Green Tea Market Size (2024 – 2030)

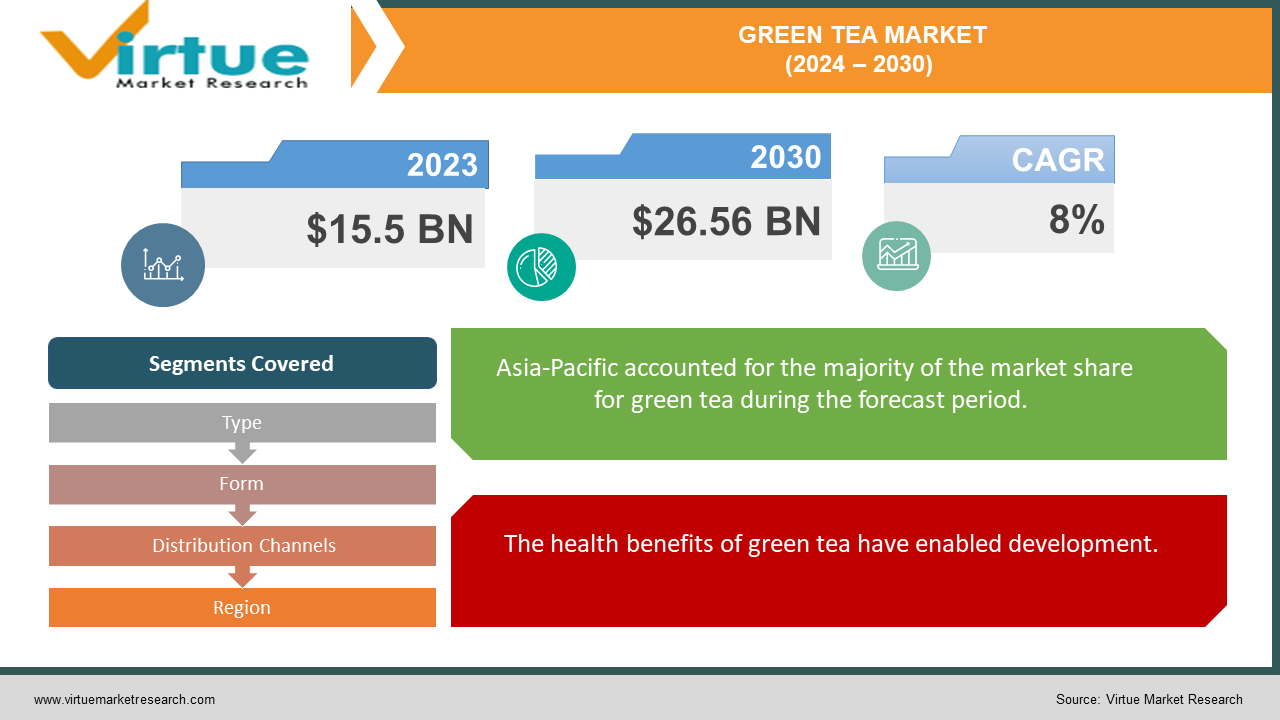

The global green tea market was valued at USD 15.5 billion and is projected to reach a market size of USD 26.56 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8%.

The leaves of the Camellia sinensis plant are the only ingredient used to make green tea, commonly referred to as unoxidized tea. To keep the leaves green and avoid oxidation, they are picked, slightly wilted, and then cooked right away. In the past, the market has had a notable presence in China, Japan, and Korea. This was consumed due to its cultural significance and health benefits. Presently, the market has witnessed a considerable boost owing to market expansion in North America, Europe, and Latin America. In the future, with an extensive focus on new formulations and technological advancements in agricultural technologies, the market is anticipated to see an upsurge.

Key Market Insights:

With 14,000 kg of green tea produced in the fiscal year 2023, Assam, a state in eastern India, produced the most.

Japan used over 74 thousand tons of green tea in 2022.

China sold about 2.4 million metric tons of tea leaves grown domestically in 2022, with green tea accounting for around 55% of all sales.

Sri Lanka produced 248,211 kilos of green tea in March 2023, up from 148.9 million kilograms in 2022.

Research conducted found that 25% less non-heme iron is absorbed when green tea extract is used. This is due to the catechol groups in the phenolic chemicals found in tea, which bind to iron and decrease its absorption. It is essential to spread the right information to the public to tackle this problem. Consumers are recommended to have this beverage between meals rather than with meals.

Green Tea Market Drivers:

The health benefits of green tea have enabled development.

L-theanine, an amino acid found in tea, helps an individual relax by reducing tension and anxiety. When it comes to L-theanine content, green tea surpasses black, oolong, and white tea by having the highest concentration of this compound. According to research, taking 200–400 mg of L-theanine per day might help lower tension and anxiety. Additionally, L-theanine is associated with enhancing memory and task performance. Secondly, green tea use may help guard against some neurodegenerative illnesses, such as Parkinson's and Alzheimer's, according to some research. Antioxidants found in high concentrations in green tea may offer protection against cell damage, which increases the risk of chronic disorders. Thirdly, osteoporosis, a bone condition that raises the risk of hip, spine, and wrist fractures, may be less common in those who drink green tea. Those who have gone through menopause are most at risk for osteoporosis. According to some research, green tea's strong antioxidant content may promote bone growth and protect against the loss of bone mass. Moreover, regular consumption can increase longevity as this beverage has polyphenols and plant compounds that reduce the signs of aging, decrease inflammation, and minimize oxidative risk. Furthermore, due to the presence of antioxidants, the risk of type 2 diabetes and stroke is reduced. All these advantages make this tea a popular option on the market.

Product innovation has been contributing to the success.

Over the years, there have been many formulations that have been commercialized on the market. The audience is fond of a variety of tastes, including lemon, mint, jasmine, berries, lychee, etc. Businesses are continuously diversifying their offerings to attract a broader consumer base. Experimentation is being done by fusing different choices to give a tangy, sweet, and sour flavor. Green tea is also being combined with functional ingredients like ginger, neem, holy basil, and matcha to enhance nutrition. Flavors are being developed, prioritizing the cultural significance of any herb or other spice in different countries. Apart from this, packaging options are being innovated to suit consumer preferences. This includes options ranging from loose-leaf to tea bags for convenience. Companies are dedicating specific budgets for research and developmental activities to develop flavors with superior characteristics.

Green Tea Market Restraints and Challenges:

Possible side effects, a lack of scientific evidence, overconsumption, and intense competition are the main issues that the market is currently facing.

Green tea contains caffeine, which can lead to adverse consequences. Anxiety, lightheadedness, heart palpitations, sleeplessness, agitation, and tremors are a few of the symptoms that may occur. Tannic acid, another ingredient in green tea, can discolor teeth. Additionally, liver issues brought on by green tea extracts may result in nausea, stomach discomfort, and yellowing of the skin or the whites of the eyes. Besides, green tea may worsen anemia, raise the risk of bleeding, induce irregular heartbeats, interfere with blood sugar regulation, and raise blood pressure and heart rate when used with stimulant medications, among other potentially harmful consequences. Everybody, even expectant mothers, shouldn't take more than 300 mg of caffeine per day, according to Healthline. Secondly, there is a lack of scientific validation. There are many claims about the potential health benefits of green tea. Companies have to provide sufficient research studies to prove the advantages that are written on the product labels. Thirdly, a small percentage of teenagers and adults associate green tea with a beverage that helps with instant weight loss. As such, there have been reports of excessive consumption in an unhealthy way to reduce their weight. Manufacturers need to provide the right information about the dosage and effects that need to be consumed. Apart from this, the industry has a lot of different brands of coffee and tea. They might be more affordable when compared to green tea. Coffee and tea are popular beverages in many Asian households. Companies need to stand out in the market to attract customers.

Green Tea Market Opportunities:

Sustainable practices can provide the market with an ample number of possibilities. Companies can focus on using recycled or biodegradable materials for packaging options. Additionally, they can come up with energy-efficient techniques to minimize waste generation, water, and other resources. Local produce needs to be emphasized to reduce the carbon footprint. Besides, organic yield is in tremendous demand because it does not use any fertilizers, chemicals, or other harmful compounds for growth. Providing green tea with fair trade and organic certifications can draw in customers who care about the environment and society. This offers an additional chance to demand a higher price. Secondly, expansion into emerging markets is beneficial. The Middle East and Latin America provide many opportunities. Companies can focus on launching and collaborating in these areas as the economies of these regions are improving, resulting in better funding and investment options. People are becoming more aware of the advantages of this beverage in these areas, leading to better income generation. Thirdly, backing up the claimed health benefits with scientific evidence drives a greater number of customers. Clinical studies and investigations are being encouraged in this matter. By implementing these strategies, the market can reach new heights.

GREEN TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Type, Form, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tata Global Beverages, The Hain Celestial Group, Bigelow Tea Company, Associated British Foods plc (Twinings), ITO EN, Ltd., Nestlé S.A., Tazo Tea Company, The Republic of Tea, Yogi Tea, Dilmah Ceylon Tea Company |

Green Tea Market Segmentation: By Type

-

Flavored

-

Unflavored

The flavored segment is the largest and fastest-growing type. The growing desire among consumers for flavored beverages to improve their taste is the reason for the growth in demand. To appeal to a larger spectrum of consumers, several firms have created new green tea drinks in a variety of flavors, such as ginger and lemon. Moreover, a lot of individuals prefer alternative tastes of green tea since they don't like the flavor of green tea as it is.

Green Tea Market Segmentation: By Form

-

Green Tea Bags

-

Instant Green Tea Mixes

-

Loose Green Tea Leaves

-

Iced Green Tea

Green tea bags are the largest growing form. They are easily available in many distribution channels, including convenience stores, supermarkets, and e-commerce. Another reason for their popularity is their convenience. People who are traveling or on the go tend to buy tea bags. They take less space, are simple to use, and have a good shelf life. Besides, many advancements have been made to use eco-friendly packaging options, driving consumer demand. The fastest-growing type is instant green tea mixes. The new normal of having two incomes has led to hectic schedules. The need for ready-to-consume alternatives has expanded as a result of this. This has resulted in people choosing this option. Furthermore, many flavors are being marketed in the industry that are tailored to the needs of individuals.

Green Tea Market Segmentation: By Distribution Channels

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

The largest growing market category is supermarkets and hypermarkets. Customers may engage with the businesses, pose inquiries, and make visual assessments of the goods. They could even change the price by haggling over the products. Moreover, some who are uncomfortable utilizing the Internet make quality in-person transactions. Another significant reason driving this category is accessibility. The need has increased because these enterprises are usually found in every municipality. Online retail is the sector growing at the fastest rate. Growth in the sector has been attributed to the rising trend toward digitization. Customers make this decision due to convenience. Online buyers may place orders and have items delivered straight to their residences. Additionally, a wider range of both local and international goods will be more easily accessible to them. Online retailers may also assist their customers by offering free delivery and discounts.

Green Tea Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. This area has a huge manufacturing hub for this beverage. China has a substantial market share for green tea because of its extensive tea plantations and long-standing customs around the use of tea. Japan is known for its specialty green teas, which are highly valued for their rarity and excellence and have played a major role in the dominance of the region. Strong tea cultures and consumption patterns engrained in India are leading the growth. North America is the region that is expanding the fastest. Leading the way are nations like the United States and Canada. This development is explained by a growing public understanding of the advantages. This is a beverage that many young people in American nations have started drinking. Earnings growth has been greatly aided by online retail. Launching new flavors helps the market tremendously.

COVID-19 Impact Analysis on the Global Green Tea Market:

The market had a mixed impact on the viral outbreak. The new norm included social isolation, travel restrictions, and lockdowns. This had an impact on supply chain management, transportation, and logistics. Imports and exports, as well as trade activities, were impacted by this. Most of the eateries and manufacturing facilities have closed. Furthermore, the launch of new collaborations and products was delayed due to a lack of funding. The majority of funding went into research and medical applications, such as hospital beds, immunizations, PPE kits, oxygen tanks, masks, etc. There was a significant degree of uncertainty, and many people lost their jobs. The outcome was a decline in tea fields. According to a report by the Tea & Coffee Trade Journal, the total annual output that remained between 80,000 and 100,000 metric tons (mt) before the pandemic fell to 69,800 mt and 78,100 mt, respectively, during the first and second half. On the other hand, the epidemic also increased people's awareness of the need to maintain excellent physical and mental health. As a result, people began to explore for healthier solutions. In addition, developing immunity was crucial for shielding the body from the infection. The demand caused the market to expand quickly. According to the DSM, 60% of consumers worldwide claim that the epidemic has increased their awareness of the need to live a healthy lifestyle to avert health issues. Post-pandemic, the market has begun to recover due to the loosening of laws and regulations.

Latest Trends/ Developments:

The use of green tea as a component in many culinary creations is growing. This includes savory meals, beverages, smoothies, and sweets (including ice cream, cakes, and pastries) flavored with green tea. This approach exposes green tea to new customer categories and emphasizes its adaptability.

Key Players:

-

Tata Global Beverages

-

The Hain Celestial Group

-

Bigelow Tea Company

-

Associated British Foods plc (Twinings)

-

ITO EN, Ltd.

-

Nestlé S.A.

-

Tazo Tea Company

-

The Republic of Tea

-

Yogi Tea

-

Dilmah Ceylon Tea Company

-

In March 2024, The Pansari Group launched TVOY GREEN TEA. This product comes in three different flavors: Kahwa green tea, chamomile, and classic green tea. Furthermore, the Fair-Trade Labeling Organization has recognized this Pansari product as Fair Trade, HACCP 2006, and ISO 9001 2008. With a paper tag and thread, the biodegradable Pyramid Tea Bag Filter Packaging holds the TVOY GREEN TEA. The Pansari Group's dedication to environmental responsibility is demonstrated by its environmentally friendly packaging.

-

In November 2023, the ready-to-drink iced green tea, Honest Tea, was introduced by Coca-Cola India during the Bengal Global Business Summit. There are two varieties of the tea: mango and lemon-tulsi. The recently released beverage offers a moment of good with every sip of iced green tea, catering to today's modern women and men who desire to lead balanced lives.

-

In February 2023, the first effervescent green tea tablet in India was introduced by Laval Green Tea. The tablet may be used to produce hot or cold green tea. When the pills are put in a glass of water, they dissolve and fizz. Laval Green Tea asserts that its tablet form is a practical substitute for conventional green tea bags.

Chapter 1. Green Tea Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Green Tea Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Green Tea Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Green Tea Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Green Tea Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Green Tea Market – By Type

6.1 Introduction/Key Findings

6.2 Flavored

6.3 Unflavored

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Green Tea Market – By Form

7.1 Introduction/Key Findings

7.2 Green Tea Bags

7.3 Instant Green Tea Mixes

7.4 Loose Green Tea Leaves

7.5 Iced Green Tea

7.6 Y-O-Y Growth trend Analysis By Form

7.7 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Green Tea Market – By Distribution Channels

8.1 Introduction/Key Findings

8.2 Supermarkets & Hypermarkets

8.3 Convenience Stores

8.4 Online Retail

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channels

8.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 9. Green Tea Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Form

9.1.4 By Distribution Channels

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Form

9.2.4 By Distribution Channels

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Form

9.3.4 By Distribution Channels

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Form

9.4.4 By Distribution Channels

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Form

9.5.4 By Distribution Channels

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Green Tea Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tata Global Beverages

10.2 The Hain Celestial Group

10.3 Bigelow Tea Company

10.4 Associated British Foods plc (Twinings)

10.5 ITO EN, Ltd.

10.6 Nestlé S.A.

10.7 Tazo Tea Company

10.8 The Republic of Tea

10.9 Yogi Tea

10.10 Dilmah Ceylon Tea Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global green tea market was valued at USD 15.5 billion and is projected to reach a market size of USD 26.56 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8%.

Health benefits and product innovation are the main factors propelling the global green tea market.

Based on type, the global green tea market is segmented into flavored and unflavored.

Asia-Pacific is the most dominant region for the global green tea market.

Tata Global Beverages, The Hain Celestial Group, and Bigelow Tea Company are the key players operating in the global green tea market.