Food service Market Size (2025-2030)

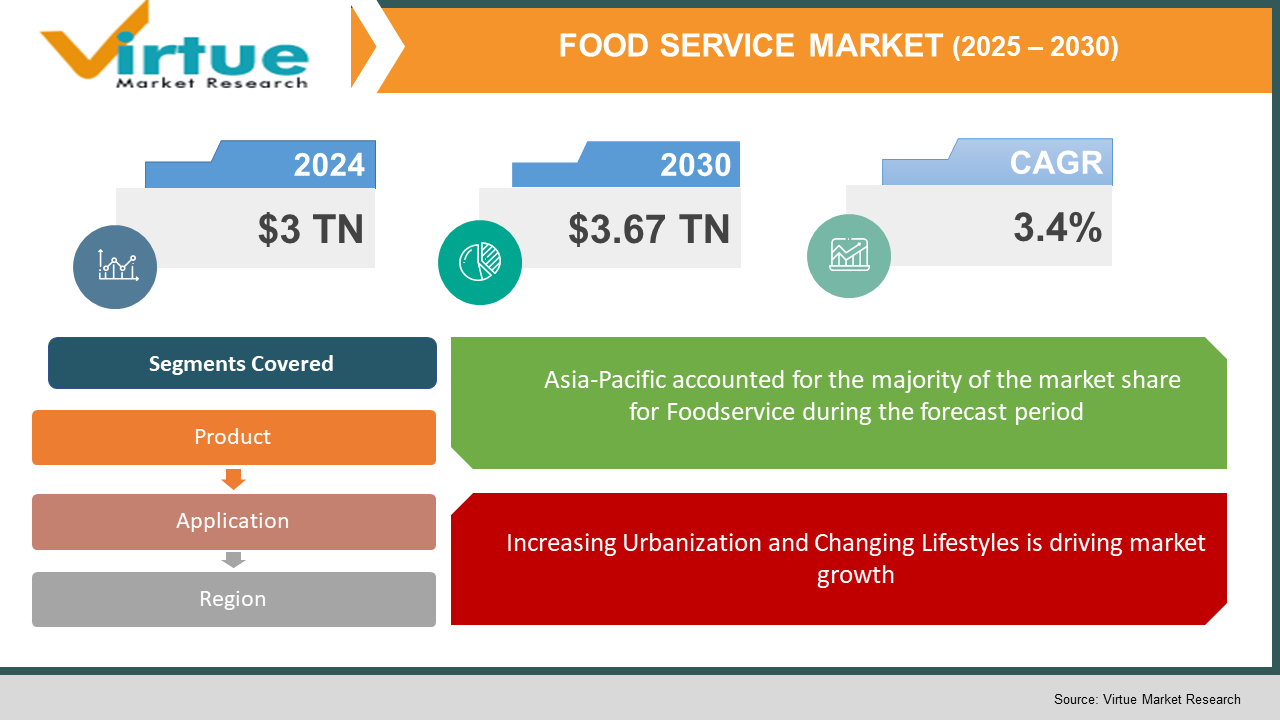

The Global Foodservice Market was valued at USD 3 trillion in 2024 and is expected to grow at a CAGR of 3.4% from 2025 to 2030. The market is projected to reach USD 3.67 trillion by 2030.

The Foodservice Market encompasses businesses, institutions, and companies responsible for any meal prepared outside the home. This includes restaurants, cafes, catering services, and delivery-based platforms. With evolving consumer preferences, increasing urbanization, and the rise of delivery services, the foodservice sector is expanding rapidly. Technological integration, including AI-driven analytics and contactless payment solutions, has also significantly contributed to the market's growth trajectory.

Key Market Insights:

-

The rapid adoption of online food delivery platforms has driven market growth, with delivery accounting for approximately 15% of global foodservice revenue in 2024, expected to grow to 22% by 2030.

-

The casual dining segment remains the largest contributor to revenue, with a market share of around 35% in 2024, driven by affordability and a wide range of options.

-

Sustainable and plant-based menus have surged in popularity, with over 30% of consumers preferring eco-friendly dining options, bolstering growth in this niche.

-

Foodservice automation, including kiosks and robotic kitchens, is expected to streamline operations, reducing labor costs by an estimated 20% over the next five years.

-

The Asia-Pacific region dominated the market in 2024, holding a 42% share, fueled by population growth, urbanization, and increasing disposable incomes.

-

Catering services have grown in demand post-COVID-19, as corporate events and gatherings resumed, contributing approximately 18% of the market revenue in 2024.

-

The emergence of ghost kitchens has disrupted traditional models, with this sub-sector growing at a CAGR of 12% from 2025 to 2030.

-

Healthy and organic meal offerings are gaining traction, with 40% of millennials preferring nutritionally balanced menus, creating opportunities for innovation in this domain.

Global Foodservice Market Drivers:

Increasing Urbanization and Changing Lifestyles is driving market growth:

Urbanization has significantly altered consumer food habits, shifting preferences toward convenience and eating out. According to a 2024 report by the World Bank, over 55% of the global population resides in urban areas, with this number expected to reach 60% by 2030. This urban shift has created opportunities for foodservice outlets to meet the demand for diverse cuisines and quick service. Changing lifestyles, including busier work schedules and dual-income households, have accelerated this trend. Consumers now rely heavily on food delivery apps, subscription meal plans, and dine-in options, fostering growth in the foodservice market.

Technological Advancements in Foodservice Operations is driving market growth:

The integration of technology in foodservice operations has been a significant growth driver. Online ordering platforms, digital payment methods, and loyalty programs have enhanced the consumer experience, increasing repeat business. Additionally, AI and machine learning tools allow businesses to forecast demand, optimize inventory, and personalize offerings. Innovations like drone delivery and robotic kitchens are emerging trends expected to revolutionize the industry further. These advancements cater to consumer convenience while providing businesses with operational efficiency, driving growth in the foodservice market.

Rising Demand for Healthy and Sustainable Eating Options is driving market growth:

Growing awareness of health and sustainability has transformed consumer dining choices. As of 2024, approximately 70% of consumers in developed economies preferred organic and health-conscious meal options. This trend has encouraged restaurants and cafes to include plant-based, vegan, and low-calorie menus. Sustainability-focused practices, such as reducing food waste, using eco-friendly packaging, and sourcing local ingredients, have become key differentiators for foodservice providers. Such practices not only appeal to environmentally conscious consumers but also align with global regulatory pressures for sustainable operations, driving market growth.

Global Foodservice Market Challenges and Restraints:

High Competition and Cost Pressures is restricting market growth:

The foodservice industry faces intense competition, with established players, regional chains, and small independent operators vying for market share. Margins remain tight due to fluctuating food prices, labor costs, and operational expenses. For instance, in 2024, labor costs accounted for an average of 30% of total operational expenses in the foodservice sector. Additionally, supply chain disruptions caused by geopolitical instability and natural disasters have made cost management increasingly challenging. Restaurants and cafes must continually innovate to differentiate themselves, which often requires significant investment in marketing and technology.

Regulatory and Health-Related Challenges is restricting market growth:

The foodservice market operates under stringent health and safety regulations. Compliance with food safety standards, such as FDA and EU directives, involves substantial costs for inspection, certification, and quality control. Moreover, rising consumer awareness has led to increased scrutiny of allergens, nutritional content, and food traceability. Non-compliance or negative publicity can severely damage brand reputation and result in legal penalties. Furthermore, emerging health crises, like the COVID-19 pandemic, expose vulnerabilities in the foodservice sector, necessitating constant adaptation to new regulatory and safety requirements.

Market Opportunities:

The Global Foodservice Market is ripe with opportunities as consumer preferences evolve and technological advancements reshape industry dynamics. One significant area is the expansion of delivery and takeaway services. The convenience of ordering food through apps and the rise of ghost kitchens eliminate the need for traditional storefronts, reducing costs and increasing accessibility. Moreover, the growing popularity of eco-friendly and health-conscious dining provides opportunities for foodservice providers to create innovative menus catering to these preferences. Collaboration with local farmers and producers to source organic and sustainable ingredients can enhance brand image while tapping into niche markets. Additionally, leveraging artificial intelligence for personalized marketing and blockchain for supply chain transparency can further enhance customer trust and operational efficiency. The increasing demand for international cuisines, driven by globalization and travel, also presents an opportunity for businesses to diversify their offerings and reach broader audiences.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

McDonald’s, Starbucks, Yum! Brands, Domino’s, Darden Restaurants, Restaurant Brands International, Chipotle Mexican Grill, Compass Group, Aramark, Sodexo |

Foodservice Market Segmentation:

Foodservice Market Segmentation By Product:

-

Full-Service Restaurants

-

Quick-Service Restaurants

-

Cafes and Bars

-

Street Vendors

-

Catering Services

-

Delivery and Takeaway Services

Quick-service restaurants dominate the product segment due to their affordability, speed, and convenience. With the rising popularity of fast food and on-the-go dining, this segment accounted for over 35% of the market share in 2024 and continues to grow at a steady pace.

Foodservice Market Segmentation By Application:

-

Commercial

-

Institutional

The commercial sector is the leading segment, driven by the presence of diverse outlets such as restaurants, bars, and food trucks. This segment held over 75% of the market share in 2024, reflecting its broad consumer base and revenue potential.

Foodservice Market Regional Segmentation:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific region leads the global foodservice market, accounting for 42% of the revenue in 2024. This dominance is driven by rapid urbanization, a growing middle-class population, and increasing disposable income. Countries like China and India are key contributors, boasting vibrant dining cultures and a strong appetite for international cuisines. Additionally, the proliferation of food delivery platforms has further boosted market growth. The region's diverse culinary traditions, coupled with a young and tech-savvy demographic, make it a lucrative market for global foodservice operators.

COVID-19 Impact Analysis on the Foodservice Market:

The COVID-19 pandemic had a profound impact on the foodservice market, disrupting all segments of the industry. During the early phases of the pandemic, dine-in establishments faced significant losses due to lockdowns and social distancing measures. With traditional dining options restricted, the crisis accelerated the shift toward delivery and takeaway services. Platforms like Uber Eats and DoorDash saw a dramatic surge in demand, as consumers increasingly turned to convenient meal options at home. In response to the changing landscape, ghost kitchens emerged as a cost-effective alternative, allowing businesses to operate without the overhead of maintaining physical dining locations. This model gained traction, especially for smaller, more nimble foodservice providers looking to adapt quickly to shifting consumer behavior. As consumer preferences shifted, contactless dining became a top priority, leading to greater investments in automation and digital platforms. These innovations enabled foodservice providers to offer safer, more efficient experiences, such as contactless ordering and payment systems, which became essential in reducing physical interactions. Health-conscious dining also gained prominence during the pandemic, as consumers became more focused on hygiene, wellness, and nutrition. This shift in consumer priorities encouraged foodservice providers to diversify their menus, offering healthier and more hygiene-conscious options. Despite the many challenges, the pandemic served as a catalyst for innovation, pushing the foodservice industry to embrace new technologies and operational efficiencies. The changes brought about during the crisis have set the stage for long-term growth in the foodservice sector, with an emphasis on digital transformation, convenience, and consumer health.

Latest Trends/Developments:

Several key trends are shaping the future of the foodservice market. One notable trend is the rise of experiential dining, which combines food with immersive environments and activities to create unique, memorable experiences. This trend is especially popular among younger consumers who seek more than just a meal but an opportunity to engage with their dining environment. Sustainability continues to be a major focus in the industry, with restaurants adopting practices like zero-waste cooking and using eco-friendly packaging to reduce their environmental impact. These initiatives resonate with eco-conscious consumers and are becoming essential for businesses aiming to meet sustainability goals. Technological advancements are also revolutionizing foodservice operations. AI-driven menus, personalized recommendations, and even drone deliveries are transforming the way restaurants interact with customers and deliver their services. These innovations enhance efficiency, customer satisfaction, and convenience. The demand for plant-based and alternative proteins is rapidly increasing, with many leading chains incorporating these options into their menus. This shift is driven by growing health-consciousness, environmental concerns, and ethical considerations regarding animal products. Globalization has also played a key role in broadening consumer tastes, leading to an increased appetite for diverse cuisines. This has sparked the popularity of fusion dining concepts, blending ingredients and cooking techniques from different cultures to create innovative dishes. Finally, blockchain technology is making waves in the foodservice industry, offering greater supply chain transparency. This technology enhances consumer trust by ensuring food safety and traceability, addressing concerns over food quality and ethical sourcing. These trends reflect a dynamic and evolving foodservice landscape that is becoming more sustainable, innovative, and consumer-focused.

Key Players:

-

McDonald’s

-

Starbucks

-

Yum! Brands

-

Domino’s

-

Darden Restaurants

-

Restaurant Brands International

-

Chipotle Mexican Grill

-

Compass Group

-

Aramark

-

Sodexo

Chapter 1. Global Foodservice Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Foodservice Market– Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Foodservice Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Foodservice Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Foodservice Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Foodservice Market – By Product

6.1 Introduction/Key Findings

6.2 Full-Service Restaurants

6.3 Quick-Service Restaurants

6.4 Cafes and Bars

6.5 Street Vendors

6.6 Catering Services

6.7 Delivery and Takeaway Services

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Global Foodservice Market – By Application

7.1 Introduction/Key Findings

7.2 Commercial

7.3 Institutional

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Foodservice Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Foodservice Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 McDonald’s

9.2 Starbucks

9.3 Yum! Brands

9.4 Domino’s

9.5 Darden Restaurants

9.6 Restaurant Brands International

9.7 Chipotle Mexican Grill

9.8 Compass Group

9.9 Aramark

9.10 Sodexo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Foodservice Market was valued at USD 3 trillion in 2024 and is expected to grow at a CAGR of 3.4% from 2025 to 2030. The market is projected to reach USD 3.67 trillion by 2030.

Key drivers include increasing urbanization, technological advancements in operations, and rising demand for healthy and sustainable dining options.

The market is segmented by product into full-service restaurants, quick-service restaurants, cafes, bars, street vendors, catering services, and delivery/takeaway services. It is also segmented by application into commercial and institutional.

The Asia-Pacific region is the most dominant, accounting for 42% of the market revenue in 2024, driven by urbanization and increasing disposable income.

Leading players include McDonald’s, Starbucks, Yum! Brands, Domino’s, Darden Restaurants, and Chipotle Mexican Grill.