and secure access management protocols.

Regulatory Compliance, Data Privacy Concerns, and Growing Awareness is Driving Growth in the Market.

Laws like GDPR in Europe and CCPA in California incentivize companies to invest in data security measures to protect personal information and avoid hefty fines. Non-compliance with these regulations can result in significant fines, leading organizations to invest in cybersecurity solutions to ensure regulatory adherence. This compliance-driven demand fuels the market for data encryption, privacy monitoring tools, and access control solutions. Media coverage of major cyberattacks, and data breaches has raised public awareness about cyber threats, prompting individuals and organizations to prioritize cybersecurity investments. This widespread concern creates a large and growing market for consumer-oriented security solutions and educational resources. As regulations become more globalized, with multiple regions adopting similar data protection frameworks, organizations operating on a global scale must navigate a complex landscape of compliance requirements. This globalized approach to data protection further fuels the demand for cybersecurity solutions that can address diverse regulatory frameworks.

Global Cyber Security Market Restraints and Challenges:

The complexity and sophistication of cyber threats pose a significant challenge to cybersecurity measures.

Cybercriminals behind APTs often employ advanced techniques to evade traditional security measures, making them challenging to detect. They may use zero-day exploits, custom malware, and advanced tactics to maintain persistence in a compromised network. APTs are frequently associated with nation-state actors seeking to conduct cyber espionage, gather intelligence, or disrupt critical infrastructure. The involvement of well-funded and highly skilled state-sponsored groups adds a layer of complexity, as these actors can leverage significant resources and expertise to achieve their objectives. Cybercriminals increasingly target the supply chain to compromise organizations indirectly. By exploiting vulnerabilities in the software or services provided by third-party suppliers, attackers can gain unauthorized access to the target organization's network. This approach leverages the interconnected nature of modern business ecosystems. Supply chain attacks can compromise the integrity of software updates, hardware components, or service providers. When a trusted link in the supply chain is compromised, it can have cascading effects on the security of downstream organizations, amplifying the complexity of the threat landscape. Addressing the complexity of cyber threats requires a multi-faceted approach that combines advanced technologies, threat intelligence, user education, and proactive defense strategies.

Cost Constraints and Budgetary Limitations restraining the Global Cyber Security Market.

Deploying and maintaining effective cybersecurity solutions can be expensive, and SMEs may find it particularly challenging to invest in advanced cybersecurity technologies and skilled personnel. As a result, they may be more vulnerable to cyber threats, creating disparities in security postures across different sectors. SMEs often operate with more constrained budgets compared to larger enterprises. The lack of financial resources may limit their ability to invest in advanced cybersecurity technologies and dedicated cybersecurity personnel. This makes SMEs more vulnerable to cyber threats, as they may lack the scale to implement comprehensive security measures. The urgency of addressing immediate business needs may overshadow the long-term benefits of investing in comprehensive cybersecurity. Organizations may focus on short-term gains and cost savings, potentially neglecting the necessary investments in proactive cybersecurity measures. Organizations often face challenges in balancing investments across the cybersecurity triad of prevention, detection, and response. Preventive measures can be costly but are essential for reducing the likelihood of successful cyber-attacks. However, a complete reliance on prevention may leave organizations vulnerable to advanced threats, necessitating investments in detection and response capabilities.

Global Cyber Security Market Opportunities:

The global cyber security market is booming, fueled by an ever-evolving threat landscape and the increasing reliance on digital technologies. This presents a plethora of opportunities for established players and innovative newcomers alike. The demand for advanced security solutions is exploding, from endpoint protection and network security to identity and access management and data loss prevention. Niche players and established vendors alike can carve lucrative spaces by offering innovative and user-friendly solutions. With the skill shortage a persistent hurdle, consulting, penetration testing, incident response, and vulnerability assessment services will continue to be goldmines for skilled professionals. AI-powered threat detection and response solutions are revolutionizing the landscape. Integrating AI and ML into security products and services will be a crucial differentiator. With the rapid adoption of cloud computing across industries, the demand for robust cloud security solutions is on the rise. As businesses migrate their data and applications to the cloud, the need for effective protection against evolving cyber threats in cloud environments becomes paramount. This presents an opportunity for cybersecurity providers to offer innovative and integrated cloud security solutions, addressing the unique challenges associated with the cloud. The integration of artificial intelligence (AI) and machine learning (ML) technologies into cybersecurity solutions offers unprecedented opportunities for threat detection and response. AI and ML algorithms can analyze vast datasets, identify patterns, and detect anomalies, enhancing the efficiency and effectiveness of cybersecurity measures. Companies specializing in AI-driven cybersecurity solutions could lead in the development of predictive and adaptive defense mechanisms. As the Internet of Things (IoT) continues to expand across industries, so does the attack surface for cyber threats. Cybersecurity companies could develop specialized solutions for securing IoT ecosystems. This includes implementing robust encryption, authentication mechanisms, and security protocols to protect the growing number of connected devices and prevent potential breaches. The global cybersecurity market is evolving, driven by the dynamic nature of cyber threats and the increasing digitalization of businesses. Companies operating in this space have a wealth of opportunities to explore, from addressing specific technological challenges to providing holistic cybersecurity solutions.

CYBER SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.56% |

|

Segments Covered |

By Component, Deployment mode, Enterprise Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Proofpoint, Inc, Sophos Ltd, Lockheed Martin Corporation, LogRhythm, Inc, McAfee, Palo Alto Networks, Inc, Cisco Systems, Inc, FireEye, Inc, Broadcom, Inc, Norton Life, Centrify Corporation |

Cyber Security Market Segmentation: By Component

-

Solutions

-

Services

Services segment accounts for the biggest revenue share of 54.3% in 2023. Many organizations, especially smaller ones, lack the in-house expertise to navigate the complex cybersecurity landscape. They prefer consulting, vulnerability assessments, incident response, and managed security services offered by expert providers. Small and Medium-sized Enterprises (SMEs) often have limited budgets and resources. Services allow them to optimize their security posture without hefty upfront investments in software and hardware. Organizations are increasingly subscribing to managed security services to build a strong defense against cyberattacks, constantly monitored and maintained by professionals.

While both segments show healthy growth, services are witnessing a faster climb, driven by the increasing sophistication and frequency of cyberattacks necessitate expert guidance and proactive measures, further boosting the demand for services. Stringent data privacy regulations are driving the need for expert compliance guidance and managed security services to ensure adherence. The proliferation of remote work demands enhanced secure access and network protection, benefiting managed security service providers.

Cyber Security Market Segmentation: By Deployment mode

-

Cloud-based

-

On-premise

The cloud category leads the global cybersecurity market with the largest revenue share in 2023. Its agility, scalability, and affordability make it the de facto choice for small and medium businesses, as well as large enterprises seeking flexibility. Its agility, scalability, and affordability make it the de facto choice for small and medium businesses, as well as large enterprises seeking flexibility. Key drivers include reduced upfront costs as there is no need for hefty hardware investments and maintenance – pay-as-you-go for seamless scalability. Faster deployment to get the defenses up and running quickly, without lengthy on-premises installations. With Automatic updates, clients can stay ahead of emerging threats with automatic software updates and patches. With the help of Centralized management clients can oversee the entire security posture from a single pane of glass, simplifying administration.

Cyber Security Market Segmentation: By Enterprise Size

-

Large Enterprises

-

Small, and medium Enterprises

The large enterprise segment holds the biggest revenue share of 68% in 2023. Large enterprises manage massive amounts of sensitive data, making them prime targets for cyberattacks. Data breaches can lead to devastating financial losses, reputational damage, and legal repercussions. With huge networks, numerous servers, and diverse endpoints, securing endpoints becomes a big task. Traditional security solutions often struggle to keep pace with the ever-evolving attack landscape. Stringent regulatory frameworks like GDPR and HIPAA add another layer of complexity, demanding robust security measures to protect personal data. Building in-house security teams or partnering with cybersecurity professionals equips large enterprises with the know-how to navigate the constantly evolving threat landscape.

SMEs are the fastest-growing segment, with a projected CAGR of 13.3%. Despite their size, they face significant vulnerabilities such as Limited Resources: Budget constraints often mean SMEs lack the sophisticated security solutions employed by large enterprises. This makes them easy targets for opportunistic attackers. Implementing and managing complex security solutions requires expertise that many SMEs struggle to afford or attract. As cyberattacks become more frequent and sophisticated, even SMEs are realizing the importance of cybersecurity. The increasing cost of cybercrime is a stark reminder of the necessity of investing in security. The cybersecurity market is evolving, offering tailored solutions and managed services that cater to the specific needs and budgets of smaller businesses.

Cyber Security Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America reigns supreme with a commanding 38% market share in 2023. This mature market is fueled by factors like high cybercrime rates, advanced IT infrastructure, and stringent data regulations. From financial institutions to government agencies, North American organizations invest heavily in robust security solutions, driving demand for advanced threat detection, data encryption, and incident response services.

Asia-Pacific region is the fastest growing region claiming a rapidly growing 22% market share. Its sheer population, booming economies, and rapid digitalization make it a breeding ground for cyber threats. Asia-Pacific organizations seek cost-effective security solutions for cloud infrastructure, mobile devices, and critical national infrastructure, presenting immense opportunities for innovative and scalable cyber security providers.

COVID-19 Impact Analysis on the Global Cyber Security Market.

The COVID-19 pandemic significantly impacted the global cyber security market, creating a complex mix of both positive and negative consequences. Increased remote work with millions shifting to remote work, reliance on digital infrastructure surged, leading to heightened awareness of cyber risks and increased spending on security solutions. Organizations prioritized cloud migration for remote work, boosting demand for cloud-based security solutions like SaaS security, data loss prevention, and access control. Exploiting the pandemic chaos, cyberattacks soared, particularly phishing scams, malware targeting remote systems, and ransomware attacks on vulnerable healthcare organizations. This drove investments in incident response and threat intelligence solutions. Public and private sectors invested in cybersecurity awareness campaigns and training programs, leading to a more security-conscious workforce. The economic recession impacted IT budgets, potentially leading to delayed investments in cybersecurity upgrades, leaving some organizations vulnerable. Global supply chain disruptions affected hardware availability and maintenance, impacting organizations' ability to implement and update security solutions. The expansion of remote work and the use of personal devices expanded the attack surface for cybercriminals, creating new vulnerabilities. As IT teams face increased workload and pressure, burnout and fatigue could lead to human errors and compromise security. Despite the initial challenges, the COVID-19 pandemic's overall impact on the global cybersecurity market was positive. The increased reliance on digital infrastructure, heightened awareness of cyber threats, and surge in cyberattacks drove a significant market growth, estimated at 14% in 2020.

Latest Trends/ Developments:

The cybersecurity landscape is continually evolving, and new trends and developments keep on emerging. With the increasing adoption of cloud services, security solutions are evolving to be more cloud-native. This involves the development of security tools specifically designed for cloud environments, addressing unique challenges related to scalability, flexibility, and dynamic infrastructure. The integration of artificial intelligence (AI) and machine learning (ML) technologies continues to grow in cybersecurity. These technologies are utilized for threat detection, behavioral analysis, and automation of response actions and ML enhances the ability to detect previously unknown threats, automate routine tasks, and improve the overall efficiency of cybersecurity operations. Organizations are focusing on improving their ransomware protection and mitigation strategies, including the development of robust backup and recovery plans. The deployment of 5G networks introduces new security challenges, including increased attack surfaces, potential vulnerabilities in network infrastructure, and the need for secure IoT deployments. As 5G technology becomes more widespread, ensuring the security of networks and connected devices is a key focus area to prevent cyber threats and disruptions. Cybersecurity concerns related to the supply chain have escalated. Organizations are placing greater emphasis on securing their supply chains to prevent attacks like software supply chain compromises.

Key Players:

-

Proofpoint, Inc

-

Sophos Ltd

-

Lockheed Martin Corporation

-

LogRhythm, Inc

-

McAfee

-

Palo Alto Networks, Inc

-

Cisco Systems, Inc

-

FireEye, Inc

-

Broadcom, Inc

-

Norton Life

-

Centrify Corporation

Chapter 1. Cyber Security Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cyber Security Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cyber Security Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cyber Security Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cyber Security Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cyber Security Market – By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Cyber Security Market – By Deployment mode

7.1 Introduction/Key Findings

7.2 Cloud-based

7.3 On-premise

7.4 Y-O-Y Growth trend Analysis By Deployment mode

7.5 Absolute $ Opportunity Analysis By Deployment mode, 2024-2030

Chapter 8. Cyber Security Market – By Enterprise Size

8.1 Introduction/Key Findings

8.2 Large Enterprises

8.3 Small, and medium Enterprises

8.4 Y-O-Y Growth trend Analysis By Enterprise Size

8.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 9. Cyber Security Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Deployment mode

9.1.4 By Enterprise Size

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Deployment mode

9.2.4 By Enterprise Size

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Deployment mode

9.3.4 By Enterprise Size

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Deployment mode

9.4.4 By Enterprise Size

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Deployment mode

9.5.4 By Enterprise Size

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cyber Security Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Proofpoint, Inc

10.2 Sophos Ltd

10.3 Lockheed Martin Corporation

10.4 LogRhythm, Inc

10.5 McAfee

10.6 Palo Alto Networks, Inc

10.7 Cisco Systems, Inc

10.8 FireEye, Inc

10.9 Broadcom, Inc

10.10 Norton Life

10.11 Centrify Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global gaming accessories market size was estimated at USD 166 Billion in 2023 and is expected to reach USD 335.19 billion in 2030.

Increasing Cyberattacks, Digital Transformation, Stricter Data Privacy Regulations, Stricter Data Privacy Regulations.

North America dominates the market for Global Cyber Security Market.

Asia-Pacific region is the fastest growing region claiming a rapidly growing 28% market share.

Artificial Intelligence and Machine Learning, Tech-Driven Advancements, Market Diversification, Cloud-Based Security.