Sensor Market Size (2024 – 2030)

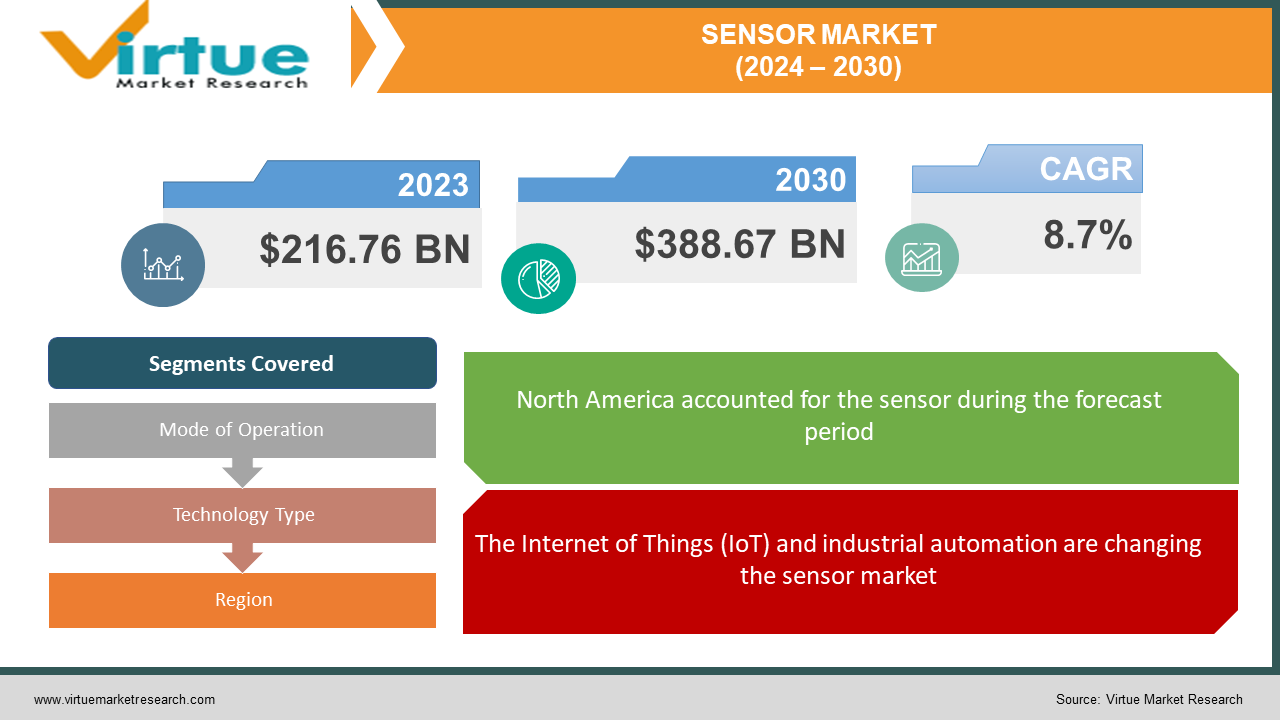

The global sensor market was valued at USD 216.76 billion in 2023 and is projected to reach a market size of USD 388.67 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.7%.

The sensor domain is always evolving to meet the demands of a world that is becoming more and more linked. It does this by adapting to the shifting needs of society. The market for sensors is expected to double in size over the next ten years as a result of a metamorphic expansion to meet the growing demand for sensor-driven technology. The development of smart gadgets, which serve as conduits for the never-ending flood of sensor-generated knowledge, is a major accelerator in this transformative journey. A crucial intersection arises when data-hungry artificial intelligence (AI) algorithms devour vast amounts of sensor-generated information. A generation of sensors with cognitive abilities is born out of this mutually beneficial partnership, and they grow into more intelligent beings who can optimize themselves. Sensors are becoming a dominant force in the new market order, from industrial sensors coordinating seamless manufacturing processes to healthcare gadgets monitoring vital indicators. The Internet of Things, a network of networked gadgets, is driving up the need for sensors that can wirelessly share the vast amounts of data they collect.

Key Market Insights:

The sensor market is still largely driven by the spread of the Internet of Things (IoT). IoT devices require sensors to function and share data. The need for sensors in industrial applications for condition monitoring, predictive maintenance, and process optimization is growing as a result of Industry 4.0 ambitions and the development of smart manufacturing techniques. Sensors are widely used in the automobile sector, particularly in the development of driverless vehicles and Advanced Driver Assistance Systems (ADAS). The market is growing as a result of the growing usage of sensors in wearables, medical equipment, and healthcare products. Personalized medicine, diagnostics, and remote patient monitoring are some examples of applications. To create more intelligent and adaptive systems, sensors are being more and more integrated with machine learning (ML) and artificial intelligence (AI) algorithms. Propelled by technical breakthroughs and the growing use of sensors in developing technologies, forecasts indicate that the sensor industry will continue to grow.

Global Sensor Market Drivers:

The Internet of Things (IoT) and industrial automation are changing the sensor market.

The Internet of Things (IoT) has ignited a sensor frenzy, with these tiny detectives becoming the need for smart cities, homes, and industries. From monitoring environmental conditions in smart cities to enabling autonomous driving, sensors are transforming our world. Sensors track valuable equipment in logistics and supply chains, ensuring efficiency and security. From air quality sensors in cities to soil moisture sensors in farms, sensors keep us informed about our environment. Smart thermostats and occupancy sensors optimize energy usage in homes and buildings. The quest for autonomous vehicles has put sensors at the top of the automotive industry. Advanced Driver Assistance Systems (ADAS) rely on LiDAR, radar, and cameras to provide safety features like collision avoidance and lane departure warnings. As autonomous driving becomes a reality, the need for high-precision sensors is seeing an upsurge. These sensors map the environment, identify obstacles, and enable vehicles to navigate without human input. From smart agriculture to personalized healthcare, the possibilities are endless.

Technological advancements and innovations are fueling the expansion.

The integration of digital technologies has fueled a sensor boom, making them crucial for monitoring and controlling every aspect of the manufacturing process. By tracking equipment conditions, production metrics, and even environmental factors, they paint a real-time picture of what's happening on the ground. Sensors track production metrics, identifying bottlenecks and optimizing processes for maximum output. Sensors detect anomalies in equipment health before they become failures, allowing for preventative maintenance and minimizing downtime. Sensors connect machines, allowing them to communicate and collaborate. Sensors with advanced capabilities are pushing the boundaries of medical imaging, leading to earlier diagnoses and improved patient outcomes. The future of sensors is brighter than ever. Research in novel materials like graphene and nanomaterials holds the promise of next-generation sensors with unparalleled sensitivity, flexibility, and durability.

Global Sensor Market Restraints and Challenges:

High initial investment and integration costs are associated with these sensors.

The sophistication and accuracy of sensors directly impact their cost, creating a significant hurdle for budget-conscious businesses and consumers. Deploying sensor networks isn't as simple as plugging them in. Gateways, data storage, and analytical tools add layers of complexity and, unsurprisingly, expense. Processing, analyzing, and interpreting this data requires software platforms, storage solutions, and skilled personnel. Seamlessly integrating sensors into existing systems can be a complex puzzle, requiring specialized expertise and customization. The high upfront costs, particularly for budget-sensitive applications, create a vicious cycle. Slow adoption hinders market growth and advancement, ultimately restricting the technology's reach and potential benefits.

Security and privacy concerns are significant challenges in the sensor market.

Stolen credit card details or disrupted financial transactions can wreak havoc on businesses and individuals. Data breaches can erode consumer trust and tarnish brand image, leaving companies scrambling to recover. Violating data privacy regulations like GDPR and CCPA can incur hefty fines and legal action. The global landscape of data privacy is a complex labyrinth, with regulations like GDPR and CCPA setting strict guidelines for data collection, storage, and usage. Staying compliant is a challenge for both sensor manufacturers and users, with non-compliance carrying the sting of financial penalties and legal trouble. Hackers can take control of sensors, turning them into tools for further attacks or disrupting their intended functions. Overwhelming sensors with data packets can render them inoperable, potentially causing chaos in critical infrastructure like industrial control systems or healthcare networks. Sensors need built-in security features like strong encryption, secure authentication, and robust access controls. Staying updated on evolving regulations and implementing data protection measures are crucial.

Global Sensor Market Opportunities:

Sensors play a pivotal role in the orchestration of data gathering and transmission, facilitating optimization, control, and monitoring. The integration of sensors and IoT technologies propels urban landscapes into an era of efficiency and sustainability, where data-driven decisions can be made. Similarly, in homes, smart devices imbued with sensors create an interconnected environment that adapts to the needs and preferences of its inhabitants. The healthcare industry stands on the cusp of a sensor-driven revolution, with applications ranging from medical imaging sensors to wearable health monitors and remote patient monitoring. Sensors not only provide a trove of data for early disease detection but also pave the way for tailored therapies and an elevated quality of healthcare delivery. The tsunami of an aging population and the paradigm shift towards preventative healthcare are forecasted to fuel the demand for health-related sensors, ushering in an era where proactive well-being is the priority. The automotive sector is coming up with many innovations concerning sensors. These are applications regarding driverless vehicles and Advanced Driver Assistance Systems (ADAS). LiDAR, radar, and video sensors have emerged as the guardians of vehicular safety, enabling functions like autonomous driving, collision avoidance, and lane-keeping assistance. In industrial environments, sensors emerge as catalysts for heightened productivity.

SENSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Mode of Operation, Technology Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International, Bosch SensorTec NXP Semiconductors, TE Connectivity, Texas Instruments, STMicroelectronics, OMRON Corporation, DENSO Corporation, Infineon Technologies AG, AMS AG |

Global Sensor Market Segmentation: By Mode of Operation

-

Optical Sensors

-

Electrical Resistance Sensors

-

Capacitive Sensors

-

Piezoelectric Sensors

-

Others (Biosensors, magnetic sensors, chemical sensors, gas sensors, inertial sensors)

Optical sensors are the most dominant mode of operation, with a market share of 30% in 2023. Optical sensors have applications in LiDAR, radar, imaging sensors, proximity sensors, optical fiber sensors, etc. It is predicted to have steady growth during the forecast period, driven by advancements in computer vision, autonomous systems, and robotics. Capacitive sensors have a market share of 18% in 2023. It has applications in proximity sensors, touch sensors, level sensors, humidity sensors, pressure sensors, etc. It is predicted to have high growth, driven by the rise of touch-enabled devices, smart homes, and IoT applications. Capacitive sensors remain the fastest-growing segment, fueled by the booming market for touchscreens, wearables, and IoT devices. Their ease of integration, low power consumption, and cost-effectiveness make them highly appealing for various consumer and industrial applications. Electrical resistance sensors have a market share of 20%. It has applications in Strain gauges, temperature sensors (RTDs, NTCs), pressure sensors, flow sensors, etc. It is predicted to have moderate growth, benefiting from increasing automation, industrial sensors, and power management.

Sensor Market Segmentation: By Technology Type

-

Microelectromechanical Systems (MEMS)

-

Complementary Metal-Oxide-Semiconductor (CMOS)

-

Nanoelectromechanical Systems (NEMS)

-

Other technologies (optical, piezoelectric, magnetic, and chemical sensor technologies).

Complementary Metal-Oxide Semiconductors (CMOS) are the largest segment in 2023. With dominant applications in image sensors, biosensors, fingerprint sensors, temperature sensors, etc. It is benefiting from advancements in image processing and mobile electronics. CMOS sensors are experiencing significant growth due to their increasing demand for smartphone cameras, security systems, and medical imaging equipment. Advancements in CMOS technology enable higher resolution, better performance, and integration with other chips. Microelectromechanical systems (MEMS) are the fastest-growing segment. It has applications in Accelerometers, gyroscopes, pressure sensors, microphones, etc. It is predicted to have steady growth, driven by miniaturization, cost reduction, and integration into various devices. They have advantages like low cost, small size, low power consumption, and mass producibility. They are prevalent in smartphones, wearables, automotive sensors, and various consumer electronics. Nanoelectromechanical systems (NEMS) have applications in emerging areas in medical, environmental, and high-precision sensors. It is predicted to have high growth but is still in the early stages of development and commercialization.

Sensor Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Holding around 35% of the market share in 2023, North America has the largest market share due to its advanced R&D infrastructure and early adoption of cutting-edge technologies. From consumer electronics to industrial automation, sensors play a vital role across various industries. This region has well-established companies with a global presence, thereby generating more profits. A few of the prominent key players include Texas Instruments Incorporated, Honeywell International Inc., TE Connectivity Ltd., and Analog Devices, Inc. With a 25% market share in 2023 and surging growth, Asia-Pacific is the region with the fastest growth. Its vast manufacturing base, like China's tech powerhouse, fuels the demand for sensors in mobile electronics and environmental monitoring. Investments in automation and smart infrastructure by regional governments further amplify the growth. Europe holds a steady 30% market share, with its mature industrial base offering a strong foundation. Medical devices, automotive applications, and industrial automation are the main reasons for this. Regulatory hurdles and economic fluctuations can sometimes dampen the European tempo, but the region's commitment to innovation ensures a consistent performance. South America's booming agricultural sector and rising consumer electronics demand create a promising future. The oil and gas industries in the Middle East and Africa, coupled with government initiatives for smart infrastructure, offer a unique composition. While North America currently controls the market, Asia Pacific's rapid growth makes it a rising star. Its vast population, technological advancements, and government support position it for a potential future leadership role.

COVID-19 Impact Analysis on the Global Sensor Market.

The outbreak of the virus had a mixed impact on the market. Due to lockdowns, movement restrictions, and social isolation, there were a lot of disruptions in the supply chain and the availability of raw materials. This caused production delays and price hikes. Sectors such as automotive, aviation, and hospitality suffered because of this. Governments and businesses shifted their priorities towards the healthcare industry, which included vaccine development and the arrangement of essentials like ventilators, hospital beds, and oxygen tanks. However, the pandemic highlighted the need for automation and remote monitoring to protect workers and ensure continuity of operations. The demand for sensors used in touchless solutions, such as automatic doors and contactless payment systems, surged as societies worldwide sought ways to minimize physical contact. These sensors became the enablers of a touchless revolution, redefining the landscape of daily interactions with an emphasis on safety and well-being. This renewed focus sparked a resurgence of interest in sensors for industrial automation, robotics, and remote asset management. As companies sought ways to navigate the complexities of a post-pandemic world, sensors became instrumental in enhancing operational resilience and efficiency. The sensor market is gradually reclaiming its vibrancy. Most segments are anticipated to reach pre-pandemic levels by 2024 or 2025, signaling a resurgence of economic activity. Although some sectors, such as automotive, continue to face challenges, others, like healthcare and environmental monitoring, are experiencing sustained growth, offering a glimpse of a more balanced and diversified sensor landscape.

Latest Trends/ Developments:

Microelectromechanical Systems (MEMS) technology is advancing, leading to smaller, more energy-efficient sensors. MEMS sensors are frequently found in wearables, consumer electronics, and automotive applications. MEMS sensors facilitate the creation of small, high-performance sensor systems and allow devices to be miniaturized. The development of MEMS sensors is perfectly in line with the increasing attention being paid to environmental issues on a global scale. The use of sensors to monitor the environment has increased as people become more aware of how human activity affects the environment. These sensors are now essential in smart cities, industrial facilities, and agricultural applications since they can measure parameters linked to climate change, water quality, and air quality. They operate by offering current information on the ecological impact of human activity and assisting in the formulation of well-informed decisions to control and lessen environmental effects. A change is occurring in data processing as edge computing becomes more and more important for sensor applications. This novel strategy makes it possible for data processing to take place nearer to the data source, which is a crucial advancement for applications that need real-time processing, such as industrial automation and driverless cars.

Key Players:

-

Honeywell International

-

Bosch SensorTec

-

NXP Semiconductors

-

TE Connectivity

-

Texas Instruments

-

STMicroelectronics

-

OMRON Corporation

-

DENSO Corporation

-

Infineon Technologies AG

-

AMS AG

Chapter 1. Sensor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sensor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sensor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sensor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sensor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sensor Market – By Mode of Operation

6.1 Introduction/Key Findings

6.2 Optical Sensors

6.3 Electrical Resistance Sensors

6.4 Capacitive Sensors

6.5 Piezoelectric Sensors

6.6 Others (Biosensors, magnetic sensors, chemical sensors, gas sensors, inertial sensors)

6.7 Y-O-Y Growth trend Analysis By Mode of Operation

6.8 Absolute $ Opportunity Analysis By Mode of Operation, 2024-2030

Chapter 7. Sensor Market – By Technology Type

7.1 Introduction/Key Findings

7.2 Microelectromechanical Systems (MEMS)

7.3 Complementary Metal-Oxide-Semiconductor (CMOS)

7.4 Nanoelectromechanical Systems (NEMS)

7.5 Other technologies (optical, piezoelectric, magnetic, and chemical sensor technologies).

7.6 Y-O-Y Growth trend Analysis By Technology Type

7.7 Absolute $ Opportunity Analysis By Technology Type, 2024-2030

Chapter 8. Sensor Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Mode of Operation

8.1.3 By Technology Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Mode of Operation

8.2.3 By Technology Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Mode of Operation

8.3.3 By Technology Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Mode of Operation

8.4.3 By Technology Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Technology Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Sensor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International

9.2 Bosch SensorTec

9.3 NXP Semiconductors

9.4 TE Connectivity

9.5 Texas Instruments

9.6 STMicroelectronics

9.7 OMRON Corporation

9.8 DENSO Corporation

9.9 Infineon Technologies AG

9.10 AMS AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Honeywell, Bosch SensorTec, NXP Semiconductors, TE Connectivity, Texas Instruments, STMicroelectronics, and OMRON hold a significant market share.

With increasing demand for medical devices and remote monitoring, sensors for vital signs, diagnostics, and wearables are booming. The rise of autonomous vehicles, drones, and robots is fueling demand for sensors for navigation, positioning, and obstacle detection. With the increasing deployment of smart devices and connectivity solutions, sensors for collecting and transmitting data across various applications are seeing rapid growth.

North America holds the largest market share of around 35% in 2023.

Asia-Pacific is projected to become the fastest-growing region (driven by China's manufacturing output and focus on technological advancements) and take the lead by 2030.

Miniaturization, low power consumption, and advanced functionalities will continue to drive innovation. Artificial intelligence (AI) and machine learning (ML) integration will enable deeper data analysis and smarter sensor applications. The Internet of Things (IoT) will continue to expand, creating new opportunities for sensor-based solutions across various sectors. A focus on sustainability and green technologies will increase demand for environmental monitoring and resource management sensors.