Cattle Feed Market Size (2024 – 2030)

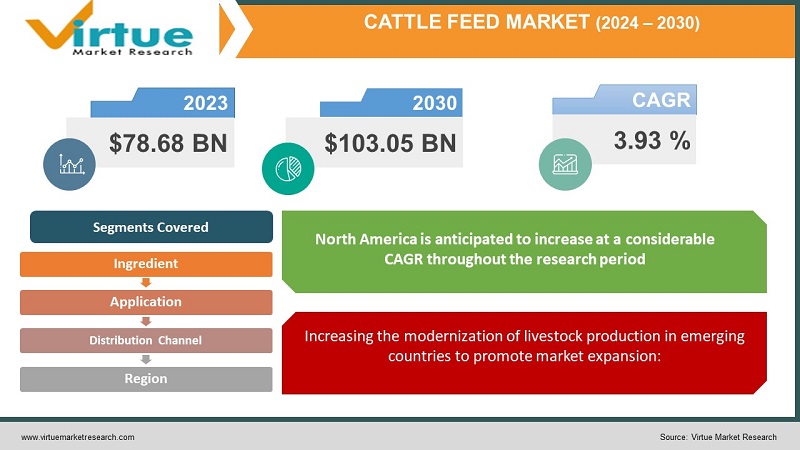

The Global Cattle Feed Market was valued at USD 78.68 billion and is projected to reach a market size of USD 103.05 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.93 %.

The food provided to cows and other bovine animals as feed is known as cattle feed. It can be made up of different kinds of molasses, mixers, grains, forages, oilseeds, protein cakes, and agro-industrial by-products that have been prepared to provide vital nutrients including fiber, phosphorus, magnesium, phosphorous, protein, and lipids. It helps maintain ideal physical conditions, safeguard pellets from infestations brought on by insects or mold, and guard against muscle diseases like laminitis and azoturia. Additionally, it stimulates milk production with better fat content, increases reproductive efficiency, and maintains a balanced diet.

Key Market Insights:

Livestock production has become more industrialized as a result of the rising population and the need to fulfill the nutritional and gastronomic tastes of the populace in emerging nations. Cattle ranching has always been a backyard profession in poor nations. The practice of raising cattle in these nations has begun to change, nevertheless, as a result of rising demand and a growing understanding of the economies of scale that come with keeping larger herds According to the FAO, developing countries that are landlocked generated 41.5 million metric tonnes of cow milk in 2020. Additionally, the number of cattle rose from 230 million heads in 2017 to 265 million heads in 2020. The use of compound feed in the proper doses would be one of the advanced management techniques that would be used as cattle husbandry became more industrialized.

Following the signing of a strategic agreement between De Heus Vietnam and Masan, De Heus took full ownership of MNS Feed's feed-related company. De Heus' position in Southeast Asia's largest animal feed market is strengthened by MNS Feed's feed business, which has thirteen animal feed mills with a combined production capacity of around 4 million metric tonnes.

Global Cattle Feed Market Drivers:

Increasing the modernization of livestock production in emerging countries to promote market expansion:

The food given to domestic animals, especially those employed in cattle, is referred to as animal feed. Cattle feed is a significant element in animal husbandry and makes up the majority of animal-rearing costs. Farmers generally try to reduce the price of this meal by using less costly feeds instead of more expensive feeds, such as leftover barley from brewing beer. One of the key elements affecting the cattle industry's future is animal welfare. Having a nutritionally balanced diet is crucial for animal well-being. Along with the bovine feed sector, the market for feed acidifiers, enzymes, antibiotics, and microbials is expanding. The increased intake of meat protein and the increased value put on premium feed components are connected to the demand for these developments. The main cause was the region's droughts, which limited forages and made it necessary for beef producers to finish their herds in feedlots. The dairy feed predictions for 2019 showed very little decrease. In Oceania and Latin America, sales decreased by 3% and 11%, respectively. It is estimated that Argentina used 870,000 fewer metric tonnes of dairy feed than Venezuela and Costa Rica combined. Oceania, especially New Zealand, where the government established new, lower target emissions, saw challenges for the dairy industry.

The demand for cow feed may be fueled by the expansion of ethical agricultural methods:

The growing popularity of ethical and ecological farming methods is being fueled by customer desire for food that is produced ethically. Specialized cow feed that is organic or devoid of genetically modified organisms (GMOs) is frequently required for these practices. The demand for such specialized cow feed choices is increasing as customers become more knowledgeable about the sources of their food. Increased demand for particular types of cow feed is strongly correlated with the requirement for environmentally friendly farming practices.

Global Cattle Feed Market Challenges:

One of the major challenges impeding the expansion of the cattle feed industry is the monitoring of mycotoxin contamination in the feed:

Mycotoxins and antibiotics are two examples of deliberate and natural contaminants in cow feed. Most mycotoxin chemicals are often persistent and cannot be removed using conventional feed and food manufacturing techniques; they may also decrease animal productivity or result in cancer in animals. Additionally, they may accumulate in meat, milk, or eggs, which may wind up in the hands of consumers and be harmful to their health. During the projected period, these problems can restrain the worldwide market for cow feed from expanding.

Global Cattle Feed Market Opportunities:

The expansion of the cow feed business may be aided by greater public knowledge of health:

People are becoming more aware of the advantages of high-quality dairy and meat products for their health. Because of this understanding, more consumers are now looking for items made from well-fed, humanely treated animals. Cattle farmers are being compelled by this customer demand to utilize premium, nutrient-dense feed, which is boosting the market. The need for premium cow feed, created to improve the health of the animal and the final product, is increasingly being catalyzed by health-conscious customers, who are emerging as a significant force.

CATTLE FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.93% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Land O'lakes Inc. , BASF SE , Cargill Inc. , Nutreco N.V., DSM N.V., Charoen Pokphand Group , New Hope Grou , Archer Daniels Midland Company , Country Bird Holdings , Alltech Inc. |

Global Cattle Feed Market Segmentation

Global Cattle Feed Market Segmentation: By Ingredient

- Corn

- Soybean Meal

- Wheat

- Oilseeds

- Additives

- Others

This covers a variety of foods, such as corn, soybean meal, wheat, oilseeds, and additives. The greatest part was maize by 42%. Corn's high carbohydrate content makes it the main source of energy in cow feed. It supplies the energy needed for everyday tasks, development, and the production of milk. It is frequently consumed in the form of whole grains, cracked corn, or cornmeal and is typically simple to digest.

Soybean meal, a byproduct of the production of soybean oil, is used as a high-protein addition to cow feed by 22%. It aids in the growth of the muscles, tissues, and enzymes in cattle since it is high in vital amino acids. Younger animals still undergoing growth as well as breastfeeding cows that require extra protein to make milk benefit most from it.

Global Cattle Feed Market Segmentation: By Application

- Beef Cattle

- Dairy Cattle

- Calves

- others

Dairy, beef, calf, and other types are included. The biggest portion of the market went to dairy 52%. A particular diet must be provided for dairy cattle to promote high milk production, reproductive health, and general well-being. Their food usually contains more protein, which is frequently provided by components like alfalfa, soybean meal, and canola meal. To maintain the quality of the milk as well as the health of the bones, essential elements like calcium and phosphorus are also supplied. For the energy needed for breastfeeding, carbohydrates are often taken from maize or barley. The goal is to preserve the health of the animal while maximizing milk output and quality through balanced feeding.

The formulation of beef cattle feed is done to maximize growth and meat quality by 30%. Compared to feed for dairy cattle, it often has a greater energy content that is frequently provided by maize and places less of a focus on protein. Depending on regional laws and particular agricultural methods, the feed may also contain chemicals like antibiotics or growth hormones. To suit the varying nutritional requirements, beef cattle diets are frequently modified during various life phases such as growing, finishing, or breeding.

Global Cattle Feed Market Segmentation: By Distribution Channel

- Offline

- Online

Both offline and online are included. The biggest part was offline by 65%. Many people still watch offline television, especially in rural regions where digital adoption is less common. Farmers may physically check items, get professional advice, and make rapid purchases at these places, which include nearby feed stores, cooperatives, and agricultural supply stores. Even direct partnerships with manufacturers are chosen by some large-scale companies to obtain bulk supplies.

Farmers now have more alternatives for finding cow feed online because of the growth of e-commerce platforms. These platforms provide quick pricing comparisons, home delivery ease, and frequently a wider selection of goods, including specialty feeds that aren't readily accessible nearby. Online sources provide the benefit of user reviews and thorough product descriptions, which help consumers make better judgments.

Global Cattle Feed Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

The market for cattle feed in North America is anticipated to increase at a considerable CAGR throughout the research period and hold a market share of almost 45%. 64 million metric tonnes of the 284 million metric tonnes of animal feed that the United States consumed in North America in 2019 was used to feed beef cattle. The United States is one of the top producers and exporters of cattle feed in the world as a result of the size and demand of its livestock industry. According to ITC, the United States was responsible for 90.7% of global feed exports in 2020. Even though the region produces and consumes more cattle feed every year, it still holds a sizable portion of the market for cow feed globally in the cattle feed sector. In the US and Canada, brands like Land O'Lakes and ADM are well-known.

The second-largest market share belongs to the cattle feed market in Europe. The 330 feed mills in Germany will help the European market grow. In addition, pig and beef consumption make up more than 65% of Spain's total animal feed consumption, making them the main factors driving the nation's cattle feed industry. Free trade agreements in the area for countries in the European Union will have a favorable effect on market growth throughout the projected period.

Due to the surge in demand from vegan customers, the Asia-Pacific Cattle Feed Market is anticipated to develop at the quickest CAGR between 2023 and 2030. The total growth of the cow feed industry is influenced by several important macroeconomic variables, including the rise in social media usage and the rise in per capita income. It is anticipated that there will be a rise in the need for meat and dairy products in child nutrition, which will probably result in major growth for LAMEA. In the region, millennials are the biggest consumers of fresh meat and other goods, and their numbers have increased significantly. As a result, the growing millennial population would likely open up lucrative market opportunities for cow feed. In addition, the Indian cattle feed market had the quickest rate of growth in the Asia-Pacific region, while the China cattle feed market had the biggest market share.

COVID-19 Impact on Global Cattle Feed Market:

Although the demand for animal feed has remained fairly steady in 2020, the coronavirus epidemic has had a significant impact on the supply. Wheat, soybean, and maize will all likely be used less in animal feed, according to researchers. Meat and seafood consumption are substantially down globally. As a result, there is much less demand for grain and oilseed (G&O). Researchers studying animal feed predict a 6% reduction in soybean, maize, and wheat consumption in 2020 in nations including Vietnam, Thailand, Malaysia, and the Philippines. Soybean, corn, and wheat production accounts for around 65% of net yearly use in the animal feed business and the remaining 35% for human consumption. Therefore, even if G&O use at home has grown, the decrease in consumption in the animal feed business substantially outweighs it.

Global Cattle Feed Market Recent developments:

Demand for cow feed is increasing as a result of changes in the environment. The natural availability of grazing grounds for cattle can be significantly impacted by factors like droughts or floods. Farmers are forced to rely more on prepared cow feed to support their herds when natural forage possibilities are few. Due to the rising requirement for dependable and nutritionally balanced bovine feed to make sure that cattle are obtaining all of the necessary nutrients, its demand has grown as a result of these environmental concerns.

Key Players:

- Land O'lakes Inc.

- BASF SE

- Cargill Inc.

- Nutreco N.V.

- DSM N.V.

- Charoen Pokphand Group

- New Hope Grou

- Archer Daniels Midland Company

- Country Bird Holdings

- Alltech Inc.

- In January 2023: With an initial capacity of producing 120,000 metric tonnes of feed for animals, including cattle, De Heus Animal Nutrition built a new, Greenfield animal feed facility in Ivory Coast.

- In May 2022: The Animal Nutrition division of Archer Daniels Midland Co. increased its presence in the Philippines by purchasing a feed mill in Southern Mindanao.

Chapter 1. Global Cattle Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Cattle Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Cattle Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Cattle Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Cattle Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Cattle Feed Market– By Ingredient

6.1. Introduction/Key Findings

6.2. Corn

6.3. Soybean Meal

6.4. Wheat

6.5. Oilseeds

6.6. Additives

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Ingredient

6.9. Absolute $ Opportunity Analysis By Ingredient , 2023-2030

Chapter 7. Global Cattle Feed Market– By Application

7.1. Introduction/Key Findings

7.2. Beef Cattle

7..3. Dairy Cattle

7.4. Calves

7.5. others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Global Cattle Feed Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Offline

8.3. Online

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Global Cattle Feed Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Ingredient

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Ingredient

9.2.3. By Application

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Ingredient

9.3.3. By Application

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Ingredient

9.4.3. By Application

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Ingredient

9.5.3. By Application

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Cattle Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Land O'lakes Inc.

10.2. BASF SE

10.3. Cargill Inc.

10.4. Nutreco N.V.

10.5. DSM N.V.

10.6. Charoen Pokphand Group

10.7. New Hope Grou

10.8. Archer Daniels Midland Company

10.9. Country Bird Holdings

10.10. Alltech Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Cattle Feed Market was valued at USD 78.68 billion and is projected to reach a market size of USD 103.05 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.93 %.

Increasing the modernization of livestock production in emerging countries to promote market expansion and the demand for cow feed may be fueled by the expansion of ethical agricultural methods are the factors driving the Global Cattle Feed Market.

One of the major challenges impeding the expansion of the cattle feed industry is the monitoring of mycotoxin contamination in the feed.

Soybean Meal ingredient is the fastest growing in the Global Cattle Feed Market.

Asia-Pacific region is the fastest growing in the Global Cattle Feed Market.