IoT Sensors Market Size (2024 – 2030)

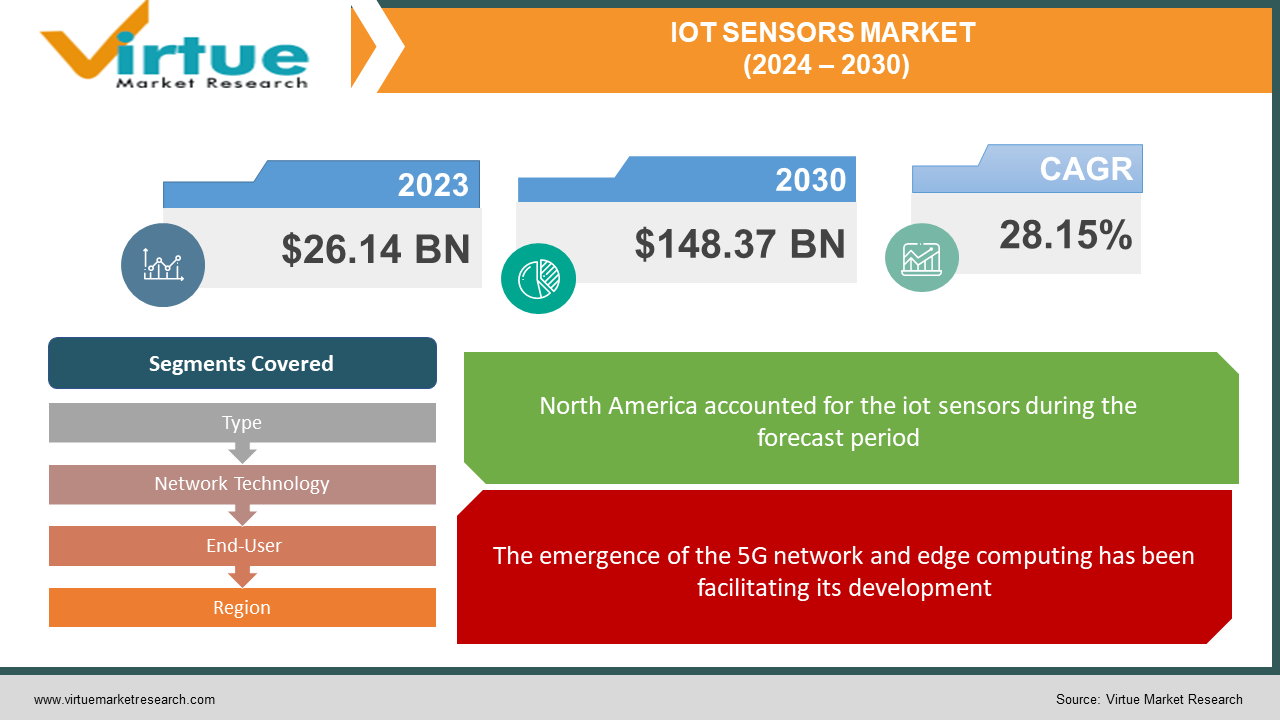

The global IoT sensor market was valued at USD 26.14 billion and is projected to reach a market size of USD 148.37 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 28.15%.

IoT sensors are electrical chipsets that use a gateway to transmit data to the internet after detecting system or environmental conditions. They may function via radiation, magnetic fields, or direct physical touch. This market has had a notable presence over the past decade. This is due to the growing adoption and awareness. Presently, this market is experiencing rapid growth owing to technological advancements and increasing connectivity. In the future, with a growing focus on data privacy and R&D activities, this market is anticipated to undergo tremendous development.

Key Market Insights:

Globally, there are around 16.7 billion IoT devices as of 2023. With over 44% of businesses fully utilizing IoT, the US is at the forefront of full-scale adoption of the technology. IoT spending was estimated to reach US$ 1.1 trillion by 2023. With 48% of the poll, IoT innovators ranked sensor processing as the most crucial topic to concentrate on. Less than 42% of businesses can identify unprotected IoT devices. To tackle this, organizations are working towards the establishment of reliable asset and inventory management solutions to monitor every Internet of Things device linked to the network.

IoT Sensors Market Drivers:

The emergence of the 5G network and edge computing has been facilitating its development.

The growth of IoT devices and applications is made possible by the implementation of 5G networks, which offer quicker data transfer, lower latency, and expanded network capacity. IoT sensors can provide massive amounts of data in real time over a 5G connection, allowing for more advanced and responsive IoT applications. Edge computing enhances 5G by lowering latency and bandwidth needs for IoT sensor data by processing data closer to the source, or at the network's edge. IoT sensor growth across sectors and use cases is fueled by the convergence of 5G networks and edge computing capabilities, which improve the scalability, dependability, and responsiveness of IoT solutions.

Rapid adoption across various end-user industries has been enabling the expansion.

IoT sensors are crucial parts of many applications in many different industries, such as retail, healthcare, agriculture, transportation, and smart cities. The need for sensors with the ability to gather and send data is being driven by the growth of Internet of Things applications, including environmental monitoring, smart transportation systems, precision agriculture, and remote medical monitoring. The market for IoT sensors is expanding as a result of companies and organizations utilizing IoT sensors to boost operational effectiveness, increase decision-making, and provide superior goods and services.

IoT Sensors Market Restraints and Challenges:

Data privacy, associated costs, power consumption, and interoperability are the main issues that the market is currently facing.

One of the biggest barriers in the market is data vulnerability. Personal information is often collected and stored on these devices. There have been numerous cases of fraud, attacks, and other crimes. These devices might lack robust security measures. Misuse and leakage can result in significant losses for the company and the individual. Secondly, the initial expenses that are associated with the hardware and software can be very high. Additionally, maintenance and other service charges add up. There might be a new feature or an update that is added. This results in financial losses for smaller and emerging firms. Thirdly, IoT sensors depend on battery power. This dependency can be a hurdle, limiting their lifespan. Besides, this can cause obstacles in remote and underdeveloped areas due to a lack of infrastructure. Furthermore, there is a lack of standardization and protocols in different regions. This can create compatibility challenges, complicating deployment and management.

IoT Sensor Market Opportunities:

Technological advancements are being prioritized through research and developmental activities. Miniaturization of these sensors is one such area where there is a lot of scope. This involves creating smaller sensors for practical purposes. Secondly, activities are being conducted to minimize the dependency of these sensors on power. This is done by extending their lifespan and finding alternative solutions when the charge is drained. Companies are also working on achieving high performance and improved sensitivity sensors for a better outcome. Besides this, other fields like artificial intelligence, big data, data analytics, and machine learning are being given utmost importance. By combining these fields, it is possible to generate data-driven insights to analyze trends and get a deeper understanding. Businesses may profit from IoT sensor data by providing data-as-a-service (DaaS) solutions, building analytics platforms, and AI-driven apps that can be used to boost operations, drive innovation, and generate new income streams. Apart from this, security measures are being enhanced by adding biometrics, authenticity, encryption, and security firmware updates. Regulatory initiatives are also being taken to increase privacy and security.

IOT SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

28.15% |

|

Segments Covered |

By Type, Network Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Sensortec, STMicroelectronics, Texas Instruments, Analog Devices, Inc., TE Connectivity, Honeywell International, Inc., NXP Semiconductors, Infineon Technologies AG, Sensirion AG, Omron Corporation |

IoT Sensors Market Segmentation: By Type

-

Magnetometer

-

Gyroscope

-

Inertial Sensor

-

Image Sensor

-

Touch Sensor

-

Temperature Sensor

-

Pressure Sensor

-

Humidity Sensor

-

Flow Sensor

-

Accelerometer

-

Others

Based on type, pressure sensors are the largest growers. Any gadget that detects pressure and transforms it into an electrical signal is an Internet of Things pressure sensor. The amount of pressure exerted determines the voltage level that the sensor outputs. These sensors make it possible for Internet of Things systems to monitor pressure-driven systems and gadgets. Predictive maintenance and other more advanced maintenance techniques are made possible by pressure sensors. Pressure transmitters can precisely detect pressure in real-time, which can improve process efficiency and lower the risk of failure, making them a popular segment. Inertial sensors are the fastest-growing category. An object's acceleration and angular velocity are measured by an inertial sensor along three mutually perpendicular axes. Small, light, and reasonably priced are the characteristics of inertial sensors. Continuous measurements are possible even when the item is moving quickly, due to inertial sensors. A compact representation of the HAR classifier is made feasible by the modest size of the data from IMU signals. Applications for inertial sensors are numerous and include spacecraft attitude, car safety systems, and therapeutic applications.

IoT Sensors Market Segmentation: By Network Technology

-

Wired

-

Wireless

-

Wi-Fi

-

Bluetooth

-

Bluetooth Smart

-

Bluetooth Smart/Ant+

-

Bluetooth 5

-

Zigbee

-

-

Z-Wave

-

NFC

-

RFID

-

Others

The wireless segment is both the largest as well as the fastest-growing. The widespread adoption of cloud platforms by both large and small organizations is one of the main causes of this. Furthermore, a major factor driving overall development is the lower installation and maintenance costs as compared to wired devices.

IoT Sensors Market Segmentation: By End-User

-

Industrial

-

Automation

-

Energy

-

Transportation

-

Smart Agriculture

-

Healthcare

-

-

Commercial

-

Retail

-

Aerospace & Defense

-

Financial Institutions

-

Entertainment

-

Logistics & Supply Chain

-

Corporate

-

-

Consumer

-

Home Automation

-

Smart Cities

-

Wearable Electronics

-

Commercial Appliances

-

The industrial sector is the most dominant market segment in 2023. This is a result of both the growing requirement for predictive maintenance approaches in business and the growing preference for carrying out complicated industrial processes. Industrial IoT sensors monitor industrial machinery and apparatus. They can measure several parameters and transmit data points to cloud-moving gateways. Thousands of data points may be collected each minute using these sensors. The energy and smart agricultural sectors occupy a significant share of this segment. The consumer is the fastest-growing end-user. This is mainly because of smart cities. IoT sensor adoption is fueled by smart city projects and is used for a range of purposes, such as public safety, traffic control, environmental monitoring, and infrastructure optimization. IoT sensors are used in smart city initiatives to increase sustainability, efficiency, and resident quality of life.

IoT Sensors Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest market as of 2023. The United States and Canada are at the forefront. This is because they have robust infrastructure, resources, leading technology companies, and high adoption rates. A lot of well-established companies are in this area. Prominent ones include Texas Instruments, Honeywell International Inc., Analog Devices Inc., and TE Connectivity. Besides this, investments in this region are increasing, contributing to its success. Asia-Pacific is the fastest-growing market during the forecast period. Countries like China, India, and Japan are the notable ones. Because of the region's growing industry, urbanization, and investments in smart city programs, the usage of IoT sensors is expanding quickly. The region's fast rise in the IoT sensor market is attributed to its expanding industrial sector and government programs to encourage IoT use.

COVID-19 Impact Analysis on the Global IoT Sensors Market:

The outbreak of the virus had a mixed impact on the market. The new normal included social isolation, movement limitations, and lockdowns. To stop the virus from spreading, the majority of the businesses were shuttered. There was an economic uncertainty that prevailed. There were a lot of constraints on budgets because of this. However, on the other hand, the pandemic accelerated a digital shift. Remote work was encouraged in most of the sectors. Many industries rely on these sensors to enable predictive maintenance, virtual monitoring, and real-time updates on critical infrastructure. Hygiene and safety became vital during the pandemic. The healthcare sector saw a rapid adoption of this technology. To guarantee adherence to health rules and improve safety measures, Internet of Things (IoT) sensors were used for applications including temperature screening, contact tracing, occupancy monitoring, and air quality monitoring. As per a report by IoT Analytics, an IoT upsurge was seen in the healthcare industry, where up to 620 digital visits were conducted by the Stanford Children's Health Hospital. Post-pandemic, the market has picked up in other industries like automotive, construction, environment, and others owing to demand. Additionally, the upliftment of rules and the relaxation of regulations have enabled normal functioning.

Latest Trends/ Developments:

Businesses in this sector are driven to grow their market share through a variety of tactics, such as investments, joint ventures, and acquisitions. Companies are investing a significant amount of money in developing strategies to maintain competitive pricing. This has led to more growth.

In place of one-time hardware purchases, several IoT sensor providers are switching to subscription-based pricing structures and providing IoT solutions as a service (IoTaaS). This change makes budgeting easier, permits scalability and flexibility in IoT installations, and gives organizations access to IoT capabilities without requiring upfront capital commitments.

Key Players:

-

Bosch Sensortec

-

STMicroelectronics

-

Texas Instruments

-

Analog Devices, Inc.

-

TE Connectivity

-

Honeywell International, Inc.

-

NXP Semiconductors

-

Infineon Technologies AG

-

Sensirion AG

-

Omron Corporation

-

In January 2024, MeitY Secretary S. Krishnan introduced a key initiative. The Intelligent Internet of Things (IIoT) Sensors Centre of Excellence (CoE) program, housed in a special building in Kochi's Makers Village, is intended to create sensors for intelligent Internet of Things devices. A broad spectrum of intelligent sensor applications in devices, networks, and sensor systems will be covered by the CoE.

-

In March 2023, three IoT sensor-based products were introduced by Shri Alkesh Kumar Sharma, the Secretary of the Ministry of Electronics and Information Technology (MeitY). These products were developed by C-MET in the CoE for IoT sensors and include the smart digital thermometer, an IoT-enabled environmental monitoring system, and a multichannel data acquisition system. One of the most often used parts in the industry is the sensor; hence, C-MET's efforts to produce commercially ready sensors and devices through translational research are in keeping with the government's Atmarnirbharata aim. India will be positioned as a worldwide center for sensors and gadgets due to its own IoT sensor solutions.

-

In February 2023, for IoT sensor engineering, Henkel introduced the Sensor INKxperience Kit. Professional engineers and developers can use the kit to experiment with printed electronics technology to construct Internet of Things sensors. Four pre-configured printed electronics technologies are included in the package, which helps expedite ideation, assessment, and prototyping. The kit is specifically designed for Internet of Things engineers, and it can assist them in investigating the potential of printed electronics technology.

Chapter 1. IoT Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. IoT Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. IoT Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. IoT Sensors Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. IoT Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. IoT Sensors Market – By Type

6.1 Introduction/Key Findings

6.2 Magnetometer

6.3 Gyroscope

6.4 Inertial Sensor

6.5 Image Sensor

6.6 Touch Sensor

6.7 Temperature Sensor

6.8 Pressure Sensor

6.9 Humidity Sensor

6.10 Flow Sensor

6.11 Accelerometer

6.12 Others

6.13 Y-O-Y Growth trend Analysis By Type

6.14 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. IoT Sensors Market – By Network Technology

7.1 Introduction/Key Findings

7.2 Wired

7.3 Wireless

7.4 Wi-Fi

7.5 Bluetooth

7.6 Bluetooth Smart

7.7 Bluetooth Smart/Ant+

7.8 Bluetooth 5

7.9 Zigbee

7.10 Z-Wave

7.11 NFC

7.12 RFID

7.13 Others

7.14 Y-O-Y Growth trend Analysis By Network Technology

7.15 Absolute $ Opportunity Analysis By Network Technology, 2024-2030

Chapter 8. IoT Sensors Market – By End User Industry

8.1 Introduction/Key Findings

8.2 Industrial

8.3 Automation

8.4 Energy

8.5 Transportation

8.6 Smart Agriculture

8.7 Healthcare

8.8 Commercial

8.9 Retail

8.10 Aerospace & Defense

8.11 Financial Institutions

8.12 Entertainment

8.13 Logistics & Supply Chain

8.14 Corporate

8.15 Consumer

8.16 Home Automation

8.17 Smart Cities

8.18 Wearable Electronics

8.19 Commercial Appliances

8.20 Y-O-Y Growth trend Analysis By End User Industry

8.21 Absolute $ Opportunity Analysis By End User Industry, 2024-2030

Chapter 9. IoT Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Network Technology

9.1.4 By By End User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Network Technology

9.2.4 By End User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Network Technology

9.3.4 By End User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Network Technology

9.4.4 By End User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Network Technology

9.5.4 By End User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. IoT Sensors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bosch Sensortec

10.2 STMicroelectronics

10.3 Texas Instruments

10.4 Analog Devices, Inc.

10.5 TE Connectivity

10.6 Honeywell International, Inc.

10.7 NXP Semiconductors

10.8 Infineon Technologies AG

10.9 Sensirion AG

10.10 Omron Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global IoT sensor market was valued at USD 26.14 billion and is projected to reach a market size of USD 148.37 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 28.15%.

The emergence of 5G networks and edge computing, as well as rapid adoption across various end-user industries, are the main factors propelling the global IoT sensor market.

Based on end-user, the global IoT sensor market is segmented into industrial, commercial, and consumer.

North America is the most dominant region for the global IoT sensor market.

Bosch Sensortec, STMicroelectronics, and Texas Instruments are the key players operating in the global IoT sensor market.