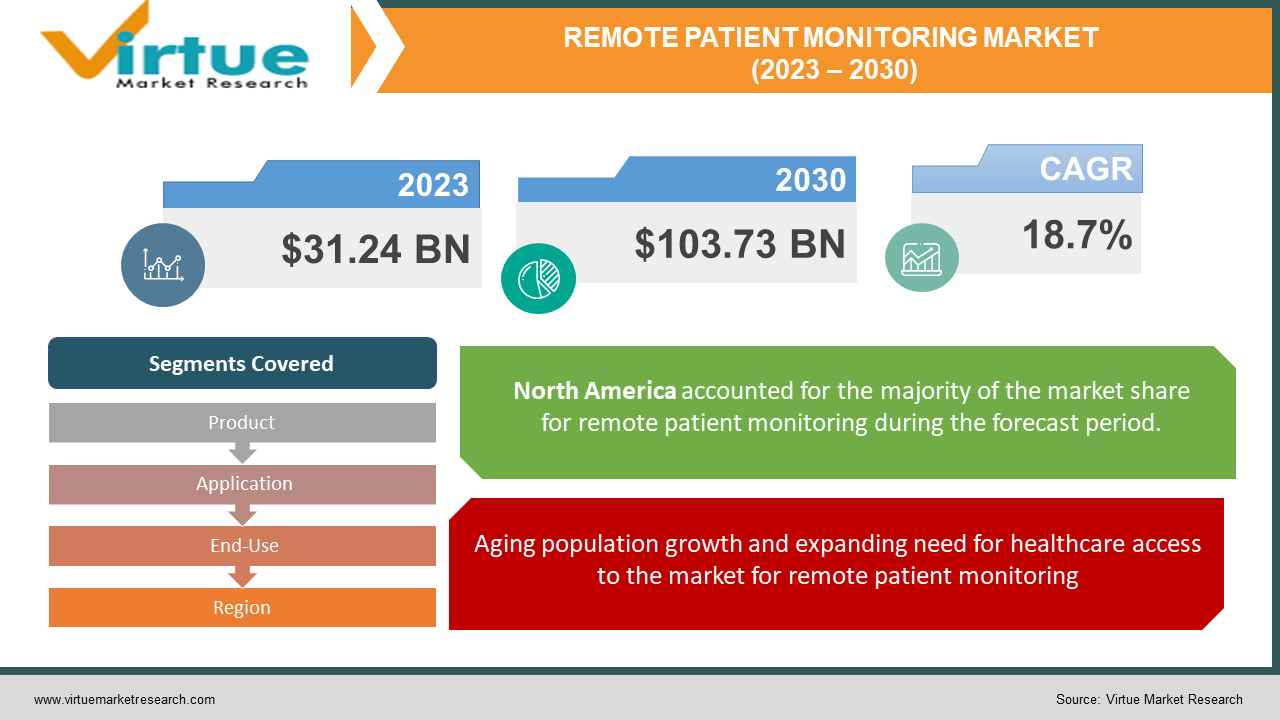

Remote Patient Monitoring Market Size (2023 – 2030)

The Global Remote Patient Monitoring Market was valued at USD 31.24 billion and is projected to reach a market size of USD 103.73 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 18.7%.

The growth of the remote patient monitoring market is being fueled by the incidence of lifestyle problems, higher usage of remote patient monitoring equipment, and an increase in the population of older people. The ease of use and accessibility of remote patient monitoring equipment is helping it become more and more popular. Additionally, elderly people utilize remote patient devices because they are more likely to have chronic diseases than younger people. The need for healthcare and long-term care services will increase as this demographic group grows, adding to the burden on public health systems and governments.

This will help the remote patient monitoring market. Remote patient monitoring can increase the accessibility and reach of healthcare while reducing unnecessary visits, hospital admissions, and readmissions, as well as the time and costs related to traveling to see medical personnel. Healthcare fraud is a critical element in telehealth and telemedicine practices. A patient or a doctor might become a victim in a variety of different ways, such as when institutional providers who are not authorized or listed utilize incorrect coding and billing for erroneous claims or when the doctor's name and accounts are used illegally to obtain funds from the insurance provider.

Key Market Insights:

To facilitate fetal and maternal monitoring, Philips introduced the Avalon CL Foetal and Maternal Pod and Patch for remote monitoring in the US, Europe, Australia, New Zealand, and Singapore.

Koninklijke Philips and the American Telemedicine Association (US) have created a partnership. The usage of telehealth in acute, post-acute, and home care settings has increased as a result of this partnership.

Envolve People Care, Inc., a Centene Corporation subsidiary that ran the On. Demand remote patient monitoring (RPM) and coaching platform, was bought by BioTeIemetry. With a focus on diabetes, hypertension, and chronic heart failure, this purchase broadens the current portfolio of acute care-linked health products and services offered by BioTeIemetry.

Global Remote Patient Monitoring Market Drivers:

Aging population growth and expanding need for healthcare access to the market for remote patient monitoring:

The growing older population and the rising need to improve healthcare access are the two main factors driving the market for remote patient monitoring. The rise in older patients who require medical care is driving the demand for remote patient monitoring systems. Systems for remote patient monitoring make it simpler for older patients to maintain contact with their doctors and have access to healthcare without having to make frequent hospital visits. The desire to better serve patients in remote and rural areas and the need to reduce healthcare costs are two additional factors driving the need for remote patient monitoring systems.

The market is driven by the high value of remote patient monitoring in containing infectious illnesses and epidemics:

RPM is a fast-developing technology that can completely change how healthcare is provided. By employing wireless technology, remote patient monitoring enables medical professionals to keep an eye on a patient's health when they are apart. Remote patient monitoring can give medical personnel a real-time picture of a patient's health and notify them of any changes or possible concerns by gathering data such as vital signs, physical activity, and sleep patterns. In the case of infectious illnesses and epidemics, remote patient monitoring is incredibly useful. Remote patient monitoring, which enables healthcare professionals to keep an eye on patients while they're away, can help them spot illness signs before they worsen, enabling early diagnosis and treatment. Additionally, remote patient monitoring can assist medical professionals in keeping an eye on the well-being of patients placed under quarantine or isolation, lowering the chance of the illness spreading to other people or communities. Remote patient monitoring can assist in decreasing the burden of infectious illnesses and help stop their spread in this way.

Global Remote Patient Monitoring Market Challenges:

The installation and training process for RPM is expensive, which will limit market expansion:

Depending on the complexity of the system, the price of implementing a remote patient monitoring system also includes the cost of installation and training, which may run from a few hundred to several thousand dollars. For instance, a simple system that only transmits vital signs can cost $500 or less, but a sophisticated system with a variety of systems might cost more than $10,000. The price of upkeep and updates for the RPM system must also be factored into total costs. Regular upkeep, software updates, and technical support services might result in escalating prices over time. The system's capacity to be scaled and customized can also affect how much it costs. Costs may increase with more sophisticated features like real-time data analysis and predictive maintenance capabilities. However, it is important to note that investing in a robust RPM system may have significant long-term advantages, including increased operational effectiveness, reduced downtime, and enhanced asset management.

Global Remote Patient Monitoring Market Opportunities:

The market for remote patient monitoring is rising as chronic diseases become more prevalent:

There are several reasons why the market is growing, including the rising incidence of chronic disorders. Chronic diseases are non-communicable conditions that require ongoing medical attention and management because they endure a long time. According to the Globe Health Organisation, chronic illnesses are the leading cause of mortality in the globe, accounting for close to 70% of all fatalities. Several factors, such as an aging population, sedentary lifestyles, poor nutrition, and environmental factors, contribute to the increased prevalence of chronic illnesses. RPM and care can aid healthcare professionals in the more effective and efficient management of chronic illnesses. The prevalence of lifestyle-associated diseases including hypertension and diabetes has increased as a result of people's increased sedentaryism. As a result, it is estimated that there will be an increase in demand for RPM and care in the market over the forecast period because of the increased prevalence of chronic conditions and the expanding use of healthcare data with portable devices.

REMOTE PATIENT MONITORING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

18.7% |

|

Segments Covered |

By Product, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Koninklijke Philips N.V., Medtronic, GE Healthcare, Cerner Corporation, Siemens Healthineers AG, OMRON Healthcare, Boston Scientific Corporation Abbott Laboratories, Resideo Life Care Solutions, Vivify Health, Inc. |

Global Remote Patient Monitoring Market Segmentation: By Product

-

Vital Sign Monitors

-

Blood Pressure Monitors

-

Pulse Oximeters

-

Heart Rate Monitor (ECG)

-

Temperature Monitor

-

Respiratory Rate

-

Monitor Brain Monitoring (EEG)

-

Special Monitors

-

Anesthesia Monitors

-

Blood Glucose Monitors

-

Cardiac Rhythm Monitor

-

Respiratory Monitor

-

Capnography

-

Spirometers

-

Fetal Heart Monitors

-

Prothrombin Monitors

-

Multi-Parameter Monitors (MPM)

-

Others

The industry is divided into vital sign monitors and specialized monitors based on products. Due to its capability to track clinically significant data before and after surgery, recognize symptoms, and avoid problems, the special monitors sector led the market in 2022 and accounted for the greatest share of more than 82.75% of the total market. Advanced features, such as wireless connection and iPad compatibility, enable early diagnosis and broaden the product's usefulness. A patient's ECG, noninvasive blood pressure, body temperature, respiration rate, and brain activity may all be efficiently monitored with vital sign monitors.

During the projection period, the popularity of these devices is anticipated to expand due to the integration of many vital sign monitors into a single system. Over the projection period, the vital sign monitors category is anticipated to develop at the quickest rate. Due to the rising prevalence of cardiac problems worldwide, heart rate monitors are a dominant product subsegment. The rising use of these monitors is a result of the growth in people with cardiac conditions. Withings debuted the most advanced and comprehensive at-home cardiovascular monitoring at CES 2019 in Las Vegas. It is anticipated to be the first item to detect blood pressure and record ECG and cardiac data using a digital stethoscope.

Global Remote Patient Monitoring Market Segmentation: By Application

-

Cancer

-

Cardiovascular Diseases

-

Diabetes

-

Sleep Disorder

-

Weight Management and Fitness Monitoring

-

Bronchitis

-

Infections

-

Eye infections

-

Sinus Infections

-

Strep Throat

-

Virus

-

Dehydration

-

Hypertension

The market is divided into categories based on applications including cancer, cardiovascular diseases, diabetes, sleep disorders, weight management, fitness monitoring, bronchitis, infections, viruses, dehydration, and hypertension. In 2022, diabetes became the dominant application sector and contributed to about 13.10% of the total market. Diabetes is one of the main causes of death, thus blood glucose levels must be monitored constantly. Numerous biological functions, including renal, liver, heart, and optical functions, are known to be affected by it.

As a result, frequent and continuous monitoring is needed, which can be conveniently done with the help of RPM devices. Over 1 billion individuals suffer from hypertension globally, according to the World Health Organisation (WHO). The management of hypertension can benefit greatly from remote patient monitoring. Due to the rising frequency of the condition, the sector for treating cardiovascular disease is predicted to increase at a profitable pace throughout the projection period.

Global Remote Patient Monitoring Market Segmentation: By End-Use

-

Hospital-based Patients

-

Ambulatory Patients

-

Home Healthcare

In 2022, the hospital end-use category dominated the market and accounted for the highest market share, at 80.00%. Both inpatients and outpatients in considerable numbers are served by hospitals. They have a larger technical team and a wide range of diagnostic tests available to meet the demands of the patients. However, it is projected that alternate site monitoring, particularly home healthcare, would show a strong CAGR throughout the projection period.

The availability of competent resources and the cost-effectiveness of this alternative site are anticipated to promote the expansion. Additionally, RPM offers market participants tremendous opportunities in terms of working with hospitals and other healthcare venues and developing new products to promote accessible treatment at a patient's home, especially in light of the growing demand for hospital resources and employees. The epidemic has also boosted the amount of patients communicating with their doctors online, which is good for the product.

Global Remote Patient Monitoring Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America led the market globally, with more than 41.45% of the total market. The main causes of the regional market growth are the rise in the prevalence of chronic illnesses, the need for wireless and portable systems, and the availability of complex reimbursement schemes designed to reduce out-of-pocket expenses.

The increased mortality rate and growing need for affordable therapy are to blame for this. Rising internal monitoring needs, helpful central data management solutions, and increasing RPM accuracy & and efficiency are the key growth factors for the region. The Asia Pacific region is likely to see the fastest CAGR over the course of the forecast period due to the availability of untapped potential in the developing economies of China and India. Japan is anticipated to be a significant source of revenue because of its large elderly population.

COVID-19 Impact on Global Remote Patient Monitoring Market:

The COVID-19 pandemic outbreak had a favorable effect on the market for remote patient monitoring, at the height of the epidemic, several nations enacted stringent regulations and even countrywide lockdowns. Due to the high patient volume in hospitals and other healthcare institutions, telehealth and remote patient monitoring allowed doctors to treat patients in their homes. Since COVID-19 is a highly infectious illness, the rise in COVID-19 cases prompted the creation of COVID-19 monitoring platforms, allowing doctors to keep an eye on their patients' health from a distance. These same variables markedly increased demand for monitoring tools like thermometers and pulse oximeters. Additionally, the U.S. FDA approved Emergency Use Authorizations (EUA) in July 2021 for a few wearable or remote patient monitoring devices, making them more accessible to patients. Additionally, during the COVID-19 epidemic, remote patient monitoring reduced healthcare workers' exposure to SARS-CoV-2, Due to the introduction of new RPM technologies, the usage of remote patient monitoring systems has expanded since the epidemic.

Global Remote Patient Monitoring Market Recent developments:

The market's main trends include the improvement of current technologies, the introduction of new products, the diversification of the product line, and mergers or partnerships with healthcare organizations. Philips bought BioTeIemetry, Inc. By integrating the cardiac diagnostics and monitoring equipment from BioTeIemetry, this purchase is anticipated to help Philips expand its patient monitoring offering. Another tactic being used by players right now is to expand industrial operations into nations with large populations and high illness rates. This facility will develop into a renowned center for the R&D, production, and operation of medical equipment systems.

Key Players:

-

Koninklijke Philips N.V.

-

Medtronic

-

GE Healthcare

-

Cerner Corporation

-

Siemens Healthineers AG

-

OMRON Healthcare

-

Boston Scientific Corporation

-

Abbott Laboratories

-

Resideo Life Care Solutions

-

Vivify Health, Inc.

-

In March 2022: By the National Agenda of "Atmanirbhar Bharat," Wipro GE Healthcare announced the opening of its new Medical Device Manufacturing factory (MDM) in Bengaluru, India. This move will help India's domestic production of medical devices like CT scanners, cath lab equipment, ultrasound scanners, patient monitoring systems, ECG machines, and ventilators.

-

In September 2021: To increase access to Statis Monitor, a linked care bedside multi-parameter monitoring device, across India, Medtronic's Indian business teamed up with Stasis Health.

Chapter 1. Remote Patient Monitoring Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Remote Patient Monitoring Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Remote Patient Monitoring Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Remote Patient Monitoring Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Remote Patient Monitoring Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Remote Patient Monitoring Market – By Product

6.1 Introduction/Key Findings

6.2 Vital Sign Monitors

6.3 Blood Pressure Monitors

6.4 Pulse Oximeters

6.5 Heart Rate Monitor (ECG)

6.6 Temperature Monitor

6.7 Respiratory Rate

6.8 Monitor Brain Monitoring (EEG)

6.9 Special Monitors

6.10 Anesthesia Monitors

6.11 Blood Glucose Monitors

6.12 Cardiac Rhythm Monitor

6.13 Respiratory Monitor

6.14 Capnography

6.15 Spirometers

6.16 Fetal Heart Monitors

6.17 Prothrombin Monitors

6.18 Multi-Parameter Monitors (MPM)

6.19 Others

6.20 Y-O-Y Growth trend Analysis By Product

6.21 Absolute $ Opportunity Analysis By Product , 2023-2030

Chapter 7. Remote Patient Monitoring Market – By Application

7.1 Introduction/Key Findings

7.2 Cancer

7.3 Cardiovascular Diseases

7.4 Diabetes

7.5 Sleep Disorder

7.6 Weight Management and Fitness Monitoring

7.7 Bronchitis

7.8 Infections

7.9 Eye infections

7.10 Sinus Infections

7.11 Strep Throat

7.12 Virus

7.13 Dehydration

7.14 Hypertension

7.15 Y-O-Y Growth trend Analysis By Application

7.16 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Remote Patient Monitoring Market – By End-Use

8.1 Introduction/Key Findings

8.2 Hospital-based Patients

8.3 Ambulatory Patients

8.4 Home Healthcare

8.5 Y-O-Y Growth trend Analysis By End-Use

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 9. Remote Patient Monitoring Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Application

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Application

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Application

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Application

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Application

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Remote Patient Monitoring Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Koninklijke Philips N.V.

10.2 Medtronic

10.3 GE Healthcare

10.4 Cerner Corporation

10.5 Siemens Healthineers AG

10.6 OMRON Healthcare

10.7 Boston Scientific Corporation

10.8 Abbott Laboratories

10.9 Resideo Life Care Solutions

10.10 Vivify Health, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Remote Patient Monitoring Market was estimated to be worth USD 26.32 billion in 2022 and is projected to reach a value of USD 103.73 billion by 2030.

Aging population growth and the expanding need for healthcare access to the market for remote patient monitoring and the market is driven by the high value of remote patient monitoring in containing infectious illnesses and epidemics are the factors driving the Global Remote Patient Monitoring Market.

The installation and training process for RPM is expensive, which will limit market expansion.

Vital sign monitor product type is the fastest growing in the Global Remote Patient Monitoring Market.

Asia-Pacific region is the fastest growing in the Global Remote Patient Monitoring Market.