Poultry Feed Market Size (2023-2030)

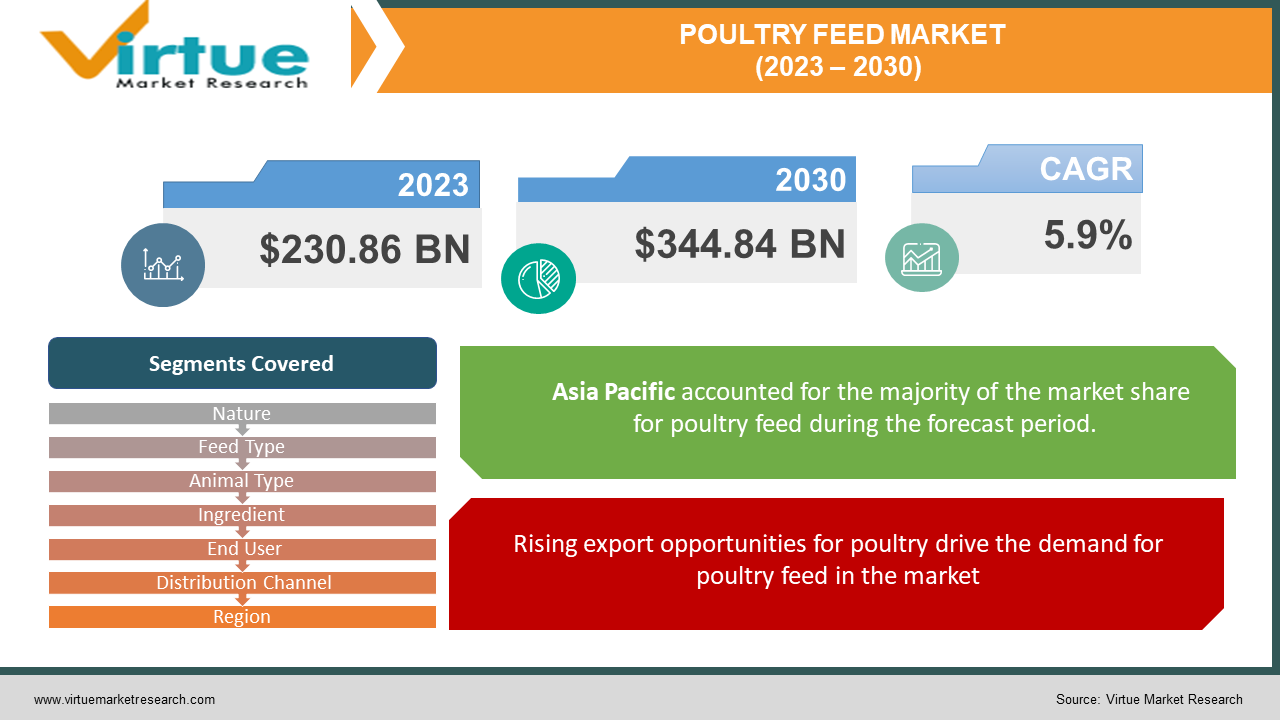

The Global Poultry Feed Market was valued at USD 230.86 billion and is projected to reach a market size of USD 344.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

In the past, poultry farming was done particularly using traditional farming practices such as cereals and other grain-based poultry raising. In addition, conventional feed was increasingly used to raise poultry animals. However, with an increase in research and innovation in feed technology, organic poultry farming gained momentum, wherein feed is prepared using natural and organic or plant-based ingredients that further help in reducing poultry-based wastage in the environment. In addition, trends in sustainable production and consumption have further led to the development of environment-friendly production techniques. The poultry feed market is anticipated to witness positive market growth in the future with technological developments in poultry farming that are meant for monitoring the growth process of poultry animals. However, the market can witness sharp competition due to growing trends in veganism in the food market.

Key Market Insights:

As per the International Feed Industry Federation (IFIF), world compound feed production is over 1 billion tonnes annually, and commercial feed manufacturing generates an annual turnover of US$ 400 billion.

Furthermore, as per the United Nations Food and Agricultural Organization (FAO), by 2050, meat production is anticipated to rise by 70%.

As per Alltech Company’s survey for feed production, broiler feed production increased by 2.3% in the year 2022, and China and India occupied a major increase in the Asia-Pacific region.

As per the American Feed Industry Association, meat and poultry products account for 1.83 million tonnes.

As per USDA, total poultry sector sales were US $76.7 billion in the year 2022.

Poultry Feed Market Drivers:

Rising export opportunities for poultry drive the demand for poultry feed in the market.

The poultry trade has witnessed an increase in recent times due to increasing consumer demand for protein-rich food such as chicken meat and eggs. Moreover, countries in North America, that consume chicken and egg in their staple diet, increasingly demand fresh and good quality meat in the market. This further has induced farmers to comply with the safety standards set by food regulatory bodies for poultry farming. Moreover, increased demand for poultry feed in the export market has also boosted the demand for specialized feeds that focus on specific poultry needs such as feed focused on the dietary preferences of consumers, feed focused on increasing meat and egg production, and others. In addition, increased government support in the form of incentives, subsidies, and others to poultry feed exporters has further developed the market landscape for poultry feed.

Rising demand for organic and natural meat products has boosted the demand for poultry feed in the market.

Consumers are increasingly demanding organic and natural meat products that are made using synthetic and additive-free ingredients. Moreover, this has led to an increase in organic poultry farming, wherein farmers use plant-based and natural feed processing techniques to produce organic poultry feed. In addition, synthetic-free poultry feed helps improve the health of poultry and also reduces the environmental impact of synthetic chemicals or fertilizers. Additionally, this reduces diseases that are borne due to the consumption of ill-health or lower-quality meat such as Salmonella from poultry, Campylobacter, and others. In addition, rising consumer preferences for green-labeled products have further boosted the demand for organic poultry feed in the market

Poultry Feed Market Restraints and Challenges:

Increasing trends toward veganism can decrease the demand for poultry feed in the market. In recent times, consumers have shifted their dietary preferences towards animal cruelty-free and vegan products that have a positive impact on their health as well as on the environment.

Furthermore, concerns regarding poultry-borne diseases due to lower-quality feed supplied to poultry animals can further decline the demand for poultry feed in the market.

Poultry Feed Market Opportunities:

The Poultry Feed Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for fresh and good quality feed for poultry animals across geographical boundaries in the market is predicted to develop the market for poultry feed and enhance its future growth opportunities.

POULTRY FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Nature, Feed Type, Animal Type, Ingredient, End User, , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Nutreco NV, De Heus BV, Charoen Pokphand Foods PCL, The Organic Feed Company, Feedex Companies, Modesto Milling, HJ Lea Oakes, Alltech, New Country Organics |

Poultry Feed Market Segmentation

Poultry Feed Market Segmentation: By Nature

- Conventional

- Organic

In 2022, based on market segmentation by nature, conventional feed occupies the highest share of about 33% in the market. Conventional poultry feed is prepared using synthetic fertilizers, additives, and other organisms. Further, these consist of maize, rice, wheat, barley, soybean, and others that offer increased nutrition, and improve the immune system of the poultry, and improve the immunity system. Moreover, conventional poultry feed is increasingly in demand due to its cost-effectiveness over organic poultry feed, as organic feed is prepared using organic ingredients, which increases the production costs and hence the final feed cost.

Organic poultry feed is gaining popularity in recent times, due to rising consumer demand for fresh and organic meat products that do not affect their health and also reduce the carbon footprint gradually. Moreover, organic poultry feed reduces the health concerns related to poultry growth and reproduction rate and provides them with natural nutrients that are free from the effects of synthetic fertilizers and pesticides.

Poultry Feed Market Segmentation: By Feed Type

- Premix

- Complete Feed

- Additives

- Concentrates

In 2022, based on market segmentation by feed type, premix occupies the highest share of about 27% in the market. Premix feed contains vitamins, minerals, amino acids, and others are usually mixtures that are added into other feed ingredients for increasing nutrition, optimizing the growth of the poultry, and improving the reproduction rate. Moreover, ensures a balanced and nutritional diet for poultry and is widely used in commercial poultry spaces for improving poultry farming by improving the conversion rate.

The complete feed segment is the fastest-growing segment during the forecast period. These are available in ready-to-eat form and usually require zero or no preparation. Moreover, it offers nutrients to poultry in a single formulation and saves storage space. In addition, it offers easy transportation and handling, leading to decreased transportation costs. Furthermore, complete feeds are suitable for commercial poultry farmers, small poultry farmers, and others who require a hassle-free feeding process with increased cost-effectiveness.

Poultry Feed Market Segmentation: By Animal Type

- Layer

- Broiler

- Turkey

- Others

In 2022, based on market segmentation by animal type, layer occupies the highest share of about 29% in the market. Layer feed is predominantly used for breeding hens to raise their reproduction rate. Moreover, a feed-for-layer has 16% protein and extra calcium content that enable hens to lay eggs with strong shells. In addition, it helps to improve their overall health and provides greater conversion rates to poultry farmers.

Broiler is the fastest-growing segment during the forecast period. The growth of this segment is attributed to increased demand for meat by consumers in the market. A broiler feed is used to increase meat production, as it offers high energy, protein, and supports the rapid development of broilers, and helps in improving the gut development of broilers. Additionally, broiler feed provides a high conversion rate to poultry farmers.

Poultry Feed Market Segmentation: By Ingredient

- Cereal

- Oilseed Meal

- Fish Oil

- Fish Meal

- Supplements

- Molasses

- Others

In 2022, based on market segmentation by ingredient, cereal occupies the highest share of about 27% in the market. These include grains such as maize, wheat, barley, sorghum, and others that serve as a primary source of energy for poultry diets, as they are highly digestible. Moreover, they are used as a base in all other poultry feed ingredients.

Supplements are the fastest-growing segment during the forecast period. Supplements contain vitamins, minerals, amino acids, and other types of nutrients that improve the overall well-being of poultry, including production rate, fertility and growth, and improved immunity system. Moreover, the growing demand for organic ingredients has increased the demand for herbal and botanical-based feed supplements that improve the health of poultry and also decrease the environmental impact of synthetic supplements.

Poultry Feed Market Segmentation: By Distribution Channel

- Offline

- Online

In 2022, based on market segmentation by distribution channel, the offline segment occupies the highest share of about 31% in the market. The comprises local feed stores, farm supply stores, agricultural markets, specialty poultry feed stores, and others that provide fresh and premium quality poultry feed to farmers. In addition, these channels offer increased information to customers, such as suitability of the feed with particular poultry, effects, benefits, and amount required to feed the poultry, which in turn enable customers to make better purchasing decisions.

The online segment has witnessed increased growth in recent years due to the rapidly booming e-commerce industry that enables farmers to get poultry delivered to their doorsteps. Moreover, online channels offer increased information to farmers such as product descriptions, customer reviews, and others that help them make better purchasing decisions. In addition, some farmers opt for subscription-based feed delivery services that offer them regular poultry feed delivery every month.

Poultry Feed Market Segmentation: By End-User

- Poultry Farm

- Home Care

- Others

In 2022, based on market segmentation by end-users, poultry farms occupy the highest share of about 41% in the market. These include small-scale farmers, large-scale farmers, commercial farmers, and others who require poultry feed to improve the diet of their poultry animals and to increase the conversion rate in the market.

The home care segment is the fastest-growing segment during the forecast period. These include small-scale poultry keepers who raise poultry for personal consumption or as a hobby. These include chickens, ducks, geese, and others. Moreover, home-care poultry keepers require smaller quantities of poultry feed, as their main goal is to improve the meat production of poultry animals.

Poultry Feed Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle-East & Africa

In 2022, based on market segmentation by region, Asia-Pacific occupies the highest share of about 52% in the market. Increased consumer demand for protein-based diets and the rapidly growing poultry industry have contributed to the growth of poultry feed in the region.

North America is the fastest-growing region during the outlook period. Increased consumer preferences for chicken-based food products and advancements in the poultry production industry have contributed to the demand for poultry feed in the region.

COVID-19 Impact Analysis on the Poultry Feed Market:

The pandemic had a significant impact on the poultry feed market. Due to the lockdown, there were supply chain disruptions, which led to a slowdown in the production and distribution process, leading to a decline in demand for poultry feed in the market. Moreover, the closure of the food services industry declined the demand for meat-based and egg-based items in the market. In addition, increased health awareness during the pandemic shifted consumer demand towards vegan and animal cruelty-free products, which reduced the demand for poultry feed during the pandemic.

Latest Developments:

The market for poultry feed has witnessed increased growth in recent years due to rising consumer demand for protein-rich diets, especially products that are prepared using organic techniques. Moreover, sustainability trends have further raised the demand for organic feed supplements and organic grain feed for raising poultry animals.

Key Players:

- Cargill

- Nutreco NV

- De Heus BV

- Charoen Pokphand Foods PCL

- The Organic Feed Company

- Feedex Companies

- Modesto Milling

- HJ Lea Oakes

- Alltech

- New Country Organics

- In July 2023, Amul Dairy launched poultry feed production lines in the Indian market. The aim is to increase the market base of the company and to use natural and homeopathic ingredients for producing poultry feeds.

- In October 2021, Cargill, launched poultry feed made from essential oils. The product contains natural essential oils that are meant to improve the overall health and wellness of poultry animals such as chickens and enhance the productivity of chickens.

Chapter 1. Global Poultry Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Nature s

1.5. Secondary Nature s

Chapter 2. Global Poultry Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Poultry Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Poultry Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Poultry Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Poultry Feed Market– By Nature

6.1. Introduction/Key Findings

6.2. Conventional

6.3. Organic

6.4. Y-O-Y Growth trend Analysis By Nature

6.5. Absolute $ Opportunity Analysis By Nature , 2023-2030

Chapter 7. Global Poultry Feed Market– By Feed Type

7.1. Introduction/Key Findings

7.2. Premix

7.3. Complete Feed

7.4. Additives

7.5. Concentrates

7.6. Y-O-Y Growth trend Analysis By Feed Type

7.7. Absolute $ Opportunity Analysis By Feed Type , 2023-2030

Chapter 8. Global Poultry Feed Market– By Animal Type

8.1. Introduction/Key Findings

8.2. Layer

8.3. Broiler

8.4. Turkey

8.5. Others

8.6. Y-O-Y Growth trend Analysis Animal Type

8.7. Absolute $ Opportunity Analysis Animal Type , 2023-2030

Chapter 9. Global Poultry Feed Market– By Ingredient

9.1. Introduction/Key Findings

9.2. Cereal

9.3. Oilseed Meal

9.4. Fish Oil

9.5. Fish Meal

9.6. Supplements

9.7. Molasses

9.8. Others

9.9. Y-O-Y Growth trend Analysis Ingredient

9.10. Absolute $ Opportunity Analysis Ingredient, 2023-2030

Chapter 10. Global Poultry Feed Market– By End-user Industry

10.1. Introduction/Key Findings

10.2. Poultry Farm

10.3. Home Care

10.4. Others

10.5. Y-O-Y Growth trend Analysis End-user Industry

10.6. Absolute $ Opportunity Analysis End-user Industry, 2023-2030

Chapter 11. Global Poultry Feed Market– By Distribution Channel

11.1. Introduction/Key Findings

11.2. Offline

11.3. Online

11.4. Y-O-Y Growth trend Analysis Distribution Channel

11.5. Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 12. Global Poultry Feed Market, By Geography – Market Size, Forecast, Trends & Insights

12.1. North America

12.1.1. By Country

12.1.1.1. U.S.A.

12.1.1.2. Canada

12.1.1.3. Mexico

12.1.2. By Nature

12.1.3. By Feed Type

12.1.4. By Ingredient

12.1.5. Animal Type

12.1.6. End-user Industry

12.1.7. Distribution Channel

12.1.8. Countries & Segments - Market Attractiveness Analysis

12.2. Europe

12.2.1. By Country

12.2.1.1. U.K.

12.2.1.2. Germany

12.2.1.3. France

12.2.1.4. Italy

12.2.1.5. Spain

12.2.1.6. Rest of Europe

12.2.2. By Nature

12.2.3. By Feed Type

12.2.4. By Ingredient

12.2.5. Animal Type

12.2.6. End-user Industry

12.2.7. Distribution Channel

12.2.8. Countries & Segments - Market Attractiveness Analysis

12.3. Asia Pacific

12.3.2. By Country

12.3.2.2. China

12.3.2.2. Japan

12.3.2.3. South Korea

12.3.2.4. India

12.3.2.5. Australia & New Zealand

12.3.2.6. Rest of Asia-Pacific

12.3.2. By Nature

12.3.3. By Feed Type

12.3.4. By Ingredient

12.3.5. Animal Type

12.3.6. End-user Industry

12.3.7. Distribution Channel

12.3.8. Countries & Segments - Market Attractiveness Analysis

12.4. South America

12.4.3. By Country

12.4.3.3. Brazil

12.4.3.2. Argentina

12.4.3.3. Colombia

12.4.3.4. Chile

12.4.3.5. Rest of South America

12.4.2. By Nature

12.4.3. By Feed Type

12.4.4. By Ingredient

12.4.5. Animal Type

12.4.6. End-user Industry

12.4.7. Distribution Channel

12.4.8. Countries & Segments - Market Attractiveness Analysis

12.5. Middle East & Africa

12.5.4. By Country

12.5.4.4. United Arab Emirates (UAE)

12.5.4.2. Saudi Arabia

12.5.4.3. Qatar

12.5.4.4. Israel

12.5.4.5. South Africa

12.5.4.6. Nigeria

12.5.4.7. Kenya

12.5.4.12. Egypt

12.5.4.12. Rest of MEA

12.5.2. By Nature

12.5.3. By Feed Type

12.5.4. By Ingredient

12.6.5. Animal Type

12.5.6. End-user Industry

12.5.7. Distribution Channel

12.5.8. Countries & Segments - Market Attractiveness Analysis

Chapter 13. Global Poultry Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1. Cargill

13.2. Nutreco NV

13.3. De Heus BV

13.4. Charoen Pokphand Foods PCL

13.5. The Organic Feed Company

13.6. Feedex Companies

13.7. Modesto Milling

13.8. HJ Lea Oakes

13.9. Alltech

13.10. New Country Organics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Poultry Feed Market was valued at USD 218 billion and is projected to reach a market size of USD 344.85 billion by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 5.9%.

Rising export opportunities for poultry and Rising demand for organic and natural meat products are the market drivers of the Poultry Feed market.

Layer, Broiler, Turkey, and others, are the segments under the Poultry Feed Market by animal type

Asia-Pacific is the most dominant country for the Poultry Feed Market.

North America is the fastest-growing country in the Poultry Feed Market