IoT Medical Devices Market Size (2023 - 2030)

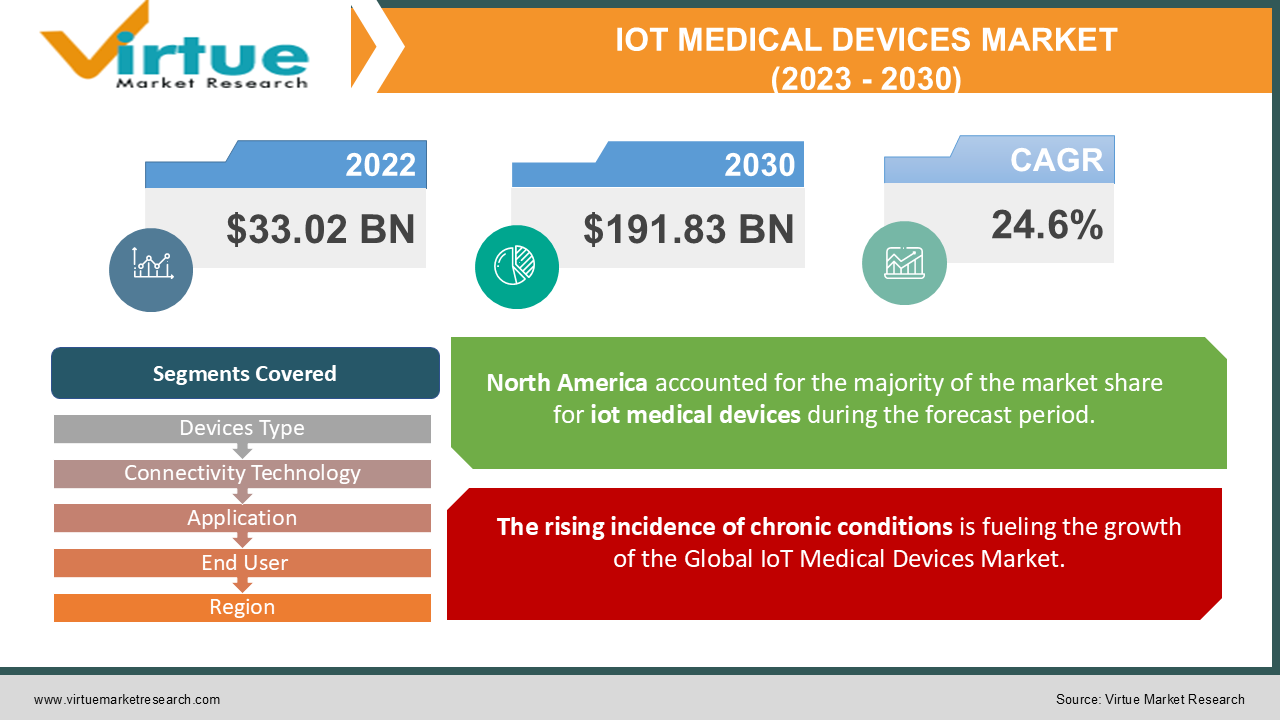

Global IoT Medical Devices Market is estimated to be worth USD 33.02 Billion in 2022 and is projected to reach a value of USD 191.83 Billion by 2030, growing at a CAGR of 24.6% during the forecast period 2023-2030.

IoT medical devices forge connectivity between medical devices, applications, and healthcare IT systems using online networks. These devices, equipped with Wi-Fi or any other connectivity technology, expedite machine-to-machine communication and support diverse applications such as remote patient monitoring, medication tracking, and ambulance connectivity. IoT medical devices utilize cloud platforms to store and analyze data, thereby boosting data availability and improving healthcare through swifter transmission and analysis. IoT medical devices also facilitate telemedicine, which enables remote monitoring and limits hospital visits. During the COVID-19 pandemic, these devices played an indispensable role by minimizing the need for travel and alleviating the burden on healthcare facilities. Furthermore, IoT medical devices improve access to care in remote areas and enable consultations with specialists irrespective of location.

IoT medical devices offer numerous advantages. These devices permit continuous patient monitoring that assists in offering insightful observations into patients' living conditions. They amplify accessibility by providing more options for healthcare services through telehealth. IoT medical devices aid in controlling costs by declining the need for in-person visits and saving time in processing health data. Patients experience enhanced benefits as they utilize novel technologies and wearable devices to access data that was conventionally acquired via in-person visits to healthcare providers. The abundance of data from IoT medical devices boosts accuracy in diagnoses and treatment. Furthermore, IoT medical devices streamline logistics by monitoring equipment, sending maintenance alerts, and ensuring proper tracking of patients and medication, thereby minimizing errors in healthcare facilities.

Global IoT Medical Devices Market Drivers:

The rising incidence of chronic conditions is fueling the growth of the Global IoT Medical Devices Market.

The global surge in chronic health conditions like diabetes, obesity, hypertension, heart diseases, and neurological disorders has sparked an augmented demand for IoT medical devices. IoT medical devices like blood glucose meters, blood pressure monitors, heart rate monitors, pulse oximeters, and fitness bands are pocket-friendly and deliver a practical and effective solution for monitoring patients with chronic conditions. Patients can easily and comfortably track their vital signs, while healthcare providers can promptly respond to emergencies through remote patient monitoring services. Consequently, the growing prevalence of chronic diseases is propelling the market demand for IoT medical devices.

The growing health awareness among the young generation is another factor contributing to the growth of the Global IoT Medical Devices Market.

The rising awareness of health issues is leading to an augmented adoption of wearable devices among the younger and more active population. Wearable medical technology has made monitoring health problems simpler and more reasonably priced. Many individuals remain undiagnosed with conditions like diabetes, prompting people to rely on wearable devices for regular health checks. Recently, Dexcom and Eversense received FDA approval for their glucose monitoring devices, capable of tracking blood sugar levels for up to 90 days. These IoT-enabled wearables are also beneficial for remote monitoring and alerting patients with chronic illnesses. Furthermore, the Zoll LifeVest 4000, a wearable defibrillator, monitors irregular heartbeats and aids in analyzing sudden cardiac arrest cases. The effectiveness of these IoT medical devices in health monitoring is projected to propel market growth.

Global IoT Medical Devices Market Challenges:

The Global IoT Medical Devices Market is encountering challenges, primarily in terms of security and data ownership. Security is a major worry in healthcare, especially in protecting sensitive patient information. Regulations like HIPAA have been forged to address these risks. Transmission of medical data exposes providers to cybersecurity threats, including breaches and fraud. Stolen credentials can be utilized for unauthorized access to medical services and drugs, which can lead to penalties and fines for providers. Another concern related to IoT medical devices is data ownership. Ascertaining who owns IoT medical device-generated data can be intricate, involving the patient, software provider, and other healthcare entities. Each party's data rights differ depending on the context and circumstances surrounding the data. Thus, these challenges inhibit the growth of the Global IoT Medical Devices Market.

Global IoT Medical Devices Market Opportunities:

The Global IoT Medical Devices Market is projected to offer profitable prospects for businesses operating in the HealthTech and MedTech domains, fostering partnerships, mergers, collaborations, and agreements during the forecasted period 2023-2030. Furthermore, there is a potential to make technological advancements and upgrades with novel business ideas for a competitive edge in the market by tapping into a profitable outcome.

COVID-19 Impact on the Global IoT Medical Devices Market:

The COVID-19 pandemic positively impacted the growth of the Global IoT Medical Devices Market. The pandemic accelerated the adoption of IoT medical devices, especially wearable devices, as patients sought ways to monitor their health from home and communicate with healthcare providers remotely. Remote monitoring of chronic conditions utilizing IoT wearable medical devices assisted in averting disease exacerbations and minimizing the need for in-person visits.

Global IoT Medical Devices Market Recent Developments:

- In November 2022, American Portwell Technology, a subsidiary of Portwell, Inc., introduced medical touch monitors and all-in-one touch computers to support the COVID-19 response. These certified medical-grade solutions comply with safety standards for medical electrical equipment and meet ISO 9001/13485 quality management system requirements, ensuring reliability and performance.

- In October 2021, Medtronic plc, a health tech company, introduced the Medtronic Open Innovation Platform (OIP) to facilitate collaborations and seek partnership opportunities in the Asia-Pacific region.

- In January 2021, Zyter, Inc., a digital health and IoT-enablement platform, introduced Zyter Smart Hospitals. This solution seamlessly integrates data systems, departments, personnel, and IoT devices within hospitals. Leveraging Zyter's robust digital communication and collaboration platform, it offers a comprehensive and efficient solution for healthcare facilities.

IoT MEDICAL DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

24.6% |

|

Segments Covered |

By Devices Type, Connectivity Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens Healthineers AG (Germany), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (United States), Honeywell Life Care Solutions (United States), Boston Scientific Corporation (United States), AliveCor, Inc. (United States), Omron Healthcare, Inc. (Japan), iHealth Lab, Inc. (United States), Biotronik (Germany) |

Global IoT Medical Devices Market Segmentation:

Global IoT Medical Devices Market Segmentation: By Device Type

- Implantable Devices

- Stationary Devices

- Wearable Devices

- Others

The wearable devices segment held the highest market share in the year 2022. The growth can be ascribed to the rising popularity of wearable devices among young individuals worldwide as they offer an extensive assortment of applications on a single device. These medical wearables utilize sensors, actuators, software, and electronic patches applied to the skin to monitor a patient's health, uncover abnormalities, and even provide treatment for certain health conditions. Examples of such devices include smartwatches, wearable vital signs monitors, glucose monitors, and wearable pain relief devices.

Global IoT Medical Devices Market Segmentation: By Connectivity Technology

- Bluetooth

- Cellular Networks

- Wi-Fi

- ZigBee

- Others

The Wi-Fi segment held the highest market share in the year 2022. The growth can be ascribed to the advantages of Wi-Fi in contrast to other connectivity technologies, including a wide coverage range. Connected medical devices refer to those equipped with sensors that collect data from the device itself and have the capability to transmit this data over the internet using connectivity technology (often Wi-Fi) to other compatible devices for receiving and analysis.

Global IoT Medical Devices Market Segmentation: By Application

- Clinical Operations

- Connected Imaging

- Medical Management

- Patient Monitoring

- Telehealth

- Others

The telehealth segment held the highest market share in the year 2022. The growth can be ascribed to the rising incidence of chronic conditions and the augmenting demand for patient monitoring. The constant improvements in telehealth technology, coupled with the introduction of telehealth services, have contributed to the augmenting demand for IoT medical devices. A notable example is Lytus Technologies, which introduced telehealth services and established a network of local health centers in India to provide additional services beyond virtual care. Furthermore, prominent players in the IoT medical devices sector are focusing on developing innovative telehealth solutions and devices to elevate the healthcare system.

Global IoT Medical Devices Market Segmentation: By End User

- Ambulatory Centres

- Clinics

- Hospitals

- Homecare Settings

- Research & Diagnostic Laboratories

- Others

The hospital’s segment held the highest market share in the year 2022. The growth can be ascribed to the rising incidence of chronic conditions like diabetes, cardiovascular disease, arthritis, and cancer that contributes to the augmenting workload on hospitals. Furthermore, the need to effectively handle expanding patient data, improve patient outcomes, ensure better accessibility and compatibility of data, and meet administrative regulations regarding patient information and safety is propelling the adoption of IoT medical devices in hospitals.

Global IoT Medical Devices Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The region of North America dominated the Global IoT Medical Devices Market in the year 2022. The early and vast adoption of cutting-edge healthcare technologies like IoMT (Internet of Medical Things), the rising incidence of chronic health conditions, such as diabetes, obesity, hypertension, cardiovascular diseases, neurological disorders, and other conditions, and the presence of well-established healthcare infrastructure in nations, such as the United States and Canada, are some of the pivotal factors propelling the region's growth. Furthermore, North America is home to several prominent market players, including GE HealthCare Technologies Inc., Honeywell Life Care Solutions, AliveCor, Inc., iHealth Lab, Inc., and Boston Scientific Corporation.

The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the rising incidence of chronic conditions, the accelerating technological advancements in the healthcare industries of nations, such as China, Japan, India, and South Korea, and the strong presence of key market players, including Omron Healthcare, Inc., Mindray Medical International Limited, and Olympus Corporation.

Global IoT Medical Devices Market Key Players:

- Siemens Healthineers AG (Germany)

- Medtronic plc (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare Technologies Inc. (United States)

- Honeywell Life Care Solutions (United States)

- Boston Scientific Corporation (United States)

- AliveCor, Inc. (United States)

- Omron Healthcare, Inc. (Japan)

- iHealth Lab, Inc. (United States)

- Biotronik (Germany)

Chapter 1. IOT MEDICAL DEVICES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. IOT MEDICAL DEVICES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. IOT MEDICAL DEVICES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. IOT MEDICAL DEVICES MARK ET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IOT MEDICAL DEVICES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IOT MEDICAL DEVICES MARKET – By Device Type

6.1 Implantable Devices

6.2. Stationary Devices

6.3. Wearable Devices

6.4. Others

Chapter 7. IOT MEDICAL DEVICES MARKET – By Connectivity Technology

7.1. Bluetooth

7.2. Cellular Networks

7.3. Wi-Fi

7.4. ZigBee

7.5. Others

Chapter 8. IOT MEDICAL DEVICES MARKET – By Application

8.1 Clinical Operations

8.2. Connected Imaging

8.3. Medical Management

8.4. Patient Monitoring

8.5. Telehealth

8.6. Others

Chapter 9. IOT MEDICAL DEVICES MARKET –By End User

9.1 Ambulatory Centres

9.2. Clinics

9.3. Hospitals

9.4. Homecare Settings

9.5. Research & Diagnostic Laboratories

9.6. Others

Chapter 10. IOT MEDICAL DEVICES MARKET – By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.Latin America

10.5. Middle-East and Africa

Chapter 11. IOT MEDICAL DEVICES MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Siemens Healthineers AG (Germany)

11.2. Medtronic plc (Ireland)

11.3. Koninklijke Philips N.V. (Netherlands)

11.4. GE HealthCare Technologies Inc. (United States)

11.5. Honeywell Life Care Solutions (United States)

11.6. Boston Scientific Corporation (United States)

11.7. AliveCor, Inc. (United States)

11.8. Omron Healthcare, Inc. (Japan)

11.9. iHealth Lab, Inc. (United States)

11.10. Biotronik (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global IoT Medical Devices Market is estimated to be worth USD 33.02 Billion in 2022 and is projected to reach a value of USD 191.83 Billion by 2030, growing at a CAGR of 24.6% during the forecast period 2023-2030

The Global IoT Medical Devices Market Drivers are the Rising Incidence of Chronic Conditions and the Growing Health Awareness among the Young Generation

Based on the Device Type, the Global IoT Medical Devices Market is segmented into Implantable Devices, Stationary Devices, and Wearable Devices.

The United States is the most dominating country in the region of North America for the Global IoT Medical Devices Market.

Siemens Healthineers AG, Medtronic plc, and Koninklijke Philips N.V. are the leading players in the Global IoT Medical Devices Market