Europe Food Service Market Size (2024-2030)

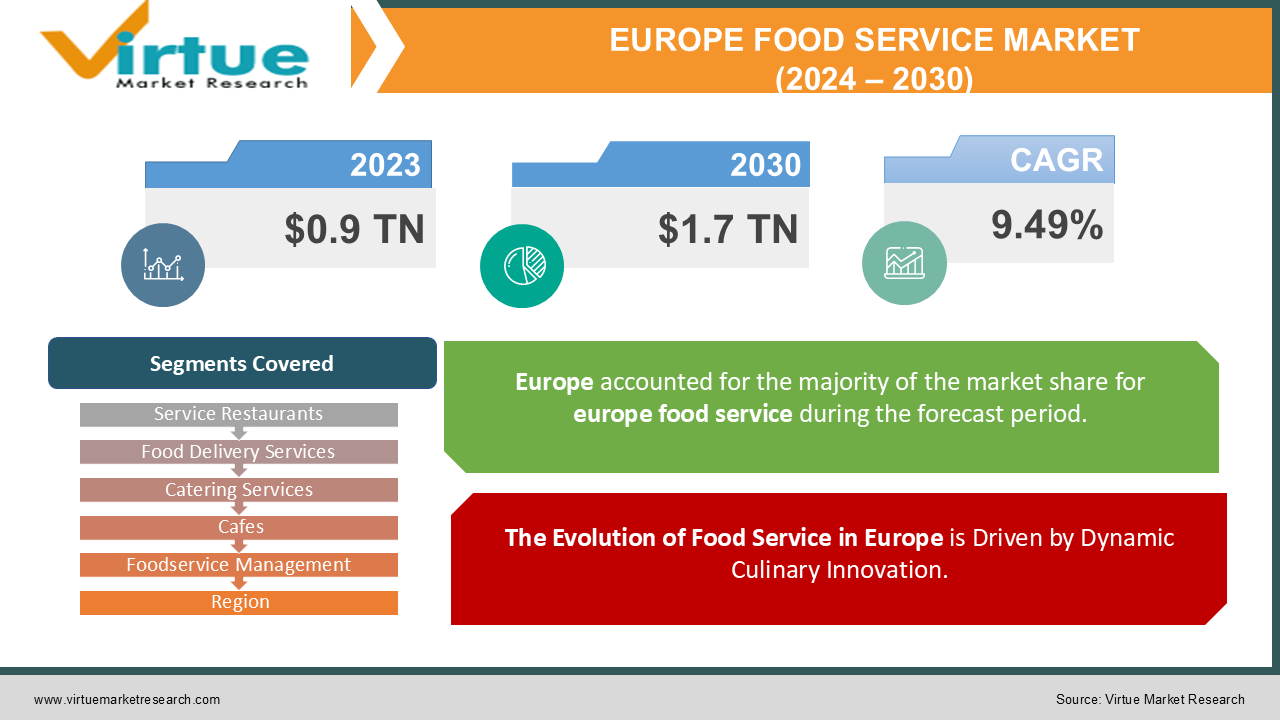

By the end of 2030, the food service business in Europe is expected to have grown from its current valuation of USD 0.9 trillion to USD 1.7 trillion. The market is anticipated to expand at a CAGR of 9.49% between 2024 and 2030.

Europe's food service industry is a thriving, multifaceted market that caters to a wide range of consumer tastes and eating experiences. The market encompasses a variety of segments, including full-service restaurants, quick-service restaurants, cafés, fast-casual outlets, and catering services, reflecting the area's diversified culinary scene. The food service sector in Europe stands out for its blend of traditional and contemporary dining ideas, with an emphasis on innovative menu offerings, shifting consumer preferences, and gastronomic customs. The sector adapts to changing consumer demands and technological advancements like online meal delivery services while keeping an eye on quality, sustainability, and a range of culinary experiences.

Key Market Insights:

The primary market insights for the food service sector in Europe demonstrate that the sector is characterized by innovation, evolving consumer behavior, and a commitment to sustainability. The food service industry in the area is impacted by a discerning clientele that values fine, locally sourced cuisine and a range of culinary experiences. The industry's adaptability to modern lives is evidenced by the rise of fast-casual dining and the integration of technology in online ordering and delivery services. Concerns about health and sustainability are driving changes to menus, with an increasing emphasis on plant-based options and eco-friendly preparation methods. Furthermore, collaborations between local farmers and food service providers improve the authenticity and sense of location in the menu options. These important insights emphasize how important it is to make an impact already created in the market.

Moreover, market insights elucidate how global events, like the COVID-19 epidemic, impact the European food service industry. The issue has caused a shift in consumer behavior, with a focus now being placed more on contactless services, online platforms, and following safety and hygiene guidelines. The food service industry has proven its tenacity by quickly addressing these issues. A lot of restaurants have embraced new technologies, such as tailored delivery services and virtual dining experiences. Furthermore, the market has become more resilient as a community due to the growing emphasis on backing local businesses. These findings demonstrate how vital adaptability, digitization, and community engagement are to the industry's long-term survival during these tumultuous changes.

Europe Food Service Market Drivers:

The Evolution of Food Service in Europe is Driven by Dynamic Culinary Innovation.

One significant factor that stands out in the dynamic European food service business is culinary innovation. Customers' growing need for unique and varied dining experiences is driving a constant rise of originality across menus. Food service businesses are leading the way in providing a diverse range of meals to the region's discerning diners, ranging from creative fusion cuisine to regionally inspired treats. By consistently pushing the boundaries of gourmet originality, this dynamic culinary innovation establishes the industry as a trendsetter and satisfies consumer demand for new flavors.

Technology Integration Is Changing the Dining Experience in Europe.

Technology integration is starting to show up in the European food service business as a crucial element of what makes a modern dining experience. Technology is a major driver of increased consumer satisfaction and operational effectiveness. This is evident in everything from sophisticated reservation systems to seamless online ordering and delivery services. The food industry is utilising modern technology to expedite processes and improve the overall dining experience. This signifies a fundamental change in the way patrons interact with and expect services from food establishments as the sector embraces digital transformation.

Innovation in the Food Service Industry in Europe is Fueled by Sustainable Practices.

Sustainability is becoming the main driver pushing the European food service industry towards a more environmentally conscious future. In response to growing customer awareness, establishments are implementing eco-friendly packaging options, reducing food waste, and sourcing organic and locally grown food. The industry's commitment to environmental responsibility not only aligns with consumer values but also strengthens its brand image and emphasizes the crucial role that sustainability will play in shaping the future.

Europe Food Service Market Restraints and Challenges:

Regulation complexity creates challenges for Europe's food service industry.

Navigating the complicated world of rules and standards is one of the main issues facing the European food service industry. Strict legislation about food safety, inconsistent national standards, and the ongoing need to adapt to new regulatory requirements are among the challenges faced by the industry. To attain and sustain compliance, substantial expenditures in training, quality assurance protocols, and robust operating standards are essential. Establishments face a great deal of difficulty in adhering to regulatory standards, which calls for meticulous attention to detail and strategic planning to ensure seamless compliance in a variety of markets.

Economic Uncertainties Affect Consumer Spending in Europe's Food Service Sector.

The scarcity of trained labor and insufficient training, particularly in the hotel sector, is one of the main problems facing the European food service business. For companies striving to offer exceptional dining experiences, recruiting and retaining skilled employees—such as cooks and wait staff—is an ongoing struggle. For the industry to continue providing high-quality services and operating effectively, a competent labor force is essential. To solve these labor issues, creative workforce management strategies, ongoing training initiatives, and collaborative efforts to bridge skill gaps within the fast-paced, highly competitive culinary industry are all required.

Economic Uncertainties Affect Consumer Spending in Europe's Food Service Sector.

The European food service market is impacted by the basic dynamics of the business as well as consumer spending patterns brought on by economic instability. A shift in the economy, exacerbated by global events such as the COVID-19 pandemic, may have an impact on disposable income and, consequently, on consumer behavior. The industry's vulnerability to economic ups and downs highlights how challenging it is to predict and adapt to changing consumer spending trends. Strategic planning, economical operational strategies, and flexibility in response to economic fluctuations are essential for maintaining growth and resilience in the European food service industry as establishments manage these risks.

Europe Food Service Market Opportunities:

Digital Renaissance: Revolutionising the European Food Service Industry with Online Platforms.

The digital era has brought about a shift in consumer habits, and the European food service industry is spearheading this revolutionary shift. The rise of online meal ordering and delivery services is a great opportunity for businesses to go digital. By investing in user-friendly mobile apps, expediting delivery procedures, and enhancing the entire online eating experience, food service firms may increase their customer base and satisfy the growing need for convenience. As more and more customers select digital solutions, businesses now have the chance to redefine their presence, engage with a larger audience, and keep their competitive edge in a market that is constantly evolving.

Enhancing Happiness: Savouring Opportunities in Health-Conscious Offerings.

The growing trend of health-conscious customer purchasing offers the European food service industry a great opportunity to embrace and advance wellness. Companies can capitalise on this by creating and providing healthier menu options, catering to the growing number of clients who value their health and well-being highly. Incorporating plant-based, organic, and nutritionally balanced products not only satisfies customers' evolving dietary needs but also positions food service providers as collaborators in their overall health. This purposeful focus on expanding opportunities in health-conscious products has the potential to capitalize on a burgeoning market niche and enhance the industry's standing.

Planting for Sustainability: Harvesting Benefits from Eco-Friendly Efforts.

The European food service market is ideally positioned to grow as it sows the seeds of sustainability and reaps the rewards of eco-friendly initiatives. Businesses can set themselves apart by introducing sustainable practices since environmental awareness is becoming more and more crucial. Several tactics can be used to align with consumers who care about the environment, including adopting eco-friendly packaging, reducing food waste, and sourcing locally for food. Companies that use sustainable methods have a competitive edge by attracting clients who respect morals and ethical dining options, in addition to helping the environment.

EUROPE FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.49% |

|

Segments Covered |

By Service Restaurants, Food Delivery Services, Catering Services, Cafes, Foodservice Management, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Autogrill SpA, Coop Gruppe Genossenschaft, Cremonini SpA, Domino's Pizza Enterprises Ltd, Costa Coffee, McDonald's Corporation, Yum! Brands Inc., Groupe Bertrand, Gategroup, Greggs PLC, QSR Platform Holding SCA, Pizza Express |

Europe Food Service Market Segmentation:

Europe Food Service Market Segmentation: By Service Restaurants:

- Full-Service Restaurants (FSR)

- Quick-Service Restaurants (QSR)

Based on the kind of restaurant, the food service industry is separated into two categories: Full-Service Restaurants (FSR) and Quick-Service Restaurants (QSR). Complete eating experiences are provided by full-service restaurants, which provide a large menu, table service, and a comfortable setting. These eateries cater to patrons seeking a low-key, immersive dining experience, often associated with fine dining or informal dining. On the other hand, quick-service restaurants also referred to as fast-food outlets, prioritize speed and efficiency while offering drive-thru, counter, and takeaway options for quick and simple meals. QSRs cater to the on-the-go lifestyle by providing fast food without compromising on flavor. This segmentation enables the food service industry to satisfy a broad spectrum of customer preferences, including quick service and informal dining.

Among all restaurant types, Quick-Service Restaurants (QSRs) are among the most well-liked and prosperous service restaurant models in the food service industry. Quick-service restaurants (QSRs) provide speed, affordability, and convenience in their dining experiences, meeting the needs of customers who lead hectic lives. A diverse spectrum of patrons enjoy the quick and delicious meals that the efficient service model provides, such as drive-thru substitutes, grab-and-go options, and smartphone ordering. Because they can dependably and swiftly serve well-known menu items, QSRs are the go-to alternative for individuals seeking quick meal options in today's frantic atmosphere, which is why they are so popular.

Europe Food Service Market Segmentation: By Food Delivery Services:

- Food Delivery Services

- Hotel and Hospitality Food Services

- Institutional Food Services

The food service industry's market segmentation includes meal delivery services, hotel and hospitality food services, and institutional food services. Due to the fact that these services enable clients to have restaurant-quality cuisine delivered directly to their homes, they are vital to the modern dining scene. These services may now offer a wide range of cuisines, providing a comprehensive and convenient dining experience, thanks to the rise of internet platforms. Hotel and Hospitality Food Services offers room service, event catering, and in-house eating to visitors staying in lodging establishments. Institutional food services typically focus on providing large-scale dining options for institutions such as corporate cafeterias, hospitals, and schools, sometimes emphasizing customized and nutritious meal plans.

The food service industry can better meet the specific needs of its clients in a range of settings and circumstances by segmenting the market. Among the food service market's most important and fruitful segments are food delivery services. The way consumers purchase and consume food has entirely changed as a result of the Internet's rapid growth and simplicity of use. Food delivery services offer a wide range of restaurant options and the ease of placing orders via mobile applications or websites, which aligns with evolving customer expectations. With the help of these services, clients can experience the flexibility of eating. The ability of these services to adjust and react to changing consumer preferences is demonstrated by their resilience in the face of significant global catastrophes, like as the COVID-19 pandemic.

Europe Food Service Market Segmentation: By Catering Services:

- Event Catering

- Wedding Catering

- Social Catering

- Educational Catering

- Healthcare Catering

- Airline Catering

- Sports and Entertainment Catering

- Others

Within the food service industry, catering services play a significant role in serving a diverse range of events, parties, and celebrations. Beyond traditional restaurant settings, these businesses provide tailored culinary experiences for weddings, business meetings, celebrations, and other events. Catering companies offer a wide range of services, including menu planning, food preparation, presentation, and frequent on-site service. In this sector, clients can benefit from professionally prepared meals that are tailored to their special requirements, ensuring a seamless and delightful dining experience for both hosts and visitors. Whether it's a little birthday celebration or a big corporate meeting, catering services are crucial for improving the entire atmosphere and food options. They include a special segment,

The specific needs and nature of the event often dictate which segment of the catering services market is the most valuable. However, since the catering service delivers and serves food at a location chosen by the client, off-premise catering stands out as being particularly effective and flexible. Customers that choose this catering option can have events in a range of venues, such as outdoor spaces and private homes, and are not restricted to utilizing conventional event spaces. Off-premise catering is adaptable and may be used for both formal and informal gatherings, depending on the situation. Because it can be customised to fit a variety of situations, off-premise catering is a very popular and successful catering service in the food service industry.

Europe Food Service Market Segmentation: By Cafes:

- Specialty Coffee Cafes

- Tea Houses

- Bakery Cafes

- Sandwich Shops

- Smoothie and Juice Bars

- Dessert Cafes

- others

Catering services are essential to the food service industry and have a big impact on the food scene overall. Enhancing dining experiences outside of traditional restaurant settings requires these services. By providing bespoke meal alternatives for a variety of events and occasions, such as private parties, business gatherings, and weddings, catering services make a significant contribution. To enable hosts and guests to enjoy perfectly cooked meals in a variety of settings, they provide all-inclusive packages that include menu design, food preparation, presentation, and often on-site service. Catering services combine culinary expertise with event planning to enhance guests' culinary enjoyment as well as the overall ambiance and success of various celebrations.

Europe Food Service Market Segmentation: By Foodservice Management:

- Full-Service Restaurants

- Fine Dining Restaurants

- Casual Dining Restaurants

- Buffet-style Restaurants

- Food Trucks and Food Carts

- Others

Foodservice Management is an essential part of the intricate network that makes up the food service industry and is crucial to the seamless running of institutional dining facilities. The management and optimisation of food operations in corporate cafeterias, hospitals, schools, and other organisations are the main topic of this section. Effective kitchen operations, ingredient procurement, menu development, and dietary guidelines compliance are within the purview of foodservice management. This division combines management with culinary expertise to ensure that healthy, well-balanced meals are offered to a range of audiences. In addition to improving the culinary aspect, foodservice management in institutional settings also increases overall diner satisfaction, cost control, and operational efficiency.

Europe Food Service Market Segmentation: By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The food service market in Europe has a varied environment in terms of regional market shares, with each category contributing differently to the overall dynamics of the sector. With a substantial market share of 16%, Spain is the dominant force among the major companies. France, known for its culinary prowess and rich culinary heritage, has had a significant impact on the growth of the European food service sector and holds 9%. With a robust 15% of the market, Germany comes in second, demonstrating the country's robust economy and passion for inventive cooking. The UK is a prominent player that demonstrates its substantial effect on the European food service industry with an 11% market share.

Italy and Spain both contribute 14% and 16%, respectively, indicating the importance of the Mediterranean region on eating patterns. The fact that the remaining regions of Europe collectively hold a sizable 35% of the market illustrates the diversity of consumer preferences and culinary landscapes found throughout the continent. The distribution of market shares among European nations highlights the regional variations that collectively define the dynamic and ever-evolving structure of the food service industry in Europe.

COVID-19 Impact Analysis on the Europe Food Service Market :

The COVID-19 pandemic has had a long-lasting effect on the food service industry in Europe, upending established norms and transforming the market. Government-enforced lockdowns, social distancing strategies, and alterations in consumer behaviour have significantly impacted the operations of food services. During the height of the epidemic, many restaurants were forced to close, and those that remained open had to make a swift transition to delivery and takeaway services. The industry's increased reliance on digital platforms for contactless delivery and online ordering has supplanted the formerly crucial traditional dine-in experience. The tight safety rules and hygiene standards caused operational issues that led to menu selection changes and a greater emphasis on food packaging. As European countries progress through the stages of recovery, the food service industry faces hurdles in restoring consumer trust and adapting to the pandemic's long-term repercussions. The industry has demonstrated resilience in adapting to the post-pandemic climate and finding a route back to recovery, as seen by its advances in digitization and evolving business models.

Latest Trends/Developments:

The food service sector in Europe is always changing due to new and inventive discoveries made by its members as well as dynamic trends that influence the sector's future. One significant trend is the increasing emphasis that businesses and consumers alike are putting on eco-friendly and sustainable practices. Buying products locally and utilising biodegradable packaging are two instances of these tactics. The continued importance of health and wellbeing is driving the need for plant-based, nutrient-dense menu options that satisfy the exacting tastes of health-conscious customers. The increasing use of contactless payment methods, online ordering, and technology integration to improve the whole eating experience are all results of digitalization.

The growing need for authentic and unique flavours among consumers is propelling the popularity of global cuisines and fusion offerings, hence contributing to the expansion of culinary variety. Additionally, immersive and interactive culinary events, or "experiential dining," are becoming increasingly popular in the industry. As it adapts to these trends, the food service sector is navigating a landscape characterised by innovation, sustainability, and a renewed emphasis on serving the changing needs of consumers in the constantly evolving European culinary scene.

Key Players:

- Autogrill SpA,

- Coop Gruppe Genossenschaft,

- Cremonini SpA,

- Domino's Pizza Enterprises Ltd

- Costa Coffee

- McDonald's Corporation

- Yum! Brands Inc.

- Groupe Bertrand

- Gategroup

- Greggs PLC

- QSR Platform Holding SCA

- Pizza Express

The European food service market is made up of several significant companies, whose combined influence defines the general environment of the sector. The expertise of Autogrill SpA, Coop Gruppe Genossenschaft, and Cremonini SpA in travel retail, cooperative retail, and catering, respectively, adds to the vibrancy of the market. Important participants in the quick-service and fast-food sectors are internationally renowned businesses with iconic stature and global reach, such as Yum! Companies Inc., McDonald's Corporation, Costa Coffee, and Domino's Pizza Enterprises Ltd. With their specific services and local expertise, Groupe Bertrand, Gategroup, Greggs PLC, and Pizza Express enhance the market with a diverse array of food options. QSR Platform Holding SCA is one burgeoning force in the quick-service restaurant sector. Together, these significant players weave a tapestry of outstanding dining experiences, inventive cooking, and dynamic evolution that defines the European food service sector.

Chapter 1. Europe Food Service Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Food Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Food Service Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Food Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Food Service Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Food Service Market – By Service Restaurants

6.1. Introduction/Key Findings

6.2. Full-Service Restaurants (FSR)

6.3 Quick-Service Restaurants (QSR)

6.4. Y-O-Y Growth trend Analysis By Service Restaurants

6.5. Absolute $ Opportunity Analysis By Service Restaurants , 2024-2030

Chapter 7. Europe Food Service Market – By Food Delivery Services

7.1. Introduction/Key Findings

7.2 Food Delivery Services

7.3. Hotel and Hospitality Food Services

7.4. Institutional Food Services

7.5. Y-O-Y Growth trend Analysis By Food Delivery Services

7.6. Absolute $ Opportunity Analysis By Food Delivery Services , 2024-2030

Chapter 8. Europe Food Service Market – By Catering Services

8.1. Introduction/Key Findings

8.2 Event Catering

8.3. Wedding Catering

8.4. Social Catering

8.5. Educational Catering

8.6. Healthcare Catering

8.7. Airline Catering

8.8. Sports and Entertainment Catering

8.9. Others

8.10. Y-O-Y Growth trend Analysis Catering Services

8.11. Absolute $ Opportunity Analysis Catering Services, 2024-2030

Chapter 9. Europe Food Service Market – By Cafes

9.1. Introduction/Key Findings

9.2 Specialty Coffee Cafes

9.3. Tea Houses

9.4. Bakery Cafes

9.5. Sandwich Shops

9.6. Smoothie and Juice Bars

9.7. Dessert Cafes

9.8. others

9.9. Y-O-Y Growth trend Analysis Cafes

9.10. Absolute $ Opportunity Analysis Cafes , 2024-2030

Chapter 10. Europe Food Service Market – By Foodservice Management

10.1. Introduction/Key Findings

10.2 Full-Service Restaurants

10.3. Fine Dining Restaurants

10.4. Casual Dining Restaurants

10.5. Buffet-style Restaurants

10.6. Food Trucks and Food Carts

10.7. Others

10.8. Y-O-Y Growth trend Analysis Foodservice Management

10.9. Absolute $ Opportunity Analysis Foodservice Management , 2024-2030

Chapter 11. Europe Food Service Market , By Geography – Market Size, Forecast, Trends & Insights

11.1. Europe

11.1.1. By Country

11.1.1.1. U.K.

11.1.1.2. Germany

11.1.1.3. France

11.1.1.4. Italy

11.1.1.5. Spain

11.1.1.6. Rest of Europe

11.1.2. By Food Delivery Services

11.1.3. By Catering Services

11.1.4. By Cafes

11.1.5. Foodservice Management

11.1.6. Service Restaurants

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Europe Food Service Market – Company Profiles – (Overview, Service Restaurants Portfolio, Financials, Strategies & Developments)

12.1 Autogrill SpA,

12.2. Coop Gruppe Genossenschaft,

12.3. Cremonini SpA,

12.4. Domino's Pizza Enterprises Ltd

12.5. Costa Coffee

12.6. McDonald's Corporation

12.7. Yum! Brands Inc.

12.8. Groupe Bertrand

12.9. Gategroup

12.10. Greggs PLC

12.11. QSR Platform Holding SCA

12.12. Pizza Express

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

It is anticipated that the food service industry in Europe will have increased from its current valuation of USD 0.9 trillion to USD 1.7 trillion by the end of 2030. The market is expected to grow between 2024 and 2030 at a compound annual growth rate of 9.49%.

Three main factors are driving the food service market: shifting consumer preferences, a growing emphasis on convenience, and the continuous demand for a broad range of innovative and imaginative culinary experiences.

Restaurants, fast food chains, industrial dining, catering, and online meal delivery are some of the industry's most popular uses

Spain is the dominant region, driven by its culture and famous dishes and their popularity

Several significant companies are involved, including Costa Coffee, Domino's Pizza Enterprises Ltd., Autogrill SpA, Coop Gruppe Genossenschaft, Cremonini SpA, McDonald's Corporation, QSR Platform Holding SCA, and Pizza Express