APAC Compound Feed Market Size (2024-2030)

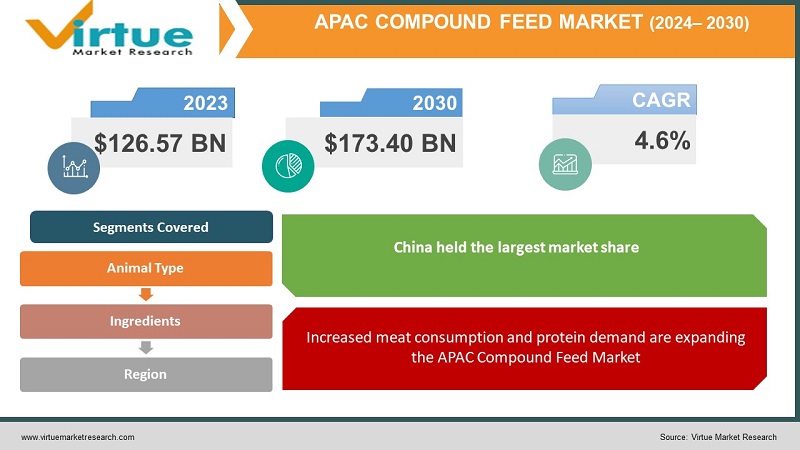

The Asia Pacific Compound Feed Market was valued at USD 126.57 Billion and is projected to reach a market size of USD 173.40 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.6%.

CLICK HERE To Request Sample Brochure

The Asia-Pacific (APAC) compound feed market is experiencing robust growth and has emerged as a significant player in the global animal feed industry. The region's expanding population, rising disposable incomes, and a shift toward increased protein consumption, particularly in countries like China and India, were driving the demand for compound feed. Additionally, the growth of the livestock and poultry sectors in APAC was a major factor fueling this market, as farmers increasingly turned to nutritionally balanced compound feeds to optimize animal growth and productivity. Government initiatives to improve food security and promote sustainable animal farming practices also played a role in shaping the market's development.

Key Market Insights:

The largest share in China's compound feed production is attributed to pig feeds, totaling 101.4 million tons, followed closely by broiler feeds with 91.4 million tons. Layer feeds rank third, accounting for 30.5 million tons, while aqua feeds hold the fourth position with a production of 23.8 million tons.

In India's compound feed production, broiler feeds take the lead with 15.8 million tons, followed by dairy feeds at 12.8 million tons. Layer feeds secure the third position with 11.9 million tons, while aqua feeds rank fourth, contributing 2.5 million tons to the production.

As of 2022, the Asia-Pacific region is home to a substantial portion of the global feed milling industry, hosting 25.4% of the total feed mills worldwide. This translates to 7,146 feed mills in the Asia-Pacific region.

According to the Food and Agriculture Organization (FAO), in 2021, global animal meat production demonstrated an upward trend, surging from 145.4 million metric tons in 2018 to 152 million metric tons in 2019. This increase was primarily driven by the growing demand for meat consumption in countries such as India, China, and the Philippines.

APAC Compound Feed Market Drivers:

Increased meat consumption and protein demand are expanding the APAC Compound Feed Market

One of the primary drivers of the APAC compound feed market is the escalating demand for meat and protein products. Rising incomes and urbanization have led to significant dietary shifts in the region, with consumers increasingly incorporating meat and poultry into their diets. For instance, China, as a major player in the APAC region, witnessed substantial growth in meat consumption. According to the United States Department of Agriculture (USDA), China's total meat consumption reached 87 million metric tons in 2020, signifying the growing demand for animal protein. This surge in meat consumption directly correlates with increased demand for compound feed, as livestock producers aim to meet the protein needs of their animals efficiently.

The expansion of livestock and poultry industries is accelerating the growth of the APAC Compound Feed market

Rapid expansion of the livestock and poultry industries in APAC countries is another key driver of the compound feed market. This expansion is driven by the need to meet the growing demand for animal-based products, such as meat, eggs, and dairy. For example, India's poultry industry experienced significant growth, with poultry meat production expected to reach over 4 million metric tons in 2021, according to the Food and Agriculture Organization (FAO). This growth necessitates the use of high-quality compound feeds to ensure optimal animal health, growth, and productivity. As a result, feed manufacturers are scaling up production to support the flourishing livestock and poultry sectors.

APAC Compound Feed Market Restraints and Challenges:

Fluctuating prices of raw materials could hinder the growth of the APAC Compound Feed market

The volatility in raw material prices is a significant constraint for the APAC compound feed market. The feed industry heavily relies on commodities such as corn, soybean meal, and wheat for its production. These raw materials are subject to price fluctuations due to factors like weather conditions, geopolitical tensions, and global supply and demand dynamics. For instance, in recent years, the prices of soybean meal, a crucial ingredient in animal feed, have been quite unpredictable. This unpredictability can disrupt production schedules, increase production costs, and ultimately affect the profitability of feed manufacturers in the APAC region. In the past, the APAC feed market has witnessed notable price fluctuations in raw materials like soybean meal, which have had a significant impact on the market's overall stability.

Regulatory challenges pose risks to the development of the APAC Compound Feed market

Regulatory challenges pose a substantial restraint to the APAC compound feed market. As the industry plays a crucial role in ensuring food safety and animal health, it is subject to strict regulations and standards imposed by governments across the region. Compliance with these regulations involves adhering to specific formulations, labeling requirements, and quality control measures. Meeting these standards can be costly and time-consuming for feed manufacturers, especially smaller or newer players in the market. Furthermore, the regulatory landscape in the APAC region can be complex and vary from country to country, making it challenging for companies to navigate and expand their operations across borders. These regulatory challenges can hinder market entry, limit market growth, and increase operational costs, affecting the overall development of the APAC compound feed market.

APAC Compound Feed Market Opportunities:

The APAC compound feed market presents several promising opportunities for growth and development. One notable opportunity is the rising demand for high-quality animal protein products driven by increasing urbanization, population growth, and a growing middle-class consumer base across the Asia-Pacific region. As dietary preferences shift towards protein-rich diets, there is a growing need for efficient and sustainable animal production, which, in turn, fuels the demand for high-quality compound feed. Additionally, the increasing awareness of the importance of animal health and nutrition is driving innovation in feed formulations and additives, creating opportunities for companies to offer specialized and value-added feed products. Moreover, the region's expanding aquaculture industry, as well as the growing trend towards organic and natural feeds, offers further avenues for market expansion and diversification, making the APAC compound feed market an attractive prospect for investors and industry players.

APAC COMPOUND FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2022 - 2030 |

||

|

Base Year |

2022 |

||

|

Forecast Period |

2023 - 2030 |

||

|

CAGR |

4.6% |

||

|

Segments Covered |

By Animal Type, Ingredients, and Region |

||

|

Various Analyses Covered |

, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

India, china, south korea, Australia, Japan | ||

|

Key Companies Profiled |

|

APAC Compound Feed Market Segmentation:

APAC Compound Feed Market Segmentation: By Animal Type:

- Poultry Feed

- Cattle Feed

- Swine Feed

- Aquaculture Feed

- Pet Food

- Other Animal Feeds

Poultry feed is the largest segment by animal type in this market, and it mainly includes broilers, layers, and breeders. Some common ingredients used in poultry feed are corn, soybean meal, minerals, vitamins, and amino acids. Growing consumption of poultry products like chicken and eggs in the APAC region has vastly expanded the demand for poultry feed. This segment accounted for approximately 43% share of the market, as chicken meat and eggs are widely consumed in many APAC countries.

Aquaculture is the fastest growing segment in the APAC Compound Feed market, growing at a CAGR of 6%, attributed to several factors like growing awareness of the health benefits of seafood, growing demand for protein-rice diet, and export of seafood products from the APAC region, leading to increased production to meet international demand. Advances in aquaculture practices like improved breeding techniques, specialized feeds, and water management have boosted production efficiency. Many APAC countries like China, India, Vietnam, and Indonesia have actively promoted and expanded their aquaculture industries to meet the rising demand for seafood.

APAC Compound Feed Market Segmentation: By Ingredients

- Cereals

- Oilseeds and Pulses

- By-Products

- Additives

- Other Ingredients

Cereals had the largest market share in the APAC Compound feed market, accounting for 35% of the market share, because cereals are primary sources of carbohydrates and energy in animal feed. Corn is specifically used in many compound feed formulations, especially for poultry and swine, while barley is most used in cattle feed. Cereals are also easily available and cost-effective making them a prominent choice for feed production.

Additives consist of a wide range of substances that are added to animal feed to enhance overall performance and nutrition. This segment is the fastest growing in the market, as additives provide a plethora of benefits like nutrient optimization, health and disease control, increasing efficiency and productivity. Some additives are also used to reduce the environmental impact of animal farming by reducing waste and improving nutrient utilization. Consumers are also increasingly seeking products from animals raised with fewer antibiotics, hence the demand for feed additives is consistently going to increase.

APAC Compound Feed Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China held the largest market share, accounting for over 31% of market revenue in the APAC Compound Feed market. China has one of the world’s largest populations, expanding the demand for meat and animal products and driving the need for compound feed to support livestock and poultry. China has notable livestock and poultry industries which require large quantities of compound feed for their animals.

India has a notable compound feed market and is the fastest-growing region, developing at a rate of 7% CAGR. Factors like population expansion, rising incomes, urbanization, and rising demand for meat and dairy products. The poultry segment has shown significant growth potential in India.

Several Southeast Asian nations like Vietnam, Thailand, and Indonesia have seen significant growth in the compound feed market driven by urbanization, and changing dietary preferences. Australia and New Zealand have smaller markets currently but have the potential for growth in high-quality feeds and specialty products. Japan and South Korea are more mature products and show growth potential, especially in aquaculture feed.

COVID-19 Impact Analysis on the APAC Compound Feed Market:

The COVID-19 pandemic had a significant impact on the APAC compound feed market. In the initial stages, disruptions in the supply chain, labor shortages, and logistical challenges affected feed production and distribution. These disruptions were particularly notable in the first half of 2020, leading to delays and increased production costs. However, as the pandemic continued, there was a shift in consumer behavior towards home-cooked meals and increased demand for animal products, leading to a recovery in the livestock and poultry sectors. The Asia-Pacific compound feed market experienced a decline in growth in 2020, with a market size of USD 142.4 billion, but it is expected to rebound and reach USD 181.8 billion by 2027, reflecting the resilience and adaptability of the industry in the face of challenging circumstances.

Latest Trends/ Developments:

Companies in the compound feed market are implementing strategic initiatives to bolster their market share. A significant trend is the diversification of their product portfolios and the introduction of innovative feed formulations. This entails the creation of specialized feeds tailored to specific animal types and growth stages, as well as feeds engineered to address pressing environmental and sustainability concerns. By expanding their range of offerings, companies seek to capture a more substantial market share and cater to the evolving demands of their customer base.

Furthermore, the adoption of digitalization and data analytics is gaining momentum across the industry. Companies are increasingly leveraging digital technologies and data-driven insights to optimize their production processes, enhance feed quality, and streamline supply chain management. This digital transformation empowers companies to operate with greater efficiency, reduce operational costs, and gain a competitive advantage, all of which contribute to an expanded market share.

Key Players:

- Suguna Holdings Private Limited

- Zagro Asia Limited

- Baiada Poultry Pty Limited

- Gold Coin Group

- Cargill Inc.

- Charoen Pokphand Foods,

- ADM Animal Nutrition

- Alltech Inc.

- Nutreco

- Purina Animal Nutrition

- In December 2022, Cargill Inc. entered the South Indian market with its manufacturing facility in Nellore, Andhra Pradesh, by investing $35 million in the new unit to grow its market in the region.

Chapter 1. APAC Compound Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. APAC Compound Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. APAC Compound Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. APAC Compound Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. APAC Compound Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. APAC Compound Feed Market– By Animal Type

6.1. Introduction/Key Findings

6.2. Poultry Feed

6.3. Cattle Feed

6.4. Swine Feed

6.5. Aquaculture Feed

6.6. Pet Food

6.7. Other Animal Feeds

6.8. Y-O-Y Growth trend Analysis By Animal Type

6.9. Absolute $ Opportunity Analysis By Animal Type, 2023-2030

Chapter 7. APAC Compound Feed Market– By Ingredients

7.1. Introduction/Key Findings

7.2. Cereals

7.3. Oilseeds and Pulses

7.4. By-Products

7.5. Additives

7.6. Other Ingredients

7.7. Biofuels 7.5. Y-O-Y Growth trend Analysis By Ingredients

7.8. Absolute $ Opportunity Analysis By Ingredients, 2023-2030

Chapter 8. APAC Compound Feed Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Animal Types

8.1.3. By Ingredients

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. APAC Compound Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Suguna Holdings Private Limited

9.2. Zagro Asia Limited

9.3. Baiada Poultry Pty Limited

9.4. Gold Coin Group

9.5. Cargill Inc.

9.6. Charoen Pokphand Foods,

9.7. ADM Animal Nutrition

9.8. Alltech Inc.

9.9. Nutreco

9.10. Purina Animal Nutrition

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Compound Feed Market was valued at USD 126.57 Billion and is projected to reach a market size of USD 173.40 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.6%.

Increased meat consumption, protein demand, and expansion of livestock and poultry industries are expanding the APAC Compound Feed market globally.

Based on ingredients, the APAC Compound feed market is divided into Cereals, Oilseeds and Pulses, By-Products, Additives, and Other Ingredients

China is the most dominant region for the APAC Compound Feed Market

Suguna Holdings Private Limited, Zagro Asia Limited, Baiada Poultry Pty Limited, Gold Coin Group, and CP Pokphand Co. Ltd. are the key players operating in the APAC Compound Feed Market.