United States Food Service Market Size (2024-2030)

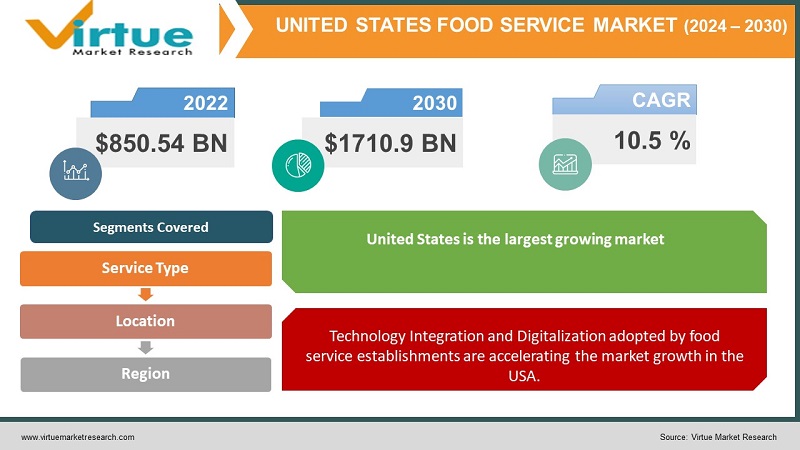

The United States Food Service Market was valued at USD 850.54 Billion in 2023 and is projected to reach a market size of USD 1710.92 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.5%.

Download Your Free Sample Report Now

The United States foodservice market is a dynamic and multifaceted industry that encompasses a wide range of segments, including restaurants, catering, cafeterias, food trucks, and more. With a focus on convenience, quality, and innovation, the sector is driven by technological advancements, digitalization, and a growing emphasis on health-conscious dining. It thrives on a blend of traditional establishments and an expanding presence of fast-casual dining experiences, alongside the enduring presence of well-established chain restaurants.

The industry has seen a notable shift in consumer behavior, with an increasing demand for sustainable sourcing, ethically produced ingredients, and an overall experience that goes beyond just food, emphasizing ambiance, service, and social responsibility.

The COVID-19 pandemic has significantly impacted the food service market, prompting adaptations such as increased emphasis on delivery services, contactless options, and an accelerated integration of technology to meet changing consumer preferences and ensure operational resilience.

Key Market Insights:

- Amidst the increasing fondness for quick dining options among American consumers, there has been a notable surge in the average order value within the quick service restaurant segment, marking a 16% rise during the forecasted period. The upsurge in the popularity of chicken preferences among consumers has prompted American restaurant chains to diversify their menu offerings.

- In 2021, over 20% of customers exhibited a heightened inclination towards chicken-centric choices. Consequently, both QSR and FSR establishments are integrating fried chicken options into their menus, intensifying the competition among operators vying to provide the most appealing offerings.

- Cloud kitchen concepts have emerged as the fastest-growing outlets in the restaurant industry, poised to achieve a projected Compound Annual Growth Rate of 9.5% during the forecast period. These kitchens rely heavily on technology to cater to their customer base. Notably, they have effectively utilized technology to incorporate customer feedback mechanisms, significantly altering the dynamics of food ordering and consumption.

- The cafes and bars segment in the United States anticipates a value-driven Compound Annual Growth Rate of 10% during the forecast period. This growth trajectory is fueled by the escalating consumption of tea and coffee across the country, particularly in the specialty tea and coffee category. Americans consumed more than 3.9 billion gallons of tea in 2021, with black tea dominating the consumption landscape at a staggering majority, followed by green tea, and to a lesser extent, oolong, white, and dark tea varieties.

CLICK HERE To Request FREE Sample Report

United States Food Service Market Drivers:

Technology Integration and Digitalization adopted by food service establishments are accelerating the market growth in the USA.

Digital platforms, mobile apps, and online ordering systems have revolutionized how consumers interact with food service establishments. The integration of technology has facilitated convenience through features like online reservations, mobile ordering, and delivery services.

Moreover, the use of data analytics and AI-driven solutions enables businesses to personalize offerings, optimize operations, and enhance customer experiences. This tech-driven approach not only streamlines operations but also meets evolving consumer expectations for convenience, speed, and customization.

Health and Sustainability Concerns among consumers are increasing the demand for food service in the USA.

Changing consumer preferences towards healthier, sustainable, and ethically sourced food options significantly impacts the market. There's a growing emphasis on transparency in the food supply chain, leading to increased demand for organic, locally sourced, and environmentally conscious products. Health-conscious consumers are seeking nutritious yet flavorful menu options, promoting a shift towards cleaner ingredients and menu transparency.

Additionally, sustainability initiatives, such as reducing food waste, eco-friendly packaging, and energy-efficient practices, are becoming integral to the ethos of food service establishments, driven by consumer awareness and demand for responsible business practices.

United States Food Service Market Restraints and Challenges:

Labor Shortage is a major hindrance in the food service market of the USA.

The food service industry in the US has been grappling with a persistent shortage of skilled labor. The demand for restaurant and food service workers often outstrips the supply of qualified individuals. Factors contributing to this shortage include low wages, high turnover rates, and sometimes demanding working conditions.

The COVID-19 pandemic exacerbated this issue, leading to layoffs, furloughs, and hesitancy among workers to return to the industry due to health concerns or shifts in career priorities. As a result, restaurants and food service businesses struggle to find and retain qualified staff, impacting operations, service quality, and overall productivity.

Supply Chain Disruptions affect the market growth of the United States Food Service Market significantly.

The food service industry heavily relies on efficient and reliable supply chains to source ingredients, equipment, and other essential items. Disruptions in these supply chains, whether due to natural disasters, geopolitical tensions, or global pandemics like COVID-19, can significantly impact the availability and cost of goods.

Supply chain disruptions can lead to ingredient shortages, increased prices, and logistical challenges, affecting menu offerings, profit margins, and operational stability for food service businesses. Adapting to these disruptions often involves finding alternative suppliers, adjusting menu options, and sometimes passing increased costs onto customers, all of which can strain the market and consumer relationships.

United States Food Service Market Opportunities:

The United States foodservice market presents numerous opportunities for innovation and growth, particularly in embracing technological advancements to enhance customer experiences and operational efficiency. Leveraging digital platforms for online ordering, delivery services, and streamlined payment systems can not only cater to changing consumer preferences but also optimize operations.

The rising demand for healthier and sustainable food options provides an avenue for businesses to diversify menus, incorporate locally sourced ingredients, and capitalize on the growing trend toward eco-conscious dining. Furthermore, catering to evolving dietary preferences, such as plant-based or allergy-specific menus, can create a niche market and foster customer loyalty, all while adapting to the dynamic landscape of consumer needs and preferences.

UNITED STAES FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Service type, location, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

united states |

|

Key Companies Profiled |

McDonald's Corporation, Starbucks Corporation, Yum! Brands, Inc., Chipotle Mexican Grill, Inc., Darden Restaurants, Inc., Subway, Domino's Pizza, Inc., Brinker International, Inc., The Wendy's Company, Panera Bread Company |

Customize This Full Report As Per Your Needs

Segmentation Analysis

United States Food Service Market - By Service Type:

- Full-Service Restaurants

- Quick-Service Restaurants

- Cafés and Coffee Shops

- Food Trucks

- Fine Dining

In the United States, Quick-Service Restaurants stand as the largest segment in the food service industry. QSRs have garnered this status due to their efficient operations, cost-effective models, and ability to cater to the fast-paced lifestyles prevalent in modern society. These establishments offer quick, affordable, and often standardized meals, appealing to a wide consumer base seeking convenience without compromising on taste or quality. The emphasis on speed of service, combined with consistent menu offerings and efficient operational practices, has contributed significantly to the widespread popularity and dominance of QSRs in the market.

The fastest-growing segment in the food service market is also Quick-Service Restaurants. This growth is primarily fueled by several factors, including evolving consumer lifestyles demanding quicker and more convenient dining options, an increased focus on takeout, delivery, and drive-thru services, and the ability of QSRs to adapt swiftly to changing consumer preferences and technology. Advancements in technology, such as mobile ordering apps and integrated delivery services, have further propelled the rapid growth of QSRs, meeting the demand for on-the-go dining experiences.

United States Food Service Market - By Location:

- Urban Restaurants

- Suburban Eateries

- Rural Dining Establishments

- Tourist Area Restaurants

The largest segment by location in the US food service market is the Urban Restaurants category having a prominent market share of 68%. Urban areas typically host a denser population, higher foot traffic, and a diverse mix of demographics, contributing to a higher concentration of restaurants and eateries. These locations benefit from the presence of office buildings, entertainment venues, and residential communities, attracting both locals and tourists.

Urban restaurants often cater to a wide range of tastes and preferences due to the diverse population, leading to higher demand, increased competition, and consequently, a larger market share compared to suburban or rural counterparts. Urban restaurants are also the fastest-growing. The rapid urbanization and concentration of population in cities drive the growth of urban restaurants.

Urban areas tend to experience higher foot traffic, a larger customer base, and increased diversity in consumer preferences. Cities often serve as hubs for culinary innovation and dining trends, attracting both residents and tourists seeking unique dining experiences. The demand for convenience, diverse cuisine options, and a thriving food culture in urban settings contribute to the rapid expansion and growth of restaurants in these areas.

Latest Trends/ Developments:

A prominent trend in the food service market is the rise of ghost kitchens and virtual restaurants. These establishments operate without a traditional dine-in space, focusing solely on food preparation for delivery or takeout. Ghost kitchens allow multiple brands or concepts to operate out of the same space, reducing overhead costs and catering specifically to the growing demand for online food delivery services. Virtual restaurants, on the other hand, are brands that exclusively exist online, often as a subset of an existing restaurant or as an entirely new concept. Both models leverage technology and delivery services to reach customers directly, adapting to changing consumer preferences for convenience and diverse culinary experiences.

A notable development in the food service market is the increasing emphasis on sustainability across the industry. Consumers are becoming more environmentally conscious, leading to a growing demand for sustainable practices within the food service sector. This includes a focus on reducing food waste, adopting eco-friendly packaging, sourcing locally produced and organic ingredients, and implementing energy-efficient practices in operations.

Many restaurants and food service businesses are aligning their strategies with sustainability goals not only to meet consumer expectations but also to contribute positively to environmental preservation, reflecting a shift toward more responsible and ethical business practices.

Key Players:

- McDonald's Corporation

- Starbucks Corporation

- Yum! Brands, Inc.

- Chipotle Mexican Grill, Inc.

- Darden Restaurants, Inc.

- Subway

- Domino's Pizza, Inc.

- Brinker International, Inc.

- The Wendy's Company

- Panera Bread Company

In November 2022, Chipotle Mexican Grill marked a significant milestone by inaugurating its 500th restaurant featuring a Chipotlane, a drive-thru pick-up lane designed for digital orders. Situated in Louisville, Kentucky, this opening highlights the brand's continuous dedication to enhancing accessibility and convenience for customers.

Chapter 1. United States Food Service Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. United States Food Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. United States Food Service Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. United States Food Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. United States Food Service Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. United States Food Service Market– By Service Type

6.1. Introduction/Key Findings

6.2. Full-Service Restaurants

6.3. Quick-Service Restaurants

6.4. Cafés and Coffee Shops

6.5. Food Trucks

6.6. Fine Dining

6.7. Y-O-Y Growth trend Analysis By Service Type

6.8. Absolute $ Opportunity Analysis By Service Type , 2023-2030

Chapter 7. United States Food Service Market– By Location

7.1. Introduction/Key Findings

7.2. Urban Restaurants

7.3. Suburban Eateries

7.4. Rural Dining Establishments

7.5. Tourist Area Restaurants

7.6. Y-O-Y Growth trend Analysis By Location

7.7. Absolute $ Opportunity Analysis By Location , 2023-2030

Chapter 8. United States Food Service Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. United States

8.1.1. By Country

8.1.1.1. United States

8.1.2. By Service Type

8.1.3. By Location

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. United States Food Service Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1.1. McDonald's Corporation

9.1.2. Starbucks Corporation

9.1.3. Yum! Brands, Inc.

9.1.4. Chipotle Mexican Grill, Inc.

9.1.5. Darden Restaurants, Inc.

9.1.6. Subway

9.1.7. Domino's Pizza, Inc.

9.1.8. Brinker International, Inc.

9.1.9. The Wendy's Company

6.1.10. Panera Bread Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The United States Food Service Market was valued at USD 850.54 Billion in 2023 and is projected to reach a market size of USD 1710.92 Billion by the end of 2030.

Technology Integration and Digitalization adopted by food service establishments along with Health and Sustainability Concerns among consumers are drivers of the United States Food Service market.

Based on location, the United States Food Service Market is segmented into Urban Restaurants, Suburban Eateries, Rural Dining Establishments, and Tourist Area Restaurants.

North America is the most dominant region for the United States Food Service Market

McDonald's Corporation, Starbucks Corporation, Yum! Brands, Inc., and Chipotle Mexican Grill, Inc. are a few of the key players operating in the United States Food Service Market.