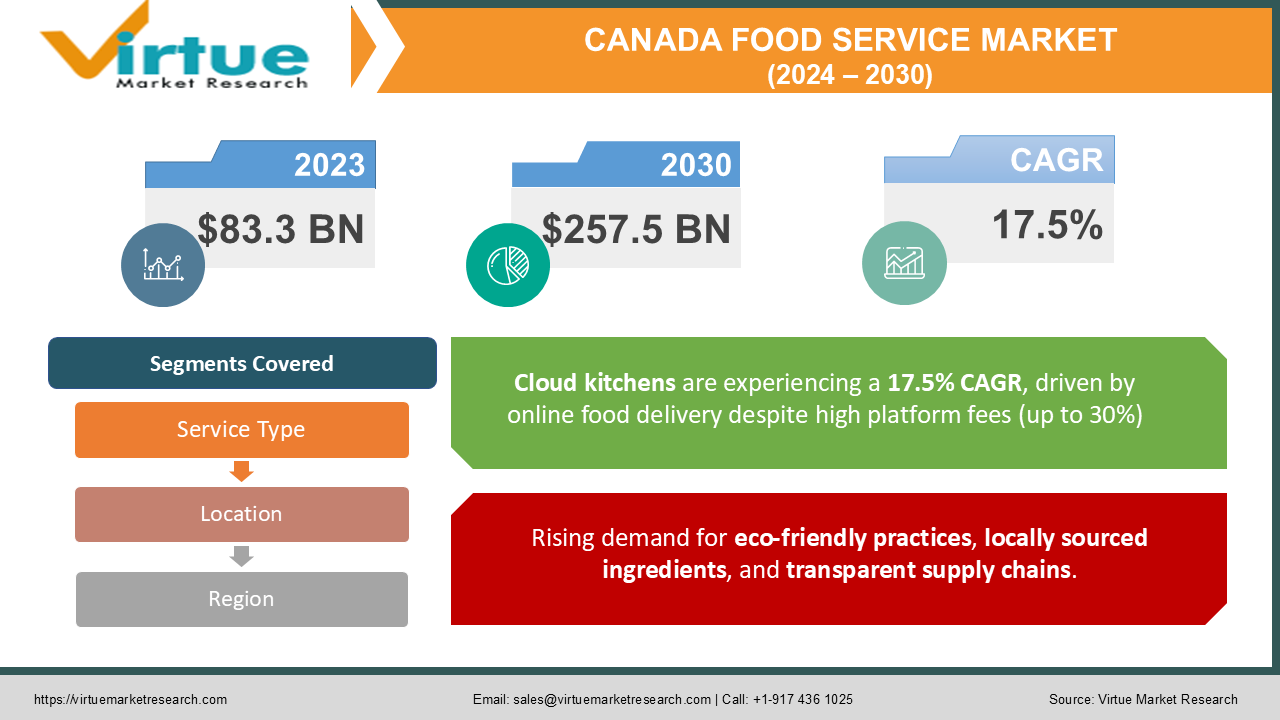

Canada Food Service Market Size (2024-2030)

The Canada Food Service Market was valued at USD 83.3 Billion in 2023 and is projected to reach a market size of USD 257.5 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.5%.

The Canadian food service market represents a dynamic and diverse landscape encompassing a wide array of establishments, including restaurants, cafes, fast-food outlets, catering services, and more. Known for its multicultural culinary scene, this market thrives on offering diverse cuisines and dining experiences, reflecting Canada's cultural richness. Major cities like Toronto, Vancouver, and Montreal serve as culinary hubs, witnessing continuous innovation and a growing emphasis on sustainability, health-conscious choices, and locally sourced ingredients. Factors such as changing consumer preferences, technological advancements in online ordering and delivery services, and the post-pandemic recovery efforts contribute to the evolving nature of Canada's food service industry, presenting opportunities for both established brands and emerging ventures to cater to a discerning and increasingly diverse customer base.

Key Market Insights:

- In 2022, quick-service restaurants emerged as the largest segment in Canada's food service market, showcasing a 7.3% compound annual growth rate during the study period. This expansion stems from the growing preference for fast food and increased dining-out habits post-pandemic.

- Notably, 16% of Canadians dined out daily in 2021, with 40% opting for on-the-go breakfasts. The market witnessed a rise in street vendors and unorganized QSR outlets, representing a market worth USD 254 million, constituting less than 1% of the total QSR market.

- Forecasts indicate rapid growth in the quick-service restaurant sector, projecting an 18.5% CAGR driven by upcoming entrepreneurship and new SME launches. Around 4% of Canadians expressed interest in opening their QSR outlets, while 28% have had previous food industry work experience.

- The cloud kitchen market is set to exhibit a 17.5% CAGR, propelled by increasing smartphone-driven online food deliveries, despite challenges posed by high commission fees of up to 30% imposed by delivery platforms.

- Fast food accounted for approximately 6.5% of Canadians' daily food consumption in 2021, signaling the evolving landscape of Canada's food industry in response to changing consumer behavior and demands.

Canada Food Service Market Drivers:

Evolving Consumer Preferences is propelling the food service market in Canada.

Changing consumer preferences and behaviors heavily impact the market. There's a growing emphasis on health-conscious dining options, leading to increased demand for organic, locally sourced, and sustainable food choices. Consumers are also seeking diverse culinary experiences, embracing global cuisines and innovative food concepts. Additionally, the rise in online food delivery services and convenience-driven dining experiences reflects a shift in how consumers interact with food services, driving establishments to adapt and expand their offerings to cater to these changing preferences.

Technology and Digitalization in the food service industry are shaping the Canadian food service market.

The integration of technology and digital solutions is a major driver reshaping the food service industry in Canada. Online ordering platforms, mobile apps, and digital payment systems have revolutionized the way customers interact with restaurants and food outlets. This technological integration not only enhances convenience for consumers but also provides valuable data and insights for businesses to personalize offerings, optimize operations, and streamline services. Moreover, advancements in kitchen technology and automation contribute to operational efficiency and cost-effectiveness, allowing businesses to meet growing demands effectively while maintaining quality standards.

Canada Food Service Market Restraints and Challenges:

Labour Shortages and Staffing Issues in the food service industry is a significant issues in this market.

The industry faces ongoing challenges in hiring and retaining skilled labor. With changing demographics, labor shortages have become a significant concern, particularly in kitchens and hospitality roles. Factors such as low wages, high turnover rates, and demanding work conditions contribute to this issue. Moreover, the pandemic exacerbated these challenges, leading to workforce disruptions, further impacting operations and service quality across various establishments.

Cost and Margin Pressure involved in the food service market of Canada region is problematic for businesses.

Rising operating costs, including expenses related to rent, food sourcing, equipment, and utilities, pose a continuous challenge for businesses in the food service sector. These escalating costs often strain profit margins, especially for smaller restaurants and independent eateries. Additionally, the increased competition and price sensitivity among consumers adds pressure to maintain competitive pricing while balancing quality and profitability, making it challenging to sustainably navigate cost pressures without compromising on food quality or service.

Canada Food Service Market Opportunities:

The Canadian food service market presents compelling opportunities driven by evolving consumer preferences and emerging trends. With a growing emphasis on sustainability, there's a rising demand for eco-friendly practices, locally sourced ingredients, and transparent supply chains, offering opportunities for establishments to differentiate themselves. Moreover, the increasing adoption of technology, such as online ordering platforms, delivery services, and mobile apps, presents avenues to enhance customer experience and reach a broader audience. The post-pandemic recovery phase offers opportunities for innovation in service models, menu offerings, and operational efficiencies, enabling businesses to adapt and cater to changing consumer needs while tapping into the expanding market for convenience, healthier options, and unique dining experiences.

CANADA FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.5% |

|

Segments Covered |

By Service Type, Location, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

canada |

|

Key Companies Profiled |

Starbucks Corp., Papa John's International Inc., Domino's Pizza Inc., The Wendys Co., Performance Food Group, Recipe Unlimited Corporation, MTY Food Group, Restaurant Brands International (RBI), Cara Operations Limited, A&W Food Services of Canada Inc. |

Canada Food Service Market Segmentation:

Canada Food Service Market Segmentation: By Service Type:

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants

- Cafes & Coffee Shops

- Fast Casual Dining

- Fine Dining Restaurants

- Others

In the Canadian food service market, the largest segment by service type is Quick Service Restaurants (QSRs) having a dominant market share of 57%, due to the fast-paced lifestyle in urban areas, consumer preferences for convenient and speedy dining options, and affordable meal choices. QSRs offer quick, on-the-go meals at competitive prices, catering to a broad demographic of consumers, including families, students, and professionals. The widespread presence of QSR chains, efficient service models, and the convenience of drive-thru and takeaway options further solidify their market leadership. The fastest-growing segment in the Canadian food service market by service type is the Fast Casual Dining segment. This trend is propelled by evolving consumer preferences seeking a balance between convenience and quality dining experiences. Fast casual dining establishments offer a middle ground between traditional quick-service restaurants (QSRs) and full-service restaurants, providing higher-quality, freshly prepared food with speed and convenience. Consumers increasingly favor this segment due to its focus on healthier ingredients, customizable menu options, and often a more relaxed dining atmosphere compared to traditional fast-food outlets.

Canada Food Service Market Segmentation: By Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The largest segment by location in the Canadian food service market is the Standalone category. Standalone restaurants encompass a wide array of establishments operating independently, such as quick-service restaurants, full-service dining venues, and specialty eateries across various regions. This segment's prominence stems from its diverse offerings and widespread presence, catering to local communities, urban centers, and suburban areas. Standalone restaurants have the flexibility to adapt their menus, themes, and services to suit specific consumer preferences, making them accessible and appealing to a broad customer base. Their independent nature allows for agility in responding to changing market demands. The fastest-growing segment by location in the Canadian food service market is the Travel segment. This growth is attributed to the resurgence in travel and tourism activities as restrictions ease post-pandemic. With an increased number of people traveling for leisure, business, or other purposes, there's a subsequent rise in demand for dining options within transportation hubs, airports, train stations, and highways. As people resume travel plans, there's a greater inclination towards on-the-go or quick-service dining experiences, driving the expansion and innovation within the travel-focused food service sector to cater to the diverse needs of travelers seeking convenience, quality, and a variety of culinary choices while on the move.

COVID-19 Impact Analysis on the Canada Food Service Market:

The COVID-19 pandemic significantly impacted the Canadian food service market, causing unprecedented challenges across the industry. Restrictions on indoor dining, lockdowns, and safety protocols profoundly disrupted operations, leading to closures, reduced capacities, and shifts toward delivery and takeout models. The sector faced revenue losses, labor shortages, and supply chain disruptions, particularly affecting smaller eateries and independent restaurants. Consumer behavior underwent substantial changes, with a surge in demand for contactless services and an increased preference for healthy, ready-to-eat meals. Despite the gradual reopening and easing of restrictions, ongoing uncertainties, supply chain issues, and evolving consumer preferences continue to shape the market's recovery, pushing businesses to adapt, innovate, and prioritize safety measures to navigate the post-pandemic landscape.

Latest Trends/ Developments:

One prominent trend in the Canadian food service market is the emergence of ghost kitchens and virtual brands. These establishments operate solely for delivery and takeout, often without a physical dining space. They leverage technology and online platforms to create and market specialized menus or brand concepts targeting specific customer preferences. This trend gained momentum during the pandemic as a response to the increased demand for convenient, contactless dining options. Ghost kitchens allow for cost-effective operations and greater flexibility in experimenting with diverse cuisines and concepts, catering to evolving consumer tastes without the overhead costs of traditional brick-and-mortar restaurants.

A significant development in the Canadian food service market involves a heightened focus on sustainability and local sourcing. Consumers are increasingly mindful of environmental impact and seek restaurants that prioritize eco-friendly practices, such as reducing food waste, using sustainable packaging, and sourcing ingredients locally. This movement aligns with a growing interest in supporting local communities and reducing carbon footprints, prompting restaurants to adapt their sourcing practices, menus, and operational strategies to emphasize sustainability. It has led to collaborations between restaurants and local farmers or suppliers, promoting transparency in the supply chain and resonating positively with environmentally conscious consumers.

Key Players:

- Starbucks Corp.

- Papa John's International Inc.

- Domino's Pizza Inc.

- The Wendys Co.

- Performance Food Group

- Recipe Unlimited Corporation

- MTY Food Group

- Restaurant Brands International (RBI)

- Cara Operations Limited

- A&W Food Services of Canada Inc.

Chapter 1. Canada Food Service Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Canada Food Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Canada Food Service Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Canada Food Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Canada Food Service Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Canada Food Service Market– By Service Type

6.1. Introduction/Key Findings

6.2. Quick Service Restaurants (QSRs)

6.3. Full-Service Restaurants

6.4. Cafes & Coffee Shops

6.5. Fast Casual Dining

6.6. Fine Dining Restaurants

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Service Type

6.9. Absolute $ Opportunity Analysis By Service Type , 2023-2030

Chapter 7. Canada Food Service Market– By Location

7.1. Introduction/Key Findings

7.2. Leisure

7.3. Lodging

7.4. Retail

7.5. Standalone

7.6. Travel

7.7. Y-O-Y Growth trend Analysis By Location

7.8. Absolute $ Opportunity Analysis By Location , 2023-2030

Chapter 8. Canada Food Service Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Canada

8.1.1. By Country

8.1.1.1. Canada

8.1.2. By Service Type

8.1.3. By Location

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Canada Food Service Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1.1. Starbucks Corp.

9.1.2. Papa John's International Inc.

9.1.3. Domino's Pizza Inc.

9.1.4. The Wendys Co.

9.1.5. Performance Food Group

9.1.6. Recipe Unlimited Corporation

9.1.7. MTY Food Group

9.1.8. Restaurant Brands International (RBI)

9.1.9. Cara Operations Limited

9.1.10. A&W Food Services of Canada Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Canada Food Service Market was valued at USD 83.3 Billion in 2023 and is projected to reach a market size of USD 257.5 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.5%.

Evolving Consumer Preferences along with Technology and Digitalization in the food service industry are drivers of the Canada Food Service market.

Based on the source, the Canada Food Service Market is segmented into Leisure, Lodging, Retail, Standalone, and Travel

Quick Service Restaurants (QSRs), Full-Service Restaurants, Cafes & Coffee Shops, Fast Casual Dining, Fine Dining Restaurants, and Others are the segments of the market by service type.

The Wendys Co., Performance Food Group, Recipe Unlimited Corporation, and MTY Food Group are a few of the key players operating in the Canada Food Service Market