Saudi Arabian Food Service Market Size (2024-2030)

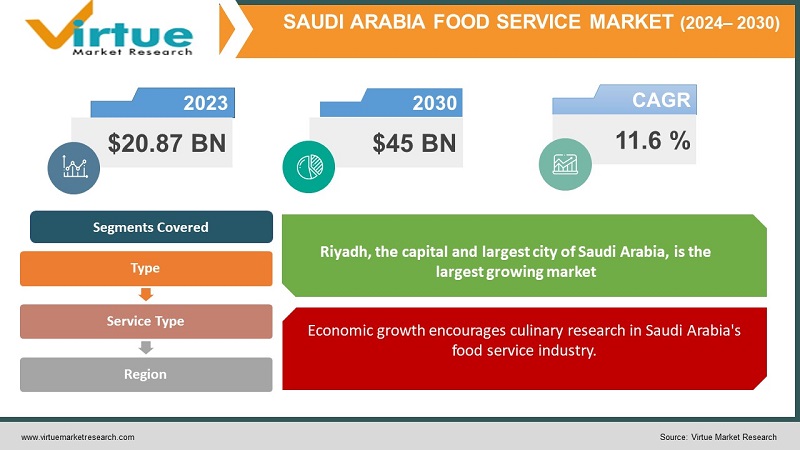

The market was valued at USD 20.87 billion in 2023 and is projected to reach USD 45 billion by 2030, with a projected CAGR of 11.6% during the forecast period from 2024 to 2030.

The food service sector in Saudi Arabia is dynamic and diverse, reflecting both the country's rich culinary traditions and its customers' shifting preferences. Among the market's sectors are full-service and quick-service restaurants (QSRs), casual dining, fine dining, bakeries, cafés, food delivery services, food trucks, and catering businesses. The industry is predicted to grow dramatically by 2030. Growing populations are among the causes propelling the development of global culinary trends, which are becoming more and more important. The sector has embraced technology, and the use of online meal delivery services is growing in popularity.

Key Market Insights:

Although the Saudi Arabian food service business is changing quickly, several significant market insights show the sector's dynamics. There's no denying that increasing urbanization and population growth are changing consumer preferences to include a greater range of culinary experiences. Global culinary trends have overtaken the industry, fueling the expansion of quick-service restaurants (QSRs), health-conscious eateries, and online meal delivery services. Technology integration in the form of digital menus, contactless payments, and data-driven customer engagement has become crucial to further enhance the entire dining experience.

Government measures and economic reforms are driving the sector's growth, with a particular emphasis on boosting tourism and the hotel industry. Moreover, the coexistence of international franchises and a thriving regional food industry creates a dynamic, competitive atmosphere that offers consumers a wide range of choices. As sustainability and health consciousness gain hold, the market's trajectory is being determined by the increased demand for food options that are healthier and sourced ethically. The Saudi Arabian food service industry is distinguished by a combination of innovation and tradition, suggesting that it is a sector that is well-positioned to expand and adapt to shifting consumer demands.

Saudi Arabian Food Service Market Drivers:

Economic growth encourages culinary research in Saudi Arabia's food service industry.

Saudi Arabia's robust economic growth and increasing disposable incomes have had a significant impact on the country's culinary scene. The expanding middle class, which has greater purchasing power, is primarily responsible for the increased demand for a range of upscale dining experiences. The economic success has led to a rise in high-end restaurants, specialist eateries, and multinational food franchises since it has enhanced consumer freedom. As long as the kingdom remains prosperous, it is anticipated that the food service sector will expand and offer a wide variety of gastronomic experiences to both foreign visitors and locals.

Saudi Arabia's dining habits are being changed by technology.

Saudi Arabia's food service sector is undergoing a technological revolution in the rapidly evolving digital era. While satisfying the demands of tech-savvy patrons, the integration of digital menus, contactless payment systems, and online delivery platforms has enhanced dining experiences on the whole. Due to the increasing usage of smartphones and internet penetration, ordering meals online has become much more convenient, requiring restaurants to adapt to the digital world. More than transactions, technology is transforming the way consumers interact with and view the extensive array of goods and services offered by Saudi Arabia's food service industry.

Health trends are influencing dining preferences.

There is a discernible trend in consumer preferences in Saudi Arabia's food service industry towards health and wellness, with a greater emphasis on selecting healthful and thoughtful eating options. Growing demand for organic, locally produced ingredients and healthier menu options is a result of growing knowledge of the health risks associated with lifestyle choices. Restaurants are responding to this trend by developing innovative, health-focused menus to satisfy the evolving demands of a customer base that is worried about their well-being. This update not only modifies the menu selections but also makes health-conscious dining a significant factor in shaping the future of the food service industry.

Saudi Arabia Food Service Restraints and Challenges:

Complexities in regulation present obstacles for food service managers.

Navigating Saudi Arabia's complicated legal system and compliance requirements is a big problem for food service operators. The regulatory environment may be intricate, necessitating meticulous attention to detail and adaptability to shifting standards for anything from permits to safety and health requirements. Even though these stringent regulations are designed to safeguard patrons, they occasionally impede eateries from running efficiently and swiftly, which significantly restrains corporate actors.

Cultural sensitivity has been affecting the diversification of menu items.

The wide variety of cultural customs that are common in Saudi Arabia creates unique challenges for food service providers looking to increase the selection of items on their menus. To honor local traditions and be mindful of cultural variances, certain foods and products cannot be introduced. Operators find it challenging to maintain regional authenticity while offering cuisines from around the world since they need to accommodate these cultural oddities to cater to a diverse clientele.

Price sensitivity and intense competition are major concerns.

Saudi Arabia's food service market is growing swiftly, increasing competition from both domestic and international players. Due to the plethora of dining options and the sensitivity of customers to pricing, restaurants are under pressure to maintain both affordability and quality. It is equally challenging to maintain profit margins in the face of price wars as it is to differentiate products. One requires astute pricing, inventive marketing, and a deep understanding of shifting consumer tastes to successfully navigate this cutthroat industry.

Saudi Arabia Food Service Market Opportunities:

Increased travel offers a wide range of culinary experiences.

The restaurant service business has a fantastic opportunity to benefit from an increase in foreign tourists, according to Saudi Arabia's Vision 2030, an ambitious strategy focused on encouraging tourism. Restaurants and eateries can provide unique culinary experiences as the country opens its doors to the outside world by offering a variety of cuisines to satisfy the palates of people everywhere. Partnerships with local businesses and the introduction of international cuisines offer a feasible avenue for growth and innovation, establishing the food service industry as a vital aspect of the kingdom's tourism appeal.

Digital transformation has been improving customer interaction.

In Saudi Arabia's growing digital ecosystem, food service providers have a plethora of opportunities to enhance customer interaction and streamline operations. Investing in digital marketing strategies, smartphone apps, and reliable internet platforms can lead to personalized experiences, simplified ordering processes, and a tech-savvy clientele. By utilizing data analytics for customer insights and preferences, businesses may further personalize their products and create a seamless, comfortable dining experience that aligns with evolving digital expectations.

Growing awareness of health encourages the need for creative menus.

The global trend towards healthy lifestyles offers Saudi Arabia's food service industry a great opportunity to launch creative menu items. Restaurants can enhance their revenue by offering health-focused menu items that align with changing consumer preferences and meet the increasing need for healthy, organic, and sustainable food options. Establishments can create wellness-focused menus and work with local suppliers for high-quality, fresh products to establish themselves as leaders in the promotion of healthy dining options and capitalize on a growing market.

SAUDI ARABIA FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.6% |

|

Segments Covered |

By Type, Service type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

saudi arabia |

|

Key Companies Profiled |

Al-Baik Restaurants, Herfy Food Services Company, Americana Group, Al Tazaj Fakieh Poultry Farms, Kudu Corporation, McDonald's Arabia, Al Kharafi Global Co. (Kuwait Food Company), Al Safeer Group, Tabuk Agriculture Development Company (TADCO), Alamar Foods Company |

Saudi Arabia Food Service Market Segmentation:

Saudi Arabia Food Service Market Segmentation: By Type:

- Full-Service Restaurants

- Quick Service Restaurants

- Institutes

- Others

Full-service restaurants are the largest segment in the market in 2023. A full-service restaurant (FSR) is one where people are attended to by wait staff from beginning to end. Customers place their orders with the waiter, who then brings the food and drinks. Customers settle the bill after dinner. This convenience attracts a broader consumer base, thereby increasing profits in this category. Quick-service restaurants are the fastest-growing segment. These businesses provide quick, easy, and reasonably priced meal alternatives to suit the needs of customers who have hectic lives and want to eat on the move. QSRs are widely known and easily accessible, which contributes to their high foot traffic and sales volume.

Saudi Arabia Food Service Market Segmentation: By Service Type:

- Commercial

- Institutional

The commercial segment is the largest category. Fast food franchises, food trucks, cafés, and coffee shops are examples of commercial establishments. They meet the demands of those seeking out different kinds of eating experiences. Additionally, cafes and coffee shops provide a laid-back setting where people may enjoy small meals, coffee, and pastries. In addition, fast-food establishments provide quick and easy meals with frequently uniform menus and rapid service. The institutional segment is the fastest-growing. This category comprises institutional food service, business and industry (B&I), healthcare, education, government, and military food services. Furthermore, institutional food service refers to the provision of food services inside establishments like colleges, hospitals, prisons, and schools. These restaurants provide a lot of food to satisfy dietary and nutritional requirements. Moreover, B&I food service provides meal choices in business and office environments. They frequently also have vending machines, cafeterias, and catering services.

Saudi Arabia Food Service Market Segmentation: Regional Analysis:

When it comes to the food service business, Riyadh, the capital and largest city of Saudi Arabia, is the largest growing market. Its renown in the food service sector is a result of its enormous population, thriving economy, and standing as a significant hub for trade and culture. In the Saudi Arabian food service industry, Jeddah is showing the fastest growth. The Red Sea coast's strategic position, Jeddah's prominence as a trade and economic hub, and the city's expanding populace all contribute to the food service industry's explosive growth in the city.

COVID-19 Impact Analysis on the Saudi Arabian Food Service Market:

The COVID-19 epidemic has had a significant impact on Saudi Arabia's food service market, altering customer behavior and exerting pressure on industry dynamics. Dine-in experiences have drastically declined, forcing many restaurants to temporarily close, as a result of stringent lockdowns, social distancing measures, and health and safety concerns. When more individuals began choosing contactless dining options, the industry witnessed a huge rise in demand for takeout and delivery services. The economic fallout from the epidemic, including job losses and unstable finances, has also influenced consumer behavior and created a demand for more reasonably priced dining options. Furthermore, food establishments have to make adjustments to their operations due to the stringent health and safety regulations that govern them, such as improving cleaning protocols and reducing the number of seating arrangements. The food service industry is navigating a new normal as the nation gradually recovers to regain the trust of its customers and adapt to the evolving post-pandemic reality. Stricter health laws, a concentration on digital innovation, and a variety of offers are some examples of this.

Latest Trends/ Developments:

It is projected that the industry will continue to use technology to enhance customer experiences, such as contactless payment methods, digital menus, and online ordering platforms. Sustainability and health-conscious dining will likely remain popular trends as consumers express a growing preference for better menu options, locally produced food, and ecologically responsible practices. It is anticipated that menu diversification—which entails blending cuisines from across the globe and meeting various dietary requirements—will remain a prominent trend. Additionally, the market will likely be influenced by advancements in delivery and takeaway services, which are being driven by consumers' increasing reliance on meal delivery apps. It is recommended to go to industry studies or more recent sources for the most recent information to gain an edge.

Key Players:

- Al-Baik Restaurants

- Herfy Food Services Company

- Americana Group

- Al Tazaj Fakieh Poultry Farms

- Kudu Corporation

- McDonald's Arabia

- Al Kharafi Global Co. (Kuwait Food Company)

- Al Safeer Group

- Tabuk Agriculture Development Company (TADCO)

- Alamar Foods Company

Chapter 1. Saudi Arabia Food Service Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Saudi Arabia Food Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Saudi Arabia Food Service Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Saudi Arabia Food Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Saudi Arabia Food Service Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Saudi Arabia Food Service Market– By Type

6.1. Introduction/Key Findings

6.2. Full-Service Restaurants

6.3. Quick Service Restaurants

6.4. Institutes

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Saudi Arabia Food Service Market– By Service Type

7.1. Introduction/Key Findings

7.2. Commercial

7.3. Institutional

7.4. Y-O-Y Growth trend Analysis By Service Type

7.5. Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 8. Saudi Arabia Food Service Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Saudi Arabia

8.1.1. By Country

8.1.1.1. Saudi Arabia

8.1.2. By Type

8.1.3. By Service Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Saudi Arabia Food Service Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Al-Baik Restaurants

9.2. Herfy Food Services Company

9.3. Americana Group

9.4. Al Tazaj Fakieh Poultry Farms

9.5. Kudu Corporation

9.6. McDonald's Arabia

9.7. Al Kharafi Global Co. (Kuwait Food Company)

9.8. Al Safeer Group

9.9. Tabuk Agriculture Development Company (TADCO)

9.10. Alamar Foods Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The market was valued at USD 20.87 billion in 2023 and is projected to reach USD 45 billion by 2030, with a projected CAGR of 11.6% during the forecast period from 2024 to 2030.

Economic growth, technological advancements, and health trends are the major drivers in the market.

The food service industry in Saudi Arabia faces several challenges that include regulatory complexities, cultural sensitivity, associated costs, and intense competition

The Saudi Arabian foodservice market is good for the country's economy since it promotes job growth, increases tourism, and advances cultural enrichment through a range of culinary experiences

Al-Baik Restaurants, Herfy Food Services Company, and Americana Group are some of the leading competitors in the market.